EX-99.2

Published on November 4, 2015

Exhibit 99.2

Supplemental Financial Reporting Package Third Quarter 2015 Rexford Industrial Realty, Inc. NYSE: REXR 11620 Wilshire Blvd Suite 1000 Los Angeles, CA 90025 310-966-1680 www.RexfordIndustrial.com

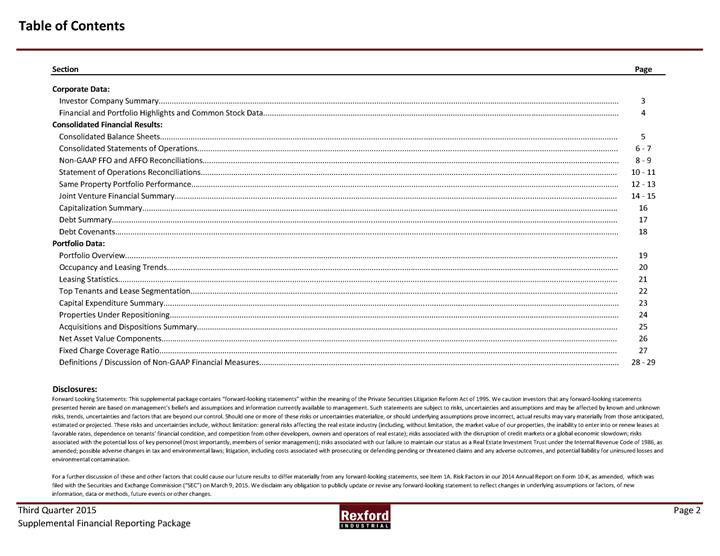

Table of Contents SectionPage Corporate Data: Investor Company Summary 3 Financial and Portfolio Highlights and Common Stock Data 4 Consolidated Financial Results: Consolidated Balance Sheets 5 Consolidated Statements of Operations 6 - 7 Non-GAAP FFO and AFFO Reconciliations 8 - 9 Statement of Operations Reconciliations 10 - 11 Same Property Portfolio Performance 12 - 13 Joint Venture Financial Summary 14 - 15 Capitalization Summary 16 Debt Summary 17 Debt Covenants 18 Portfolio Data: Portfolio Overview 19 Occupancy and Leasing Trends 20 Leasing Statistics 21 Top Tenants and Lease Segmentation 22 Capital Expenditure Summary 23 Properties Under Repositioning 24 Acquisitions and Dispositions Summary 25 Net Asset Value Components 26 Fixed Charge Coverage Ratio 27 Definitions / Discussion of Non-GAAP Financial Measures 28 - 29 Disclosures: Forward Looking Statements: This supplemental package contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. We caution investors that any forward-looking statements presented herein are based on management’s beliefs and assumptions and information currently available to management. Such statements are subject to risks, uncertainties and assumptions and may be affected by known and unknown risks, trends, uncertainties and factors that are beyond our control. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, estimated or projected. These risks and uncertainties include, without limitation: general risks affecting the real estate industry (including, without limitation, the market value of our properties, the inability to enter into or renew leases at favorable rates, dependence on tenants’ financial condition, and competition from other developers, owners and operators of real estate); risks associated with the disruption of credit markets or a global economic slowdown; risks associated with the potential loss of key personnel (most importantly, members of senior management); risks associated with our failure to maintain our status as a Real Estate Investment Trust under the Internal Revenue Code of 1986, as amended; possible adverse changes in tax and environmental laws; litigation, including costs associated with prosecuting or defending pending or threatened claims and any adverse outcomes, and potential liability for uninsured losses and environmental contamination. For a further discussion of these and other factors that could cause our future results to differ materially from any forward-looking statements, see Item 1A. Risk Factors in our 2014 Annual Report on Form 10-K, as amended, which was filed with the Securities and Exchange Commission (“SEC”) on March 9, 2015. We disclaim any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, of new information, data or methods, future events or other changes. Third Quarter 2015 Page 2 Supplemental Financial Reporting Package

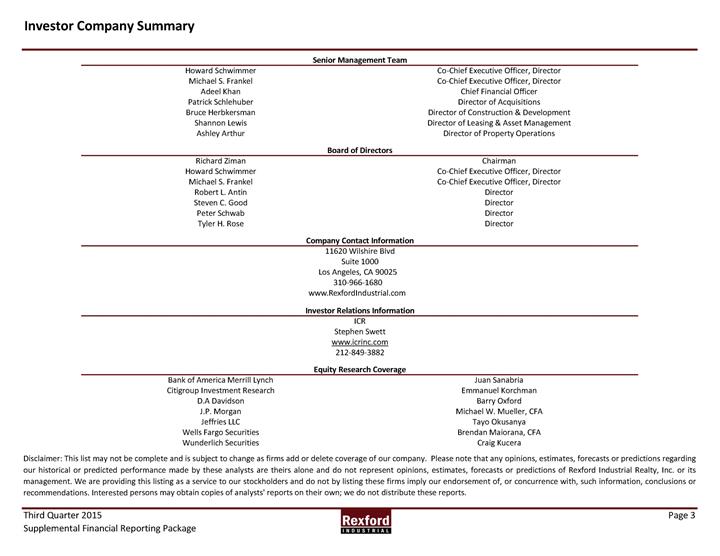

Investor Company Summary Senior Management Team Howard Schwimmer Co-Chief Executive Officer, Director Michael S. Frankel Co-Chief Executive Officer, Director Adeel Khan Chief Financial Officer Patrick Schlehuber Director of Acquisitions Bruce Herbkersman Director of Construction & Development Shannon Lewis Director of Leasing & Asset Management Ashley Arthur Director of Property Operations Board of Directors Richard Ziman Chairman Howard Schwimmer Co-Chief Executive Officer, Director Michael S. Frankel Co-Chief Executive Officer, Director Robert L. Antin Director Steven C. Good Director Peter Schwab Director Tyler H. Rose Director Company Contact Information 11620 Wilshire Blvd Suite 1000 Los Angeles, CA 90025 310-966-1680 www.RexfordIndustrial.com Investor Relations Information ICR Stephen Swett www.icrinc.com 212-849-3882 Equity Research Coverage Bank of America Merrill LynchJuan Sanabria Citigroup Investment Research Emmanuel Korchman D.A Davidson Barry Oxford J.P. Morgan Michael W. Mueller, CFA Jeffries LLC Tayo Okusanya Wells Fargo Securities Brendan Maiorana, CFA Wunderlich Securities Craig Kucera Disclaimer: This list may not be complete and is subject to change as firms add or delete coverage of our company. Please note that any opinions, estimates, forecasts or predictions regarding our historical or predicted performance made by these analysts are theirs alone and do not represent opinions, estimates, forecasts or predictions of Rexford Industrial Realty, Inc. or its management. We are providing this listing as a service to our stockholders and do not by listing these firms imply our endorsement of, or concurrence with, such information, conclusions or recommendations. Interested persons may obtain copies of analysts' reports on their own; we do not distribute these reports. Third Quarter 2015 Page 3 Supplemental Financial Reporting Package

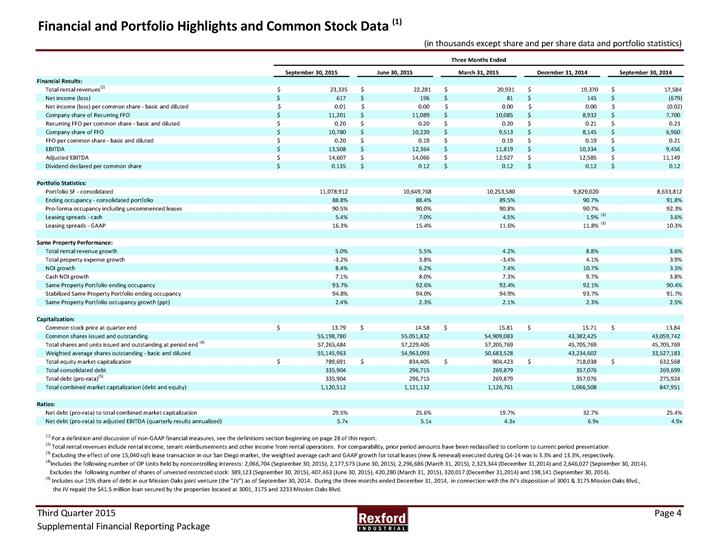

Financial and Portfolio Highlights and Common Stock Data (1) (in thousands except share and per share data and portfolio statistics) Three Months Ended September 30, 2015June 30, 2015March 31, 2015December 31, 2014September 30, 2014 Financial Results: Total rental revenues(2) $ 23,335 $ 22,281 $ 20,931 $ 19,370 $ 17,584 Net income (loss) $ 617 $ 196 $ 81 $ 145 $ (679) Net income (loss) per common share - basic and diluted $ 0.01 $ 0.00 $ 0.00 $ 0.00 $ (0.02) Company share of Recurring FFO $ 11,201 $ 11,089 $ 10,085 $ 8,932 $ 7,700 Recurring FFO per common share - basic and diluted $ 0.20 $ 0.20 $ 0.20 $ 0.21 $ 0.23 Company share of FFO $ 10,780 $ 10,220 $ 9,513 $ 8,145 $ 6,960 FFO per common share - basic and diluted $ 0.20 $ 0.19 $ 0.19 $ 0.19 $ 0.21 EBITDA $ 13,508 $ 12,364 $ 11,819 $ 10,334 $ 9,456 Adjusted EBITDA $ 14,607 $ 14,066 $ 12,927 $ 12,585 $ 11,149 Dividend declared per common share $ 0.135 $ 0.12 $ 0.12 $ 0.12 $ 0.12 Portfolio Statistics: Portfolio SF - consolidated11,078,91210,649,76810,253,5809,829,0208,633,812 Ending occupancy - consolidated portfolio88.8%88.4%89.5%90.7%91.8% Pro-forma occupancy including uncommenced leases90.5%90.0%90.8%90.7%92.3% Leasing spreads - cash5.4%7.0%4.5%1.9%(3)3.6% Leasing spreads - GAAP16.3%15.4%11.6%11.8%(3)10.3% Same Property Performance: Total rental revenue growth5.0%5.5%4.2%8.8%3.6% Total property expense growth-3.2%3.8%-3.4%4.1%3.9% NOI growth8.4%6.2%7.4%10.7%3.5% Cash NOI growth7.1%8.0%7.3%9.7%3.8% Same Property Portfolio ending occupancy93.7%92.6%92.4%92.1%90.4% Stabilized Same Property Portfolio ending occupancy94.8%94.0%94.9%93.7%91.7% Same Property Portfolio occupancy growth (ppt)2.4%2.3%2.1%2.3%2.5% Capitalization: Common stock price at quarter end $ 13.79 $ 14.58 $ 15.81 $ 15.71 $ 13.84 Common shares issued and outstanding 55,198,780 55,051,832 54,909,083 43,382,425 43,059,742 Total shares and units issued and outstanding at period end (4) 57,265,484 57,229,405 57,205,769 45,705,769 45,705,769 Weighted average shares outstanding - basic and diluted 55,145,963 54,963,093 50,683,528 43,234,602 33,527,183 Total equity market capitalization $ 789,691 $ 834,405 $ 904,423 $ 718,038 $ 632,568 Total consolidated debt 335,904 296,715 269,879 357,076 269,699 Total debt (pro-rata)(5) 335,904 296,715 269,879 357,076 275,924 Total combined market capitalization (debt and equity) 1,120,512 1,121,132 1,126,761 1,066,508 847,951 Ratios: Net debt (pro-rata) to total combined market capitalization29.5%25.6%19.7%32.7%25.4% Net debt (pro-rata) to adjusted EBITDA (quarterly results annualized)5.7x5.1x4.3x6.9x4.9x (1) For a definition and discussion of non-GAAP financial measures, see the definitions section beginning on page 28 of this report. (2) Total rental revenues include rental income, tenant reimbursements and other income from rental operations. For comparability, prior period amounts have been reclassified to conform to current period presentation (3) Excluding the effect of one 15,040 sqft lease transaction in our San Diego market, the weighted average cash and GAAP growth for total leases (new & renewal) executed during Q4-14 was is 3.3% and 13.3%, respectively. (4)Includes the following number of OP Units held by noncontrolling interests: 2,066,704 (September 30, 2015), 2,177,573 (June 30, 2015), 2,296,686 (March 31, 2015), 2,323,344 (December 31,2014) and 2,646,027 (September 30, 2014). Excludes the following number of shares of unvested restricted stock: 389,123 (September 30, 2015), 407,463 (June 30, 2015), 420,280 (March 31, 2015), 320,017 (December 31,2014) and 198,141 (September 30, 2014). (5) Includes our 15% share of debt in our Mission Oaks joint venture (the "JV") as of September 30, 2014. During the three months ended December 31, 2014, in connection with the JV's disposition of 3001 & 3175 Mission Oaks Blvd., the JV repaid the $41.5 million loan secured by the properties located at 3001, 3175 and 3233 Mission Oaks Blvd. Third Quarter 2015 Page 4 Supplemental Financial Reporting Package

Consolidated Balance Sheets (unaudited and in thousands) 9/30/156/30/153/31/1512/31/14(1)9/30/14(1) Assets Investments in real estate, net $1,010,384 $955,365 $902,747 $853,578 $722,689 Cash and cash equivalents 5,083 9,988 47,541 8,606 60,541 Restricted cash 307 Notes receivable - 13,137 13,135 13,137 13,138 Rents and other receivables, net 2,221 2,210 1,892 1,812 1,738 Deferred rent receivable 7,009 6,067 5,520 5,165 4,547 Deferred leasing costs, net 5,044 4,526 3,744 3,608 3,275 Deferred loan costs, net 1,595 1,745 1,895 2,045 2,195 Acquired lease intangible assets, net(2) 27,838 28,580 26,504 28,136 23,558 Indefinite-lived intangible 5,271 5,271 5,271 5,271 5,271 Other assets 5,491 5,221 5,534 4,699 4,552 Acquisition related deposits 1,250 1,400 250 2,110 - Investment in unconsolidated real estate entities 4,056 4,018 4,013 4,018 5,744 Total Assets $1,075,242 $1,037,528 $1,018,046 $932,185 $847,555 Liabilities Notes payable $335,058 $296,333 $269,541 $356,362 $269,011 Interest rate swap liability 4,716 2,960 3,279 1,402 228 Accounts payable and accrued expenses 13,886 9,257 11,566 10,053 9,519 Dividends payable 7,504 6,655 6,639 5,244 5,191 Acquired lease intangible liabilities, net(3) 2,700 2,579 2,903 3,016 1,921 Tenant security deposits 10,523 9,711 9,112 8,768 7,927 Prepaid rents 1,935 2,517 1,144 1,463 1,329 Total Liabilities 376,322 330,012 304,184 386,308 295,126 Equity Common stock 552 550 549 434 431 Additional paid in capital 722,102 720,583 719,199 542,318 538,248 Cumulative distributions in excess of earnings (41,613) (34,702) (28,235) (21,673) (16,574) Accumulated other comprehensive income (loss) (4,546) (2,847) (3,147) (1,331) 158 Total stockholders' equity 676,495 683,584 688,366 519,748 522,263 Noncontrolling interests 22,425 23,932 25,496 26,129 30,166 Total Equity 698,920 707,516 713,862 545,877 552,429 Total Liabilities and Equity $1,075,242 $1,037,528 $1,018,046 $932,185 $847,555 (1) For comparability, certain prior period amounts have been reclassified to conform to current period presentation. (2) Includes net above-market tenant lease intangibles of $5,621 (Sept. 30, 2015), $5,725 (June 30, 2015), $3,312 (March 31, 2015), $3,644 (Dec. 31 2014) and $3,474 (Sept. 30, 2014). (3) Includes net below-market tenant lease intangibles of $2,479 (Sept. 30, 2015), $2,350 (June 30, 2015), $2,666 (March 31, 2015), $2,771 (Dec. 31 2014) and $1,668 (Sept. 30, 2014). Third Quarter 2015Page 5 Supplemental Financial Reporting Package

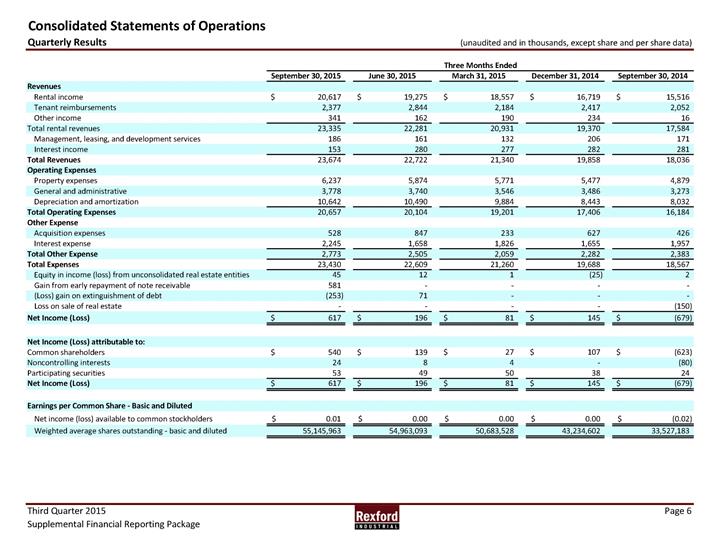

Consolidated Statements of Operations Quarterly Results (unaudited and in thousands, except share and per share data) Three Months Ended September 30, 2015June 30, 2015March 31, 2015December 31, 2014September 30, 2014 Revenues Rental income $ 20,617 $ 19,275 $ 18,557 $ 16,719 $ 15,516 Tenant reimbursements 2,377 2,844 2,184 2,417 2,052 Other income 341 162 190 234 16 Total rental revenues 23,335 22,281 20,931 19,370 17,584 Management, leasing, and development services 186 161 132 206 171 Interest income 153 280 277 282 281 Total Revenues 23,674 22,722 21,340 19,858 18,036 Operating Expenses Property expenses 6,237 5,874 5,771 5,477 4,879 General and administrative 3,778 3,740 3,546 3,486 3,273 Depreciation and amortization 10,642 10,490 9,884 8,443 8,032 Total Operating Expenses 20,657 20,104 19,201 17,406 16,184 Other Expense Acquisition expenses 528 847 233 627 426 Interest expense 2,245 1,658 1,826 1,655 1,957 Total Other Expense 2,773 2,505 2,059 2,282 2,383 Total Expenses 23,430 22,609 21,260 19,688 18,567 Equity in income (loss) from unconsolidated real estate entities 45 12 1 (25) 2 Gain from early repayment of note receivable 581 (Loss) gain on extinguishment of debt (253) 71 Loss on sale of real estate - (150) Net Income (Loss) $ 617 $ 196 $ 81 $ 145 $ (679) Net Income (Loss) attributable to: Common shareholders $ 540 $ 139 $ 27 $ 107 $ (623) Noncontrolling interests 24 8 4 (80) Participating securities 53 49 50 38 24 Net Income (Loss) $ 617 $ 196 $ 81 $ 145 $ (679) Earnings per Common Share - Basic and Diluted Net income (loss) available to common stockholders $ 0.01 $ 0.00 $ 0.00 $ 0.00 $ (0.02) Weighted average shares outstanding - basic and diluted 55,145,963 54,963,093 50,683,528 43,234,602 33,527,183 Third Quarter 2015 Page 6 Supplemental Financial Reporting Package

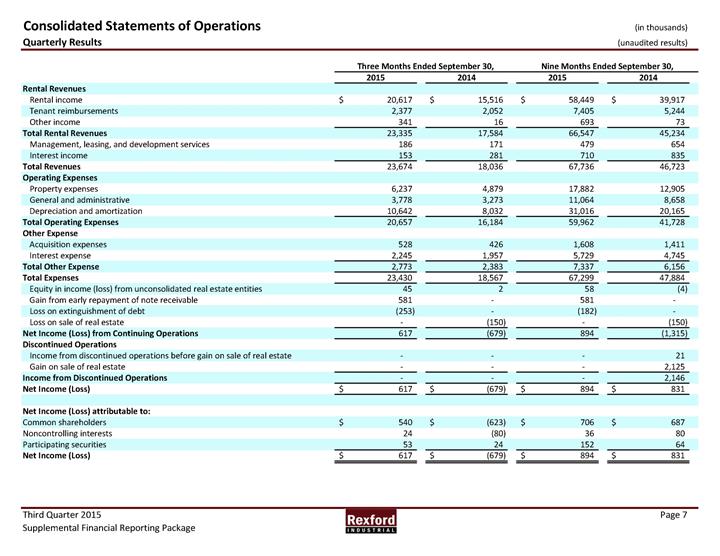

Consolidated Statements of Operations (in thousands) Quarterly Results (unaudited results) Three Months Ended September 30, Nine Months Ended September 30, 2015 2014 2015 2014 Rental Revenues Rental income $ 20,617 $ 15,516 $ 58,449 $ 39,917 Tenant reimbursements 2,377 2,052 7,405 5,244 Other income 341 16 693 73 Total Rental Revenues 23,335 17,584 66,547 45,234 Management, leasing, and development services 186 171 479 654 Interest income 153 281 710 835 Total Revenues 23,674 18,036 67,736 46,723 Operating Expenses Property expenses 6,237 4,879 17,882 12,905 General and administrative 3,778 3,273 11,064 8,658 Depreciation and amortization 10,642 8,032 31,016 20,165 Total Operating Expenses 20,657 16,184 59,962 41,728 Other Expense Acquisition expenses 528 426 1,608 1,411 Interest expense 2,245 1,957 5,729 4,745 Total Other Expense 2,773 2,383 7,337 6,156 Total Expenses 23,430 18,567 67,299 47,884 Equity in income (loss) from unconsolidated real estate entities 45 2 58 (4) Gain from early repayment of note receivable 581 581 Loss on extinguishment of debt (253) - (182) - Loss on sale of real estate - (150) - (150) Net Income (Loss) from Continuing Operations 617 (679) 894 (1,315) Discontinued Operations Income from discontinued operations before gain on sale of real estate - 21 Gain on sale of real estate - 2,125 Income from Discontinued Operations - 2,146 Net Income (Loss) $ 617 $ (679) $ 894 $ 831 Net Income (Loss) attributable to: Common shareholders $ 540 $ (623) $ 706 $ 687 Noncontrolling interests 24 (80) 36 80 Participating securities 53 24 152 64 Net Income (Loss) $ 617 $ (679) $ 894 $ 831 Third Quarter 2015 Page 7 Supplemental Financial Reporting Package

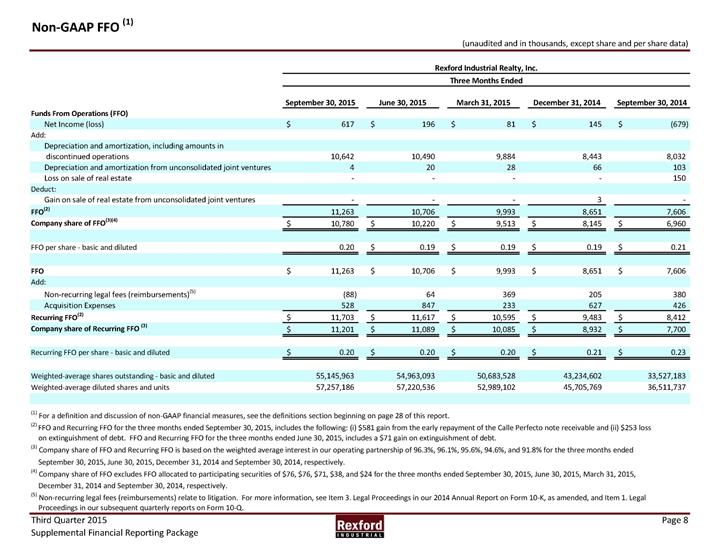

Non-GAAP FFO (1) (unaudited and in thousands, except share and per share data) Rexford Industrial Realty, Inc. Three Months Ended September 30, 2015 June 30, 2015 March 31, 2015 December 31, 2014 September 30, 2014 Funds From Operations (FFO) Net Income (loss) $ 617 $ 196 $ 81 $ 145 $ (679) Add: Depreciation and amortization, including amounts in discontinued operations 10,642 10,490 9,884 8,443 8,032 Depreciation and amortization from unconsolidated joint ventures 4 20 28 66 103 Loss on sale of real estate - - - 150 Deduct: Gain on sale of real estate from unconsolidated joint ventures - - - 3 - FFO(2) 11,263 10,706 9,993 8,651 7,606 Company share of FFO(3)(4) $ 10,780 $ 10,220 $ 9,513 $ 8,145 $ 6,960 FFO per share - basic and diluted 0.20 $ 0.19 $ 0.19 $ 0.19 $ 0.21 FFO $ 11,263 $ 10,706 $ 9,993 $ 8,651 $ 7,606 Add: Non-recurring legal fees (reimbursements)(5) (88) 64 369 205 380 Acquisition Expenses 528 847 233 627 426 Recurring FFO(2) $ 11,703 $ 11,617 $ 10,595 $ 9,483 $ 8,412 Company share of Recurring FFO (3) $ 11,201 $ 11,089 $ 10,085 $ 8,932 $ 7,700 Recurring FFO per share - basic and diluted $ 0.20 $ 0.20 $ 0.20 $ 0.21 $ 0.23 Weighted-average shares outstanding - basic and diluted 55,145,963 54,963,093 50,683,528 43,234,602 33,527,183 Weighted-average diluted shares and units 57,257,186 57,220,536 52,989,102 45,705,769 36,511,737 (1) For a definition and discussion of non-GAAP financial measures, see the definitions section beginning on page 28 of this report. (2) FFO and Recurring FFO for the three months ended September 30, 2015, includes the following: (i) $581 gain from the early repayment of the Calle Perfecto note receivable and (ii) $253 loss on extinguishment of debt. FFO and Recurring FFO for the three months ended June 30, 2015, includes a $71 gain on extinguishment of debt. (3) Company share of FFO and Recurring FFO is based on the weighted average interest in our operating partnership of 96.3%, 96.1%, 95.6%, 94.6%, and 91.8% for the three months ended September 30, 2015, June 30, 2015, December 31, 2014 and September 30, 2014, respectively. (4) Company share of FFO excludes FFO allocated to participating securities of $76, $76, $71, $38, and $24 for the three months ended September 30, 2015, June 30, 2015, March 31, 2015, December 31, 2014 and September 30, 2014, respectively. (5) Non-recurring legal fees (reimbursements) relate to litigation. For more information, see Item 3. Legal Proceedings in our 2014 Annual Report on Form 10-K, as amended, and Item 1. Legal Proceedings in our subsequent quarterly reports on Form 10-Q. Third Quarter 2015 Page 8 Supplemental Financial Reporting Package

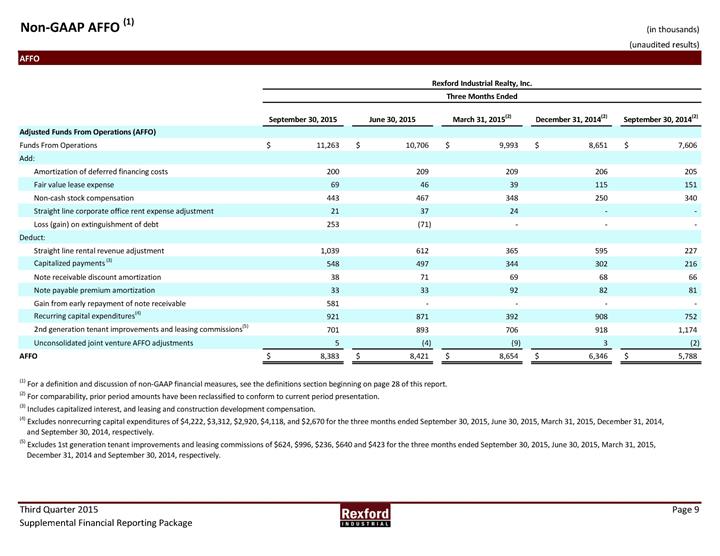

Non-GAAP AFFO (1) (in thousands) (unaudited results) AFFO Rexford Industrial Realty, Inc. Three Months Ended September 30, 2015 June 30, 2015 March 31, 2015(2) December 31, 2014(2) September 30, 2014(2) Adjusted Funds From Operations (AFFO) Funds From Operations $ 11,263 $ 10,706 $ 9,993 $ 8,651 $ 7,606 Add: Amortization of deferred financing costs 200 209 209 206 205 Fair value lease expense 69 46 39 115 151 Non-cash stock compensation 443 467 348 250 340 Straight line corporate office rent expense adjustment 21 37 24 - - Loss (gain) on extinguishment of debt 253 (71) Deduct: Straight line rental revenue adjustment 1,039 612 365 595 227 Capitalized payments (3) 548 497 344 302 216 Note receivable discount amortization 38 71 69 68 66 Note payable premium amortization 33 33 92 82 81 Gain from early repayment of note receivable 581 - - - - Recurring capital expenditures(4) 921 871 392 908 752 2nd generation tenant improvements and leasing commissions(5) 701 893 706 918 1,174 Unconsolidated joint venture AFFO adjustments 5 (4) (9) 3 (2) AFFO $ 8,383 $ 8,421 $ 8,654 $ 6,346 $ 5,788 (1) For a definition and discussion of non-GAAP financial measures, see the definitions section beginning on page 28 of this report. (2) For comparability, prior period amounts have been reclassified to conform to current period presentation. (3) Includes capitalized interest, and leasing and construction development compensation. (4) Excludes nonrecurring capital expenditures of $4,222, $3,312, $2,920, $4,118, and $2,670 for the three months ended September 30, 2015, June 30, 2015, March 31, 2015, December 31, 2014, and September 30, 2014, respectively. (5) Excludes 1st generation tenant improvements and leasing commissions of $624, $996, $236, $640 and $423 for the three months ended September 30, 2015, June 30, 2015, March 31, 2015, December 31, 2014 and September 30, 2014, respectively. Third Quarter 2015 Page 9 Supplemental Financial Reporting Package

Statement of Operations Reconciliations (1) (in thousands) (unaudited results) Rexford Industrial Realty, Inc. Three Months Ended September 30, 2015 June 30, 2015 March 31, 2015 December 31, 2014 September 30, 2014 Net Operating Income (NOI) Rental income $ 20,617 $ 19,275 $ 18,557 $ 16,719 $ 15,516 Tenant reimbursements 2,377 2,844 2,184 2,417 2,052 Other income 341 162 190 234 16 Total rental revenues 23,335 22,281 20,931 19,370 17,584 Property expenses 6,237 5,874 5,771 5,477 4,879 NOI $ 17,098 $ 16,407 $ 15,160 $ 13,893 $ 12,705 Fair value lease revenue 69 46 39 115 151 Straight line rental revenue adjustment (1,039) (612) (365) (595) (227) Cash NOI $ 16,128 $ 15,841 $ 14,834 $ 13,413 $ 12,629 Net Income (Loss) $ 617 $ 196 $ 81 $ 145 $ (679) Add: General and administrative 3,778 3,740 3,546 3,486 3,273 Depreciation and amortization 10,642 10,490 9,884 8,443 8,032 Acquisition expenses 528 847 233 627 426 Interest expense 2,245 1,658 1,826 1,655 1,957 Loss (gain) on extinguishment of debt 253 (71) Loss on sale of real estate 150 Subtract: Management, leasing, and development services 186 161 132 206 171 Interest income 153 280 277 282 281 Equity in income (loss) from unconsolidated real estate entities 45 12 1 (25) 2 Gain from early repayment of note receivable 581 - - - - NOI $ 17,098 $ 16,407 $ 15,160 $ 13,893 $ 12,705 Fair value lease revenue 69 46 39 115 151 Straight line rental revenue adjustment (1,039) (612) (365) (595) (227) Cash NOI $ 16,128 $ 15,841 $ 14,834 $ 13,413 $ 12,629 (1) For a definition and discussion of non-GAAP financial measures, see the definitions section beginning on page 28 of this report. Third Quarter 2015 Page 10 Supplemental Financial Reporting Package

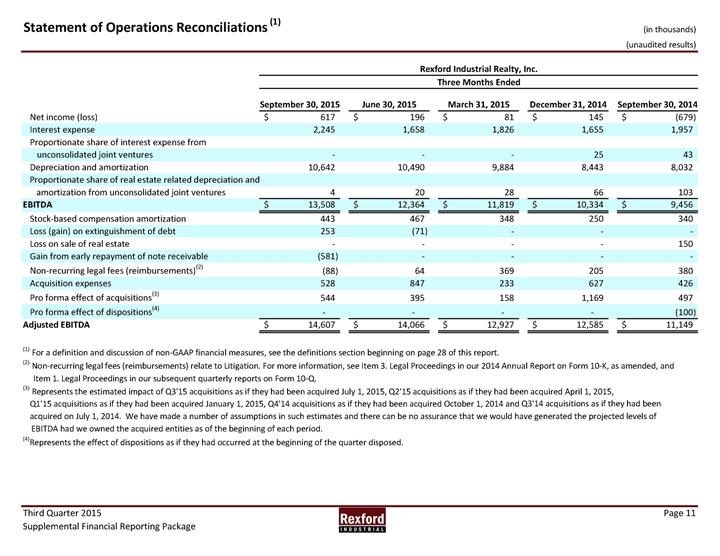

Statement of Operations Reconciliations (1) (in thousands) (unaudited results) Rexford Industrial Realty, Inc. Three Months Ended September 30, 2015 June 30, 2015 March 31, 2015 December 31, 2014 September 30, 2014 Net income (loss) $ 617 $ 196 $ 81 $ 145 $ (679) Interest expense 2,245 1,658 1,826 1,655 1,957 Proportionate share of interest expense from unconsolidated joint ventures 25 43 Depreciation and amortization 10,642 10,490 9,884 8,443 8,032 Proportionate share of real estate related depreciation and amortization from unconsolidated joint ventures 4 20 28 66 103 EBITDA $ 13,508 $ 12,364 $ 11,819 $ 10,334 $ 9,456 Stock-based compensation amortization 443 467 348 250 340 Loss (gain) on extinguishment of debt 253 (71) Loss on sale of real estate 150 Gain from early repayment of note receivable (581) Non-recurring legal fees (reimbursements)(2) (88) 64 369 205 380 Acquisition expenses 528 847 233 627 426 Pro forma effect of acquisitions(3) 544 395 158 1,169 497 Pro forma effect of dispositions(4) (100) Adjusted EBITDA $ 14,607 $ 14,066 $ 12,927 $ 12,585 $ 11,149 (1) For a definition and discussion of non-GAAP financial measures, see the definitions section beginning on page 28 of this report. (2) Non-recurring legal fees (reimbursements) relate to Litigation. For more information, see Item 3. Legal Proceedings in our 2014 Annual Report on Form 10-K, as amended, and Item 1. Legal Proceedings in our subsequent quarterly reports on Form 10-Q. (3) Represents the estimated impact of Q3'15 acquisitions as if they had been acquired July 1, 2015, Q2'15 acquisitions as if they had been acquired April 1, 2015, Q1'15 acquisitions as if they had been acquired January 1, 2015, Q4'14 acquisitions as if they had been acquired October 1, 2014 and Q3'14 acquisitions as if they had been acquired on July 1, 2014. We have made a number of assumptions in such estimates and there can be no assurance that we would have generated the projected levels of EBITDA had we owned the acquired entities as of the beginning of each period. (4)Represents the effect of dispositions as if they had occurred at the beginning of the quarter disposed. Third Quarter 2015 Page 11 Supplemental Financial Reporting Package

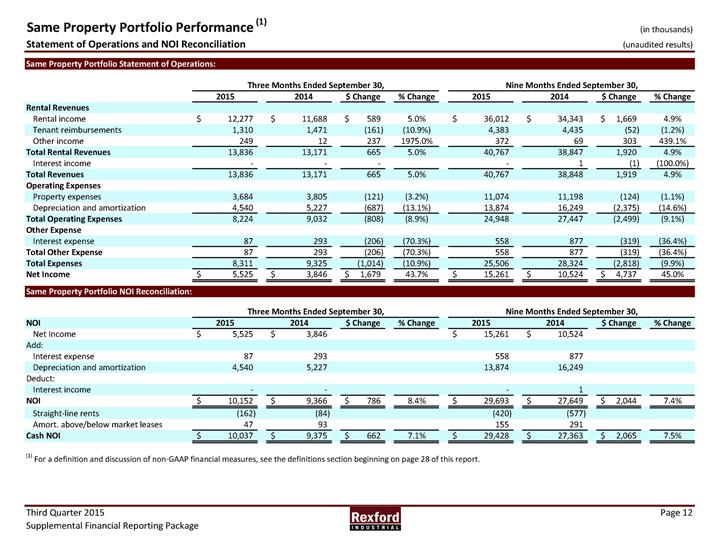

Same Property Portfolio Performance (1) (in thousands) Statement of Operations and NOI Reconciliation (unaudited results) Same Property Portfolio Statement of Operations: Three Months Ended September 30, Nine Months Ended September 30, 2015 2014 $ Change % Change 2015 2014 $ Change % Change Rental Revenues Rental income $ 12,277 $ 11,688 $ 589 5.0% $ 36,012 $ 34,343 $ 1,669 4.9% Tenant reimbursements 1,310 1,471 (161) (10.9%) 4,383 4,435 (52) (1.2%) Other income 249 12 237 1975.0% 372 69 303 439.1% Total Rental Revenues 13,836 13,171 665 5.0% 40,767 38,847 1,920 4.9% Interest income - 1 (1) (100.0%) Total Revenues 13,836 13,171 665 5.0% 40,767 38,848 1,919 4.9% Operating Expenses Property expenses 3,684 3,805 (121) (3.2%) 11,074 11,198 (124) (1.1%) Depreciation and amortization 4,540 5,227 (687) (13.1%) 13,874 16,249 (2,375) (14.6%) Total Operating Expenses 8,224 9,032 (808) (8.9%) 24,948 27,447 (2,499) (9.1%) Other Expense Interest expense 87 293 (206) (70.3%) 558 877 (319) (36.4%) Total Other Expense 87 293 (206) (70.3%) 558 877 (319) (36.4%) Total Expenses 8,311 9,325 (1,014) (10.9%) 25,506 28,324 (2,818) (9.9%) Net Income $ 5,525 $ 3,846 $ 1,679 43.7% $ 15,261 $ 10,524 $ 4,737 45.0% Same Property Portfolio NOI Reconciliation: Three Months Ended September 30, Nine Months Ended September 30, NOI 2015 2014 $ Change % Change 2015 2014 $ Change % Change Net Income $ 5,525 $ 3,846 $ 15,261 $ 10,524 Add: Interest expense 87 293 558 877 Depreciation and amortization 4,540 5,227 13,874 16,249 Deduct: Interest income - 1 NOI $ 10,152 $ 9,366 $ 786 8.4% $ 29,693 $ 27,649 $ 2,044 7.4% Straight-line rents (162) (84) (420) (577) Amort. above/below market leases 47 93 155 291 Cash NOI $ 10,037 $ 9,375 $ 662 7.1% $ 29,428 $ 27,363 $ 2,065 7.5% (1) For a definition and discussion of non-GAAP financial measures, see the definitions section beginning on page 28 of this report. Third Quarter 2015 Page 12 Supplemental Financial Reporting Package

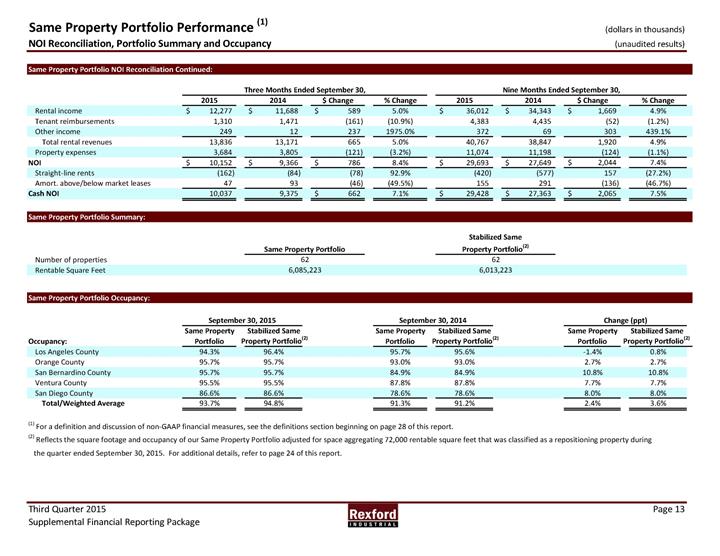

Same Property Portfolio Performance (1) (dollars in thousands) NOI Reconciliation, Portfolio Summary and Occupancy (unaudited results) Same Property Portfolio NOI Reconciliation Continued: Three Months Ended September 30, Nine Months Ended September 30, 2015 2014 $ Change % Change 2015 2014 $ Change % Change Rental income $ 12,277 $ 11,688 $ 589 5.0% $ 36,012 $ 34,343 $ 1,669 4.9% Tenant reimbursements 1,310 1,471 (161) (10.9%) 4,383 4,435 (52) (1.2%) Other income 249 12 237 1975.0% 372 69 303 439.1% Total rental revenues 13,836 13,171 665 5.0% 40,767 38,847 1,920 4.9% Property expenses 3,684 3,805 (121) (3.2%) 11,074 11,198 (124) (1.1%) NOI $ 10,152 $ 9,366 $ 786 8.4% $ 29,693 $ 27,649 $ 2,044 7.4% Straight-line rents (162) (84) (78) 92.9% (420) (577) 157 (27.2%) Amort. above/below market leases 47 93 (46) (49.5%) 155 291 (136) (46.7%) Cash NOI 10,037 9,375 $ 662 7.1% $ 29,428 $ 27,363 $ 2,065 7.5% Same Property Portfolio Summary: Same Property Portfolio Stabilized Same Property Portfolio(2) Number of properties 62 62 Rentable Square Feet 6,085,223 6,013,223 Same Property Portfolio Occupancy: September 30, 2015 September 30, 2014 Change (ppt) Same Property Stabilized Same Same Property Stabilized Same Same Property Stabilized Same Occupancy: Portfolio Property Portfolio(2) Portfolio Property Portfolio(2) Portfolio Property Portfolio(2) Los Angeles County 94.3% 96.4% 95.7% 95.6% 1.4% 0.8% Orange County 95.7% 95.7% 93.0% 93.0% 2.7% 2.7% San Bernardino County 95.7% 95.7% 84.9% 84.9% 10.8% 10.8% Ventura County 95.5% 95.5% 87.8% 87.8% 7.7% 7.7% San Diego County 86.6% 86.6% 78.6% 78.6% 8.0% 8.0% Total/Weighted Average 93.7% 94.8% 91.3% 91.2% 2.4% 3.6% (1) For a definition and discussion of non-GAAP financial measures, see the definitions section beginning on page 28 of this report. (2) Reflects the square footage and occupancy of our Same Property Portfolio adjusted for space aggregating 72,000 rentable square feet that was classified as a repositioning property during the quarter ended September 30, 2015. For additional details, refer to page 24 of this report. Third Quarter 2015 Page 13 Supplemental Financial Reporting Package

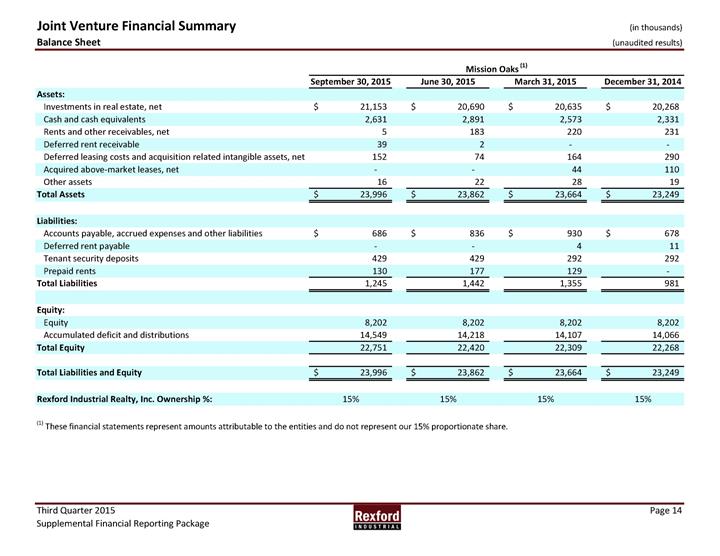

Joint Venture Financial Summary (in thousands) Balance Sheet (unaudited results) Mission Oaks (1) September 30, 2015 June 30, 2015 March 31, 2015 December 31, 2014 Assets: Investments in real estate, net $ 21,153 $ 20,690 $ 20,635 $ 20,268 Cash and cash equivalents 2,631 2,891 2,573 2,331 Rents and other receivables, net 5 183 220 231 Deferred rent receivable 39 2 Deferred leasing costs and acquisition related intangible assets, net 152 74 164 290 Acquired above-market leases, net - 44 110 Other assets 16 22 28 19 Total Assets $ 23,996 $ 23,862 $ 23,664 $ 23,249 Liabilities: Accounts payable, accrued expenses and other liabilities $ 686 $ 836 $ 930 $ 678 Deferred rent payable - 4 11 Tenant security deposits 429 429 292 292 Prepaid rents 130 177 129 Total Liabilities 1,245 1,442 1,355 981 Equity: Equity 8,202 8,202 8,202 8,202 Accumulated deficit and distributions 14,549 14,218 14,107 14,066 Total Equity 22,751 22,420 22,309 22,268 Total Liabilities and Equity $ 23,996 $ 23,862 $ 23,664 $ 23,249 Rexford Industrial Realty, Inc. Ownership %: 15% 15% 15% 15% (1) These financial statements represent amounts attributable to the entities and do not represent our 15% proportionate share. Third Quarter 2015 Page 14 Supplemental Financial Reporting Package

Joint Venture Financial Summary (1) (in thousands) Statement of Operations (unaudited results) Statement of Operations: Mission Oaks (2) Three Months Ended September 30, 2015 June 30, 2015 March 31, 2015 December 31, 2014 Income Statement Rental revenues $ 502 $ 373 $ 348 $ 807 Tenant reimbursements 191 312 315 355 Other operating revenues 2 - - - Total revenue 695 685 663 1,162 Total operating expense 334 423 425 555 NOI 361 262 238 607 General and administrative 3 13 12 11 Depreciation and amortization 27 138 185 442 Interest expense 165 Loss on Extinguishment of Debt 70 Gain on sale of assets/investments (13,389) Total expense (income) 364 574 622 (12,146) Net Income 331 111 41 $ 13,308 EBITDA Net income $ 331 $ 111 $ 41 $ 13,308 Interest expense 165 Depreciation and amortization 27 138 185 442 EBITDA $ 358 $ 249 $ 226 $ 13,915 Rexford Industrial Realty, Inc. Ownership %: 15% 15% 15% 15% Reconciliation - Equity Income in Joint Venture: Net income $ 331 $ 111 $ 41 $ 13,308 Rexford Industrial Realty, Inc. Ownership %: 15% 15% 15% 15% Company share 50 17 6 1,996 Intercompany eliminations/basis adjustments (5) (5) (5) (2,021) Equity in net income (loss) from unconsolidated real estate entities $ 45 $ 12 $ 1 $ (25) (1) For a definition and discussion of non-GAAP financial measures, see the definitions section beginning on page 28 of this report. (2) These financial statements represent amounts attributable to the entities and do not represent our 15% proportionate share. Third Quarter 2015 Page 15 Supplemental Financial Reporting Package

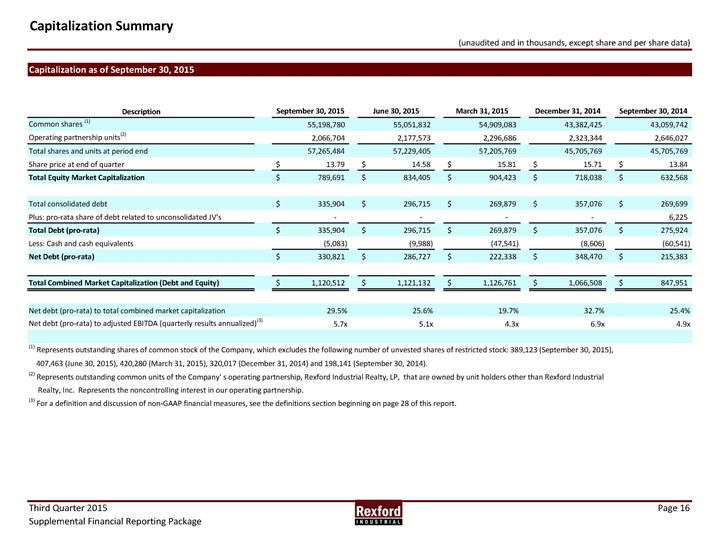

Capitalization Summary (unaudited and in thousands, except share and per share data) Capitalization as of September 30, 2015 Description September 30, 2015 June 30, 2015 March 31, 2015 December 31, 2014 September 30, 2014 Common shares (1) 55,198,780 55,051,832 54,909,083 43,382,425 43,059,742 Operating partnership units(2) 2,066,704 2,177,573 2,296,686 2,323,344 2,646,027 Total shares and units at period end 57,265,484 57,229,405 57,205,769 45,705,769 45,705,769 Share price at end of quarter $ 13.79 $ 14.58 $ 15.81 $ 15.71 $ 13.84 Total Equity Market Capitalization $ 789,691 $ 834,405 $ 904,423 $ 718,038 $ 632,568 Total consolidated debt $ 335,904 $ 296,715 $ 269,879 $ 357,076 $ 269,699 Plus: pro-rata share of debt related to unconsolidated JV's 6,225 Total Debt (pro-rata) $ 335,904 $ 296,715 $ 269,879 $ 357,076 $ 275,924 Less: Cash and cash equivalents (5,083) (9,988) (47,541) (8,606) (60,541) Net Debt (pro-rata) $ 330,821 $ 286,727 $ 222,338 $ 348,470 $ 215,383 Total Combined Market Capitalization (Debt and Equity) $ 1,120,512 $ 1,121,132 $ 1,126,761 $ 1,066,508 $ 847,951 Net debt (pro-rata) to total combined market capitalization 29.5% 25.6% 19.7% 32.7% 25.4% Net debt (pro-rata) to adjusted EBITDA (quarterly results annualized)(3) 5.7x 5.1x 4.3x 6.9x 4.9x (1) Represents outstanding shares of common stock of the Company, which excludes the following number of unvested shares of restricted stock: 389,123 (September 30, 2015), 407,463 (June 30, 2015), 420,280 (March 31, 2015), 320,017 (December 31, 2014) and 198,141 (September 30, 2014). (2) Represents outstanding common units of the Company' s operating partnership, Rexford Industrial Realty, LP, that are owned by unit holders other than Rexford Industrial Realty, Inc. Represents the noncontrolling interest in our operating partnership. (3) For a definition and discussion of non-GAAP financial measures, see the definitions section beginning on page 28 of this report. Third Quarter 2015 Page 16 Supplemental Financial Reporting Package

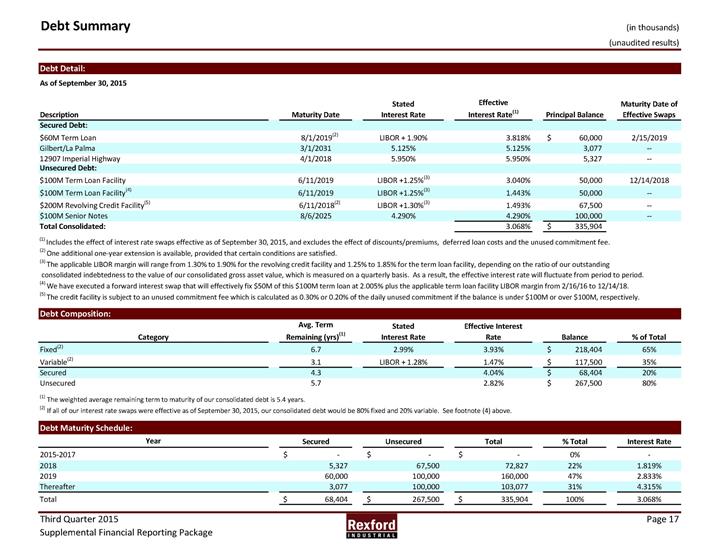

Debt Summary (in thousands) (unaudited results) Debt Detail: As of September 30, 2015 Description Maturity Date Stated Interest Rate Effective Interest Rate(1) Principal Balance Maturity Date of Effective Swaps Secured Debt: $60M Term Loan 8/1/2019(2) LIBOR + 1.90% 3.818% $ 60,000 2/15/2019 Gilbert/La Palma 3/1/2031 5.125% 5.125% 3,077 -- 12907 Imperial Highway 4/1/2018 5.950% 5.950% 5,327 -- Unsecured Debt: $100M Term Loan Facility 6/11/2019 LIBOR +1.25%(3) 3.040% 50,000 12/14/2018 $100M Term Loan Facility(4) 6/11/2019 LIBOR +1.25%(3) 1.443% 50,000 -- $200M Revolving Credit Facility(5) 6/11/2018(2) LIBOR +1.30%(3) 1.493% 67,500 -- $100M Senior Notes 8/6/2025 4.290% 4.290% 100,000 -- Total Consolidated: 3.068% $ 335,904 (1) Includes the effect of interest rate swaps effective as of September 30, 2015, and excludes the effect of discounts/premiums, deferred loan costs and the unused commitment fee. (2) One additional one-year extension is available, provided that certain conditions are satisfied. (3) The applicable LIBOR margin will range from 1.30% to 1.90% for the revolving credit facility and 1.25% to 1.85% for the term loan facility, depending on the ratio of our outstanding consolidated indebtedness to the value of our consolidated gross asset value, which is measured on a quarterly basis. As a result, the effective interest rate will fluctuate from period to period. (4) We have executed a forward interest swap that will effectively fix $50M of this $100M term loan at 2.005% plus the applicable term loan facility LIBOR margin from 2/16/16 to 12/14/18. (5) The credit facility is subject to an unused commitment fee which is calculated as 0.30% or 0.20% of the daily unused commitment if the balance is under $100M or over $100M, respectively. Debt Composition: Category Avg. Term Remaining (yrs)(1) Stated

Interest Rate Effective Interest Rate Balance % of Total Fixed(2) 6.7 2.99% 3.93% $ 218,404 65% Variable(2) 3.1 LIBOR + 1.28% 1.47% $ 117,500 35% Secured 4.3 4.04% $ 68,404 20% Unsecured 5.7 2.82% $ 267,500 80% (1) The weighted average remaining term to maturity of our consolidated debt is 5.4 years. (2) If all of our interest rate swaps were effective as of September 30, 2015, our consolidated debt would be 80% fixed and 20% variable. See footnote (4) above. Debt Maturity Schedule: Year Secured Unsecured Total % Total Interest Rate 2015-2017 $ $ - $ 0% 2018 5,327 67,500 72,827 22% 1.819% 2019 60,000 100,000 160,000 47% 2.833% Thereafter 3,077 100,000 103,077 31% 4.315% Total $ 68,404 $ 267,500 $ 335,904 100% 3.068% Third Quarter 2015 Page 17 Supplemental Financial Reporting Package

Debt Covenants (unaudited results) Unsecured Revolving Credit Facility and Term Loan Facility Covenants(1) Covenant September 30, 2015 June 30, 2015 March 31, 2015 Maximum Leverage Ratio less than 60% 30.2% 28.1% 26.6% Maximum Secured Leverage Ratio less than 45% 6.2% 15.1% 16.7% Maximum Secured Recourse Debt(2) less than 15% 0.0% - - Maximum Recourse Debt(2) less than 15% - 1.0% 1.1% Minimum Tangible Net Worth $582,432,000 $755,982,000 $756,231,000 $762,145,000 Minimum Fixed Charge Coverage Ratio at least 1.50 to 1.00 5.26 to 1.00 8.47 to 1.00 7.60 to 1.00 Unencumbered Leverage Ratio less than 60% 27.1% 17.1% 13.1% Unencumbered Interest Coverage Ratio at least 1.75 to 1.00 3.87 to 1.00 5.96 to 1.00 7.55 to 1.00 (1) Our actual performance for each covenant is calculated based on the definitions set forth in the credit agreement. (2) On July 15, 2015, we amended our credit agreement. The amendment provides for, among other things, the replacement of the maximum recourse debt covenant with a maximum secured recourse debt covenant. Third Quarter 2015 Page 18 Supplemental Financial Reporting Package

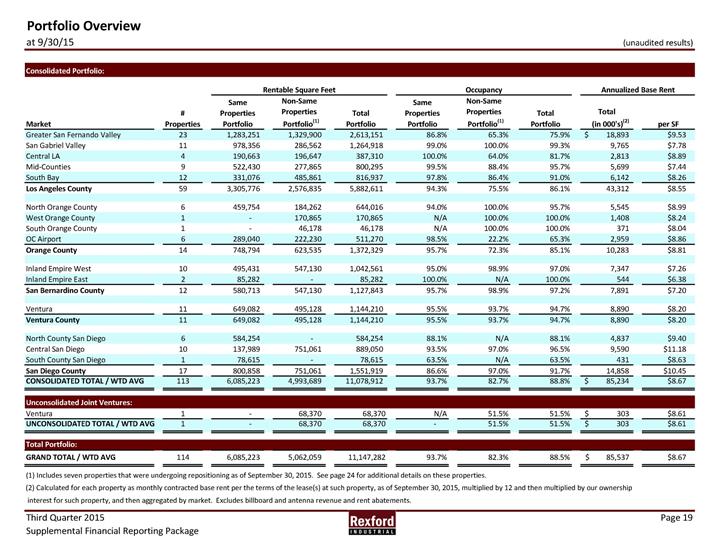

Portfolio Overview at 9/30/15 (unaudited results) Consolidated Portfolio: Rentable Square Feet Occupancy Annualized Base Rent Market # Properties Same Properties Portfolio Non-Same Properties Portfolio(1) Total Portfolio Same Properties Portfolio Non-Same Properties Portfolio(1) Total Portfolio Total (in 000's)(2) per SF Greater San Fernando Valley 23 1,283,251 1,329,900 2,613,151 86.8% 65.3% 75.9% $ 18,893 $9.53 San Gabriel Valley 11 978,356 286,562 1,264,918 99.0% 100.0% 99.3% 9,765 $7.78 Central LA 4 190,663 196,647 387,310 100.0% 64.0% 81.7% 2,813 $8.89 Mid-Counties 9 522,430 277,865 800,295 99.5% 88.4% 95.7% 5,699 $7.44 South Bay 12 331,076 485,861 816,937 97.8% 86.4% 91.0% 6,142 $8.26 Los Angeles County 59 3,305,776 2,576,835 5,882,611 94.3% 75.5% 86.1% 43,312 $8.55 North Orange County 6 459,754 184,262 644,016 94.0% 100.0% 95.7% 5,545 $8.99 West Orange County 1 170,865 170,865 N/A 100.0% 100.0% 1,408 $8.24 South Orange County 1 46,178 46,178 N/A 100.0% 100.0% 371 $8.04 OC Airport 6 289,040 222,230 511,270 98.5% 22.2% 65.3% 2,959 $8.86 Orange County 14 748,794 623,535 1,372,329 95.7% 72.3% 85.1% 10,283 $8.81 Inland Empire West 10 495,431 547,130 1,042,561 95.0% 98.9% 97.0% 7,347 $7.26 Inland Empire East 2 85,282 - 85,282 100.0% N/A 100.0% 544 $6.38 San Bernardino County 12 580,713 547,130 1,127,843 95.7% 98.9% 97.2% 7,891 $7.20 Ventura 11 649,082 495,128 1,144,210 95.5% 93.7% 94.7% 8,890 $8.20 Ventura County 11 649,082 495,128 1,144,210 95.5% 93.7% 94.7% 8,890 $8.20 North County San Diego 6 584,254 - 584,254 88.1% N/A 88.1% 4,837 $9.40 Central San Diego 10 137,989 751,061 889,050 93.5% 97.0% 96.5% 9,590 $11.18 South County San Diego 1 78,615 - 78,615 63.5% N/A 63.5% 431 $8.63 San Diego County 17 800,858 751,061 1,551,919 86.6% 97.0% 91.7% 14,858 $10.45 CONSOLIDATED TOTAL / WTD AVG 113 6,085,223 4,993,689 11,078,912 93.7% 82.7% 88.8% $ 85,234 $8.67 Unconsolidated Joint Ventures: Ventura 1 68,370 68,370 N/A 51.5% 51.5% $ 303 $8.61 UNCONSOLIDATED TOTAL / WTD AVG 1 68,370 68,370 51.5% 51.5% $ 303 $8.61 Total Portfolio: GRAND TOTAL / WTD AVG 114 6,085,223 5,062,059 11,147,282 93.7% 82.3% 88.5% $ 85,537 $8.67 (1) Includes seven properties that were undergoing repositioning as of September 30, 2015. See page 24 for additional details on these properties. (2) Calculated for each property as monthly contracted base rent per the terms of the lease(s) at such property, as of September 30, 2015, multiplied by 12 and then multiplied by our ownership interest for such property, and then aggregated by market. Excludes billboard and antenna revenue and rent abatements. Third Quarter 2015 Page 19 Supplemental Financial Reporting Package

Occupancy and Leasing Trends (unaudited results, data represents consolidated portfolio only) Occupancy by County: Sep. 30, 2015 Jun. 30, 2015 Mar. 31, 2015 Dec. 31, 2014 Sep. 30, 2014 Occupancy: Los Angeles County 86.1% 87.7% 87.1% 91.0% 95.7% Orange County 85.1% 84.4% 92.6% 92.1% 90.3% San Bernardino County 97.2% 96.7% 96.3% 92.1% 88.1% Ventura County 94.7% 90.8% 91.8% 91.4% 87.8% San Diego County 91.7% 87.5% 89.0% 86.3% 82.4% Total/Weighted Average 88.8% 88.4% 89.5% 90.7% 91.8% Consolidated Portfolio SF 11,078,912 10,649,768 10,253,580 9,829,020 8,633,812 Leasing Activity: Three Months Ended Sep. 30, 2015 Jun. 30, 2015 Mar. 31, 2015 Dec. 31, 2014 Sep. 30, 2014 Leasing Activity (SF): (1) New leases 216,499 283,695 458,301 201,269 253,422 Renewal 323,085 442,019 319,849 229,226 438,251 Gross leasing 539,584 725,714 778,150 430,495 691,673 Expiring leases 455,677 857,483 625,534 388,816 624,995 Net absorption 83,907 (131,769)(2) 152,616 41,679 66,678 Retention rate 71% 52%(2) 51% 59% 70% Weighted Average New/Renewal Leasing Spreads: Three Months Ended Sep. 30, 2015 Jun. 30, 2015 Mar. 31, 2015 Dec. 31, 2014 Sep. 30, 2014 Cash Rent Change 5.4% 7.0% 4.5% 1.9%(3) 3.6% GAAP Rent Change 16.3% 15.4% 11.6% 11.8%(3) 10.3% (1) Excludes month-to-month tenants. (2) Excluding the effect of two move-outs aggregating 146,133 sqft at two of our repositioning properties, Birch and Frampton, our net absorption was 14,364 sqft and our retention rate was 62%. (3) Excluding the effect of one 15,040 sqft lease transaction in our San Diego market, the weighted average cash and GAAP growth for total executed leases was 3.3% and 13.3%, respectively. Third Quarter 2015 Page 20 Supplemental Financial Reporting Package

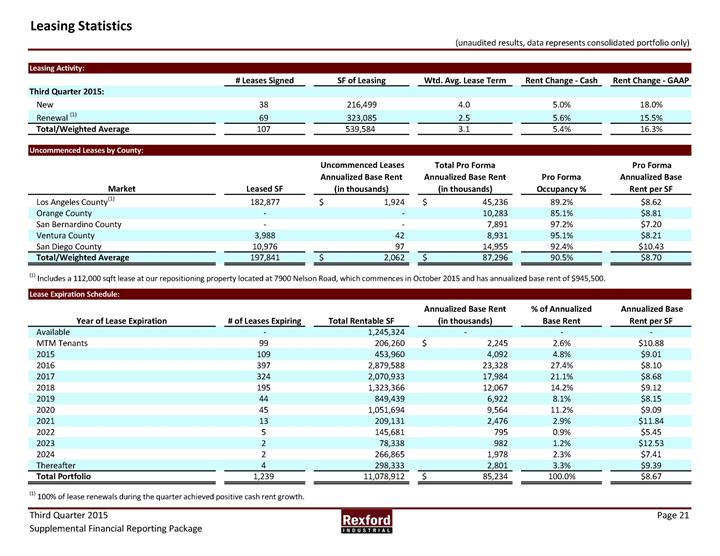

Leasing Statistics (unaudited results, data represents consolidated portfolio only) Leasing Activity: # Leases Signed SF of Leasing Wtd. Avg. Lease Term Rent Change - Cash Rent Change - GAAP Third Quarter 2015: New 38 216,499 4.0 5.0% 18.0% Renewal (1) 69 323,085 2.5 5.6% 15.5% Total/Weighted Average 107 539,584 3.1 5.4% 16.3% Uncommenced Leases by County: Market Leased SF Uncommenced Leases Annualized Base Rent (in thousands) Total Pro Forma Annualized Base Rent (in thousands) Pro Forma Occupancy % Pro Forma Annualized Base Rent per SF Los Angeles County(1) 182,877 $ 1,924 $ 45,236 89.2% $8.62 Orange County 10,283 85.1% $8.81 San Bernardino County 7,891 97.2% $7.20 Ventura County 3,988 42 8,931 95.1% $8.21 San Diego County 10,976 97 14,955 92.4% $10.43 Total/Weighted Average 197,841 $ 2,062 $ 87,296 90.5% $8.70 (1) Includes a 112,000 sqft lease at our repositioning property located at 7900 Nelson Road, which commences in October 2015 and has annualized base rent of $945,500. Lease Expiration Schedule: Year of Lease Expiration # of Leases Expiring Total Rentable SF Annualized Base Rent (in thousands) % of Annualized Base Rent Annualized Base Rent per SF Available 1,245,324 - MTM Tenants 99 206,260 $ 2,245 2.6% $10.88 2015 109 453,960 4,092 4.8% $9.01 2016 397 2,879,588 23,328 27.4% $8.10 2017 324 2,070,933 17,984 21.1% $8.68 2018 195 1,323,366 12,067 14.2% $9.12 2019 44 849,439 6,922 8.1% $8.15 2020 45 1,051,694 9,564 11.2% $9.09 2021 13 209,131 2,476 2.9% $11.84 2022 5 145,681 795 0.9% $5.45 2023 2 78,338 982 1.2% $12.53 2024 2 266,865 1,978 2.3% $7.41 Thereafter 4 298,333 2,801 3.3% $9.39 Total Portfolio 1,239 11,078,912 $ 85,234 100.0% $8.67 (1) 100% of lease renewals during the quarter achieved positive cash rent growth. Third Quarter 2015 Page 21 Supplemental Financial Reporting Package

Top Tenants and Lease Segmentation (unaudited results, data represents consolidated portfolio only) Top 10 Tenants: Tenant Submarket Leased SF % of Total Ann. Base Rent Ann. Base Rent per SF Lease Expiration Cosmetic Laboratories of America, LLC LA - San Fern. Valley 319,348 2.1% $5.64 6/30/2020 Valeant Pharmaceuticals International, Inc. OC - West 170,865 1.7% $8.24 12/31/2019 Triumph Processing, Inc. LA - South Bay 164,662 1.5% $7.86 5/31/2030 Senior Operations, Inc. LA - San Fern. Valley 130,800 1.4% $8.88 11/30/2024 Biosense Webster, Inc. LA - San Gabriel Valley 89,920 1.4% $12.82 10/31/2020(1) Warehouse Specialists, Inc. LA - San Gabriel Valley 245,961 1.3% $4.44 11/30/2017 32 Cold, LLC LA - Central 78,280 1.3% $13.80 9/30/2025 Department of Corrections Inland Empire West 58,781 1.3% $18.25 3/31/2020 Tarnik, Inc. LA - San Fern. Valley 138,980 1.1% $6.80 4/30/2016 Exelis Inc. LA - San Gabriel Valley 67,838 1.0% $13.01 9/30/2023 Top 10 Total / Wtd. Avg. 1,465,435 14.1% $8.11 (1)Includes 1,120 rentable square feet expiring 9/30/2016, 12,800 rentable square feet expiring 9/30/2017 and 76,000 rentable square feet expiring 10/31/2020, as of September 30, 2015. Lease Segmentation by Size: Square Feet Number of Leases Leased SF Ann. Base Rent (in thousands) % of Total Ann. Base Rent Ann. Base Rent per SF <4,999 879 1,830,374 $ 19,279 22.6% $10.53 5,000 - 9,999 148 1,019,517 10,364 12.1% $10.17 10,000 - 24,999 141 2,202,116 20,210 23.7% $9.18 25,000 - 49,999 35 1,229,941 10,381 12.3% $8.44 >50,000 36 3,551,640 25,000 29.3% $7.04 Total / Wtd. Avg. 1,239 9,833,588 $ 85,234 100.0% $8.67 Third Quarter 2015 Page 22 Supplemental Financial Reporting Package

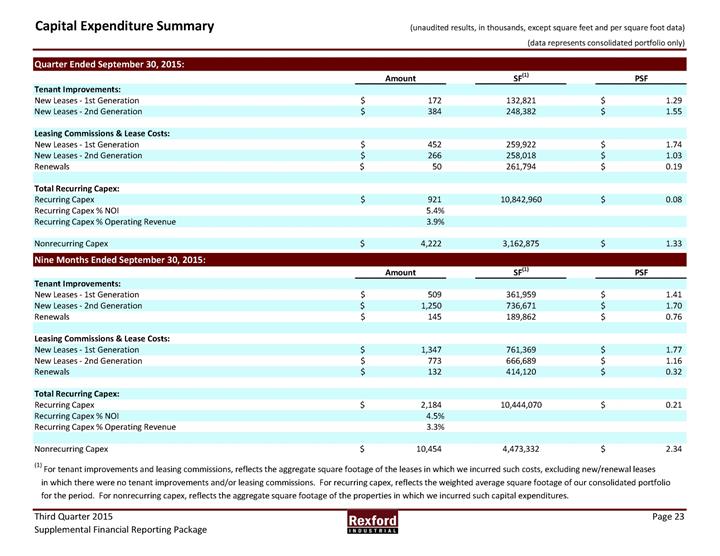

Capital Expenditure Summary (unaudited results, in thousands, except square feet and per square foot data) (data represents consolidated portfolio only) Quarter Ended September 30, 2015: Amount SF(1) PSF Tenant Improvements: New Leases - 1st Generation $ 172 132,821 $ 1.29 New Leases - 2nd Generation $ 384 248,382 $ 1.55 Leasing Commissions & Lease Costs: New Leases - 1st Generation $ 452 259,922 $ 1.74 New Leases - 2nd Generation $ 266 258,018 $ 1.03 Renewals $ 50 261,794 $ 0.19 Total Recurring Capex: Recurring Capex $ 921 10,842,960 $ 0.08 Recurring Capex % NOI 5.4% Recurring Capex % Operating Revenue 3.9% Nonrecurring Capex $ 4,222 3,162,875 $ 1.33 Nine Months Ended September 30, 2015: Amount SF(1) PSF Tenant Improvements: New Leases - 1st Generation $ 509 361,959 $ 1.41 New Leases - 2nd Generation $ 1,250 736,671 $ 1.70 Renewals $ 145 189,862 $ 0.76 Leasing Commissions & Lease Costs: New Leases - 1st Generation $ 1,347 761,369 $ 1.77 New Leases - 2nd Generation $ 773 666,689 $ 1.16 Renewals $ 132 414,120 $ 0.32 Total Recurring Capex: Recurring Capex $ 2,184 10,444,070 $ 0.21 Recurring Capex % NOI 4.5% Recurring Capex % Operating Revenue 3.3% Nonrecurring Capex $ 10,454 4,473,332 $ 2.34 (1) For tenant improvements and leasing commissions, reflects the aggregate square footage of the leases in which we incurred such costs, excluding new/renewal leases in which there were no tenant improvements and/or leasing commissions. For recurring capex, reflects the weighted average square footage of our consolidated portfolio for the period. For nonrecurring capex, reflects the aggregate square footage of the properties in which we incurred such capital expenditures. Third Quarter 2015 Page 23 Supplemental Financial Reporting Package

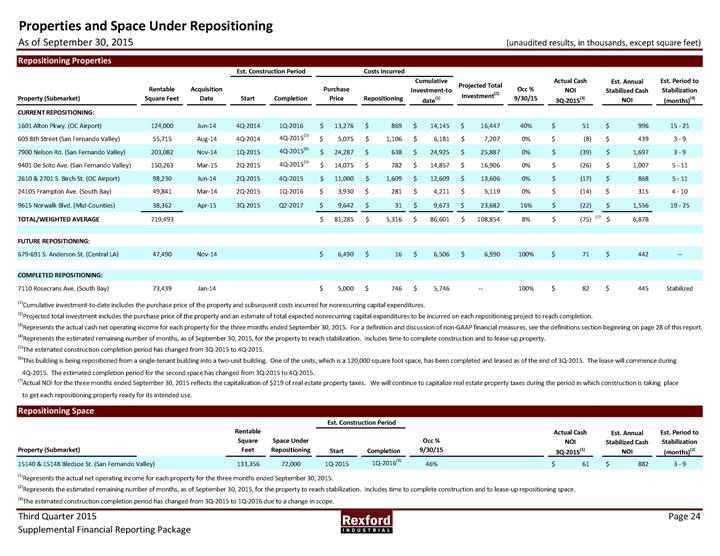

Properties and Space Under Repositioning As of September 30, 2015 (unaudited results, in thousands, except square feet) Repositioning Properties Est. Construction Period Costs Incurred Property (Submarket) Rentable Square Feet Acquisition Date Start Completion Purchase Price Repositioning Cumulative Investment-to-date(1) Projected Total Investment(2) Occ % 9/30/15 Actual Cash NOI 3Q-2015(3) Est. Annual Stabilized Cash NOI Est. Period to Stabilization (months)(4) CURRENT REPOSITIONING: 1601 Alton Pkwy. (OC Airport) 124,000 Jun-14 4Q-2014 1Q-2016 $ 13,276 $ 869 $ 14,145 $ 16,447 40% $ 51 $ 996 15 - 21 605 8th Street (San Fernando Valley) 55,715 Aug-14 4Q-2014 4Q-2015(5) $ 5,075 $ 1,106 $ 6,181 $ 7,207 0% $ (8) $ 439 3 - 9 7900 Nelson Rd. (San Fernando Valley) 203,082 Nov-14 1Q-2015 4Q-2015(6) $ 24,287 $ 638 $ 24,925 $ 25,887 0% $ (39) $ 1,697 3 - 9 9401 De Soto Ave. (San Fernando Valley) 150,263 Mar-15 2Q-2015 4Q-2015(5) $ 14,075 $ 782 $ 14,857 $ 16,906 0% $ (26) $ 1,007 5 - 11 2610 & 2701 S. Birch St. (OC Airport) 98,230 Jun-14 2Q-2015 4Q-2015 $ 11,000 $ 1,609 $ 12,609 $ 13,606 0% $ (17) $ 868 5 - 11 24105 Frampton Ave. (South Bay) 49,841 Mar-14 2Q-2015 1Q-2016 $ 3,930 $ 281 $ 4,211 $ 5,119 0% $ (14) $ 315 4 - 10 9615 Norwalk Blvd. (Mid-Counties) 38,362 Apr-15 3Q-2015 Q2-2017 $ 9,642 $ 31 $ 9,673 $ 23,682 16% $ (22) $ 1,556 19 - 25 TOTAL/WEIGHTED AVERAGE 719,493 $ 81,285 $ 5,316 $ 86,601 $ 108,854 8% $ (75) (7) $ 6,878 FUTURE REPOSITIONING: 679-691 S. Anderson St. (Central LA) 47,490 Nov-14 $ 6,490 $ 16 $ 6,506 $ 6,990 100% $ 71 $ 442 - COMPLETED REPOSITIONING: 7110 Rosecrans Ave. (South Bay) 73,439 Jan-14 $ 5,000 $ 746 $ 5,746 - 100% $ 82 $ 445 Stabilized (1)Cumulative investment-to-date includes the purchase price of the property and subsequent costs incurred for nonrecurring capital expenditures. (2)Projected total investment includes the purchase price of the property and an estimate of total expected nonrecurring capital expenditures to be incurred on each repositioning project to reach completion. (3)Represents the actual cash net operating income for each property for the three months ended September 30, 2015. For a definition and discussion of non-GAAP financial measures, see the definitions section beginning on page 28 of this report. (4)Represents the estimated remaining number of months, as of September 30, 2015, for the property to reach stabilization. Includes time to complete construction and to lease-up property. (5)The estimated construction completion period has changed from 3Q-2015 to 4Q-2015. (6)This building is being repositioned from a single-tenant building into a two-unit building. One of the units, which is a 120,000 square foot space, has been completed and leased as of the end of 3Q‐2015. The lease will commence during 4Q-2015. The estimated completion period for the second space has changed from 3Q-2015 to 4Q-2015. (7)Actual NOI for the three months ended September 30, 2015 reflects the capitalization of $219 of real estate property taxes. We will continue to capitalize real estate property taxes during the period in which construction is taking place to get each repositioning property ready for its intended use. Repositioning Space Est. Construction Period Property (Submarket) Rentable Square Feet Space Under Repositioning Start Completion Occ % 9/30/15 Actual Cash NOI 3Q-2015(1) Est. Annual Stabilized Cash NOI Est. Period to Stabilization (months)(2) 15140 & 15148 Bledsoe St. (San Fernando Valley) 133,356 72,000 1Q-2015 1Q-2016(3) 46% $ 61 $ 882 3 - 9 (1)Represents the actual net operating income for each property for the three months ended September 30, 2015. (2)Represents the estimated remaining number of months, as of September 30, 2015, for the property to reach stabilization. Includes time to complete construction and to lease-up repositioning space. (3)The estimated construction completion period has changed from 3Q-2015 to 1Q-2016 due to a change in scope. Third Quarter 2015 Page 24 Supplemental Financial Reporting Package

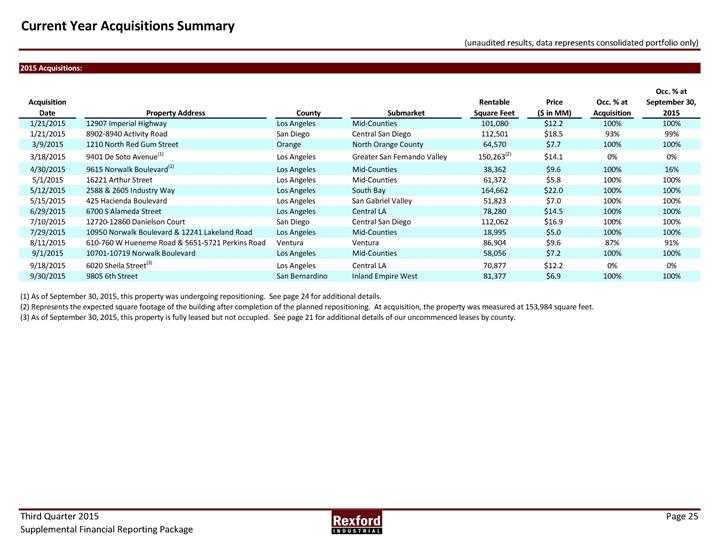

Current Year Acquisitions Summary (unaudited results, data represents consolidated portfolio only) 2015 Acquisitions: Acquisition Date Property Address County Submarket Rentable Square Feet Price ($ in MM) Occ. % at Acquisition Occ. % at September 30, 2015 1/21/2015 12907 Imperial Highway Los Angeles Mid-Counties 101,080 $12.2 100% 100% 1/21/2015 8902-8940 Activity Road San Diego Central San Diego 112,501 $18.5 93% 99% 3/9/2015 1210 North Red Gum Street Orange North Orange County 64,570 $7.7 100% 100% 3/18/2015 9401 De Soto Avenue(1) Los Angeles Greater San Fernando Valley 150,263(2) $14.1 0% 0% 4/30/2015 9615 Norwalk Boulevard(1) Los Angeles Mid-Counties 38,362 $9.6 100% 16% 5/1/2015 16221 Arthur Street Los Angeles Mid-Counties 61,372 $5.8 100% 100% 5/12/2015 2588 & 2605 Industry Way Los Angeles South Bay 164,662 $22.0 100% 100% 5/15/2015 425 Hacienda Boulevard Los Angeles San Gabriel Valley 51,823 $7.0 100% 100% 6/29/2015 6700 S Alameda Street Los Angeles Central LA 78,280 $14.5 100% 100% 7/10/2015 12720-12860 Danielson Court San Diego Central San Diego 112,062 $16.9 100% 100% 7/29/2015 10950 Norwalk Boulevard & 12241 Lakeland Road Los Angeles Mid-Counties 18,995 $5.0 100% 100% 8/11/2015 610-760 W Hueneme Road & 5651-5721 Perkins Road Ventura Ventura 86,904 $9.6 87% 91% 9/1/2015 10701-10719 Norwalk Boulevard Los Angeles Mid-Counties 58,056 $7.2 100% 100% 9/18/2015 6020 Sheila Street(3) Los Angeles Central LA 70,877 $12.2 0% 0% 9/30/2015 9805 6th Street San Bernardino Inland Empire West 81,377 $6.9 100% 100% (1) As of September 30, 2015, this property was undergoing repositioning. See page 24 for additional details. (2) Represents the expected square footage of the building after completion of the planned repositioning. At acquisition, the property was measured at 153,984 square feet. (3) As of September 30, 2015, this property is fully leased but not occupied. See page 21 for additional details of our uncommenced leases by county. Third Quarter 2015 Page 25 Supplemental Financial Reporting Package

Net Asset Value Components at 9/30/15 (unaudited and in thousands, except share data) Net Operating Income ProForma Net Operating Income (NOI)(1)(2) For the Three Months Ended September 30, 2015 Total operating revenues $ 23,335 Property operating expenses (6,237) Pro forma effect of acquisitions(3) 544 ProForma NOI 17,642 Fair value lease revenue 69 Straight line rental revenue adjustment (1,039) ProForma Cash NOI $ 16,672 Balance Sheet Items Other assets and liabilities September 30, 2015 Cash and cash equivalents $ 5,083 Rents and other receivables, net 2,221 Other assets 5,491 Acquisition related deposits 1,250 Accounts payable, accrued expenses and other liabilities (13,886) Dividends payable (7,504) Tenant security deposits (10,523) Prepaid rents (1,935) Total other assets and liabilities $ (19,803) Debt and Shares Outstanding Total consolidated debt(4) $ 335,904 Common shares outstanding(5) 55,198,780 Operating partnership units outstanding(6) 2,066,704 (1) For a definition and discussion of non-GAAP financial measures, see the definitions section beginning on page 28 of this report. (2) ProForma Net Operating Income as calculated does not reflect the potential incremental value from properties and space under repositioning. See page 24 for additional details. (3) Represents the estimated impact of Q3'15 acquisitions as if they had been acquired July 1, 2015. (4) Excludes net deferred loan fees and net loan premium aggregating $846. (5) Represents outstanding shares of common stock of the Company, which excludes 389,123 shares of unvested shares of restricted stock. (6) Represents outstanding common units of the Company' s operating partnership, Rexford Industrial Realty, LP, that are owned by unit holders other than Rexford Industrial Realty, Inc. Represents the noncontrolling interest in our operating partnership. Third Quarter 2015 Page 26 Supplemental Financial Reporting Package

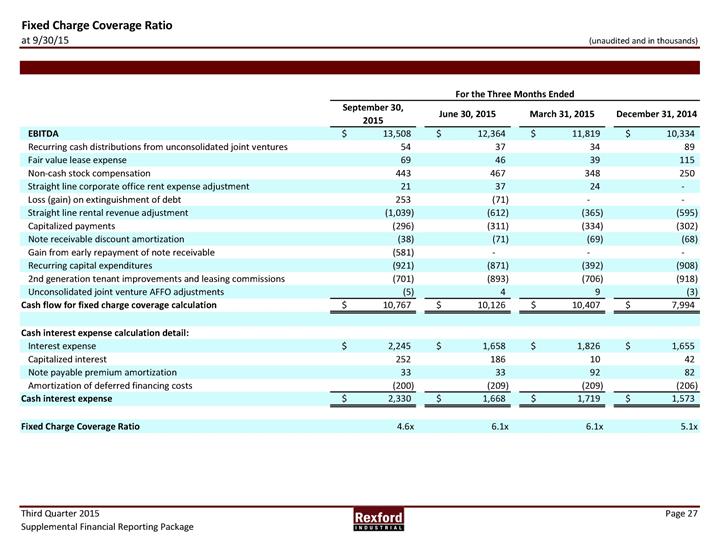

Fixed Charge Coverage Ratio at 9/30/15 (unaudited and in thousands) For the Three Months Ended September 30, 2015 June 30, 2015 March 31, 2015 December 31, 2014 EBITDA $ 13,508 $ 12,364 $ 11,819 $ 10,334 Recurring cash distributions from unconsolidated joint ventures 54 37 34 89 Fair value lease expense 69 46 39 115 Non-cash stock compensation 443 467 348 250 Straight line corporate office rent expense adjustment 21 37 24 Loss (gain) on extinguishment of debt 253 (71) - Straight line rental revenue adjustment (1,039) (612) (365) (595) Capitalized payments (296) (311) (334) (302) Note receivable discount amortization (38) (71) (69) (68) Gain from early repayment of note receivable (581) - Recurring capital expenditures (921) (871) (392) (908) 2nd generation tenant improvements and leasing commissions (701) (893) (706) (918) Unconsolidated joint venture AFFO adjustments (5) 4 9 (3) Cash flow for fixed charge coverage calculation $ 10,767 $ 10,126 $ 10,407 $ 7,994 Cash interest expense calculation detail: Interest expense $ 2,245 $ 1,658 $ 1,826 $ 1,655 Capitalized interest 252 186 10 42 Note payable premium amortization 33 33 92 82 Amortization of deferred financing costs (200) (209) (209) (206) Cash interest expense $ 2,330 $ 1,668 $ 1,719 $ 1,573 Fixed Charge Coverage Ratio 4.6x 6.1x 6.1x 5.1x Third Quarter 2015 Page 27 Supplemental Financial Reporting Package

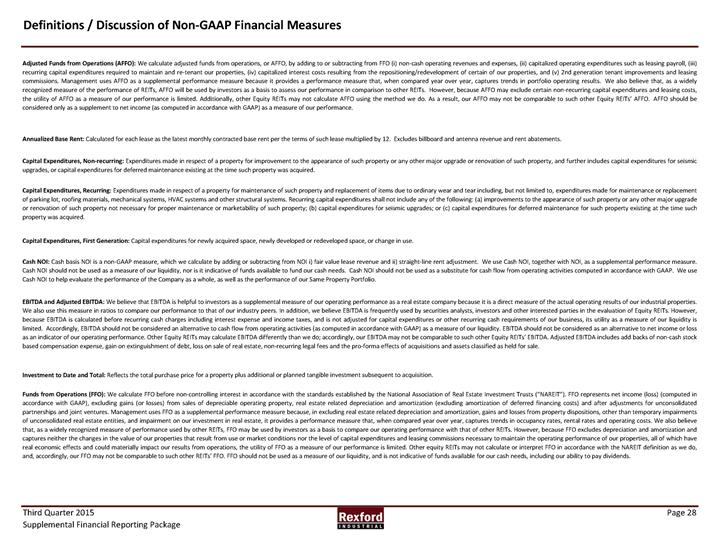

Definitions / Discussion of Non-GAAP Financial Measures Adjusted Funds from Operations (AFFO): We calculate adjusted funds from operations, or AFFO, by adding to or subtracting from FFO (i) non-cash operating revenues and expenses, (ii) capitalized operating expenditures such as leasing payroll, (iii) recurring capital expenditures required to maintain and re-tenant our properties, (iv) capitalized interest costs resulting from the repositioning/redevelopment of certain of our properties, and (v) 2nd generation tenant improvements and leasing commissions. Management uses AFFO as a supplemental performance measure because it provides a performance measure that, when compared year over year, captures trends in portfolio operating results. We also believe that, as a widely recognized measure of the performance of REITs, AFFO will be used by investors as a basis to assess our performance in comparison to other REITs. However, because AFFO may exclude certain non-recurring capital expenditures and leasing costs, the utility of AFFO as a measure of our performance is limited. Additionally, other Equity REITs may not calculate AFFO using the method we do. As a result, our AFFO may not be comparable to such other Equity REITs’ AFFO. AFFO should be considered only as a supplement to net income (as computed in accordance with GAAP) as a measure of our performance. Annualized Base Rent: Calculated for each lease as the latest monthly contracted base rent per the terms of such lease multiplied by 12. Excludes billboard and antenna revenue and rent abatements. Capital Expenditures, Non-recurring: Expenditures made in respect of a property for improvement to the appearance of such property or any other major upgrade or renovation of such property, and further includes capital expenditures for seismic upgrades, or capital expenditures for deferred maintenance existing at the time such property was acquired. Capital Expenditures, Recurring: Expenditures made in respect of a property for maintenance of such property and replacement of items due to ordinary wear and tear including, but not limited to, expenditures made for maintenance or replacement of parking lot, roofing materials, mechanical systems, HVAC systems and other structural systems. Recurring capital expenditures shall not include any of the following: (a) improvements to the appearance of such property or any other major upgrade or renovation of such property not necessary for proper maintenance or marketability of such property; (b) capital expenditures for seismic upgrades; or (c) capital expenditures for deferred maintenance for such property existing at the time such property was acquired. Capital Expenditures, First Generation: Capital expenditures for newly acquired space, newly developed or redeveloped space, or change in use. Cash NOI: Cash basis NOI is a non-GAAP measure, which we calculate by adding or subtracting from NOI i) fair value lease revenue and ii) straight-line rent adjustment. We use Cash NOI, together with NOI, as a supplemental performance measure. Cash NOI should not be used as a measure of our liquidity, nor is it indicative of funds available to fund our cash needs. Cash NOI should not be used as a substitute for cash flow from operating activities computed in accordance with GAAP. We use Cash NOI to help evaluate the performance of the Company as a whole, as well as the performance of our Same Property Portfolio. EBITDA and Adjusted EBITDA: We believe that EBITDA is helpful to investors as a supplemental measure of our operating performance as a real estate company because it is a direct measure of the actual operating results of our industrial properties. We also use this measure in ratios to compare our performance to that of our industry peers. In addition, we believe EBITDA is frequently used by securities analysts, investors and other interested parties in the evaluation of Equity REITs. However, because EBITDA is calculated before recurring cash charges including interest expense and income taxes, and is not adjusted for capital expenditures or other recurring cash requirements of our business, its utility as a measure of our liquidity is limited. Accordingly, EBITDA should not be considered an alternative to cash flow from operating activities (as computed in accordance with GAAP) as a measure of our liquidity. EBITDA should not be considered as an alternative to net income or loss as an indicator of our operating performance. Other Equity REITs may calculate EBITDA differently than we do; accordingly, our EBITDA may not be comparable to such other Equity REITs’ EBITDA. Adjusted EBITDA includes add backs of non-cash stock based compensation expense, gain on extinguishment of debt, loss on sale of real estate, non-recurring legal fees and the pro-forma effects of acquisitions and assets classified as held for sale. Investment to Date and Total: Reflects the total purchase price for a property plus additional or planned tangible investment subsequent to acquisition. Funds from Operations (FFO): We calculate FFO before non-controlling interest in accordance with the standards established by the National Association of Real Estate Investment Trusts (“NAREIT”). FFO represents net income (loss) (computed in accordance with GAAP), excluding gains (or losses) from sales of depreciable operating property, real estate related depreciation and amortization (excluding amortization of deferred financing costs) and after adjustments for unconsolidated partnerships and joint ventures. Management uses FFO as a supplemental performance measure because, in excluding real estate related depreciation and amortization, gains and losses from property dispositions, other than temporary impairments of unconsolidated real estate entities, and impairment on our investment in real estate, it provides a performance measure that, when compared year over year, captures trends in occupancy rates, rental rates and operating costs. We also believe that, as a widely recognized measure of performance used by other REITs, FFO may be used by investors as a basis to compare our operating performance with that of other REITs. However, because FFO excludes depreciation and amortization and captures neither the changes in the value of our properties that result from use or market conditions nor the level of capital expenditures and leasing commissions necessary to maintain the operating performance of our properties, all of which have real economic effects and could materially impact our results from operations, the utility of FFO as a measure of our performance is limited. Other equity REITs may not calculate or interpret FFO in accordance with the NAREIT definition as we do, and, accordingly, our FFO may not be comparable to such other REITs’ FFO. FFO should not be used as a measure of our liquidity, and is not indicative of funds available for our cash needs, including our ability to pay dividends. Third Quarter 2015 Page 28 Supplemental Financial Reporting Package

Definitions / Discussion of Non-GAAP Financial Measures NOI: Includes the revenue and expense directly attributable to our real estate properties calculated in accordance with GAAP. Calculated as total revenue from real estate operations including i) rental revenues ii) tenant reimbursements, and iii) other income less property expenses and other property expenses (before interest expense, depreciation and amortization). We use NOI as a supplemental performance measure because, in excluding real estate depreciation and amortization expense and gains (or losses) from property dispositions, it provides a performance measure that, when compared year over year, captures trends in occupancy rates, rental rates and operating costs. We also believe that NOI will be useful to investors as a basis to compare our operating performance with that of other REITs. However, because NOI excludes depreciation and amortization expense and captures neither the changes in the value of our properties that result from use or market conditions, nor the level of capital expenditures and leasing commissions necessary to maintain the operating performance of our properties (all of which have real economic effect and could materially impact our results from operations), the utility of NOI as a measure of our performance is limited. Other equity REITs may not calculate NOI in a similar manner and, accordingly, our NOI may not be comparable to such other REITs’ NOI. Accordingly, NOI should be considered only as a supplement to net income as a measure of our performance. NOI should not be used as a measure of our liquidity, nor is it indicative of funds available to fund our cash needs. NOI should not be used as a substitute for cash flow from operating activities in accordance with GAAP. We use NOI to help evaluate the performance of the Company as a whole, as well as the performance of our Same Property Portfolio. Proforma NOI: Proforma NOI is calculated by adding to NOI the estimated impact of current period acquisitions as if they had been acquired at the beginning of the reportable period. These estimates do not purport to be indicative of what operating results would have been had the acquisitions actually occurred at the beginning of the reportable period and may not be indicative of future operating results. Properties Under Repositioning: Typically defined as properties where a significant amount of space is held vacant in order to implement capital improvements that improve the market rentability and leasing functionality of that space. Considered completed once investment is fully or nearly fully deployed and the property is marketable for leasing. Recurring Funds From Operations (Recurring FFO): We calculate Recurring FFO by adjusting FFO to exclude the effect of non-recurring expenses and acquisition expenses. Rent Change - Cash: Compares the first month cash rent excluding any abatement on new leases to the last month rent for the most recent expiring lease. Data included for comparable leases only. Comparable leases generally exclude properties under repositioning, short-term leases, and space that has been vacant for over one year. Rent Change - GAAP: Compares GAAP rent, which straightlines rental rate increases and abatement, on new leases to GAAP rent for the most recent expiring lease. Data included for comparable leases only. Comparable leases generally exclude properties under repositioning, short-term leases, and space that has been vacant for over one year. Same Property Portfolio: Our Same Property Portfolio is a subset of our consolidated portfolio and includes properties that were wholly-owned by us as of January 1, 2014 and still owned by us as of September 30, 2015. The Company’s computation of same property performance may not be comparable to other REITs. Space Under Repositioning: Defined as space during held vacant during the current quarter in order to implement capital improvements to change the leasing functionality of that space. Considered completed once the repositioning has been completed and the unit is marketable for leasing. Stabilized Same Property Portfolio: Our Stabilized Same Property Portfolio represents the properties included in our Same Property Portfolio, adjusted to exclude spaces that were under repositioning during the current quarter. Uncommenced Leases: Reflects signed leases that have not yet commenced as of the reporting date. Third Quarter 2015 Page 29 Supplemental Financial Reporting Package