EX-99.2

Published on August 5, 2015

Exhibit 99.2

Supplemental Financial Repor .. ng Package Second Quarter 2015 Rexford Industrial Realty, Inc. NYSE: REXR 11620 Wilshire Blvd Suite 1000 Los Angeles, CA 90025 310- 966- 1680 www. RexfordIndustrial. com

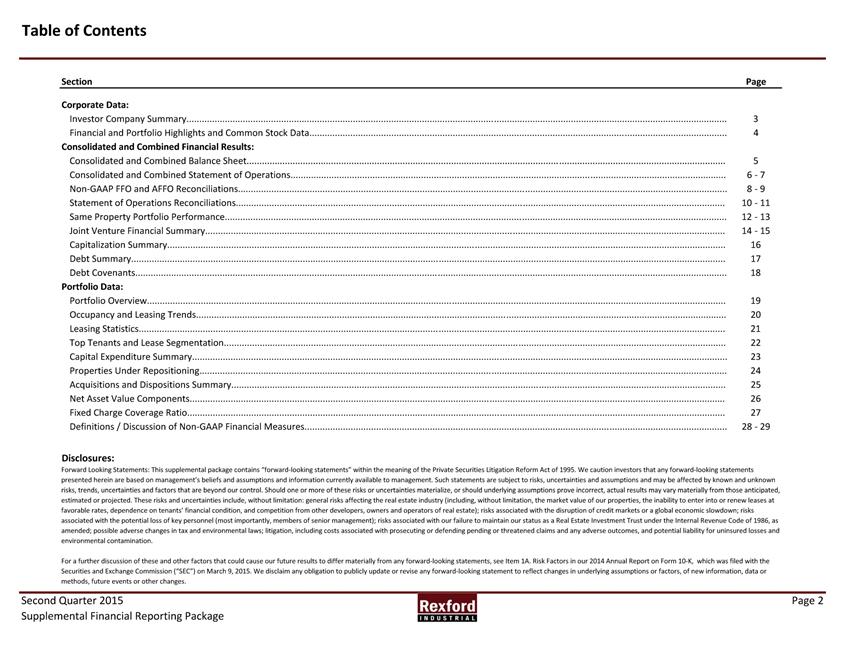

Table of Contents Section Page Corporate Data: Investor Company Summary. 3 Financial and Portfolio Highlights and Common Stock Data4 Consolidated and Combined Financial Results: Consolidated and Combined Balance Sheet5 Consolidated and Combined Statement of Operations. 6 - 7 Non- GAAP FFO and AFFO Reconciliations. 8 - 9 Statement of Operations Reconciliations10 - 11 Same Property Portfolio Performance12 - 13 Joint Venture Financial Summary14 - 15 Capitalization Summary16 Debt Summary 17 Debt Covenants 18 Portfolio Data: Portfolio Overview. 19 Occupancy and Leasing Trends. 20 Leasing Statistics. 21 Top Tenants and Lease Segmentation. 22 Capital Expenditure Summary 23 Properties Under Repositioning. 24 Acquisitions and Dispositions Summary. 25 Net Asset Value Components26 Fixed Charge Coverage Ratio. 27 Definitions / Discussion of Non- GAAP Financial Measures. 28 - 29 Disclosures: Forward Looking Statements: This supplemental package contains “forward- looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. We caution investors that any forward- looking statements presented herein are based on management’s beliefs and assumptions and information currently available to management. Such statements are subject to risks, uncertainties and assumptions and may be affected by known and unknown risks, trends, uncertainties and factors that are beyond our control. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, estimated or projected. These risks and uncertainties include, without limitation: general risks affecting the real estate industry ( including, without limitation, the market value of our properties, the inability to enter into or renew leases at favorable rates, dependence on tenants’ financial condition, and competition from other developers, owners and operators of real estate) ; risks associated with the disruption of credit markets or a global economic slowdown; risks associated with the potential loss of key personnel (most importantly, members of senior management) ; risks associated with our failure to maintain our status as a Real Estate Investment Trust under the Internal Revenue Code of 1986, as amended; possible adverse changes in tax and environmental laws; litigation, including costs associated with prosecuting or defending pending or threatened claims and any adverse outcomes, and potential liability for uninsured losses and environmental contamination. For a further discussion of these and other factors that could cause our future results to differ materially from any forward- looking statements, see Item 1A. Risk Factors in our 2014 Annual Report on Form 10- K, which was filed with the Securities and Exchange Commission (“ SEC” ) on March 9, 2015. We disclaim any obligation to publicly update or revise any forward- looking statement to reflect changes in underlying assumptions or factors, of new information, data or methods, future events or other changes. SecondQuarter2015Page2SupplementalFinancialReportingPackage

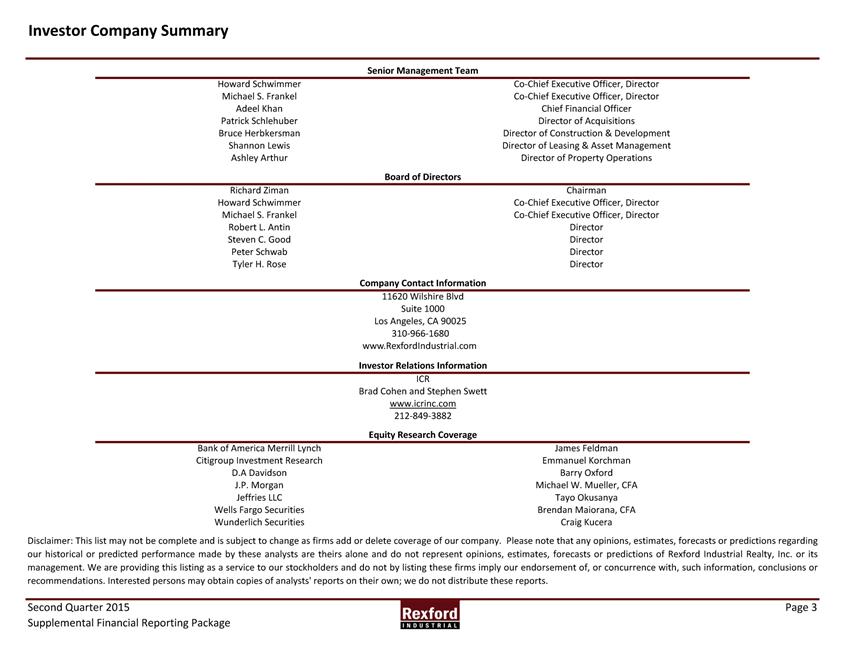

Investor Company Summary Howard Schwimmer Michael S. Frankel Adeel Khan Patrick Schlehuber Bruce Herbkersman Shannon Lewis Ashley Arthur Senior Management Team Co- Chief Executive Officer, Director Co- Chief Executive Officer, Director Chief Financial Officer Director of Acquisitions Director of Construction & Development Director of Leasing & Asset Management Director of Property Operations Board of Directors Richard Ziman Howard Schwimmer Michael S. Frankel Robert L. Antin Steven C. Good Peter Schwab Tyler H. Rose Chairman Co- Chief Executive Officer, Director Co- Chief Executive Officer, Director Director Director Director Director Company Contact Information 11620 Wilshire Blvd Suite 1000 Los Angeles, CA 90025 310- 966- 1680 www.RexfordIndustrial.com Investor Relations Information ICR Brad Cohen and Stephen Swett www. icrinc. com 212- 849- 3882 Equity Research Coverage Bank of America Merrill Lynch James Feldman Citigroup Investment Research Emmanuel Korchman D. A Davidson Barry Oxford J.P. Morgan Michael W. Mueller, CFA Jeffries LLC Tayo Okusanya Wells Fargo Securities Brendan Maiorana, CFA Wunderlich Securities Craig Kucera Disclaimer: This list may not be complete and is subject to change as firms add or delete coverage of our company. Please note that any opinions, estimates, forecasts or predictions regarding our historical or predicted performance made by these analysts are theirs alone and do not represent opinions, estimates, forecasts or predictions of Rexford Industrial Realty, Inc. or its management. We are providing this listing as a service to our stockholders and do not by listing these firms imply our endorsement of, or concurrence with, such information, conclusions or recommendations. Interested persons may obtain copies of analysts' reports on their own; we do not distribute these reports. Second Quarter 2015 Page 3 Supplemental Financial Reporting Package

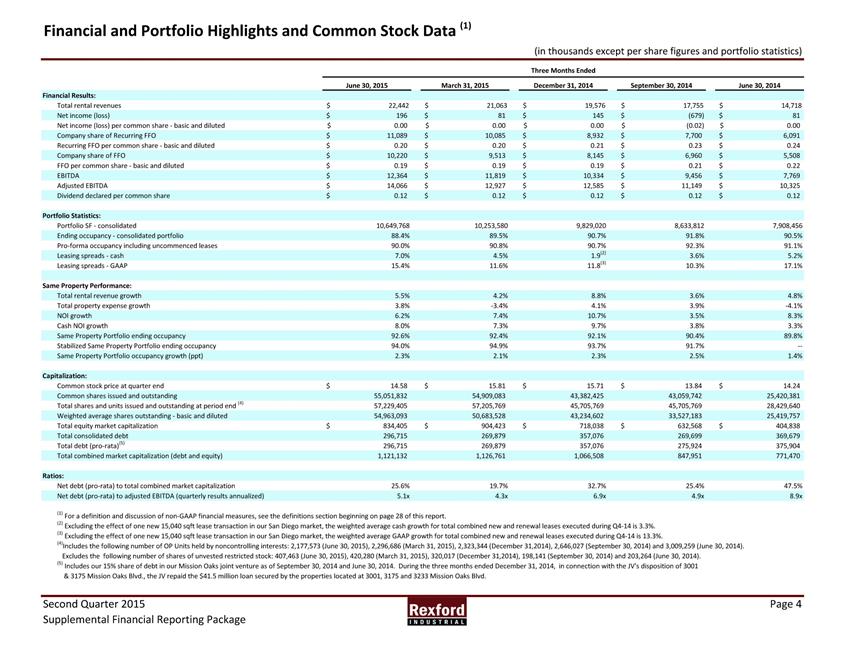

Financial and Portfolio Highlights and Common Stock Data (1) (in thousands except per share figures and portfolio statistics) Three Months Ended June 30, 2015 March 31, 2015 December 31, 2014 September 30, 2014 June 30, 2014 Financial Results: Total rental revenues $ 22,442 $ 21,063 $ 19,576 $ 17,755 $ 14,718 Net income (loss) 196$ 81$ 145$ ( 679) $ 81$ Net income (loss) per common share basic and diluted 0.00 $ 0.00 $ 0.00 $ ( 0.02) $ 0.00 $ Company share of Recurring FFO $ 11,089 $ 10,085 $ 8,932 $ 7,700 $ 6,091 Recurring FFO per common share - basic and diluted $ 0.20 $ 0.20 $ 0.21 $ 0.23 $ 0.24 Company share of FFO $ 10,220 $ 9,513 $ 8,145 $ 6,960 $ 5,508 FFO per common share - basic and diluted $ 0.19 $ 0.19 $ 0.19 $ 0.21 $ 0.22 EBITDA $ 12,364 $ 11,819 $ 10,334 $ 9,456 $ 7,769 Adjusted EBITDA $ 14,066 $ 12,927 $ 12,585 $ 11,149 $ 10,325 Dividend declared per common share $ 0.12 $ 0.12 $ 0.12 $ 0.12 $ 0.12 Portfolio Statistics: Portfolio SF - consolidated 10,649,768 10,253,580 9,829,020 8,633,812 7,908,456 Ending occupancy - consolidated portfolio 88.4% 89.5% 90.7% 91.8% 90.5% Pro- forma occupancy including uncommenced leases 90.0% 90.8% 90.7% 92.3% 91.1% Leasing spreads - cash 7.0% 4.5% 1.9(2) 3.6% 5.2% Leasing spreads - GAAP 15.4% 11.6% 11.8(3) 10.3% 17.1% Same Property Performance: Total rental revenue growth 5.5% 4.2% 8.8% 3.6% 4.8% Total property expense growth 3.8% - 3.4% 4.1% 3.9% - 4.1% NOI growth 6.2% 7.4% 10.7% 3.5% 8.3% Cash NOI growth 8.0% 7.3% 9.7% 3.8% 3.3% Same Property Portfolio ending occupancy 92.6% 92.4% 92.1% 90.4% 89.8% Stabilized Same Property Portfolio ending occupancy 94.0% 94.9% 93.7% 91.7% - Same Property Portfolio occupancy growth (ppt) 2.3% 2.1% 2.3% 2.5% 1.4% Capitalization: Common stock price at quarter end $ 14.58 $ 15.81 $ 15.71 $ 13.84 $ 14.24 Common shares issued and outstanding 55,051,832 54,909,083 43,382,425 43,059,742 25,420,381 Total shares and units issued and outstanding at period end (4) 57,229,405 57,205,769 45,705,769 45,705,769 28,429,640 Weighted average shares outstanding - basic and diluted 54,963,093 50,683,528 43,234,602 33,527,183 25,419,757 Total equity market capitalization $ 834,405 $ 904,423 $ 718,038 $ 632,568 $ 404,838 Total consolidated debt 296,715 269,879 357,076 269,699 369,679 Total debt (pro- rata) (5) 296,715 269,879 357,076 275,924 375,904 Total combined market capitalization (debt and equity) 1,121,132 1,126,761 1,066,508 847,951 771,470 Ratios: Net debt (pro- rata) to total combined market capitalization 25.6% 19.7% 32.7% 25.4% 47.5% Net debt (pro- rata) to adjusted EBITDA ( quarterly results annualized) 5.1x 4.3x 6.9x 4.9x 8.9x (1) For a definition and discussion of non- GAAP financial measures, see the definitions section beginning on page 28 of this report. (2) Excluding the effect of one new 15,040 sqft lease transaction in our San Diego market, the weighted average cash growth for total combined new and renewal leases executed during Q4- 14 is 3.3% . (3) Excluding the effect of one new 15,040 sqft lease transaction in our San Diego market, the weighted average GAAP growth for total combined new and renewal leases executed during Q4- 14 is 13.3% . (4) Includes the following number of OP Units held by noncontrolling interests: 2,177,573 ( June 30, 2015) , 2,296,686 (March 31, 2015) , 2,323,344 (December 31,2014) , 2,646,027 (September 30, 2014) and 3,009,259 ( June 30, 2014) . Excludes the following number of shares of unvested restricted stock: 407,463 ( June 30, 2015) , 420,280 (March 31, 2015) , 320,017 (December 31,2014) , 198,141 (September 30, 2014) and 203,264 ( June 30, 2014) . (5) Includes our 15% share of debt in our Mission Oaks joint venture as of September 30, 2014 and June 30, 2014. During the three months ended December 31, 2014, in connection with the JV's disposition of 3001 & 3175 Mission Oaks Blvd. , the JV repaid the $41.5 million loan secured by the properties located at 3001, 3175 and 3233 Mission Oaks Blvd. Second Quarter 2015 Page 4 Supplemental Financial Reporting Package

Consolidated Balance Sheets ( unaudited and in thousands) Rexford Industrial Realty, Inc. 6/ 30/ 15 3/ 31/ 15 12/ 31/ 14(1) 9/ 30/ 14(1) 6/ 30/ 14(1) Assets Investments in real estate, net $ 955,365 $ 902,747 $ 853,578 $ 722,689 $ 651,920 Cash and cash equivalents 9,988 47,541 8,606 60,541 9,272 Restricted cash - - - 307 379 Notes receivable 13,137 13,135 13,137 13,138 13,136 Rents and other receivables, net 2,210 1,892 1,812 1,738 1,455 Deferred rent receivable 6,067 5,520 5,165 4,547 4,314 Deferred leasing costs, net 4,526 3,744 3,608 3,275 2,640 Deferred loan costs, net 1,745 1,895 2,045 2,195 2,344 Acquired lease intangible assets, net(2) 28,580 26,504 28,136 23,558 22,621 Indefinite- lived intangible 5,271 5,271 5,271 5,271 5,271 Other assets 5,221 5,534 4,699 4,552 2,568 Acquisition related deposits 1,400 250 2,110 - 1,450 Investment in unconsolidated real estate entities 4,018 4,013 4,018 5,744 5,758 Assets associated with real estate held for sale - - - - 1,958 Total Assets $ 1,037,528 $ 1,018,046 $ 932,185 $ 847,555 $ 725,086 Liabilities Notes payable 296,333$ 269,541$ 356,362$ 269,011$ $ 369,020 Interest rate swap liability 2,960 3,279 1,402 228 459 Accounts payable and accrued expenses 9,257 11,566 10,053 9,519 5,708 Dividends payable 6,655 6,639 5,244 5,191 3,075 Acquired lease intangible liabilities, net(3) 2,579 2,903 3,016 1,921 1,970 Tenant security deposits 9,711 9,112 8,768 7,927 7,396 Prepaid rents 2,517 1,144 1,463 1,329 964 Liabilities associated with real estate held for sale - - - - 293 Total Liabilities 330,012 304,184 386,308 295,126 388,885 Equity Common stock 550 549 434 431 255 Additional paid in capital 720,583 719,199 542,318 538,248 312,451 Cumulative distributions in excess of earnings ( 34,702) ( 28,235) ( 21,673) ( 16,574) ( 10,784) Accumulated other comprehensive income (loss) ( 2,847) ( 3,147) ( 1,331) 158 ( 410) Total stockholders' equity 683,584 688,366 519,748 522,263 301,512 Noncontrolling interests 23,932 25,496 26,129 30,166 34,689 Total Equity 707,516 713,862 545,877 552,429 336,201 Total Liabilities and Equity 1,037,528$ 1,018,046$ 932,185$ 847,555$ $ 725,086 (1) For comparability, certain prior period amounts have been reclassified to conform to current period presentation. (2) Includes net above- market tenant lease intangibles of $5,725 ( June 30, 2015) , $3,312 (March 31, 2015) , $3,644 (Dec. 31 2014) , $3,474 (Sept. 30, 2014) and $3,443 ( June 30, 2014) . (3) Includes net below- market tenant lease intangibles of $2,350 ( June 30, 2015) , $2,666 (March 31, 2015) , $2,771 (Dec. 31 2014) , $1,668 (Sept. 30, 2014) and $1,716 ( June 30, 2014) . SecondQuarter2015Page5SupplementalFinancialReportingPackage

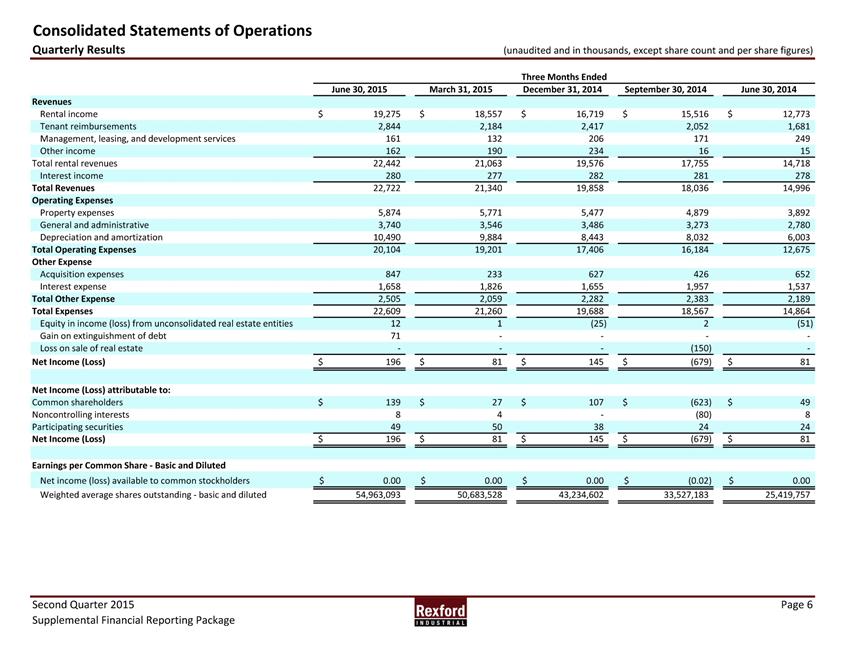

Consolidated Statements of Operations Quarterly Results ( unaudited and in thousands, except share count and per share figures) Three Months Ended June 30, 2015 March 31, 2015 December 31, 2014 September 30, 2014 June 30, 2014 Revenues Rental income $ 19,275 $ 18,557 16,719$ 15,516$ $ 12,773 Tenant reimbursements 2,844 2,184 2,417 2,052 1,681 Management, leasing, and development services 161 132 206 171 249 Other income 162 190 234 16 15 Total rental revenues 22,442 21,063 19,576 17,755 14,718 Interest income 280 277 282 281 278 Total Revenues 22,722 21,340 19,858 18,036 14,996 Operating Expenses Property expenses 5,874 5,771 5,477 4,879 3,892 General and administrative 3,740 3,546 3,486 3,273 2,780 Depreciation and amortization 10,490 9,884 8,443 8,032 6,003 Total Operating Expenses 20,104 19,201 17,406 16,184 12,675 Other Expense Acquisition expenses 847 233 627 426 652 Interest expense 1,658 1,826 1,655 1,957 1,537 Total Other Expense 2,505 2,059 2,282 2,383 2,189 Total Expenses 22,609 21,260 19,688 18,567 14,864 Equity in income (loss) from unconsolidated real estate entities 12 1 (25) 2 (51) Gain on extinguishment of debt 71 - - - - Loss on sale of real estate - - - (150) - Net Income (Loss) $ 196 $ 81 145$ (679) $ $ 81 Net Income (Loss) attributable to: Common shareholders $ 139 $ 27 $ 107 $ (623) $ 49 Noncontrolling interests 8 4 - (80) 8 Participating securities 49 50 38 24 24 Net Income (Loss) $ 196 $ 81 $ 145 $ (679) $ 81 Earnings per Common Share - Basic and Diluted Net income (loss) available to common stockholders $ 0.00 $ 0.00 $ 0.00 $ (0.02) $ 0.00 Weighted average shares outstanding - basic and diluted 54,963,093 50,683,528 43,234,602 33,527,183 25,419,757 Second Quarter 2015 Page 6 Supplemental Financial Reporting Package

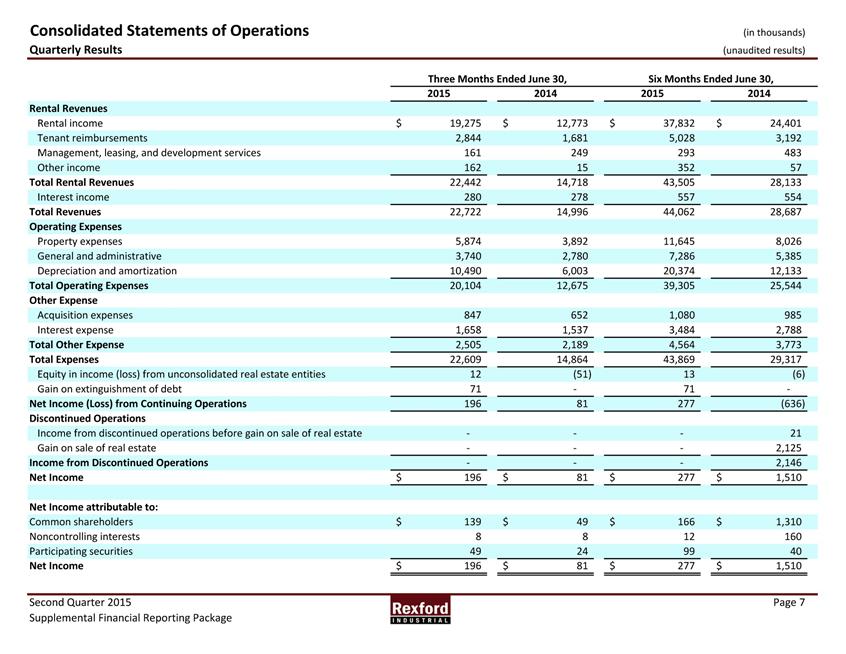

Consolidated Statements of Operations (in thousands) Quarterly Results ( unaudited results) Three Months Ended June 30, Six Months Ended June 30, 2015 2014 2015 2014 Rental Revenues Rental income $ 19,275 12,773$ $ 37,832 24,401$ Tenant reimbursements 2,844 1,681 5,028 3,192 Management, leasing, and development services 161 249 293 483 Other income 162 15 352 57 Total Rental Revenues 22,442 14,718 43,505 28,133 Interest income 280 278 557 554 Total Revenues 22,722 14,996 44,062 28,687 Operating Expenses Property expenses 5,874 3,892 11,645 8,026 General and administrative 3,740 2,780 7,286 5,385 Depreciation and amortization 10,490 6,003 20,374 12,133 Total Operating Expenses 20,104 12,675 39,305 25,544 Other Expense Acquisition expenses 847 652 1,080 985 Interest expense 1,658 1,537 3,484 2,788 Total Other Expense 2,505 2,189 4,564 3,773 Total Expenses 22,609 14,864 43,869 29,317 Equity in income ( loss) from unconsolidated real estate entities 12 (51) 13 (6) Gain on extinguishment of debt 71 - 71 - Net Income (Loss) from Continuing Operations 196 81 277 (636) Discontinued Operations Income from discontinued operations before gain on sale of real estate - - 21 Gain on sale of real estate - - - 2,125 Income from Discontinued Operations - - - 2,146 Net Income $ 196 81$ $ 277 1,510$ Net Income attributable to: Common shareholders $ 139 49$ $ 166 1,310$ Noncontrolling interests 8 8 12 160 Participating securities 49 24 99 40 Net Income $ 196 81$ $ 277 1,510$ Second Quarter 2015 Page 7 Supplemental Financial Reporting Package

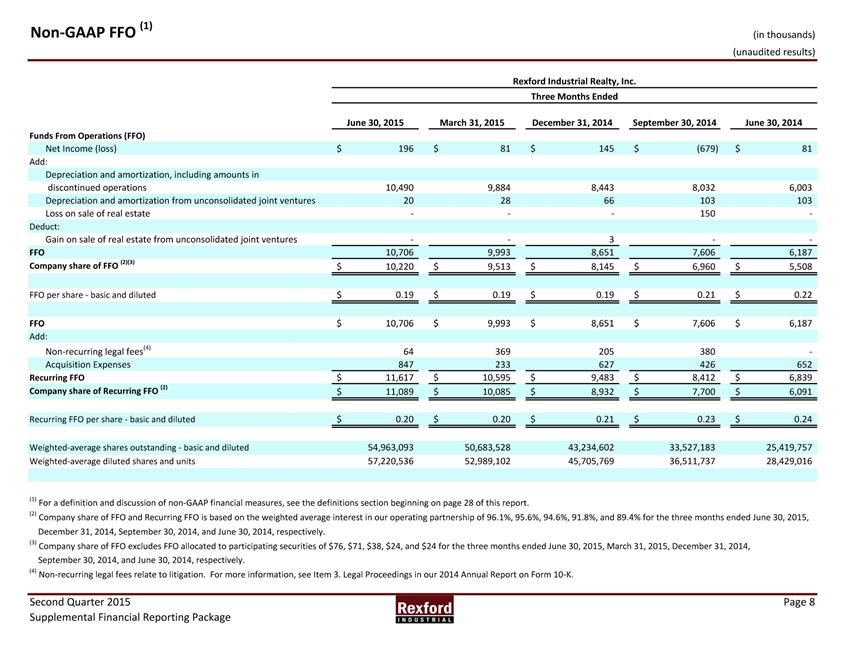

Non- GAAP FFO (1) (in thousands) ( unaudited results) Rexford Industrial Realty, Inc. Three Months Ended June 30, 2015 March 31, 2015 December 31, 2014 September 30, 2014 June 30, 2014 Funds From Operations (FFO) Net Income (loss) 196$ 81$ 145$ (679) $ 81$ Add: Depreciation and amortization, including amounts in discontinued operations 10,490 9,884 8,443 8,032 6,003 Depreciation and amortization from unconsolidated joint ventures 20 28 66 103 103 Loss on sale of real estate - - - 150 - Deduct: Gain on sale of real estate from unconsolidated joint ventures - - 3 - - FFO 10,706 9,993 8,651 7,606 6,187 Company share of FFO (2)(3) 10,220 $ 9,513 $ 8,145 $ 6,960 $ 5,508 $ FFO per share - basic and diluted $ 0.19 $ 0.19 $ 0.19 $ 0.21 $ FFO $ 10,706 $ 9,993 $ 8,651 $ 7,606 $ 6,187 Add: Non- recurring legal fees(4) 64 369 205 380 Acquisition Expenses 847 233 627 426 652 Recurring FFO $ 11,617 $ 10,595 $ 9,483 $ 8,412 $ 6,839 Company share of Recurring FFO (2) $ 11,089 $ 10,085 $ 8,932 $ 7,700 $ 6,091 Recurring FFO per share - basic and diluted $ 0.20 $ 0.20 $ 0.21 $ 0.23 $ 0.24 Weighted- average shares outstanding - basic and diluted 54,963,093 50,683,528 43,234,602 33,527,183 25,419,757 Weighted- average diluted shares and units 57,220,536 52,989,102 45,705,769 36,511,737 28,429,016 (1) For a definition and discussion of non- GAAP financial measures, see the definitions section beginning on page 28 of this report. (2) Company share of FFO and Recurring FFO is based on the weighted average interest in our operating partnership of 96.1% , 95.6% , 94.6% , 91.8% , and 89.4% for the three months ended June 30, 2015, December 31, 2014, September 30, 2014, and June 30, 2014, respectively. (3) Company share of FFO excludes FFO allocated to participating securities of $76, $71, $38, $24, and $24 for the three months ended June 30, 2015, March 31, 2015, December 31, 2014, September 30, 2014, and June 30, 2014, respectively. (4) Non- recurring legal fees relate to litigation. For more information, see Item 3. Legal Proceedings in our 2014 Annual Report on Form 10- K. Second Quarter 2015 Page 8 Supplemental Financial Reporting Package

Non- GAAP AFFO (1) (in thousands) ( unaudited results) AFFO Rexford Industrial Realty, Inc. Three Months Ended June 30, 2015 March 31, 2015(2) December 31, 2014(2) September 30, 2014(2) June 30, 2014(2) Adjusted Funds From Operations (AFFO) Funds From Operations $ 10,706 $ 9,993 $ 8,651 $ 7,606 $ 6,187 Add: Amortization of deferred financing costs 209 209 206 205 144 Fair value lease expense 46 39 115 151 73 Non- cash stock compensation 467 348 250 340 279 Straight line corporate office rent expense adjustment 37 24 - - Deduct: Straight line rental revenue adjustment 612 365 595 227 395 Capitalized payments (3) 497 344 302 216 222 Note receivable discount amortization 71 69 68 66 65 Note payable premium amortization 33 92 82 81 35 Gain on extinguishment of debt 71 - - - Recurring capital expenditures(4) 871 392 908 752 447 2nd generation tenant improvements and leasing commissions(5) 893 706 918 1,174 795 Unconsolidated joint venture AFFO adjustments ( 4) (9) 3 (2) (3) AFFO $ 8,421 $ 8,654 $ 6,346 $ 5,788 $ 4,727 (1) For a definition and discussion of non- GAAP financial measures, see the definitions section beginning on page 28 of this report. (2) For comparability, prior period amounts have been reclassified to conform to current period presentation. (3) Includes capitalized interest, and leasing and construction development compensation. (4) Excludes nonrecurring capital expenditures of $3,312, $2,920, $4,118, $2,670, and $1,708 for the three months ended June 30, 2015, March 31, 2015, December 31, 2014, September 30, 2014 and June 30, 2014, respectively. (5) Excludes 1st generation tenant improvements and leasing commissions of $996, $236, $640, $423, and $31 for the three months ended June 30, 2015, March 31, 2015, December 31, 2014, September 30, 2014 and June 30, 2014, respectively. SecondQuarter2015Page9SupplementalFinancialReportingPackage

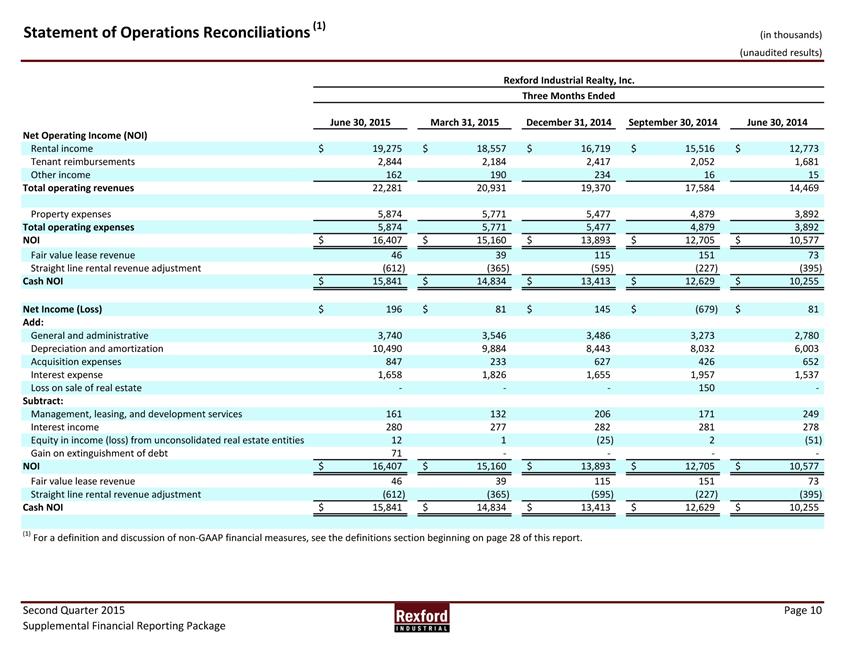

Statement of Operations Reconciliations (1) (in thousands) ( unaudited results) Rexford Industrial Realty, Inc. Three Months Ended June 30, 2015 March 31, 2015 December 31, 2014 September 30, 2014 June 30, 2014 Net Operating Income ( NOI) Rental income 19,275$ 18,557$ 16,719$ 15,516$ $ 12,773 Tenant reimbursements 2,844 2,184 2,417 2,052 1,681 Other income 162 190 234 16 15 Total operating revenues 22,281 20,931 19,370 17,584 14,469 Property expenses 5,874 5,771 5,477 4,879 3,892 Total operating expenses 5,874 5,771 5,477 4,879 3,892 NOI 16,407$ 15,160$ 13,893$ 12,705$ $ 10,577 Fair value lease revenue 46 39 115 151 73 Straight line rental revenue adjustment (612) (365) (595) (227) (395) Cash NOI 15,841$ 14,834$ 13,413$ 12,629$ $ 10,255 Net Income (Loss) 196$ 81$ 145$ (679) $ $ 81 Add: General and administrative 3,740 3,546 3,486 3,273 2,780 Depreciation and amortization 10,490 9,884 8,443 8,032 6,003 Acquisition expenses 847 233 627 426 652 Interest expense 1,658 1,826 1,655 1,957 1,537 Loss on sale of real estate - - - 150 - Subtract: Management, leasing, and development services 161 132 206 171 249 Interest income 280 277 282 281 278 Equity in income (loss) from unconsolidated real estate entities 12 1 (25) 2 (51) Gain on extinguishment of debt 71 - - - - NOI 16,407$ 15,160$ 13,893$ 12,705$ $ 10,577 Fair value lease revenue 46 39 115 151 73 Straight line rental revenue adjustment (612) (365) (595) (227) (395) Cash NOI 15,841$ 14,834$ 13,413$ 12,629$ $ 10,255 (1) For a definition and discussion of non- GAAP financial measures, see the definitions section beginning on page 28 of this report. SecondQuarter2015Page10SupplementalFinancialReportingPackage

Statement of Operations Reconciliations (1) (in thousands) ( unaudited results) Rexford Industrial Realty, Inc. Three Months Ended June 30, 2015 March 31, 2015 December 31, 2014 September 30, 2014 June 30, 2014 Net income ( loss) $ 196 $ 81 $ 145 $ (679) $ 81 Interest expense 1,658 1,826 1,655 1,957 1,537 Proportionate share of interest expense from unconsolidated joint ventures - - 25 43 45 Depreciation and amortization 10,490 9,884 8,443 8,032 6,003 Proportionate share of real estate related depreciation and amortization from unconsolidated joint ventures 20 28 66 103 103 EBITDA $ 12,364 $ 11,819 $ 10,334 $ 9,456 $ 7,769 Stock- based compensation amortization 467 348 250 340 279 Gain on extinguishment of debt ( 71) - - - Loss on sale of real estate - - - 150 Non- recurring legal fees(2) 64 369 205 380 Acquisition expenses 847 233 627 426 652 Pro forma effect of acquisitions(3) 395 158 1,169 497 1,625 Pro forma effect of dispositions(4) - - - (100) Adjusted EBITDA $ 14,066 $ 12,927 $ 12,585 $ 11,149 $ 10,325 (1) For a definition and discussion of non- GAAP financial measures, see the definitions section beginning on page 28 of this report. (2) Non- recurring legal fees relate to Litigation. For more information, see Item 3. Legal Proceedings in our 2014 Annual Report on Form 10-K. (3) Represents the estimated impact of Q2' 15 acquisitions as if they had been acquired April 1, 2015, Q1' 15 acquisitions as if they had been acquired January 1, 2015, Q4' 14 acquisitions as if they had been acquired October 1, 2014, Q3' 14 acquisitions as if they had been acquired on July 1, 2014, and Q2' 14 acquisitions as if they had been acquired on April 1, 2014. We have made a number of assumptions in such estimates and there can be no assurance that we would have generated the projected levels of EBITDA had we owned the acquired entities as of the beginning of each period. (4) Represents the effect of dispositions as if they had occurred at the beginning of the quarter disposed. See the dispositions section on page 25 for additional details. Second Quarter 2015 Page 11 Supplemental Financial Reporting Package

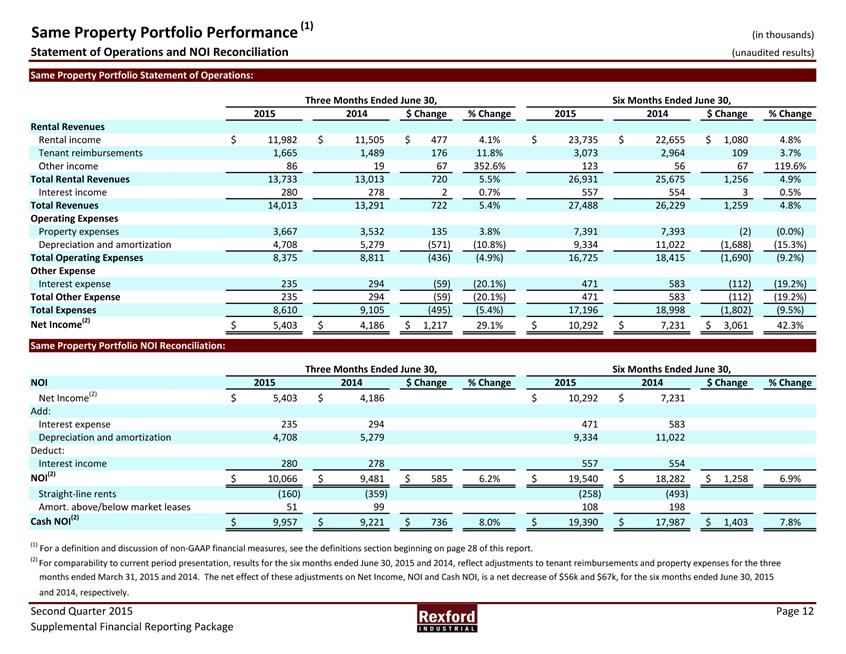

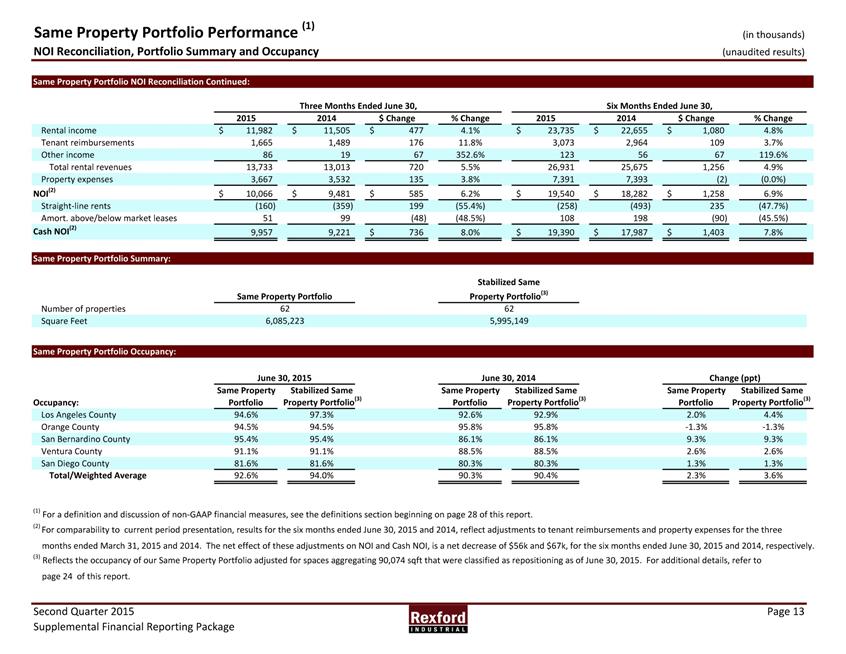

Same Property Portfolio Performance (1) (in thousands) Statement of Operations and NOI Reconciliation ( unaudited results) Same Property Portfolio Statement of Operations: Three Months Ended June 30, Six Months Ended June 30, 2015 2014 $ Change % Change 2015 2014 $ Change % Change Rental Revenues Rental income $ 11,982 11,505$ 477$ 4.1% $ 23,735 22,655$ 1,080$ 4.8% Tenant reimbursements 1,665 1,489 176 11.8% 3,073 2,964 109 3.7% Other income 86 19 67 352.6% 123 56 67 119.6% Total Rental Revenues 13,733 13,013 720 5.5% 26,931 25,675 1,256 4.9% Interest income 280 278 2 0.7% 557 554 3 0.5% Total Revenues 14,013 13,291 722 5.4% 27,488 26,229 1,259 4.8% Operating Expenses Property expenses 3,667 3,532 135 3.8% 7,391 7,393 (2) (0.0% ) Depreciation and amortization 4,708 5,279 (571) (10.8% ) 9,334 11,022 (1,688) (15.3% ) Total Operating Expenses 8,375 8,811 (436) (4.9% ) 16,725 18,415 (1,690) (9.2% ) Other Expense Interest expense 235 294 (59) (20.1% ) 471 583 (112) (19.2% ) Total Other Expense 235 294 (59) (20.1% ) 471 583 (112) (19.2% ) Total Expenses 8,610 9,105 (495) (5.4% ) 17,196 18,998 (1,802) (9.5% ) Net Income(2) $ 5,403 4,186$ 1,217$ 29.1% $ 10,292 7,231$ 3,061$ 42.3% Same Property Portfolio NOI Reconciliation: Three Months Ended June 30, Six Months Ended June 30, NOI 2015 2014 $ Change % Change 2015 2014 $ Change % Change Net Income(2) $ 5,403 $ 4,186 $ 10,292 $ 7,231 Add: Interest expense 235 294 471 583 Depreciation and amortization 4,708 5,279 9,334 11,022 Deduct: Interest income 280 278 557 554 NOI(2) 10,066$ 9,481$ 585$ 6.2% 19,540$ 18,282$ 1,258$ 6.9% Straight- line rents ( 160) (359) (258) (493) Amort. above/ below market leases 51 99 108 198 Cash NOI(2) 9,957$ 9,221$ 736$ 8.0% 19,390$ 17,987$ 1,403$ 7.8% (1) For a definition and discussion of non- GAAP financial measures, see the definitions section beginning on page 28 of this report. (2) For comparability to current period presentation, results for the six months ended June 30, 2015 and 2014, reflect adjustments to tenant reimbursements and property expenses for the three months ended March 31, 2015 and 2014. The net effect of these adjustments on Net Income, NOI and Cash NOI, is a net decrease of $56k and $67k, for the six months ended June 30, 2015 and 2014, respectively. SecondQuarter2015Page12SupplementalFinancialReportingPackage

Same Property Portfolio Performance (1) (in thousands) NOI Reconciliation, Portfolio Summary and Occupancy ( unaudited results) Same Property Portfolio NOI Reconciliation Continued: Three Months Ended June 30, Six Months Ended June 30, 2015 2014 11,982 $ 11,505 $ 1,665 1,489 86 19 13,733 13,013 720 5.5% 26,931 25,675 3,667 3,532 135 3.8% 7,391 7,393 Rental income Tenant reimbursements Other income Total rental revenues Property expenses NOI(2) Straight- line rents Amort. above/ below market leases Cash NOI(2) $ 10,066 $ 9,481 $ 585 6.2% $ 19,540 $ 18,282 ( 160) ( 359) 199 ( 55.4% ) ( 258) ( 493) 51 99 ( 48) ( 48.5% ) 108 198 9,957 9,221 $ Change 477$ 176 67 % Change 4.1% 11.8% 352.6% $ 2015 23,735 3,073 123 $ 2014 22,655 2,964 56 $ Change 1,080 $ 109 67 % Change 4.8% 3.7% 119.6% $ 736 8.0% $ 19,390 $ 17,987 1,256 (2) $ 1,258 235 ( 90) $ 1,403 4.9% (0.0% ) 6.9% ( 47.7% ) ( 45.5% ) 7.8% Same Property Portfolio Summary: Stabilized Same Same Property Portfolio Property Portfolio(3) Number of properties 62 62 Square Feet 6,085,223 5,995,149 Same Property Portfolio Occupancy: June 30, 2015 June 30, 2014 Change ( ppt) Occupancy: Same Property Portfolio Stabilized Same Property Portfolio(3) Same Property Portfolio Stabilized Same Property Portfolio(3) Same Property Portfolio Stabilized Same Property Portfolio(3) Los Angeles County 94.6% 97.3% 92.6% 92.9% 2.0% 4.4% Orange County 94.5% 94.5% 95.8% 95.8% - 1.3% - 1.3% San Bernardino County 95.4% 95.4% 86.1% 86.1% 9.3% 9.3% Ventura County 91.1% 91.1% 88.5% 88.5% 2.6% 2.6% San Diego County 81.6% 81.6% 80.3% 80.3% 1.3% 1.3% Total/ Weighted Average 92.6% 94.0% 90.3% 90.4% 2.3% 3.6% (1) For a definition and discussion of non- GAAP financial measures, see the definitions section beginning on page 28 of this report. (2) For comparability to current period presentation, results for the six months ended June 30, 2015 and 2014, reflect adjustments to tenant reimbursements and property expenses for the three months ended March 31, 2015 and 2014. The net effect of these adjustments on NOI and Cash NOI, is a net decrease of $56k and $67k, for the six months ended June 30, 2015 and 2014, respectively. (3) Reflects the occupancy of our Same Property Portfolio adjusted for spaces aggregating 90,074 sqft that were classified as repositioning as of June 30, 2015. For additional details, refer to page 24 of this report. Second Quarter 2015 Page 13 Supplemental Financial Reporting Package

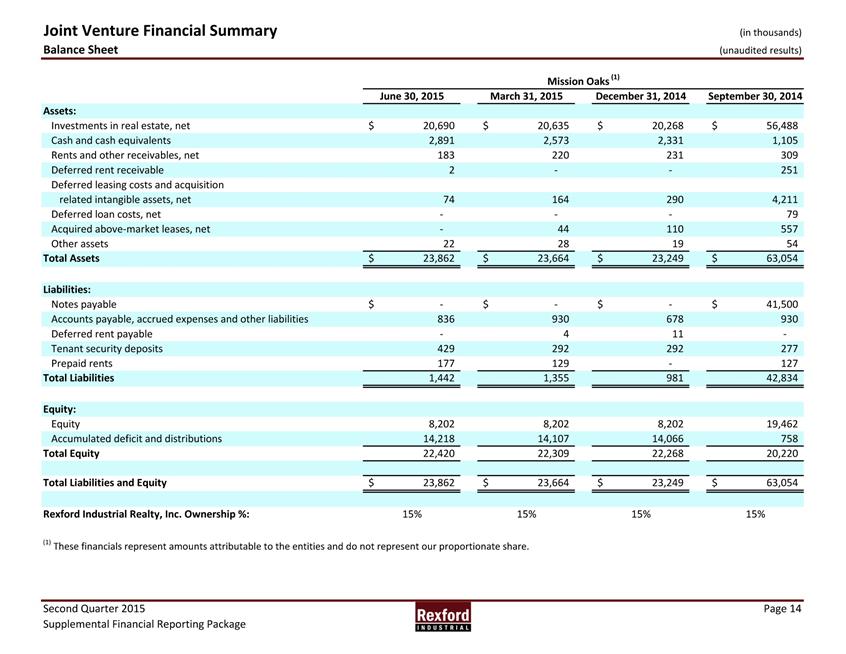

Joint Venture Financial Summary (in thousands) Balance Sheet ( unaudited results) Mission Oaks (1) June 30, 2015 March 31, 2015 December 31, 2014 September 30, 2014 Assets: Investments in real estate, net 20,690$ 20,635$ 20,268$ 56,488$ Cash and cash equivalents 2,891 2,573 2,331 1,105 Rents and other receivables, net 183 220 231 309 Deferred rent receivable 2 - - 251 Deferred leasing costs and acquisition related intangible assets, net 74 164 290 4,211 Deferred loan costs, net - - - 79 Acquired above- market leases, net - 44 110 557 Other assets 22 28 19 54 Total Assets 23,862$ 23,664$ 23,249$ 63,054$ Liabilities: Notes payable - $ - $ - $ 41,500$ Accounts payable, accrued expenses and other liabilities 836 930 678 930 Deferred rent payable - 4 11 - Tenant security deposits 429 292 292 277 Prepaid rents 177 129 - 127 Total Liabilities 1,442 1,355 981 42,834 Equity: Equity 8,202 8,202 8,202 19,462 Accumulated deficit and distributions 14,218 14,107 14,066 758 Total Equity 22,420 22,309 22,268 20,220 Total Liabilities and Equity $ 23,862 $ 23,664 $ 23,249 $ 63,054 Rexford Industrial Realty, Inc. Ownership %: 15% 15% 15% 15% (1) These financials represent amounts attributable to the entities and do not represent our proportionate share. Second Quarter 2015 Page 14 Supplemental Financial Reporting Package

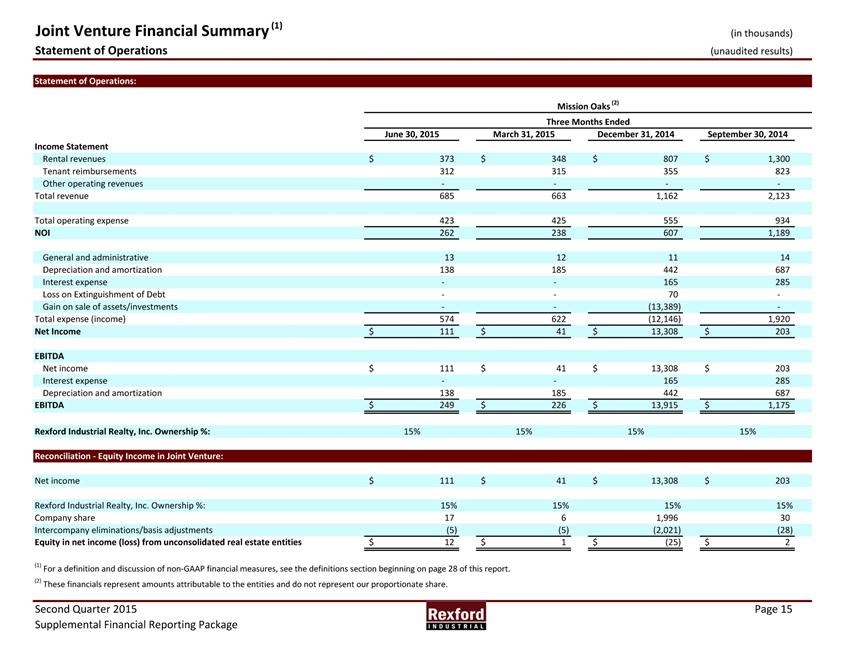

Joint Venture Financial Summary (1) (in thousands) Statement of Operations ( unaudited results) Statement of Operations: Mission Oaks (2) Income Statement Rental revenues Tenant reimbursements Other operating revenues Total revenue $ June 30, 2015 373 312 -685 $ Three Months Ended March 31, 2015 December 31, 2014 348 807$ 315 355 - - 663 1,162 September 30, 2014 1,300$ 823 -2,123 Total operating expense NOI 423 262 425 238 555 607 934 1,189 General and administrative Depreciation and amortization Interest expense Loss on Extinguishment of Debt Gain on sale of assets/investments Total expense (income) Net Income $ 13 138 ---574 111 $ 12 11 185 442 - 165 - 70 - (13,389) 622 (12,146) 41 13,308$ 14 687 285 --1,920 203$ EBITDA Net income Interest expense Depreciation and amortization EBITDA $ $ 111 -138 249 $ $ 41 13,308$ - 165 185 442 226 13,915$ 203$ 285 687 1,175$ Rexford Industrial Realty, Inc. Ownership % : 15% 15% 15% 15% Reconciliation Equity Income in Joint Venture: Net income 111$ $ 41 $ 13,308 $ 203 Rexford Industrial Realty, Inc. Ownership % : Company share Intercompany eliminations/basis adjustments Equity in net income (loss) from unconsolidated real estate entities $ 15% 17 ( 5) 12 $ 15% 6 (5) 1 $ 15% 1,996 (2,021) (25) $ 15% 30 (28) 2 (1) For a definition and discussion of non- GAAP financial measures, see the definitions section beginning on page 28 of this report. (2) These financials represent amounts attributable to the entities and do not represent our proportionate share. SecondQuarter2015Page15SupplementalFinancialReportingPackage

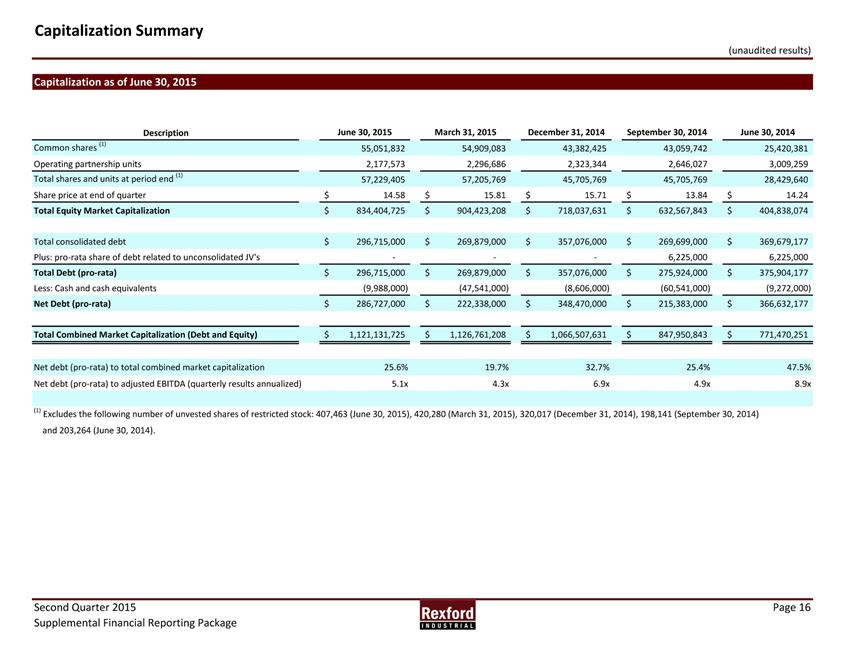

Capitalization Summary ( unaudited results) Capitalization as of June 30, 2015 Description Common shares (1) June 30, 2015 55,051,832 March 31, 2015 December 31, 2014 September 30, 2014 54,909,083 43,382,425 43,059,742 June 30, 2014 25,420,381 Operating partnership units Total shares and units at period end (1) 2,177,573 57,229,405 2,296,686 57,205,769 2,323,344 45,705,769 2,646,027 45,705,769 3,009,259 28,429,640 Share price at end of quarter $ 14.58 $ 15.81 $ 15.71 $ 13.84 $ 14.24 Total Equity Market Capitalization $ 834,404,725 $ 904,423,208 $ 718,037,631 $ 632,567,843 $ 404,838,074 Total consolidated debt $ 296,715,000 $ 269,879,000 $ 357,076,000 $ 269,699,000 $ 369,679,177 Plus: pro- rata share of debt related to unconsolidated JV's - - - 6,225,000 6,225,000 Total Debt (pro- rata) $ 296,715,000 $ 269,879,000 $ 357,076,000 $ 275,924,000 $ 375,904,177 Less: Cash and cash equivalents ( 9,988,000) (47,541,000) (8,606,000) (60,541,000) (9,272,000) Net Debt (pro- rata) $ 286,727,000 $ 222,338,000 $ 348,470,000 $ 215,383,000 $ 366,632,177 Total Combined Market Capitalization (Debt and Equity) $ 1,121,131,725 $ 1,126,761,208 $ 1,066,507,631 $ 847,950,843 $ 771,470,251 Net debt (pro- rata) to total combined market capitalization 25.6% 19.7% 32.7% 25.4% 47.5% Net debt (pro- rata) to adjusted EBITDA ( quarterly results annualized) 5.1x 4.3x 6.9x 4.9x 8.9x (1) Excludes the following number of unvested shares of restricted stock: 407,463 ( June 30, 2015) , 420,280 (March 31, 2015) , 320,017 (December 31, 2014) , 198,141 ( September 30, 2014) and 203,264 ( June 30, 2014) . SecondQuarter2015Page16SupplementalFinancialReportingPackage

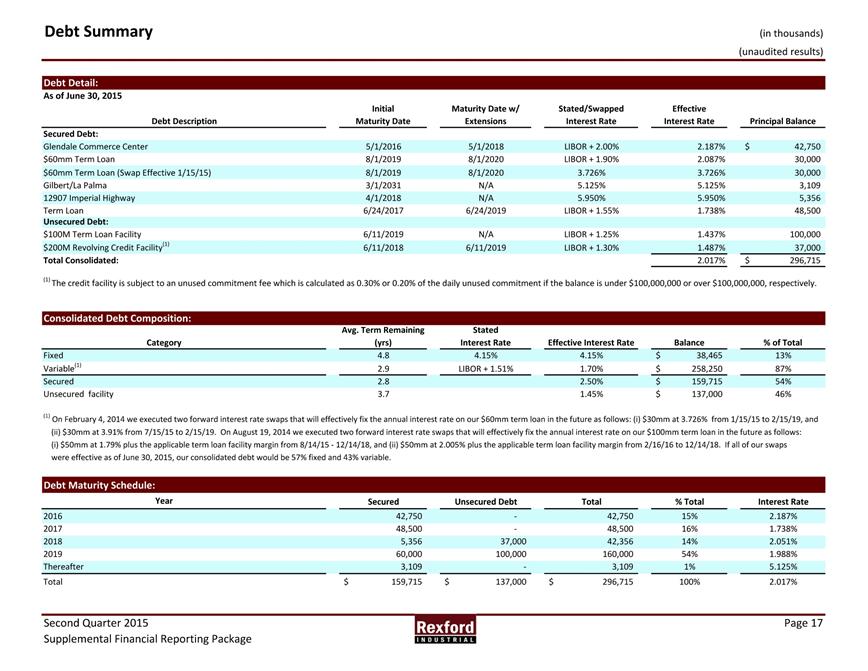

Debt Summary (in thousands) ( unaudited results) Debt Detail: As of June 30, 2015 Initial Maturity Date w/ Stated/ Swapped Effective Debt Description Maturity Date Extensions Interest Rate Interest Rate Principal Balance Secured Debt: Glendale Commerce Center 5/ 1/ 2016 5/ 1/ 2018 LIBOR + 2.00% 2.187% $ 42,750 $60mm Term Loan 8/ 1/ 2019 8/ 1/ 2020 LIBOR + 1.90% 2.087% 30,000 $60mm Term Loan (Swap Effective 1/ 15/ 15) 8/ 1/ 2019 8/ 1/ 2020 3.726% 3.726% 30,000 Gilbert/La Palma 3/1/ 2031 N/ A 5.125% 5.125% 3,109 12907 Imperial Highway 4/1/ 2018 N/ A 5.950% 5.950% 5,356 Term Loan 6/ 24/ 2017 6/ 24/ 2019 LIBOR + 1.55% 1.738% 48,500 Unsecured Debt: $100M Term Loan Facility 6/11/2019 N/ A LIBOR + 1.25% 1.437% 100,000 $200M Revolving Credit Facility(1) 6/ 11/ 2018 6/ 11/ 2019 LIBOR + 1.30% 1.487% 37,000 Total Consolidated: 2.017% $ 296,715 (1) The credit facility is subject to an unused commitment fee which is calculated as 0.30% or 0.20% of the daily unused commitment if the balance is under $100,000,000 or over $100,000,000, respectively. Consolidated Debt Composition: Avg. Term Remaining Stated Category (yrs) Interest Rate Effective Interest Rate Balance % of Total Fixed 4.8 4.15% 4.15% $ 38,465 13% Variable(1) 2.9 LIBOR + 1.51% 1.70% $ 258,250 87% Secured 2.8 2.50% $ 159,715 54% Unsecured facility 3.7 1.45% $ 137,000 46% (1) On February 4, 2014 we executed two forward interest rate swaps that will effectively fix the annual interest rate on our $60mm term loan in the future as follows: (i) $30mm at 3.726% from 1/15/15 to 2/15/19, and (ii) $30mm at 3.91% from 7/15/15 to 2/15/19. On August 19, 2014 we executed two forward interest rate swaps that will effectively fix the annual interest rate on our $100mm term loan in the future as follows: (i) $50mm at 1.79% plus the applicable term loan facility margin from 8/14/15 - 12/14/18, and (ii) $50mm at 2.005% plus the applicable term loan facility margin from 2/16/16 to 12/14/18. If all of our swaps were effective as of June 30, 2015, our consolidated debt would be 57% fixed and 43% variable. Debt Maturity Schedule: Year Secured Unsecured Debt Total % Total Interest Rate 2016 42,750 - 42,750 15% 2.187% 2017 48,500 - 48,500 16% 1.738% 2018 5,356 37,000 42,356 14% 2.051% 2019 60,000 100,000 160,000 54% 1.988% Thereafter 3,109 - 3,109 1% 5.125% Total $ 159,715 $ 137,000 $ 296,715 100% 2.017% SecondQuarter2015Page17SupplementalFinancialReportingPackage

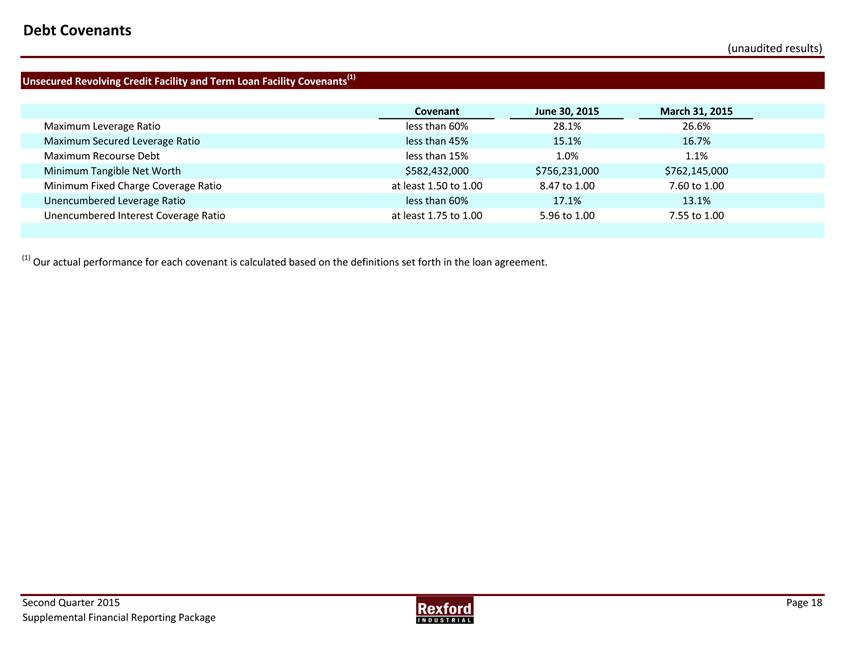

Debt Covenants (unaudited results) Unsecured Revolving Credit Facility and Term Loan Facility Covenants(1) Covenant June 30, 2015 March 31, 2015 Maximum Leverage Ratio less than 60% 28.1% 26.6% Maximum Secured Leverage Ratio less than 45% 15.1% 16.7% Maximum Recourse Debt less than 15% 1.0% 1.1% Minimum Tangible Net Worth $582,432,000 $756,231,000 $762,145,000 Minimum Fixed Charge Coverage Ratio at least 1.50 to 1.00 8.47 to 1.00 7.60 to 1.00 Unencumbered Leverage Ratio less than 60% 17.1% 13.1% Unencumbered Interest Coverage Ratio at least 1.75 to 1.00 5.96 to 1.00 7.55 to 1.00 (1) Our actual performance for each covenant is calculated based on the definitions set forth in the loan agreement. Second Quarter 2015 Page 18 Supplemental Financial Reporting Package

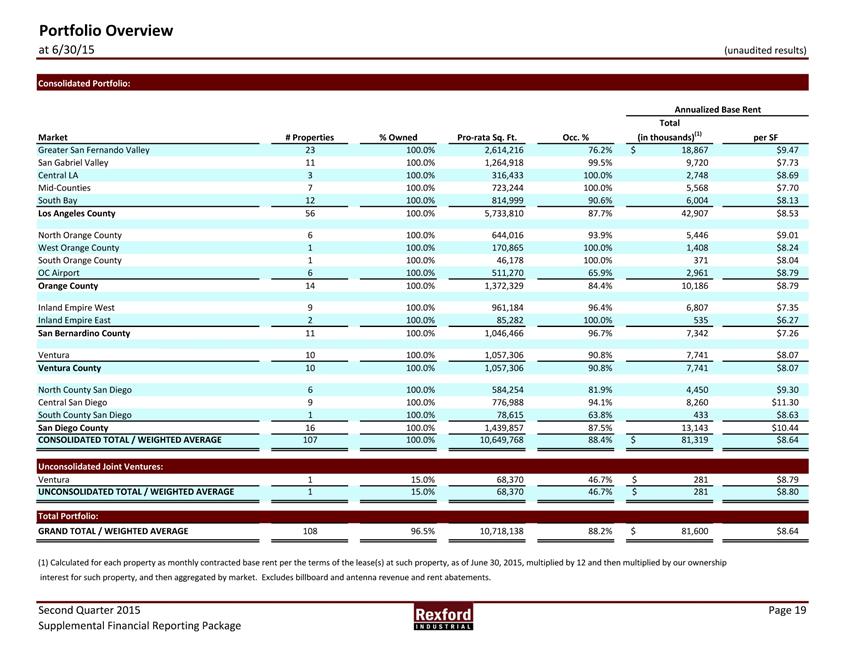

Portfolio Overview at 6/30/15 ( unaudited results) Consolidated Portfolio: Annualized Base Rent Total Market # Properties % Owned Pro- rata Sq. Ft. Occ. % (in thousands) (1) per SF Greater San Fernando Valley 23 100.0% 2,614,216 76.2% 18,867$ $9.47 San Gabriel Valley 11 100.0% 1,264,918 99.5% 9,720 $7.73 Central LA 3 100.0% 316,433 100.0% 2,748 $8.69 Mid- Counties 7 100.0% 723,244 100.0% 5,568 $7.70 South Bay 12 100.0% 814,999 90.6% 6,004 $8.13 Los Angeles County 56 100.0% 5,733,810 87.7% 42,907 $8.53 North Orange County West Orange County South Orange County OC Airport Orange County 6 1 1 6 14 100.0% 100.0% 100.0% 100.0% 100.0% 644,016 170,865 46,178 511,270 1,372,329 93.9% 100.0% 100.0% 65.9% 84.4% 5,446 1,408 371 2,961 10,186 $9.01 $8.24 $8.04 $8.79 $8.79 Inland Empire West Inland Empire East San Bernardino County 9 2 11 100.0% 100.0% 100.0% 961,184 85,282 1,046,466 96.4% 100.0% 96.7% 6,807 535 7,342 $7.35 $6.27 $7.26 Ventura Ventura County 10 10 100.0% 100.0% 1,057,306 1,057,306 90.8% 90.8% 7,741 7,741 $8.07 $8.07 North County San Diego Central San Diego South County San Diego San Diego County CONSOLIDATED TOTAL / WEIGHTED AVERAGE 6 9 1 16 107 100.0% 100.0% 100.0% 100.0% 100.0% 584,254 776,988 78,615 1,439,857 10,649,768 81.9% 94.1% 63.8% 87.5% 88.4% $ 4,450 8,260 433 13,143 81,319 $9.30 $11.30 $8.63 $10.44 $8.64 Unconsolidated Joint Ventures: Ventura 1 15.0% 68,370 46.7% $ 281 $8.79 UNCONSOLIDATED TOTAL / WEIGHTED AVERAGE 1 15.0% 68,370 46.7% $ 281 $8.80 Total Portfolio: GRAND TOTAL / WEIGHTED AVERAGE 108 96.5% 10,718,138 88.2% $ 81,600 $8.64 (1) Calculated for each property as monthly contracted base rent per the terms of the lease( s) at such property, as of June 30, 2015, multiplied by 12 and then multiplied by our ownership interest for such property, and then aggregated by market. Excludes billboard and antenna revenue and rent abatements. SecondQuarter2015Page19SupplementalFinancialReportingPackage

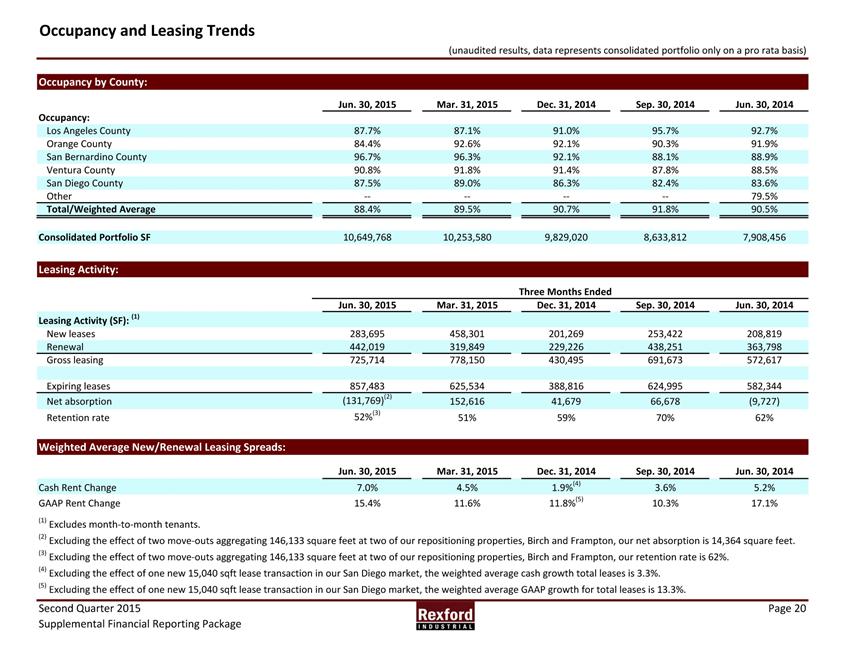

Occupancy and Leasing Trends ( unaudited results, data represents consolidated portfolio only on a pro rata basis) Occupancy by County: Jun. 30, 2015 Mar. 31, 2015 Dec. 31, 2014 Sep. 30, 2014 Jun. 30, 2014 Occupancy: Los Angeles County 87.7% 87.1% 91.0% 95.7% 92.7% Orange County 84.4% 92.6% 92.1% 90.3% 91.9% San Bernardino County 96.7% 96.3% 92.1% 88.1% 88.9% Ventura County 90.8% 91.8% 91.4% 87.8% 88.5% San Diego County 87.5% 89.0% 86.3% 82.4% 83.6% Other - - - - 79.5% Total/ Weighted Average 88.4% 89.5% 90.7% 91.8% 90.5% Consolidated Portfolio SF 10,649,768 10,253,580 9,829,020 8,633,812 7,908,456 Leasing Activity: Three Months Ended Leasing Activity ( SF) : (1) New leases Renewal Gross leasing Jun. 30, 2015 283,695 442,019 725,714 Mar. 31, 2015 458,301 319,849 778,150 Dec. 31, 2014 201,269 229,226 430,495 Sep. 30, 2014 253,422 438,251 691,673 Jun. 30, 2014 208,819 363,798 572,617 Expiring leases Net absorption Retention rate 857,483 (131,769) (2) 52% (3) 625,534 152,616 51% 388,816 41,679 59% 624,995 66,678 70% 582,344 (9,727) 62% Weighted Average New/Renewal Leasing Spreads: Jun. 30, 2015 Mar. 31, 2015 Dec. 31, 2014 Sep. 30, 2014 Jun. 30, 2014 Cash Rent Change 7.0% 4.5% 1.9% (4) 3.6% 5.2% GAAP Rent Change 15.4% 11.6% 11.8% (5) 10.3% 17.1% (1) Excludes month- to- month tenants. (2) Excluding the effect of two move- outs aggregating 146,133 square feet at two of our repositioning properties, Birch and Frampton, our net absorption is 14,364 square feet. (3) Excluding the effect of two move- outs aggregating 146,133 square feet at two of our repositioning properties, Birch and Frampton, our retention rate is 62% . (4) Excluding the effect of one new 15,040 sqft lease transaction in our San Diego market, the weighted average cash growth total leases is 3.3% . (5) Excluding the effect of one new 15,040 sqft lease transaction in our San Diego market, the weighted average GAAP growth for total leases is 13.3% . Second Quarter 2015 Page 20 Supplemental Financial Reporting Package

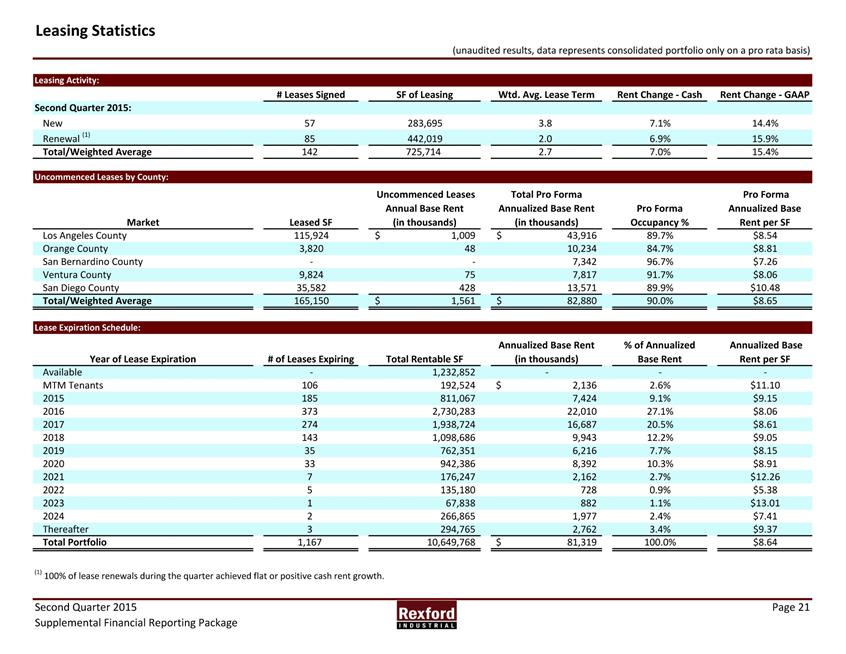

Leasing Statistics ( unaudited results, data represents consolidated portfolio only on a pro rata basis) Leasing Activity: # Leases Signed SF of Leasing Wtd. Avg. Lease Term Rent Change - Cash Rent Change - GAAP Second Quarter 2015: New 57 283,695 3.8 7.1% 14.4% Renewal (1) 85 442,019 2.0 6.9% 15.9% Total/ Weighted Average 142 725,714 2.7 7.0% 15.4% Uncommenced Leases by County: Uncommenced Leases Total Pro Forma Pro Forma Annual Base Rent Annualized Base Rent Pro Forma Annualized Base Market Los Angeles County Orange County San Bernardino County Ventura County San Diego County Total/ Weighted Average Leased SF115,924 3,820 - 9,824 35,582 165,150 (in thousands) 1,009$ 48 - 75 428 1,561$ (in thousands) 43,916$ 10,234 7,342 7,817 13,571 82,880$ Occupancy % 89.7% 84.7% 96.7% 91.7% 89.9% 90.0% Rent per SF $8.54 $8.81 $7.26 $8.06 $10.48 $8.65 Lease Expiration Schedule: Annualized Base Rent % of Annualized Annualized Base Year of Lease Expiration # of Leases Expiring Total Rentable SF (in thousands) Base RentRent per SF Available MTM Tenants 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 Thereafter Total Portfolio -106 185 373 274 143 35 33 7 5 1 2 3 1,167 1,232,852 192,524 811,067 2,730,283 1,938,724 1,098,686 762,351 942,386 176,247 135,180 67,838 266,865 294,765 10,649,768 $ $ - 2,136 7,424 22,010 16,687 9,943 6,216 8,392 2,162 728 882 1,977 2,762 81,319 -2.6% 9.1% 27.1% 20.5% 12.2% 7.7% 10.3% 2.7% 0.9% 1.1% 2.4% 3.4% 100.0% -$11.10 $9.15 $8.06 $8.61 $9.05 $8.15 $8.91 $12.26 $5.38 $13.01 $7.41 $9.37 $8.64 (1) 100% of lease renewals during the quarter achieved flat or positive cash rent growth. Second Quarter 2015 Page 21 Supplemental Financial Reporting Package

Top Tenants and Lease Segmentation ( unaudited results, data represents consolidated portfolio only on a pro rata basis) Top 10 Tenants: % of Total Ann. Ann. Base Rent Tenant Submarket Leased SF Base Rent per SF Lease Expiration Cosmetic Laboratories of America, LLC LA - San Fern. Valley 319,348 2.2% $5.64 6/30/2020 Valeant Pharmaceuticals International, Inc. OC - West 170,865 1.7% $8.24 12/31/2019 Triumph Processing, Inc. LA - South Bay 164,662 1.6% $7.86 5/31/2030 Senior Operations, Inc. LA - San Fern. Valley 130,800 1.4% $8.88 11/30/2024 Biosense Webster, Inc. LA - San Gabriel Valley 89,920 1.4% $12.58 10/31/2020(1) Warehouse Specialists, Inc. LA - San Gabriel Valley 245,961 1.3% $4.44 11/30/2017 32 Cold, LLC LA - Central 78,280 1.3% $13.80 9/30/2025 Department of Corrections Inland Empire West 58,781 1.3% $18.25 3/31/2020 Tarnik, Inc. LA - San Fern. Valley 138,980 1.2% $6.80 4/30/2016 Exelis Inc. LA - San Gabriel Valley 67,838 1.1% $13.01 9/30/2023 Top 10 Total / Wtd. Avg. 1,465,435 14.6% $8.10 (1) Includes 1,120 square feet expiring 9/ 30/ 2016, 12,800 square feet expiring 9/ 30/ 2017 and 76,000 square feet expiring 10/ 31/ 2020, as of June 30, 2015. Lease Segmentation by Size: Ann. Base Rent % of Total Ann. Ann. Base Rent Square Feet Number of Leases Leased SF (in thousands) Base Rent per SF <4,999 835 1,703,355 $ 17,924 22.0% $10.52 5,000 - 9,999 132 911,214 9,402 11.6% $10.32 10,000 - 24,999 130 2,046,254 18,476 22.7% $9.03 25,000 - 49,999 33 1,195,315 10,444 12.9% $8.74 >50,000 37 3,560,778 25,073 30.8% $7.04 Total / Wtd. Avg. 1,167 9,416,916 $ 81,319 100.0% $8.64 SecondQuarter2015Page22SupplementalFinancialReportingPackage

Capital Expenditure Summary ( unaudited results, data represents consolidated portfolio only on a pro rata basis) Quarter Ended June 30, 2015: Tenant Improvements: New Leases 1st Generation New Leases 2nd Generation Renewals $ $ $ Amount 199,000 503,000 67,000 SF(1) 141,063 347,941 150,365 $ $ $ PSF 1.41 1.45 0.45 Leasing Commissions & Lease Costs: New Leases 1st Generation New Leases 2nd Generation Renewals $ $ $ 797,000 264,000 59,000 434,509 223,763 86,636 $ $ $ 1.83 1.18 0.68 Total Recurring Capex: Recurring Capex Recurring Capex % NOI Recurring Capex % Operating Revenue $ 871,000 5.3% 3.9% 10,441,505 $ 0.08 Nonrecurring Capex $ 3,312,000 3,670,387 $ 0.90 Six Months Ended June 30, 2015: Tenant Improvements: New Leases 1st Generation New Leases 2nd Generation Renewals Amount SF(1) 337,000$ 229,138 866,000$ 488,289 145,000$ 189,862 $ $ $ PSF 1.47 1.77 0.76 Leasing Commissions & Lease Costs: New Leases 1st Generation New Leases 2nd Generation Renewals 895,000$ 501,447 507,000$ 408,671 82,000$ 152,326 $ $ $ 1.78 1.24 0.54 Total Recurring Capex: Recurring Capex Recurring Capex % NOI Recurring Capex % Operating Revenue 1,263,000$ 10,240,446 4.0% 2.9% $ 0.12 Nonrecurring Capex 6,232,000$ 4,150,429 $ 1.50 (1) For tenant improvements and leasing commissions, reflects the aggregate square footage of the leases in which we incurred such costs, excluding new/ renewal leases in which there were no tenant improvements and/ or leasing commissions. For recurring capex, reflects the weighted average square footage of our consolidated portfolio for the period. For nonrecurring capex, reflects the aggregate square footage of the properties in which we incurred such capital expenditures. SecondQuarter2015Page23SupplementalFinancialReportingPackage

Properties and Space Under Repositioning As of June 30, 2015 ( unaudited results, in thousands, except square footage) Repositioning Properties Est. Construction Period Costs Incurred Estimated Estimated Cumulative Actual Cash Annual Period to Rentable Acquisition Purchase Investment- to- Projected Total Occ % NOI Stabilized Cash Stabilization Property (Submarket) Square Feet Date Start Completion Price Repositioning date(1) Investment(2) 6/30/15 2Q- 2015(3) NOI (months) (5) CURRENT REPOSITIONING: 1601 Alton Pkwy. (OC Airport) 124,000 Jun-14 4Q- 2014 1Q- 2016 13,276$ 620$ 13,896$ 16,447$ 40% 105$ 996$ 18 - 24 605 8th Street (San Fernando Valley) 56,780 Aug-14 4Q- 2014 3Q- 2015 5,075$ 523$ 5,598$ 7,207$ 0% (5) $ 439$ 6 - 12 7900 Nelson Rd. (San Fernando Valley) 203,082 Nov-14 1Q- 2015 3Q- 2015 24,287$ 182$ 24,469$ 27,065$ 0% (62) $ 1,676$ 18 - 24 9401 De Soto Ave. (San Fernando Valley) 150,263 Mar-15 2Q- 2015 3Q- 2015 14,075$ 95$ 14,170$ 16,906$ 0% (37) $ 1,007$ 8 - 14 2610 & 2701 S. Birch St. (OC Airport) 98,230 Jun-14 2Q- 2015 4Q- 2015 11,000$ 215$ 11,215$ 13,606$ 0% - $ 868$ 8 - 14 24105 Frampton Ave. (South Bay) 47,903 Mar-14 2Q- 2015 1Q- 2016 3,930$ 204$ 4,134$ TBD 0% ( 14) $ 315$ 7 - 13 TOTAL/ WEIGHTED AVERAGE 680,258 71,643$ 1,839$ 73,482$ 81,231$ 7% $ (13) (4) $ 5,301 FUTURE REPOSITIONING: 679- 691 S. Anderson St. (Central LA) 47,490 Nov-14 $ 6,490 8$ 6,498$ 6,990$ 100% 56$ 442$ - COMPLETED REPOSITIONING: 7110 Rosecrans Ave. (South Bay) 73,439 Jan-14 $ 5,000 $ 691 $ 5,691 5,691 100% $ 41 $ 417 Stabilized ( 1) Cumulative investment- to- date includes the purchase price of the property and subsequent costs incurred for nonrecurring capital expenditures. (2) Projected total investment includes the purchase price of the property and an estimate of total expected nonrecurring capital expenditures to be incurred on each repositioning project to reach completion. ( 3) Represents the actual net operating income for each property for the three months ended June 30, 2015. (4) Actual NOI for the three months ended June 30, 2015, reflects the capitalization of $175 of real estate property taxes. We will continue to capitalize real estate property taxes during the period in which construction is taking place to get each repositioning property ready for its intended use. (5) Represents the estimated remaining number of months, as of June 30, 2015, for the property to reach stabilization. Includes time to complete construction and to lease-up property. Repositioning Space Est. Construction Period Estimated Estimated Rentable Actual Cash Annual Period to Square Space Under Occ % NOI Stabilized Cash Stabilization Property (Submarket) Feet Repositioning Start Completion 6/30/15 2Q- 2015(1) NOI (months) (2) CURRENT REPOSITIONING: 28159 Avenue Stanford (San Fernando Valley) 79,701 18,074 4Q- 2014 2Q- 2015 69% $ 108 $ 682 10 - 16 15140 & 15148 Bledsoe St. (San Fernando Valley) 133,356 72,000 1Q- 2015 3Q- 2015 46% $ 88 $ 882 6 - 12 TOTAL/ WEIGHTED AVERAGE 213,057 90,074 55% $ 196 $ 1,564 (1) Represents the actual net operating income for each property for the three months ended June 30, 2015. (2) Represents the estimated remaining number of months, as of June 30, 2015, for the property to reach stabilization. Includes time to complete construction and to lease-up repositioning space. SecondQuarter2015Page24SupplementalFinancialReportingPackage

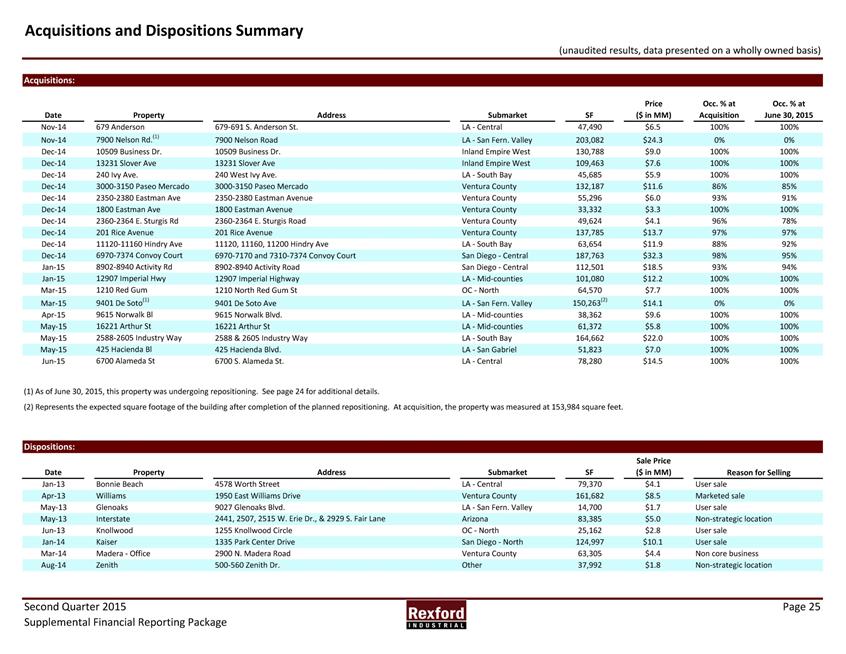

Acquisitions and Dispositions Summary ( unaudited results, data presented on a wholly owned basis) Acquisitions: Price Occ. % at Occ. % at Date Property Address Submarket SF ($ in MM) Acquisition June 30, 2015 Nov- 14 679 Anderson 679- 691 S. Anderson St. LA - Central 47,490 $6.5 100% 100% Nov- 14 7900 Nelson Rd. (1) 7900 Nelson Road LA - San Fern. Valley 203,082 $24.3 0% 0% Dec- 14 10509 Business Dr. 10509 Business Dr. Inland Empire West 130,788 $9.0 100% 100% Dec- 14 13231 Slover Ave 13231 Slover Ave Inland Empire West 109,463 $7.6 100% 100% Dec- 14 240 Ivy Ave. 240 West Ivy Ave. LA - South Bay 45,685 $5.9 100% 100% Dec- 14 3000- 3150 Paseo Mercado 3000- 3150 Paseo Mercado Ventura County 132,187 $11.6 86% 85% Dec- 14 2350- 2380 Eastman Ave 2350- 2380 Eastman Avenue Ventura County 55,296 $6.0 93% 91% Dec- 14 1800 Eastman Ave 1800 Eastman Avenue Ventura County 33,332 $3.3 100% 100% Dec- 14 2360- 2364 E. Sturgis Rd 2360- 2364 E. Sturgis Road Ventura County 49,624 $4.1 96% 78% Dec- 14 201 Rice Avenue 201 Rice Avenue Ventura County 137,785 $13.7 97% 97% Dec- 14 11120- 11160 Hindry Ave 11120, 11160, 11200 Hindry Ave LA - South Bay 63,654 $11.9 88% 92% Dec- 14 6970- 7374 Convoy Court 6970- 7170 and 7310- 7374 Convoy Court San Diego - Central 187,763 $32.3 98% 95% Jan- 15 8902- 8940 Activity Rd 8902- 8940 Activity Road San Diego - Central 112,501 $18.5 93% 94% Jan- 15 12907 Imperial Hwy 12907 Imperial Highway LA - Mid- counties 101,080 $12.2 100% 100% Mar- 15 1210 Red Gum 1210 North Red Gum St OC - North 64,570 $7.7 100% 100% Mar- 15 9401 De Soto(1) 9401 De Soto Ave LA - San Fern. Valley 150,263(2) $14.1 0% 0% Apr- 15 9615 Norwalk Bl 9615 Norwalk Blvd. LA - Mid- counties 38,362 $9.6 100% 100% May- 15 16221 Arthur St 16221 Arthur St LA - Mid- counties 61,372 $5.8 100% 100% May- 15 2588- 2605 Industry Way 2588 & 2605 Industry Way LA - South Bay 164,662 $22.0 100% 100% May- 15 425 Hacienda Bl 425 Hacienda Blvd. LA - San Gabriel 51,823 $7.0 100% 100% Jun- 15 6700 Alameda St 6700 S. Alameda St. LA - Central 78,280 $14.5 100% 100% (1) As of June 30, 2015, this property was undergoing repositioning. See page 24 for additional details. (2) Represents the expected square footage of the building after completion of the planned repositioning. At acquisition, the property was measured at 153,984 square feet. Dispositions: Sale Price Date Property Address Submarket SF ($ in MM) Reason for Selling Jan- 13 Bonnie Beach 4578 Worth Street LA - Central 79,370 $4.1 User sale Apr- 13 Williams 1950 East Williams Drive Ventura County 161,682 $8.5 Marketed sale May- 13 Glenoaks 9027 Glenoaks Blvd. LA - San Fern. Valley 14,700 $1.7 User sale May- 13 Interstate 2441, 2507, 2515 W. Erie Dr. , & 2929 S. Fair Lane Arizona 83,385 $5.0 Non- strategic location Jun- 13 Knollwood 1255 Knollwood Circle OC - North 25,162 $2.8 User sale Jan- 14 Kaiser 1335 Park Center Drive San Diego - North 124,997 $10.1 User sale Mar- 14 Madera - Office 2900 N. Madera Road Ventura County 63,305 $4.4 Non core business Aug- 14 Zenith 500- 560 Zenith Dr. Other 37,992 $1.8 Non- strategic location Second Quarter 2015 Page 25 Supplemental Financial Reporting Package

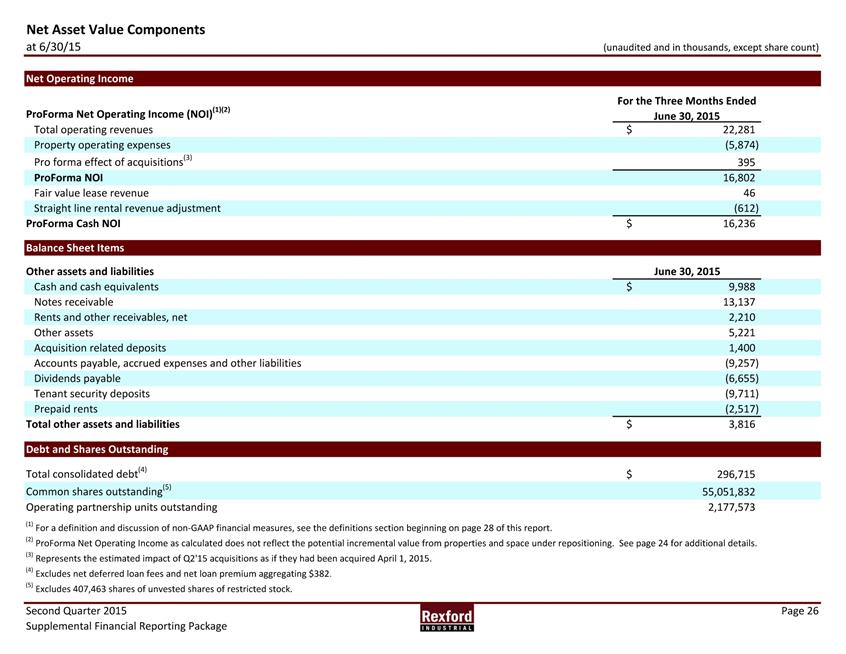

Net Asset Value Components at 6/30/15 ( unaudited and in thousands, except share count) Net Operating Income For the Three Months Ended ProForma Net Operating Income (NOI) (1)(2) June 30, 2015 Total operating revenues $ 22,281 Property operating expenses ( 5,874) Pro forma effect of acquisitions(3) 395 ProForma NOI 16,802 Fair value lease revenue 46 Straight line rental revenue adjustment ( 612) ProForma Cash NOI $ 16,236 Balance Sheet Items Other assets and liabilities June 30, 2015 Cash and cash equivalents $ 9,988 Notes receivable 13,137 Rents and other receivables, net 2,210 Other assets 5,221 Acquisition related deposits 1,400 Accounts payable, accrued expenses and other liabilities ( 9,257) Dividends payable ( 6,655) Tenant security deposits ( 9,711) Prepaid rents ( 2,517) Total other assets and liabilities $ 3,816 Debt and Shares Outstanding Total consolidated debt(4) $ 296,715 Common shares outstanding(5) 55,051,832 Operating partnership units outstanding 2,177,573 (1) For a definition and discussion of non- GAAP financial measures, see the definitions section beginning on page 28 of this report. (2) ProForma Net Operating Income as calculated does not reflect the potential incremental value from properties and space under repositioning. See page 24 for additional details. (3) Represents the estimated impact of Q2'15 acquisitions as if they had been acquired April 1, 2015. (4) Excludes net deferred loan fees and net loan premium aggregating $382. (5) Excludes 407,463 shares of unvested shares of restricted stock. SecondQuarter2015Page26SupplementalFinancialReportingPackage

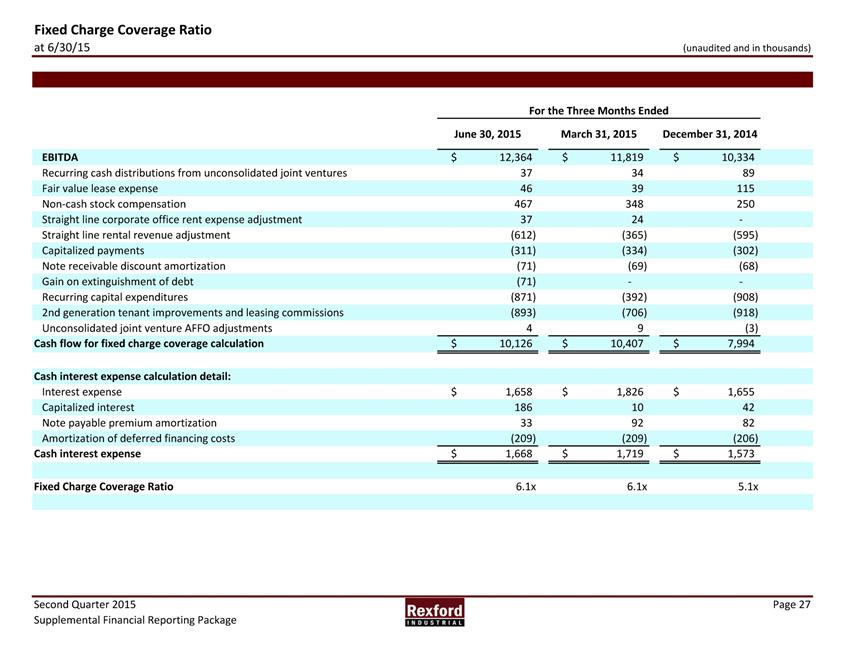

Fixed Charge Coverage Ratio at 6/30/15 ( unaudited and in thousands) For the Three Months Ended June 30, 2015 March 31, 2015 December 31, 2014 EBITDA $ 12,364 $ 11,819 $ 10,334 Recurring cash distributions from unconsolidated joint ventures 37 34 89 Fair value lease expense 46 39 115 Non- cash stock compensation 467 348 250 Straight line corporate office rent expense adjustment 37 24 Straight line rental revenue adjustment (612) (365) (595) Capitalized payments (311) (334) (302) Note receivable discount amortization (71) (69) (68) Gain on extinguishment of debt ( 71) - Recurring capital expenditures ( 871) (392) (908) 2nd generation tenant improvements and leasing commissions ( 893) (706) (918) Unconsolidated joint venture AFFO adjustments 4 9 (3) Cash flow for fixed charge coverage calculation $ 10,126 $ 10,407 $ 7,994 Cash interest expense calculation detail: Interest expense $ 1,658 $ 1,826 $ 1,655 Capitalized interest 186 10 42 Note payable premium amortization 33 92 82 Amortization of deferred financing costs ( 209) (209) (206) Cash interest expense $ 1,668 $ 1,719 $ 1,573 Fixed Charge Coverage Ratio 6.1x 6.1x 5.1x Second Quarter 2015 Page 27 Supplemental Financial Reporting Package

Definitions / Discussion of Non- GAAP Financial Measures Adjusted Funds from Operations (AFFO): We calculate adjusted funds from operations, or AFFO, by adding to or subtracting from FFO ( i) non- cash operating revenues and expenses, ( ii) capitalized operating expenditures such as leasing payroll, ( iii) recurring capital expenditures required to maintain and re- tenant our properties, ( iv) capitalized interest costs resulting from the repositioning/ redevelopment of certain of our properties, and ( v) 2nd generation tenant improvements and leasing commissions. Management uses AFFO as a supplemental performance measure because it provides a performance measure that, when compared year over year, captures trends in portfolio operating results. We also believe that, as a widely recognized measure of the performance of REITs, AFFO will be used by investors as a basis to assess our performance in comparison to other REITs. However, because AFFO may exclude certain non- recurring capital expenditures and leasing costs, the utility of AFFO as a measure of our performance is limited. Additionally, other Equity REITs may not calculate AFFO using the method we do. As a result, our AFFO may not be comparable to such other Equity REITs’ AFFO. AFFO should be considered only as a supplement to net income (as computed in accordance with GAAP) as a measure of our performance. Annualized Base Rent: Calculated for each lease as the latest monthly contracted base rent per the terms of such lease multiplied by 12. Excludes billboard and antenna revenue and rent abatements. Capital Expenditures, Non- recurring: Expenditures made in respect of a property for improvement to the appearance of such property or any other major upgrade or renovation of such property, and further includes capital expenditures for seismic upgrades, or capital expenditures for deferred maintenance existing at the time such property was acquired. Capital Expenditures, Recurring: Expenditures made in respect of a property for maintenance of such property and replacement of items due to ordinary wear and tear including, but not limited to, expenditures made for maintenance or replacement of parking lot, roofing materials, mechanical systems, HVAC systems and other structural systems. Recurring capital expenditures shall not include any of the following: ( a) improvements to the appearance of such property or any other major upgrade or renovation of such property not necessary for proper maintenance or marketability of such property; ( b) capital expenditures for seismic upgrades; or ( c) capital expenditures for deferred maintenance for such property existing at the time such property was acquired. Capital Expenditures, First Generation: Capital expenditures for newly acquired space, newly developed or redeveloped space, or change in use. Cash NOI: Cash basis NOI is a non- GAAP measure, which we calculate by adding or subtracting from NOI i) fair value lease revenue and ii) straight- line rent adjustment. We use Cash NOI, together with NOI, as a supplemental performance measure. Cash NOI should not be used as a measure of our liquidity, nor is it indicative of funds available to fund our cash needs. Cash NOI should not be used as a substitute for cash flow from operating activities computed in accordance with GAAP. We use Cash NOI to help evaluate the performance of the Company as a whole, as well as the performance of our Same Property Portfolio. EBITDA and Adjusted EBITDA: We believe that EBITDA is helpful to investors as a supplemental measure of our operating performance as a real estate company because it is a direct measure of the actual operating results of our industrial properties. We also use this measure in ratios to compare our performance to that of our industry peers. In addition, we believe EBITDA is frequently used by securities analysts, investors and other interested parties in the evaluation of Equity REITs. However, because EBITDA is calculated before recurring cash charges including interest expense and income taxes, and is not adjusted for capital expenditures or other recurring cash requirements of our business, its utility as a measure of our liquidity is limited. Accordingly, EBITDA should not be considered an alternative to cash flow from operating activities ( as computed in accordance with GAAP) as a measure of our liquidity. EBITDA should not be considered as an alternative to net income or loss as an indicator of our operating performance. Other Equity REITs may calculate EBITDA differently than we do; accordingly, our EBITDA may not be comparable to such other Equity REITs’ EBITDA. Adjusted EBITDA includes add backs of non- cash stock based compensation expense, gain on extinguishment of debt, loss on sale of real estate, non- recurring legal fees and the pro- forma effects of acquisitions and assets classified as held for sale. Investment to Date and Total: Reflects the total purchase price for a property plus additional or planned tangible investment subsequent to acquisition. Funds from Operations (FFO): We calculate FFO before non- controlling interest in accordance with the standards established by the National Association of Real Estate Investment Trusts ( “ NAREIT” ) . FFO represents net income ( loss) ( computed in accordance with GAAP) , excluding gains ( or losses) from sales of depreciable operating property, real estate related depreciation and amortization ( excluding amortization of deferred financing costs) and after adjustments for unconsolidated partnerships and joint ventures. Management uses FFO as a supplemental performance measure because, in excluding real estate related depreciation and amortization, gains and losses from property dispositions, other than temporary impairments of unconsolidated real estate entities, and impairment on our investment in real estate, it provides a performance measure that, when compared year over year, captures trends in occupancy rates, rental rates and operating costs. We also believe that, as a widely recognized measure of performance used by other REITs, FFO may be used by investors as a basis to compare our operating performance with that of other REITs. However, because FFO excludes depreciation and amortization and captures neither the changes in the value of our properties that result from use or market conditions nor the level of capital expenditures and leasing commissions necessary to maintain the operating performance of our properties, all of which have real economic effects and could materially impact our results from operations, the utility of FFO as a measure of our performance is limited. Other equity REITs may not calculate or interpret FFO in accordance with the NAREIT definition as we do, and, accordingly, our FFO may not be comparable to such other REITs’ FFO. FFO should not be used as a measure of our liquidity, and is not indicative of funds available for our cash needs, including our ability to pay dividends. Second Quarter 2015 Page 28 Supplemental Financial Reporting Package

Definitions / Discussion of Non- GAAP Financial Measures NOI: Includes the revenue and expense directly attributable to our real estate properties calculated in accordance with GAAP. Calculated as total revenue from real estate operations including i) rental revenues ii) tenant reimbursements, and iii) other income less property expenses and other property expenses ( before interest expense, depreciation and amortization) . We use NOI as a supplemental performance measure because, in excluding real estate depreciation and amortization expense and gains ( or losses) from property dispositions, it provides a performance measure that, when compared year over year, captures trends in occupancy rates, rental rates and operating costs. We also believe that NOI will be useful to investors as a basis to compare our operating performance with that of other REITs. However, because NOI excludes depreciation and amortization expense and captures neither the changes in the value of our properties that result from use or market conditions, nor the level of capital expenditures and leasing commissions necessary to maintain the operating performance of our properties ( all of which have real economic effect and could materially impact our results from operations) , the utility of NOI as a measure of our performance is limited. Other equity REITs may not calculate NOI in a similar manner and, accordingly, our NOI may not be comparable to such other REITs’ NOI. Accordingly, NOI should be considered only as a supplement to net income as a measure of our performance. NOI should not be used as a measure of our liquidity, nor is it indicative of funds available to fund our cash needs. NOI should not be used as a substitute for cash flow from operating activities in accordance with GAAP. We use NOI to help evaluate the performance of the Company as a whole, as well as the performance of our Same Property Portfolio. Proforma NOI: Proforma NOI is calculated by adding to NOI the estimated impact of current period acquisitions as if they had been acquired at the beginning of the reportable period. These estimates do not purport to be indicative of what operating results would have been had the acquisitions actually occured at the beginning of the reportable period and may not be indicative of future operating results. Properties Under Repositioning: Typically defined as properties where a significant amount of space is held vacant in order to implement capital improvements that improve the market rentability and leasing functionality of that space. Considered completed once investment is fully or nearly fully deployed and the property is marketable for leasing. Recurring Funds From Operations (Recurring FFO): We calculate Recurring FFO by adjusting FFO to exclude the effect of non- recurring expenses and acquisition expenses. Rent Change - Cash: Compares the first month cash rent excluding any abatement on new leases to the last month rent for the most recent expiring lease. Data included for comparable leases only. Comparable leases generally exclude properties under repositioning, short- term leases, and space that has been vacant for over one year. Rent Change - GAAP: Compares GAAP rent, which straightlines rental rate increases and abatement, on new leases to GAAP rent for the most recent expiring lease. Data included for comparable leases only. Comparable leases generally exclude properties under repositioning, short- term leases, and space that has been vacant for over one year. Same Property Portfolio: Our Same Property Portfolio is a subset of our consolidated portfolio and includes properties that were wholly- owned by us as of January 1, 2014 and still owned by us as of June 30, 2015. The Company’s computation of same property performance may not be comparable to other REITs. Space Under Repositioning: Defined as space held vacant in order to implement capital improvements to change the leasing functionality of that space. Considered completed once the repositioning has been completed and the unit is marketable for leasing. Stabilized Same Property Portfolio: Our Stabilized Same Property Portfolio represents the properties included in our Same Property Portfolio, adjusted to exclude spaces that were under repositioning. Uncommenced Leases: Reflects signed leases that have not yet commenced as of the reporting date. Second Quarter 2015 Page 29 Supplemental Financial Reporting Package