EX-99.2

Published on February 4, 2026

Exhibit 99.2

Table of Contents. | ||||||||

| Section | Page | ||||

| Corporate Data: | |||||

Guidance | |||||

| Consolidated Financial Results: | |||||

| Portfolio Data: | |||||

Disclosures:

Forward-Looking Statements: This supplemental package contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. We caution investors that any forward-looking statements presented herein are based on management’s beliefs and assumptions and information currently available to management. Such statements are subject to risks, uncertainties and assumptions and may be affected by known and unknown risks, trends, uncertainties and factors that are beyond our control. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, estimated or projected. These risks and uncertainties include, without limitation: general risks affecting the real estate industry (including, without limitation, the market value of our properties, the inability to enter into or renew leases at favorable rates, portfolio occupancy varying from our expectations, dependence on tenants’ financial condition, and competition from other developers, owners and operators of real estate); risks associated with the disruption of credit markets or a global economic slowdown; risks associated with the potential loss of key personnel (most importantly, members of senior management); risks associated with our failure to maintain our status as a Real Estate Investment Trust under the Internal Revenue Code of 1986, as amended; possible adverse changes in tax and environmental laws; an epidemic or pandemic (such as the outbreak and worldwide spread of novel coronavirus (COVID-19), and the measures that international, federal, state and local governments, agencies, law enforcement and/or health authorities may implement to address it, which may (as with COVID-19) precipitate or exacerbate one or more of the above-mentioned factors and/or other risks, and significantly disrupt or prevent us from operating our business in the ordinary course for an extended period; litigation, including costs associated with prosecuting or defending pending or threatened claims and any adverse outcomes, and potential liability for uninsured losses and environmental contamination.

For a further discussion of these and other factors that could cause our future results to differ materially from any forward-looking statements, see Item 1A. Risk Factors in our 2024 Annual Report on Form 10-K, which was filed with the Securities and Exchange Commission (“SEC”) on February 10, 2025, and other risks described in documents we subsequently file from time to time with the SEC. We disclaim any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, of new information, data or methods, future events or other changes.

Our credit ratings, which are disclosed on page 4, may not reflect the potential impact of risks relating to the structure or trading of the Company's securities and are provided solely for informational purposes. Credit ratings are not recommendations to buy, sell or hold any security, and may be revised or withdrawn at any time by the issuing organization in its sole discretion. The Company does not undertake any obligation to maintain the ratings or to advise of any change in ratings. Each agency's rating should be evaluated independently of any other agency's rating. An explanation of the significance of the ratings may be obtained from each of the rating agencies.

Fourth Quarter 2025 Supplemental Financial Reporting Package | Page 2 |  | ||||||

Investor Company Summary. | ||||||||

| Executive Management Team | ||||||||

| Howard Schwimmer | Co-Chief Executive Officer, Director | |||||||

| Michael S. Frankel | Co-Chief Executive Officer, Director | |||||||

| Laura Clark | Chief Operating Officer, Incoming Chief Executive Officer, Director | |||||||

| Michael Fitzmaurice | Chief Financial Officer | |||||||

David E. Lanzer | General Counsel and Corporate Secretary | |||||||

| Board of Directors | ||||||||

| Tyler H. Rose | Chairman | |||||||

| Howard Schwimmer | Co-Chief Executive Officer, Director | |||||||

| Michael S. Frankel | Co-Chief Executive Officer, Director | |||||||

Laura Clark | Chief Operating Officer, Incoming Chief Executive Officer, Director | |||||||

| Robert L. Antin | Director | |||||||

| Diana J. Ingram | Director | |||||||

| Angela L. Kleiman | Director | |||||||

| Debra L. Morris | Director | |||||||

David P. Stockert | Director | |||||||

| Investor Relations Information | ||||||||

Mikayla Lynch | ||||||||

Director, Investor Relations and Capital Markets | ||||||||

mlynch@rexfordindustrial.com | ||||||||

| Equity Research Coverage | ||||||||||||||||||||||||||||||||

| BofA Securities | Samir Khanal | (646) 855-1497 | Green Street Advisors | Vince Tibone | (949) 640-8780 | |||||||||||||||||||||||||||

| Barclays | Brendan Lynch | (212) 526-9428 | J.P. Morgan Securities | Michael Mueller | (212) 622-6689 | |||||||||||||||||||||||||||

| BMO Capital Markets | John Kim | (212) 885-4115 | Jefferies LLC | Jonathan Petersen | (212) 284-1705 | |||||||||||||||||||||||||||

| BNP Paribas Exane | Nate Crossett | (646) 342-1588 | Mizuho Securities USA | Vikram Malhotra | (212) 282-3827 | |||||||||||||||||||||||||||

Cantor Fitzgerald | Richard Anderson | (929) 441-6927 | Robert W. Baird & Co. | Nicholas Thillman | (414) 298-5053 | |||||||||||||||||||||||||||

| Citigroup Investment Research | Craig Mailman | (212) 816-4471 | Scotiabank | Greg McGinniss | (212) 225-6906 | |||||||||||||||||||||||||||

| Colliers Securities | Barry Oxford | (203) 961-6573 | Truist Securities | Anthony Hau | (212) 303-4176 | |||||||||||||||||||||||||||

Deutsche Bank | Omotayo Okusanya | (212) 250-9284 | Wells Fargo Securities | Blaine Heck | (443) 263-6529 | |||||||||||||||||||||||||||

Evercore ISI | Steve Sakwa | (212) 446-9462 | Wolfe Research | Andrew Rosivach | (646) 582-9250 | |||||||||||||||||||||||||||

Disclaimer: This list may not be complete and is subject to change as firms add or delete coverage of our company. Please note that any opinions, estimates, forecasts or predictions regarding our historical or predicted performance made by these analysts are theirs alone and do not represent opinions, estimates, forecasts or predictions of Rexford Industrial Realty, Inc. or its management. We are providing this listing as a service to our stockholders and do not by listing these firms imply our endorsement of, or concurrence with, such information, conclusions or recommendations. Interested persons may obtain copies of analysts’ reports on their own; we do not distribute these reports.

Fourth Quarter 2025 Supplemental Financial Reporting Package | Page 3 |  | ||||||

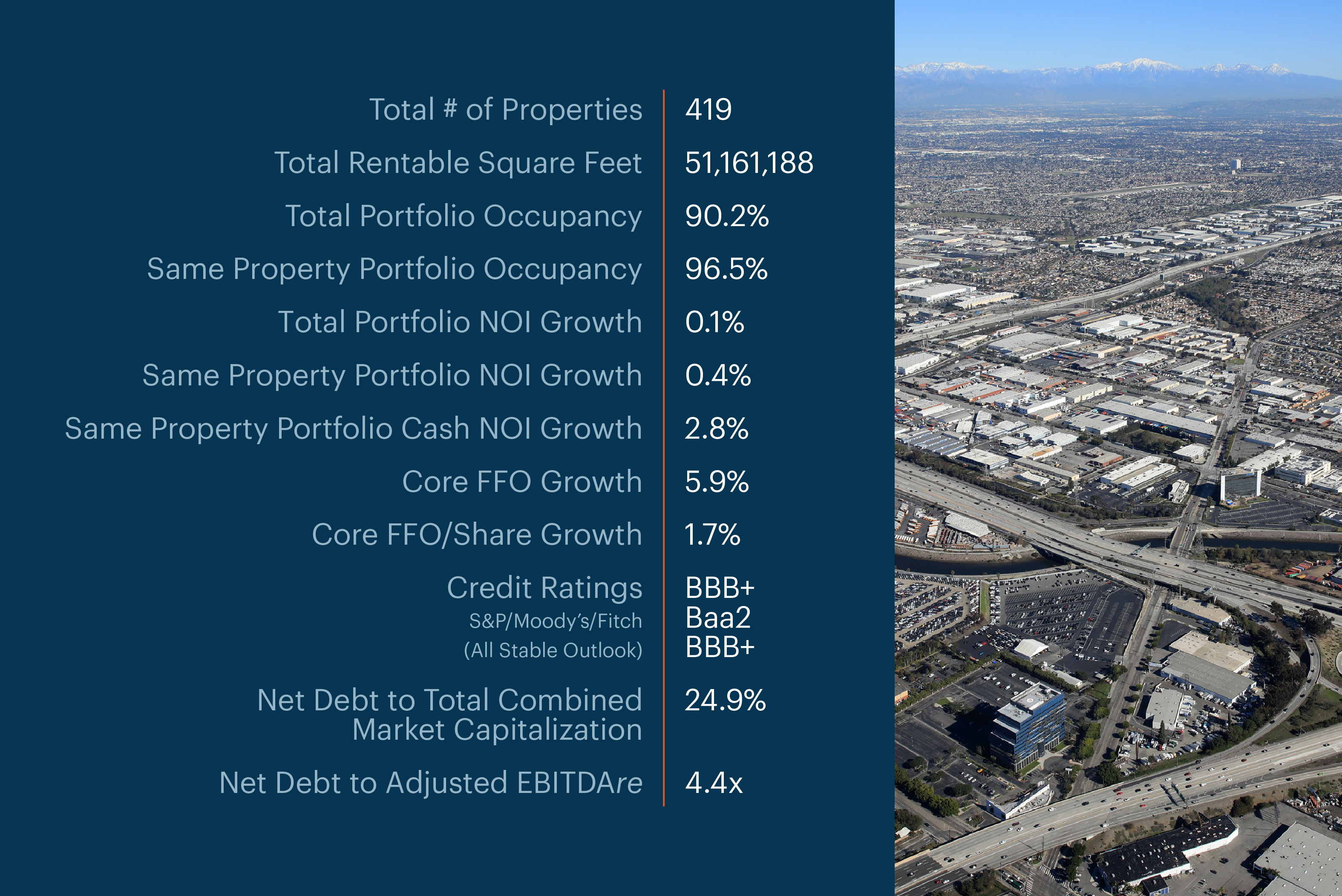

Company Overview. | ||||||||

| For the Quarter Ended December 31, 2025 | ||||||||

Fourth Quarter 2025 Supplemental Financial Reporting Package | Page 4 |  | ||||||

Highlights - Consolidated Financial Results. | ||||||||

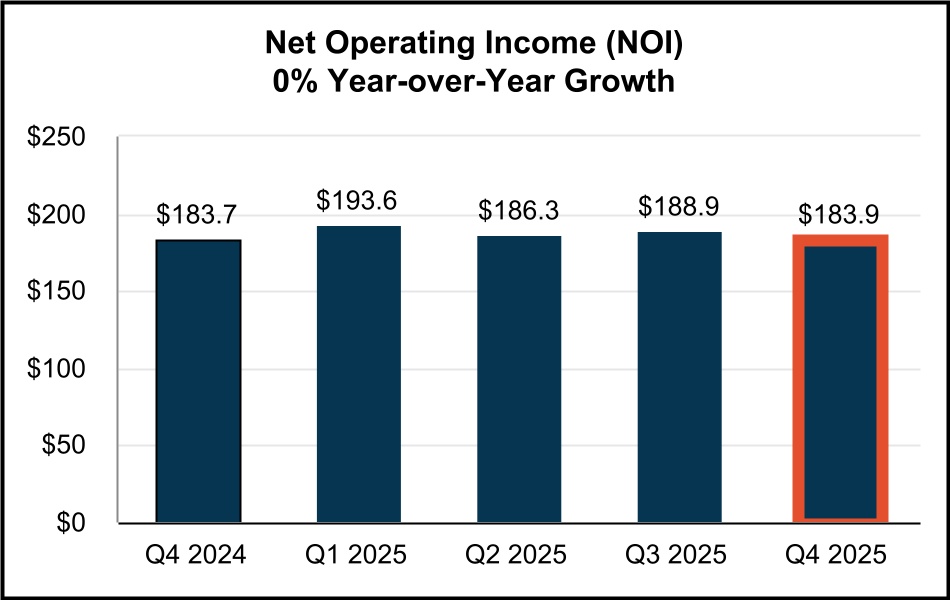

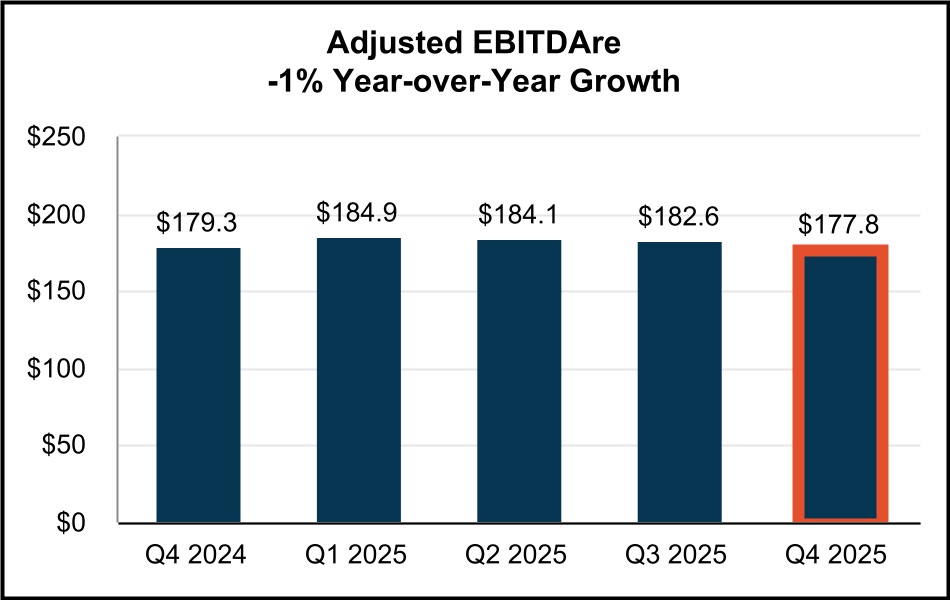

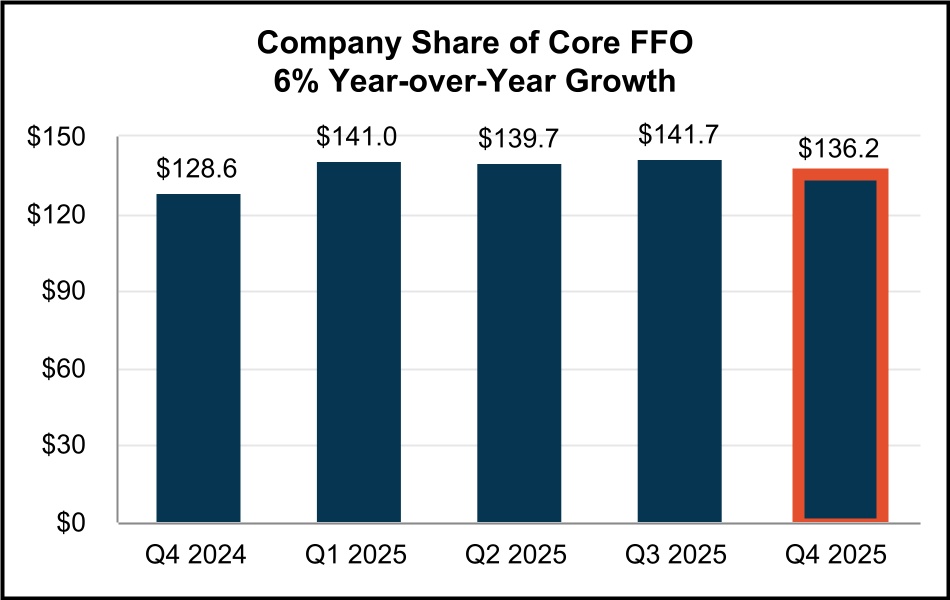

| Quarterly Results | (in millions) | |||||||

Fourth Quarter 2025 Supplemental Financial Reporting Package | Page 5 |  | ||||||

Financial and Portfolio Highlights and Capitalization Data.(1) | ||||||||

| (in thousands except share and per share data and portfolio statistics) | ||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| December 31, 2025 | September 30, 2025 | June 30, 2025 | March 31, 2025 | December 31, 2024 | |||||||||||||||||||||||||

| Financial Results: | |||||||||||||||||||||||||||||

| Total rental income | $ | 243,230 | $ | 246,757 | $ | 241,568 | $ | 248,821 | $ | 239,737 | |||||||||||||||||||

Net (loss) income | $ | (67,735) | $ | 93,056 | $ | 120,394 | $ | 74,048 | $ | 64,910 | |||||||||||||||||||

| Net Operating Income (NOI) | $ | 183,943 | $ | 188,878 | $ | 186,270 | $ | 193,560 | $ | 183,731 | |||||||||||||||||||

| Company share of Core FFO | $ | 136,182 | $ | 141,700 | $ | 139,709 | $ | 141,023 | $ | 128,562 | |||||||||||||||||||

| Company share of Core FFO per common share - diluted | $ | 0.59 | $ | 0.60 | $ | 0.59 | $ | 0.62 | $ | 0.58 | |||||||||||||||||||

Adjusted EBITDAre | $ | 177,808 | $ | 182,624 | $ | 184,111 | $ | 184,859 | $ | 179,347 | |||||||||||||||||||

| Dividend declared per common share | $ | 0.4300 | $ | 0.4300 | $ | 0.4300 | $ | 0.4300 | $ | 0.4175 | |||||||||||||||||||

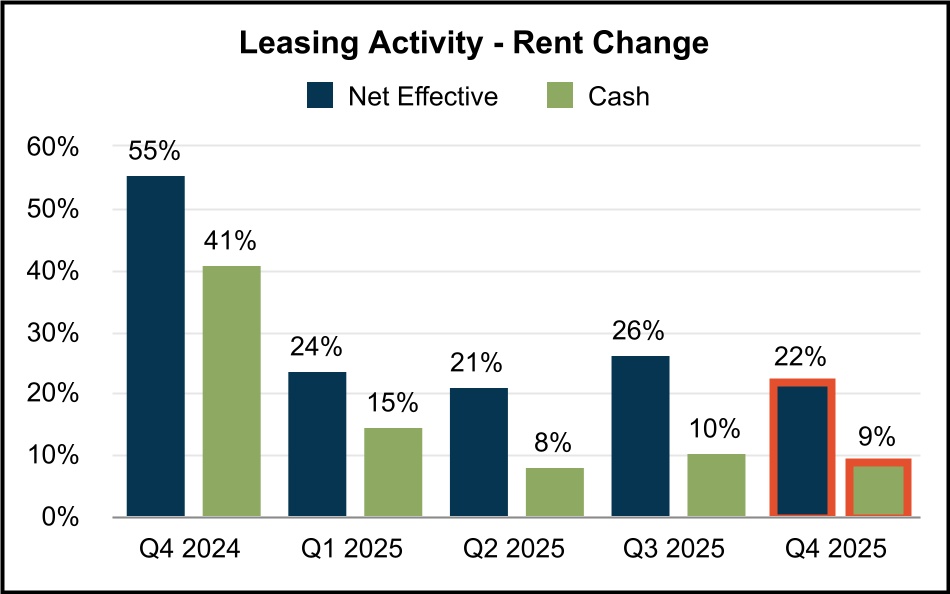

| Portfolio Statistics: | |||||||||||||||||||||||||||||

| Portfolio rentable square feet (“RSF”) | 51,161,188 | 50,850,824 | 51,021,897 | 50,952,137 | 50,788,225 | ||||||||||||||||||||||||

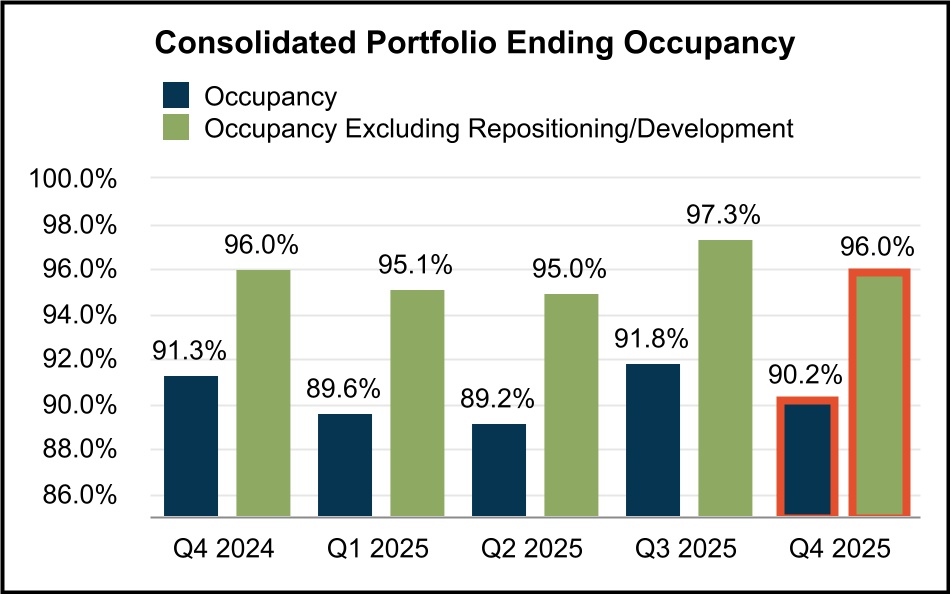

| Ending occupancy | 90.2% | 91.8% | 89.2% | 89.6% | 91.3% | ||||||||||||||||||||||||

Ending occupancy excluding repositioning/development | 96.0% | 97.3% | 95.0% | 95.1% | 96.0% | ||||||||||||||||||||||||

| Net Effective Rent Change | 22.0% | 26.1% | 20.9% | 23.8% | 55.4% | ||||||||||||||||||||||||

| Cash Rent Change | 9.0% | 10.3% | 8.1% | 14.7% | 41.0% | ||||||||||||||||||||||||

| Same Property Portfolio Performance: | |||||||||||||||||||||||||||||

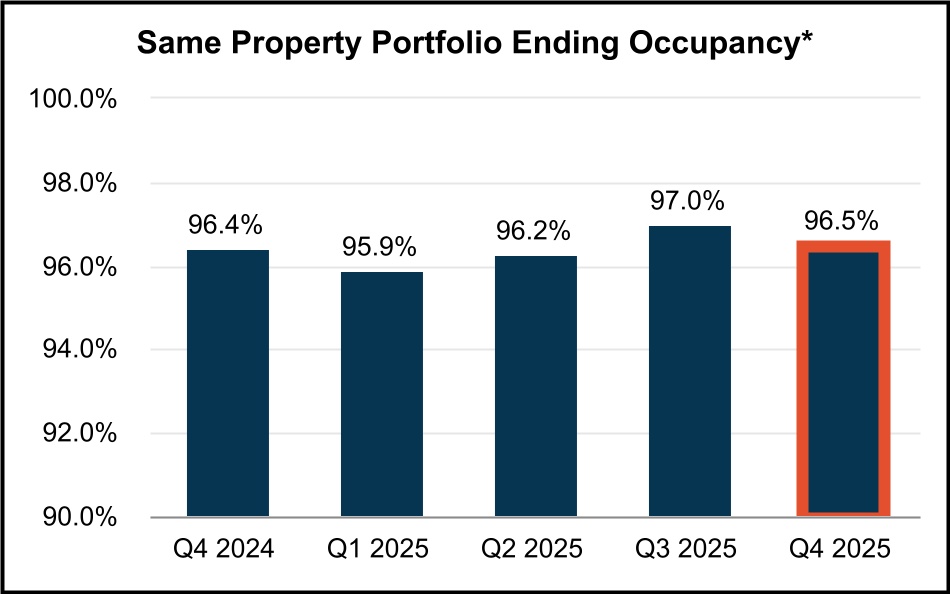

Same Property Portfolio ending occupancy(2)(3) | 96.5% | 97.0% | 96.2% | 95.9% | 96.4% | ||||||||||||||||||||||||

Same Property Portfolio NOI growth(4) | 0.4% | 2.0% | 1.2% | 0.7% | |||||||||||||||||||||||||

Same Property Portfolio Cash NOI growth(4) | 2.8% | 5.7% | 3.9% | 5.0% | |||||||||||||||||||||||||

| Capitalization: | |||||||||||||||||||||||||||||

Total shares and units issued and outstanding at period end(5) | 238,245,286 | 240,452,878 | 244,334,274 | 244,310,773 | 233,295,793 | ||||||||||||||||||||||||

| Series B and C Preferred Stock and Series 1, 2 and 3 CPOP Units | $ | 173,250 | $ | 173,250 | $ | 173,250 | $ | 173,250 | $ | 213,956 | |||||||||||||||||||

| Total equity market capitalization | $ | 9,398,107 | $ | 10,058,268 | $ | 8,864,220 | $ | 9,738,017 | $ | 9,233,171 | |||||||||||||||||||

| Total consolidated debt | $ | 3,278,649 | $ | 3,278,896 | $ | 3,379,141 | $ | 3,379,383 | $ | 3,379,622 | |||||||||||||||||||

| Total combined market capitalization (net debt plus equity) | $ | 12,510,978 | $ | 13,088,208 | $ | 11,812,244 | $ | 12,612,821 | $ | 12,556,822 | |||||||||||||||||||

| Ratios: | |||||||||||||||||||||||||||||

| Net debt to total combined market capitalization | 24.9% | 23.2% | 25.0% | 22.8% | 26.5% | ||||||||||||||||||||||||

Net debt to Adjusted EBITDAre (quarterly results annualized) | 4.4x | 4.1x | 4.0x | 3.9x | 4.6x | ||||||||||||||||||||||||

(1)For definition/discussion of non-GAAP financial measures & reconciliations to their nearest GAAP equivalents, see definitions section & reconciliation section beginning on page 33 and page 12 of this report, respectively.

(2)Reflects the ending occupancy for the 2025 Same Property Portfolio for each period presented. For historical ending occupancy as reported in prior Supplemental packages, see “SPP Historical Information” on page 36.

(3)For comparability, Same Property Portfolio ending occupancy, NOI growth and Cash NOI growth for all comparable periods have been restated to remove the results of 600-650 South Grand Avenue, which was sold during Q4’25. See page 31 for details related to dispositions.

(4)Represents the year over year percentage change in NOI and Cash NOI for the Same Property Portfolio.

(5)Includes the following # of OP Units/vested LTIP units held by noncontrolling interests: 8,288,228 (Dec 31, 2025), 8,155,706 (Sep 30, 2025), 8,182,445 (Jun 30, 2025), 8,700,301 (Mar 31, 2025) and 8,426,905 (Dec 31, 2024). Excludes the following # of shares of unvested restricted stock: 1,623,077 (Dec 31, 2025), 513,234 (Sep 30, 2025), 542,922 (Jun 30, 2025), 560,382 (Mar 31, 2025) and 416,123 (Dec 31, 2024). Excludes unvested LTIP units and unvested performance units.

Fourth Quarter 2025 Supplemental Financial Reporting Package | Page 6 |  | ||||||

Guidance. | ||||||||

| As of December 31, 2025 | ||||||||

2026 OUTLOOK*

| 2026 GUIDANCE | |||||||||||||||||

Low | High | ||||||||||||||||

| Earnings | |||||||||||||||||

Net Income Attributable to Common Stockholders per diluted share(1)(2) | $1.15 | $1.20 | |||||||||||||||

Company share of Core FFO per diluted share(1)(2) | $2.35 | $2.40 | |||||||||||||||

Same Property Portfolio(3) | |||||||||||||||||

Same Property Portfolio NOI Growth - Net Effective | (2.5)% | (1.5)% | |||||||||||||||

Same Property Portfolio NOI Growth - Cash | (2.0)% | (1.0)% | |||||||||||||||

Average Same Property Portfolio Occupancy (Full Year) | 94.8% | 95.3% | |||||||||||||||

| Capital Allocation | |||||||||||||||||

Dispositions | $400M | $500M | |||||||||||||||

Repositioning/Development Annualized Stabilized Cash NOI(4) | $19M | $21M | |||||||||||||||

Repositioning/Development Starts (SF) | 1.1M | 1.1M | |||||||||||||||

Repositioning/Development Starts (Total Estimated Project Costs) | $140M | $150M | |||||||||||||||

| Other Assumptions | |||||||||||||||||

General and Administrative Expenses | +/-$60M | ||||||||||||||||

Interest Expense | +/- $112M | ||||||||||||||||

(1)2026 Net Income and Core FFO Guidance refers to the Company's in-place portfolio as of February 4, 2026, as well as guidance expectations related to investment activity.

(2)See page 37 for a reconciliation of the Company’s 2026 guidance range of net income attributable to common stockholders per diluted share, the most directly comparable forward-looking GAAP financial measure, to Company share of Core FFO per diluted share.

(3)2026 Same Property Portfolio is a subset of our consolidated portfolio and includes properties that were wholly owned by us for the period from January 1, 2025 through February 4, 2026 and excludes properties that were or will be classified as repositioning/development (current and future) or lease-up during 2025 and 2026 (unless otherwise noted). As of January 1, 2026, our 2026 Same Property Portfolio consisted of 342 properties aggregating 42.0 million rentable square feet. For the full year 2025, Average Same Property Portfolio occupancy was 95.6% for the 2026 Same Property Portfolio.

(4)Represents estimated annualized Cash NOI for repositioning/development projects expected to stabilize in 2026.

* A number of factors could impact the Company’s ability to deliver results in line with its guidance, including, but not limited to, interest rates, inflation, the economy, the supply and demand of industrial real estate, the availability and terms of financing to the Company or to potential acquirers of real estate and the timing and yields for divestment and investment. There can be no assurance that the Company can achieve such results.

Fourth Quarter 2025 Supplemental Financial Reporting Package | Page 7 |  | ||||||

Guidance (Continued). | ||||||||

| As of December 31, 2025 | ||||||||

2026 Guidance Rollforward(1)

| Earnings Components | Range ($ per share) | Notes | ||||||||||||||||||

Low | High | |||||||||||||||||||

2025 Core FFO Per Diluted Share | $2.40 | $2.40 | 2025 Actual | |||||||||||||||||

Same Property Portfolio NOI Growth - Net Effective | (0.06) | (0.04) | Guidance range of (2.5%) to (1.5%) | |||||||||||||||||

Repositioning/Development NOI, Net | 0.06 | 0.07 | Incremental NOI from repositionings & developments compared to prior year, net of NOI coming offline due to construction starts | |||||||||||||||||

Dispositions, Net | (0.04) | (0.02) | 2025 actual dispositions and 2026 projected dispositions, net of capital recycling which could include share repurchases and/or future repositioning & development investment | |||||||||||||||||

General and Administrative Expenses | 0.08 | 0.08 | Savings associated with CEO leadership transition | |||||||||||||||||

Interest Expense | (0.03) | (0.03) | Lower capitalized interest related to repositioning and development stabilizations, offset by lower interest expense | |||||||||||||||||

| Other Items | (0.06) | (0.06) | Lower interest income related to lower cash balances and lower non-same property termination revenue | |||||||||||||||||

2026 Core FFO Per Diluted Share Guidance | $2.35 | $2.40 | ||||||||||||||||||

Core FFO per Diluted Share Annual Growth | (2.1)% | —% | ||||||||||||||||||

(1)2026 Core FFO Guidance refers to the in-place portfolio as of February 4, 2026, as well as guidance expectations related to investment activity.

Fourth Quarter 2025 Supplemental Financial Reporting Package | Page 8 |  | ||||||

Consolidated Balance Sheets. | ||||||||

| (unaudited and in thousands) | ||||||||

| December 31, 2025 | September 30, 2025 | June 30, 2025 | March 31, 2025 | December 31, 2024 | |||||||||||||||||||||||||

| ASSETS | |||||||||||||||||||||||||||||

| Land | $ | 7,689,921 | $ | 7,774,737 | $ | 7,787,021 | $ | 7,797,744 | $ | 7,822,290 | |||||||||||||||||||

| Buildings and improvements | 4,677,318 | 4,607,202 | 4,594,494 | 4,573,881 | 4,611,987 | ||||||||||||||||||||||||

| Tenant improvements | 198,161 | 194,405 | 186,429 | 181,632 | 188,217 | ||||||||||||||||||||||||

| Furniture, fixtures, and equipment | 132 | 132 | 132 | 132 | 132 | ||||||||||||||||||||||||

| Construction in progress | 451,109 | 475,072 | 431,807 | 386,719 | 333,690 | ||||||||||||||||||||||||

| Total real estate held for investment | 13,016,641 | 13,051,548 | 12,999,883 | 12,940,108 | 12,956,316 | ||||||||||||||||||||||||

| Accumulated depreciation | (1,165,792) | (1,119,746) | (1,070,684) | (1,021,151) | (977,133) | ||||||||||||||||||||||||

| Investments in real estate, net | 11,850,849 | 11,931,802 | 11,929,199 | 11,918,957 | 11,979,183 | ||||||||||||||||||||||||

| Cash and cash equivalents | 165,778 | 248,956 | 431,117 | 504,579 | 55,971 | ||||||||||||||||||||||||

| Restricted cash | — | 65,464 | 130,071 | 50,105 | — | ||||||||||||||||||||||||

| Loan receivable, net | 123,704 | 123,589 | 123,474 | 123,359 | 123,244 | ||||||||||||||||||||||||

| Rents and other receivables, net | 13,958 | 15,727 | 12,861 | 17,622 | 15,772 | ||||||||||||||||||||||||

| Deferred rent receivable, net | 190,376 | 181,439 | 173,691 | 166,893 | 161,693 | ||||||||||||||||||||||||

| Deferred leasing costs, net | 87,745 | 82,227 | 71,482 | 70,404 | 67,827 | ||||||||||||||||||||||||

| Deferred loan costs, net | 6,886 | 7,391 | 7,892 | 1,642 | 1,999 | ||||||||||||||||||||||||

Acquired lease intangible assets, net(1) | 140,627 | 154,931 | 169,036 | 182,444 | 201,467 | ||||||||||||||||||||||||

Acquired indefinite-lived intangible asset | 5,156 | 5,156 | 5,156 | 5,156 | 5,156 | ||||||||||||||||||||||||

Interest rate swap assets | 2,025 | 2,804 | 3,586 | 5,580 | 8,942 | ||||||||||||||||||||||||

| Other assets | 25,609 | 31,522 | 15,765 | 20,730 | 26,964 | ||||||||||||||||||||||||

| Assets associated with real estate held for sale, net | — | — | 6,282 | 18,386 | — | ||||||||||||||||||||||||

| Total Assets | $ | 12,612,713 | $ | 12,851,008 | $ | 13,079,612 | $ | 13,085,857 | $ | 12,648,218 | |||||||||||||||||||

| LIABILITIES & EQUITY | |||||||||||||||||||||||||||||

| Liabilities | |||||||||||||||||||||||||||||

| Notes payable | $ | 3,251,909 | $ | 3,249,733 | $ | 3,347,575 | $ | 3,348,060 | $ | 3,345,962 | |||||||||||||||||||

| Interest rate swap liability | 829 | 1,626 | 667 | — | — | ||||||||||||||||||||||||

| Accounts payable, accrued expenses and other liabilities | 120,849 | 153,558 | 124,814 | 141,999 | 149,707 | ||||||||||||||||||||||||

| Dividends and distributions payable | 103,399 | 103,913 | 105,594 | 105,285 | 97,823 | ||||||||||||||||||||||||

Acquired lease intangible liabilities, net(2) | 116,487 | 122,870 | 129,683 | 136,661 | 147,473 | ||||||||||||||||||||||||

| Tenant security deposits | 92,444 | 91,835 | 90,757 | 90,050 | 90,698 | ||||||||||||||||||||||||

Tenant prepaid rents | 88,777 | 85,114 | 85,494 | 88,822 | 90,576 | ||||||||||||||||||||||||

| Liabilities associated with real estate held for sale | — | — | 4 | 234 | — | ||||||||||||||||||||||||

| Total Liabilities | 3,774,694 | 3,808,649 | 3,884,588 | 3,911,111 | 3,922,239 | ||||||||||||||||||||||||

| Equity | |||||||||||||||||||||||||||||

| Series B preferred stock, net ($75,000 liquidation preference) | 72,443 | 72,443 | 72,443 | 72,443 | 72,443 | ||||||||||||||||||||||||

| Series C preferred stock, net ($86,250 liquidation preference) | 83,233 | 83,233 | 83,233 | 83,233 | 83,233 | ||||||||||||||||||||||||

| Preferred stock | 155,676 | 155,676 | 155,676 | 155,676 | 155,676 | ||||||||||||||||||||||||

| Common stock | 2,316 | 2,328 | 2,367 | 2,362 | 2,253 | ||||||||||||||||||||||||

| Additional paid in capital | 8,945,123 | 8,993,439 | 9,140,264 | 9,116,069 | 8,601,276 | ||||||||||||||||||||||||

| Cumulative distributions in excess of earnings | (642,130) | (474,813) | (462,309) | (474,550) | (441,881) | ||||||||||||||||||||||||

| Accumulated other comprehensive income (loss) | (422) | (515) | 1,092 | 3,582 | 6,746 | ||||||||||||||||||||||||

| Total stockholders’ equity | 8,460,563 | 8,676,115 | 8,837,090 | 8,803,139 | 8,324,070 | ||||||||||||||||||||||||

| Noncontrolling interests | 377,456 | 366,244 | 357,934 | 371,607 | 401,909 | ||||||||||||||||||||||||

| Total Equity | 8,838,019 | 9,042,359 | 9,195,024 | 9,174,746 | 8,725,979 | ||||||||||||||||||||||||

| Total Liabilities and Equity | $ | 12,612,713 | $ | 12,851,008 | $ | 13,079,612 | $ | 13,085,857 | $ | 12,648,218 | |||||||||||||||||||

(1)Includes net above-market tenant lease intangibles of $19,460 (Dec 31, 2025), $22,574 (Sep 30, 2025), $24,994 (Jun 30, 2025), $27,043 (Mar 31, 2025) and $29,530 (Dec 31, 2024), and a net below-market ground lease intangible of $12,354 (Dec 31, 2025), $12,395 (Sep 30, 2025), $12,436 (Jun 30, 2025), $12,477 (Mar 31, 2025) and $12,518 (Dec 31, 2024).

(2)Represents net below-market tenant lease intangibles as of the balance sheet date.

Fourth Quarter 2025 Supplemental Financial Reporting Package | Page 9 |  | ||||||

Consolidated Statements of Operations. | ||||||||

| Quarterly Results | (unaudited and in thousands, except share and per share data) | |||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| Dec 31, 2025 | Sep 30, 2025 | Jun 30, 2025 | Mar 31, 2025 | Dec 31, 2024 | |||||||||||||||||||||||||

| Revenues | |||||||||||||||||||||||||||||

Rental income(1) | $ | 243,230 | $ | 246,757 | $ | 241,568 | $ | 248,821 | $ | 239,737 | |||||||||||||||||||

| Management and leasing services | 197 | 118 | 132 | 142 | 167 | ||||||||||||||||||||||||

| Interest income | 4,670 | 6,367 | 7,807 | 3,324 | 2,991 | ||||||||||||||||||||||||

| Total Revenues | 248,097 | 253,242 | 249,507 | 252,287 | 242,895 | ||||||||||||||||||||||||

| Operating Expenses | |||||||||||||||||||||||||||||

| Property expenses | 59,287 | 57,879 | 55,298 | 55,261 | 56,006 | ||||||||||||||||||||||||

| General and administrative | 19,199 | 20,037 | 19,752 | 19,868 | 21,940 | ||||||||||||||||||||||||

| Depreciation and amortization | 76,819 | 81,172 | 71,188 | 86,740 | 71,832 | ||||||||||||||||||||||||

| Total Operating Expenses | 155,305 | 159,088 | 146,238 | 161,869 | 149,778 | ||||||||||||||||||||||||

| Other Expenses | |||||||||||||||||||||||||||||

| Other expenses | 65,910 | 4,218 | 244 | 2,239 | 34 | ||||||||||||||||||||||||

| Interest expense | 25,451 | 25,463 | 26,701 | 27,288 | 28,173 | ||||||||||||||||||||||||

| Total Other Expenses | 91,361 | 29,681 | 26,945 | 29,527 | 28,207 | ||||||||||||||||||||||||

| Total Expenses | 246,666 | 188,769 | 173,183 | 191,396 | 177,985 | ||||||||||||||||||||||||

| Impairment of real estate | (89,097) | — | — | — | — | ||||||||||||||||||||||||

| Debt extinguishment and modification expenses | — | — | (291) | — | — | ||||||||||||||||||||||||

| Gains on sale of real estate | 19,931 | 28,583 | 44,361 | 13,157 | — | ||||||||||||||||||||||||

Net (Loss) Income | (67,735) | 93,056 | 120,394 | 74,048 | 64,910 | ||||||||||||||||||||||||

Less: net loss (income) attributable to noncontrolling interests | 2,312 | (3,137) | (4,060) | (2,849) | (2,725) | ||||||||||||||||||||||||

Net (loss) income attributable to Rexford Industrial Realty, Inc. | (65,423) | 89,919 | 116,334 | 71,199 | 62,185 | ||||||||||||||||||||||||

| Less: preferred stock dividends | (2,315) | (2,314) | (2,315) | (2,314) | (2,315) | ||||||||||||||||||||||||

| Less: earnings allocated to participating securities | (952) | (519) | (592) | (539) | (457) | ||||||||||||||||||||||||

Net (loss) income attributable to common stockholders | $ | (68,690) | $ | 87,086 | $ | 113,427 | $ | 68,346 | $ | 59,413 | |||||||||||||||||||

| Earnings per Common Share | |||||||||||||||||||||||||||||

Net (loss) income attributable to common stockholders per share - basic | $ | (0.30) | $ | 0.37 | $ | 0.48 | $ | 0.30 | $ | 0.27 | |||||||||||||||||||

Net (loss) income attributable to common stockholders per share - diluted | $ | (0.30) | $ | 0.37 | $ | 0.48 | $ | 0.30 | $ | 0.27 | |||||||||||||||||||

| Weighted average shares outstanding - basic | 231,758,110 | 234,586,980 | 236,098,831 | 227,395,984 | 222,516,006 | ||||||||||||||||||||||||

| Weighted average shares outstanding - diluted | 232,050,966 | 234,586,980 | 236,098,831 | 227,395,984 | 222,856,120 | ||||||||||||||||||||||||

(1)We elected the “non-separation practical expedient” in ASC 842, which allows us to avoid separating lease and non-lease rental income. As a result of this election, all rental income earned pursuant to tenant leases, including tenant reimbursements, is reflected as one line, “Rental income,” in the consolidated statements of operations. Under the section “Rental Income” on page 36 in the definitions section of this report, we include a presentation of rental revenues, tenant reimbursements and other income for all periods because we believe this information is frequently used by management, investors, securities analysts and other interested parties to evaluate our performance.

Fourth Quarter 2025 Supplemental Financial Reporting Package | Page 10 |  | ||||||

Consolidated Statements of Operations. | ||||||||

| Quarterly Results (continued) | (unaudited and in thousands, except share and per share data) | |||||||

| Three Months Ended December 31, | Year Ended December 31, | ||||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||||||||||||||

| Revenues | |||||||||||||||||||||||

| Rental income | $ | 243,230 | $ | 239,737 | $ | 980,376 | $ | 922,096 | |||||||||||||||

| Management and leasing services | 197 | 167 | 589 | 611 | |||||||||||||||||||

| Interest income | 4,670 | 2,991 | 22,168 | 13,700 | |||||||||||||||||||

| Total Revenues | 248,097 | 242,895 | 1,003,133 | 936,407 | |||||||||||||||||||

| Operating Expenses | |||||||||||||||||||||||

| Property expenses | 59,287 | 56,006 | 227,725 | 210,260 | |||||||||||||||||||

| General and administrative | 19,199 | 21,940 | 78,856 | 82,153 | |||||||||||||||||||

| Depreciation and amortization | 76,819 | 71,832 | 315,919 | 275,247 | |||||||||||||||||||

| Total Operating Expenses | 155,305 | 149,778 | 622,500 | 567,660 | |||||||||||||||||||

| Other Expenses | |||||||||||||||||||||||

| Other expenses | 65,910 | 34 | 72,611 | 2,238 | |||||||||||||||||||

| Interest expense | 25,451 | 28,173 | 104,903 | 98,596 | |||||||||||||||||||

| Total Expenses | 246,666 | 177,985 | 800,014 | 668,494 | |||||||||||||||||||

Impairment of real estate | (89,097) | — | (89,097) | — | |||||||||||||||||||

Debt extinguishment and modification expenses | — | — | (291) | — | |||||||||||||||||||

| Gains on sale of real estate | 19,931 | — | 106,032 | 18,013 | |||||||||||||||||||

Net (Loss) Income | (67,735) | 64,910 | 219,763 | 285,926 | |||||||||||||||||||

Less: net loss (income) attributable to noncontrolling interests | 2,312 | (2,725) | (7,734) | (12,124) | |||||||||||||||||||

Net (loss) income attributable to Rexford Industrial Realty, Inc. | (65,423) | 62,185 | 212,029 | 273,802 | |||||||||||||||||||

| Less: preferred stock dividends | (2,315) | (2,315) | (9,258) | (9,258) | |||||||||||||||||||

| Less: earnings allocated to participating securities | (952) | (457) | (2,602) | (1,679) | |||||||||||||||||||

Net (loss) income attributable to common stockholders | $ | (68,690) | $ | 59,413 | $ | 200,169 | $ | 262,865 | |||||||||||||||

Net (loss) income attributable to common stockholders per share – basic | $ | (0.30) | $ | 0.27 | $ | 0.86 | $ | 1.20 | |||||||||||||||

Net (loss) income attributable to common stockholders per share – diluted | $ | (0.30) | $ | 0.27 | $ | 0.86 | $ | 1.20 | |||||||||||||||

| Weighted-average shares of common stock outstanding – basic | 231,758,110 | 222,516,006 | 232,477,754 | 218,279,597 | |||||||||||||||||||

| Weighted-average shares of common stock outstanding – diluted | 232,050,966 | 222,856,120 | 232,550,968 | 218,466,954 | |||||||||||||||||||

Fourth Quarter 2025 Supplemental Financial Reporting Package | Page 11 |  | ||||||

Non-GAAP FFO and Core FFO Reconciliations.(1) | ||||||||

| (unaudited and in thousands, except share and per share data) | ||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| December 31, 2025 | September 30, 2025 | June 30, 2025 | March 31, 2025 | December 31, 2024 | |||||||||||||||||||||||||

Net (Loss) Income | $ | (67,735) | $ | 93,056 | $ | 120,394 | $ | 74,048 | $ | 64,910 | |||||||||||||||||||

| Adjustments: | |||||||||||||||||||||||||||||

| Depreciation and amortization | 76,819 | 81,172 | 71,188 | 86,740 | 71,832 | ||||||||||||||||||||||||

Impairment of real estate(2) | 89,097 | — | — | — | — | ||||||||||||||||||||||||

| Gains on sale of real estate | (19,931) | (28,583) | (44,361) | (13,157) | — | ||||||||||||||||||||||||

NAREIT Defined Funds From Operations (FFO) | 78,250 | 145,645 | 147,221 | 147,631 | 136,742 | ||||||||||||||||||||||||

| Less: preferred stock dividends | (2,315) | (2,314) | (2,315) | (2,314) | (2,315) | ||||||||||||||||||||||||

Less: FFO attributable to noncontrolling interests(3) | (2,688) | (4,906) | (4,962) | (5,394) | (5,283) | ||||||||||||||||||||||||

Less: FFO attributable to participating securities(4) | (953) | (713) | (728) | (750) | (624) | ||||||||||||||||||||||||

| Company share of FFO | $ | 72,294 | $ | 137,712 | $ | 139,216 | $ | 139,173 | $ | 128,520 | |||||||||||||||||||

| Company share of FFO per common share‐basic | $ | 0.31 | $ | 0.59 | $ | 0.59 | $ | 0.61 | $ | 0.58 | |||||||||||||||||||

| Company share of FFO per common share‐diluted | $ | 0.31 | $ | 0.59 | $ | 0.59 | $ | 0.61 | $ | 0.58 | |||||||||||||||||||

| FFO | $ | 78,250 | $ | 145,645 | $ | 147,221 | $ | 147,631 | $ | 136,742 | |||||||||||||||||||

| Adjustments: | |||||||||||||||||||||||||||||

Acquisition expenses(5) | 10 | 161 | 23 | 79 | 9 | ||||||||||||||||||||||||

| Debt extinguishment and modification expenses | — | — | 291 | — | — | ||||||||||||||||||||||||

| Amortization of loss on termination of interest rate swaps | — | — | — | — | 34 | ||||||||||||||||||||||||

Non-capitalizable demolition costs(5) | — | — | — | 365 | — | ||||||||||||||||||||||||

Co-CEO transition costs(5)(6) | 60,223 | — | — | — | — | ||||||||||||||||||||||||

Severance costs(5)(7) | — | 2,728 | 199 | 1,483 | — | ||||||||||||||||||||||||

Other nonrecurring expenses(5)(8) | 5,605 | 1,259 | — | — | — | ||||||||||||||||||||||||

| Core FFO | 144,088 | 149,793 | 147,734 | 149,558 | 136,785 | ||||||||||||||||||||||||

| Less: preferred stock dividends | (2,315) | (2,314) | (2,315) | (2,314) | (2,315) | ||||||||||||||||||||||||

Less: Core FFO attributable to noncontrolling interests(3) | (4,943) | (5,045) | (4,979) | (5,461) | (5,284) | ||||||||||||||||||||||||

Less: Core FFO attributable to participating securities(4)(9) | (648) | (734) | (731) | (760) | (624) | ||||||||||||||||||||||||

| Company share of Core FFO | $ | 136,182 | $ | 141,700 | $ | 139,709 | $ | 141,023 | $ | 128,562 | |||||||||||||||||||

| Company share of Core FFO per common share‐basic | $ | 0.59 | $ | 0.60 | $ | 0.59 | $ | 0.62 | $ | 0.58 | |||||||||||||||||||

| Company share of Core FFO per common share‐diluted | $ | 0.59 | $ | 0.60 | $ | 0.59 | $ | 0.62 | $ | 0.58 | |||||||||||||||||||

| Weighted-average shares outstanding-basic | 231,758,110 | 234,586,980 | 236,098,831 | 227,395,984 | 222,516,006 | ||||||||||||||||||||||||

Weighted-average shares outstanding-diluted | 232,050,966 | 234,586,980 | 236,098,831 | 227,395,984 | 222,856,120 | ||||||||||||||||||||||||

(1)For a definition and discussion of non-GAAP financial measures, see the definitions section beginning on page 33 of this report.

(2)Impairment charges relate to properties originally planned for development and reflect the write-down to estimated fair value due to a plan to pursue their sale rather than continue with development.

(3)Noncontrolling interests relate to interests in the Company’s operating partnership, represented by common units and preferred units (Series 2 & 3 CPOP units) of partnership interests in the operating partnership that are owned by unit holders other than the Company. On March 6, 2025, we exercised our conversion right to convert all remaining Series 2 CPOP units into OP Units.

(4)Participating securities include unvested shares of restricted stock, unvested LTIP units and unvested performance units.

(5)Amounts are included in the line item “Other expenses” in the consolidated statements of operations.

(6)Reflects accelerated share‑based compensation expense in connection with the Co-CEO transition, including transition-related restricted stock awards and pre-existing awards.

(7)Includes costs associated with workforce reduction and workforce reorganization.

(8)Reflects nonrecurring advisory service costs.

(9)For the three months ended December 31, 2025, Core FFO attributable to participating securities was adjusted to exclude $569 of otherwise allocable Core FFO related solely to the transition‑related restricted stock awards noted above, consistent with the exclusion of the related accelerated share‑based compensation from Core FFO.

Fourth Quarter 2025 Supplemental Financial Reporting Package | Page 12 |  | ||||||

Non-GAAP FFO and Core FFO Reconciliations.(1) | ||||||||

| (unaudited and in thousands, except share and per share data) | ||||||||

| Three Months Ended December 31, | Year Ended December 31, | |||||||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||||||||||||

Net (Loss) Income | $ | (67,735) | $ | 64,910 | $ | 219,763 | $ | 285,926 | ||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||

| Depreciation and amortization | 76,819 | 71,832 | 315,919 | 275,247 | ||||||||||||||||||||||

Impairment of real estate(2) | 89,097 | — | 89,097 | — | ||||||||||||||||||||||

| Gains on sale of real estate | (19,931) | — | (106,032) | (18,013) | ||||||||||||||||||||||

| Funds From Operations (FFO) | 78,250 | 136,742 | 518,747 | 543,160 | ||||||||||||||||||||||

| Less: preferred stock dividends | (2,315) | (2,315) | (9,258) | (9,258) | ||||||||||||||||||||||

| Less: FFO attributable to noncontrolling interests | (2,688) | (5,283) | (17,950) | (21,270) | ||||||||||||||||||||||

| Less: FFO attributable to participating securities | (953) | (624) | (3,144) | (2,342) | ||||||||||||||||||||||

| Company share of FFO | $ | 72,294 | $ | 128,520 | $ | 488,395 | $ | 510,290 | ||||||||||||||||||

| Company share of FFO per common share‐basic | $ | 0.31 | $ | 0.58 | $ | 2.10 | $ | 2.34 | ||||||||||||||||||

| Company share of FFO per common share‐diluted | $ | 0.31 | $ | 0.58 | $ | 2.10 | $ | 2.34 | ||||||||||||||||||

| FFO | $ | 78,250 | $ | 136,742 | $ | 518,747 | $ | 543,160 | ||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||

Acquisition expenses(3) | 10 | 9 | 273 | 123 | ||||||||||||||||||||||

| Debt extinguishment and modification expenses | — | — | 291 | — | ||||||||||||||||||||||

| Amortization of loss on termination of interest rate swaps | — | 34 | — | 211 | ||||||||||||||||||||||

Non-capitalizable demolition costs(3) | — | — | 365 | 1,127 | ||||||||||||||||||||||

Co-CEO transition costs(3)(4) | 60,223 | — | 60,223 | — | ||||||||||||||||||||||

Severance costs(3)(5) | — | — | 4,410 | — | ||||||||||||||||||||||

Other nonrecurring expenses(3)(6) | 5,605 | — | 6,864 | — | ||||||||||||||||||||||

| Core FFO | 144,088 | 136,785 | 591,173 | 544,621 | ||||||||||||||||||||||

| Less: preferred stock dividends | (2,315) | (2,315) | (9,258) | (9,258) | ||||||||||||||||||||||

| Less: Core FFO attributable to noncontrolling interests | (4,943) | (5,284) | (20,428) | (21,319) | ||||||||||||||||||||||

Less: Core FFO attributable to participating securities(7) | (648) | (624) | (2,873) | (2,349) | ||||||||||||||||||||||

| Company share of Core FFO | $ | 136,182 | $ | 128,562 | $ | 558,614 | $ | 511,695 | ||||||||||||||||||

| Company share of Core FFO per common share‐basic | $ | 0.59 | $ | 0.58 | $ | 2.40 | $ | 2.34 | ||||||||||||||||||

| Company share of Core FFO per common share‐diluted | $ | 0.59 | $ | 0.58 | $ | 2.40 | $ | 2.34 | ||||||||||||||||||

| Weighted-average shares outstanding-basic | 231,758,110 | 222,516,006 | 232,477,754 | 218,279,597 | ||||||||||||||||||||||

| Weighted-average shares outstanding-diluted | 232,050,966 | 222,856,120 | 232,550,968 | 218,466,954 | ||||||||||||||||||||||

(1)For a definition and discussion of non-GAAP financial measures, see the definitions section beginning on page 33 of this report.

(2)Impairment charges relate to properties originally planned for development and reflect the write-down to estimated fair value due to a plan to pursue their sale rather than continue with development.

(3)Amounts are included in the line item “Other expenses” in the consolidated statements of operations.

(4)Reflects accelerated share‑based compensation expense in connection with the Co-CEO transition, including transition-related restricted stock awards and pre-existing awards.

(5)Includes costs associated with workforce reduction and workforce reorganization.

(6)Reflects nonrecurring advisory service costs.

(7)For the three months and year ended December 31, 2025, Core FFO attributable to participating securities was adjusted to exclude $569 of otherwise allocable Core FFO related solely to the transition‑related restricted stock awards noted above, consistent with the exclusion of the related accelerated share‑based compensation from Core FFO.

Fourth Quarter 2025 Supplemental Financial Reporting Package | Page 13 |  | ||||||

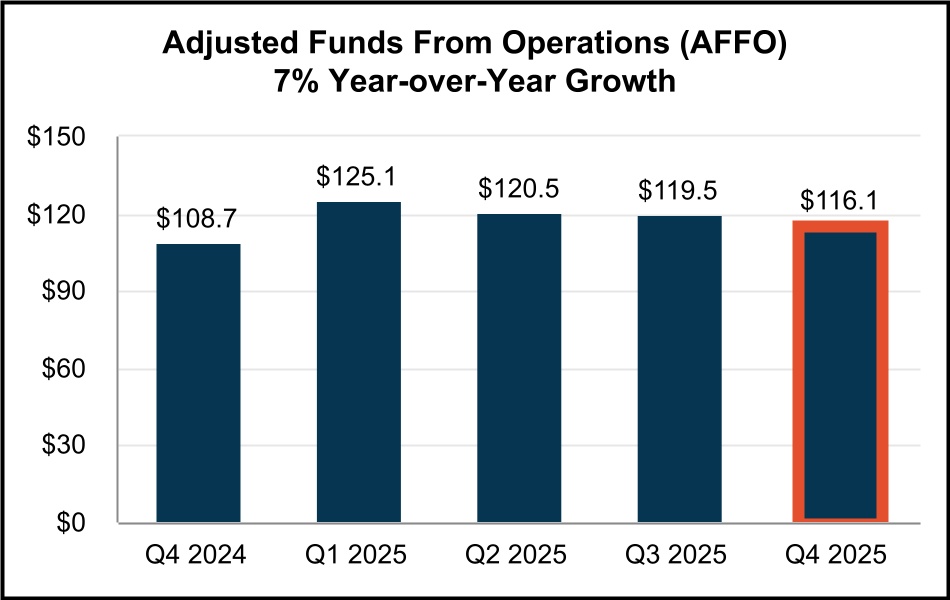

Non-GAAP AFFO Reconciliation.(1) | ||||||||

| (unaudited and in thousands, except share and per share data) | ||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| December 31, 2025 | September 30, 2025 | June 30, 2025 | March 31, 2025 | December 31, 2024 | |||||||||||||||||||||||||

Funds From Operations(2) | $ | 78,250 | $ | 145,645 | $ | 147,221 | $ | 147,631 | $ | 136,742 | |||||||||||||||||||

| Adjustments: | |||||||||||||||||||||||||||||

| Amortization of deferred financing costs | 1,333 | 1,340 | 1,255 | 1,134 | 1,246 | ||||||||||||||||||||||||

| Non-cash stock compensation | 8,537 | 10,485 | 10,091 | 9,699 | 11,539 | ||||||||||||||||||||||||

| Debt extinguishment and modification expenses | — | — | 291 | — | — | ||||||||||||||||||||||||

| Amortization related to termination/settlement of interest rate derivatives | 78 | 78 | 76 | 77 | 112 | ||||||||||||||||||||||||

| Note payable (discount) premium amortization, net | 1,616 | 1,597 | 1,579 | 1,560 | 1,534 | ||||||||||||||||||||||||

| Non-capitalizable demolition costs | — | — | — | 365 | — | ||||||||||||||||||||||||

Co-CEO transition costs | 60,223 | — | — | — | — | ||||||||||||||||||||||||

| Severance costs | — | 2,728 | 199 | 1,483 | — | ||||||||||||||||||||||||

Other nonrecurring expenses | 5,605 | 1,259 | — | — | — | ||||||||||||||||||||||||

| Deduct: | |||||||||||||||||||||||||||||

| Preferred stock dividends | (2,315) | (2,314) | (2,315) | (2,314) | (2,315) | ||||||||||||||||||||||||

Straight line rental revenue adjustment(3) | (9,073) | (8,164) | (6,918) | (5,517) | (10,057) | ||||||||||||||||||||||||

| Above/(below) market lease revenue adjustments | (4,129) | (5,254) | (5,788) | (9,186) | (6,159) | ||||||||||||||||||||||||

Capitalized payments(4) | (14,814) | (15,756) | (14,368) | (13,321) | (12,102) | ||||||||||||||||||||||||

| Accretion of net loan origination fees | (115) | (115) | (115) | (115) | (115) | ||||||||||||||||||||||||

Recurring capital expenditures(5) | (2,566) | (3,563) | (5,887) | (1,311) | (7,882) | ||||||||||||||||||||||||

2nd generation tenant improvements(6) | (179) | (460) | (663) | (162) | (296) | ||||||||||||||||||||||||

2nd generation leasing commissions(7) | (6,324) | (8,007) | (4,162) | (4,879) | (3,520) | ||||||||||||||||||||||||

| Adjusted Funds From Operations (AFFO) | $ | 116,127 | $ | 119,499 | $ | 120,496 | $ | 125,144 | $ | 108,727 | |||||||||||||||||||

(1)For a definition and discussion of non-GAAP financial measures, see the definitions section beginning on page 33 of this report.

(2)A quarterly reconciliation of net income to Funds From Operations is set forth on page 12 of this report.

(3)The straight line rental revenue adjustment includes concessions of $11,244, $7,433, $5,844, $7,035 and $8,504 for the three months ended December 31, 2025, September 30, 2025, June 30, 2025, March 31, 2025 and December 31, 2024, respectively.

(4)Includes capitalized interest, taxes, insurance and construction-related compensation costs.

(5)Excludes nonrecurring capital expenditures of $57,730, $62,309, $65,376, $43,361 and $67,594 for the three months ended December 31, 2025, September 30, 2025, June 30, 2025, March 31, 2025 and December 31, 2024, respectively.

(6)Excludes 1st generation tenant improvements of $67, $328, $292, $798 and $189 for the three months ended December 31, 2025, September 30, 2025, June 30, 2025, March 31, 2025 and December 31, 2024, respectively.

(7)Excludes 1st generation leasing commissions of $5,057, $7,984, $1,879, $3,058 and $290 for the three months ended December 31, 2025, September 30, 2025, June 30, 2025, March 31, 2025 and December 31, 2024, respectively.

Fourth Quarter 2025 Supplemental Financial Reporting Package | Page 14 |  | ||||||

Statement of Operations Reconciliations - NOI, Cash NOI, EBITDAre and Adjusted EBITDAre.(1) | ||||||||

| (unaudited and in thousands) | ||||||||

| NOI and Cash NOI | |||||||||||||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| Dec 31, 2025 | Sep 30, 2025 | Jun 30, 2025 | Mar 31, 2025 | Dec 31, 2024 | |||||||||||||||||||||||||

Rental income(2)(3)(4) | $ | 243,230 | $ | 246,757 | $ | 241,568 | $ | 248,821 | $ | 239,737 | |||||||||||||||||||

| Less: Property expenses | 59,287 | 57,879 | 55,298 | 55,261 | 56,006 | ||||||||||||||||||||||||

| Net Operating Income (NOI) | $ | 183,943 | $ | 188,878 | $ | 186,270 | $ | 193,560 | $ | 183,731 | |||||||||||||||||||

Above/(below) market lease revenue adjustments | (4,129) | (5,254) | (5,788) | (9,186) | (6,159) | ||||||||||||||||||||||||

| Straight line rental revenue adjustment | (9,073) | (8,164) | (6,918) | (5,517) | (10,057) | ||||||||||||||||||||||||

| Cash NOI | $ | 170,741 | $ | 175,460 | $ | 173,564 | $ | 178,857 | $ | 167,515 | |||||||||||||||||||

EBITDAre and Adjusted EBITDAre | |||||||||||||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| Dec 31, 2025 | Sep 30, 2025 | Jun 30, 2025 | Mar 31, 2025 | Dec 31, 2024 | |||||||||||||||||||||||||

Net (loss) income | $ | (67,735) | $ | 93,056 | $ | 120,394 | $ | 74,048 | $ | 64,910 | |||||||||||||||||||

| Interest expense | 25,451 | 25,463 | 26,701 | 27,288 | 28,173 | ||||||||||||||||||||||||

| Depreciation and amortization | 76,819 | 81,172 | 71,188 | 86,740 | 71,832 | ||||||||||||||||||||||||

Impairment of real estate | 89,097 | — | — | — | — | ||||||||||||||||||||||||

| Gains on sale of real estate | (19,931) | (28,583) | (44,361) | (13,157) | — | ||||||||||||||||||||||||

EBITDAre | $ | 103,701 | $ | 171,108 | $ | 173,922 | $ | 174,919 | $ | 164,915 | |||||||||||||||||||

| Stock-based compensation amortization | 8,537 | 10,485 | 10,091 | 9,699 | 11,539 | ||||||||||||||||||||||||

| Debt extinguishment and modification expenses | — | — | 291 | — | — | ||||||||||||||||||||||||

| Acquisition expenses | 10 | 161 | 23 | 79 | 9 | ||||||||||||||||||||||||

Co-CEO transition costs | 60,223 | — | — | — | — | ||||||||||||||||||||||||

Other nonrecurring expenses | 5,605 | 1,259 | — | — | — | ||||||||||||||||||||||||

Pro forma effect of acquisitions(5) | — | — | — | — | 2,884 | ||||||||||||||||||||||||

Pro forma effect of dispositions(6) | (268) | (389) | (216) | 162 | — | ||||||||||||||||||||||||

Adjusted EBITDAre | $ | 177,808 | $ | 182,624 | $ | 184,111 | $ | 184,859 | $ | 179,347 | |||||||||||||||||||

(1)For a definition and discussion of non-GAAP financial measures, see the definitions section beginning on page 33 of this report.

(2)See footnote (1) on page 10 for details related to our presentation of “Rental income” in the consolidated statements of operations for all periods presented.

(3)Reflects increase (decrease) to rental income due to changes in the Company’s assessment of lease payment collectability as follows (in thousands): $(2,615), $13, $(141), $(2,303) and $(200) for the three months ended December 31, 2025, September 30, 2025, June 30, 2025, March 31, 2025 and December 31, 2024, respectively.

(4)Rental income includes net lease termination income (in thousands) of $0, $458, $0, $8,935 and $614 for the three months ended December 31, 2025, September 30, 2025, June 30, 2025, March 31, 2025 and December 31, 2024, respectively. Amounts include lease termination fees and write-offs of straight-line rent and above/(below) market lease intangibles associated with lease terminations.

(5)Represents the estimated impact on 4Q'24 EBITDAre of 4Q'24 acquisitions as if they had been acquired on October 1, 2024. We have made a number of assumptions in such estimates and there can be no assurance that we would have generated the projected levels of EBITDAre had we acquired these as of the beginning of each period.

(6)Represents the estimated impact on 4Q'25 EBITDAre of 4Q'25 dispositions as if they had been sold as of October 1, 2025, the impact on 3Q'25 EBITDAre of 3Q'25 dispositions as if they had been sold as of July 1, 2025, the impact on 2Q'25 EBITDAre of 2Q'25 dispositions as if they had been sold as of April 1, 2025 and the impact on 1Q'25 EBITDAre of 1Q'25 dispositions as if they had been sold as of January 1, 2025.

Fourth Quarter 2025 Supplemental Financial Reporting Package | Page 15 |  | ||||||

Same Property Portfolio Performance.(1) | ||||||||

| (unaudited and dollars in thousands) | ||||||||

| Same Property Portfolio: | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Number of properties | 287 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Square Feet | 37,466,856 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Same Property Portfolio NOI and Cash NOI: | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Three Months Ended December 31, | Year Ended December 31, | |||||||||||||||||||||||||||||||||||||||||||||||||

| 2025 | 2024 | $ Change | % Change | 2025 | 2024 | $ Change | % Change | |||||||||||||||||||||||||||||||||||||||||||

Rental income(2)(3)(4) | $ | 190,470 | $ | 187,372 | $ | 3,098 | 1.7% | $ | 759,209 | $ | 745,932 | $ | 13,277 | 1.8% | ||||||||||||||||||||||||||||||||||||

| Property expenses | 44,269 | 41,727 | 2,542 | 6.1% | 170,034 | 163,053 | 6,981 | 4.3% | ||||||||||||||||||||||||||||||||||||||||||

| Same Property Portfolio NOI | $ | 146,201 | $ | 145,645 | $ | 556 | 0.4% | (4) | $ | 589,175 | $ | 582,879 | $ | 6,296 | 1.1% | (4) | ||||||||||||||||||||||||||||||||||

Straight-line rental revenue adjustment | (2,198) | (5,167) | 2,969 | (57.5)% | (14,075) | (27,437) | 13,362 | (48.7)% | ||||||||||||||||||||||||||||||||||||||||||

Above/(below) market lease revenue adjustments | (4,953) | (5,260) | 307 | (5.8)% | (19,695) | (23,129) | 3,434 | (14.8)% | ||||||||||||||||||||||||||||||||||||||||||

| Same Property Portfolio Cash NOI | $ | 139,050 | $ | 135,218 | $ | 3,832 | 2.8% | (4) | $ | 555,405 | $ | 532,313 | $ | 23,092 | 4.3% | (4) | ||||||||||||||||||||||||||||||||||

| Same Property Portfolio Occupancy: | |||||||||||||||||||||||||||||

| Three Months Ended December 31, | |||||||||||||||||||||||||||||

| 2025 | 2024 | Year-over-Year Change (basis points) | Three Months Ended September 30, 2025(5) | Sequential Change (basis points) | |||||||||||||||||||||||||

Quarterly Weighted Average Occupancy:(5) | |||||||||||||||||||||||||||||

| Los Angeles County | 96.7% | 96.7% | 0 bps | 96.9% | (20) bps | ||||||||||||||||||||||||

| Orange County | 98.9% | 99.4% | (50) bps | 98.9% | — bps | ||||||||||||||||||||||||

| Riverside / San Bernardino County | 96.4% | 96.6% | (20) bps | 95.3% | 110 bps | ||||||||||||||||||||||||

| San Diego County | 98.1% | 97.5% | 60 bps | 98.3% | (20) bps | ||||||||||||||||||||||||

| Ventura County | 94.5% | 91.1% | 340 bps | 94.3% | 20 bps | ||||||||||||||||||||||||

| Quarterly Weighted Average Occupancy | 96.8% | 96.6% | 20 bps | 96.6% | 20 bps | ||||||||||||||||||||||||

| Ending Occupancy: | 96.5% | 96.4% | 10 bps | 97.0% | (50) bps | ||||||||||||||||||||||||

(1)For a definition and discussion of non-GAAP financial measures, see the definitions section beginning on page 33 of this report.

(2)See “Same Property Portfolio Rental Income” on page 36 of the definitions section of this report for a breakdown of rental income into rental revenues, tenant reimbursements and other income for the three months and year ended December 31, 2025 and 2024.

(3)Reflects (decrease) increase to rental income due to changes in the Company’s assessment of lease payment collectability as follows: $(2,185) thousand and $(51) thousand for the three months ended December 31, 2025 and 2024, respectively, and $(4,648) thousand and $(2,352) thousand for the years ended December 31, 2025 and 2024.

(4)Rental income includes lease termination fees of $208 thousand and $121 thousand for the three months ended December 31, 2025 and 2024, respectively, and $1,081 thousand and $253 thousand for the years ended December 31, 2025 and 2024, respectively. Excluding these lease termination fees, Same Property Portfolio NOI increased by approximately 0.3% and 0.9% and Same Property Portfolio Cash NOI increased by approximately 2.8% and 4.2% during the three months and year ended December 31, 2025, compared to the three months and year ended December 31, 2024, respectively.

(5)Calculated by averaging the occupancy rate at the end of each month in 4Q-2025 and September 2025 (for 4Q-2025), the end of each month in 4Q-2024 and September 2024 (for 4Q-2024) and the end of each month in 3Q-2025 and June 2025 (for 3Q-2025).

Fourth Quarter 2025 Supplemental Financial Reporting Package | Page 16 |  | ||||||

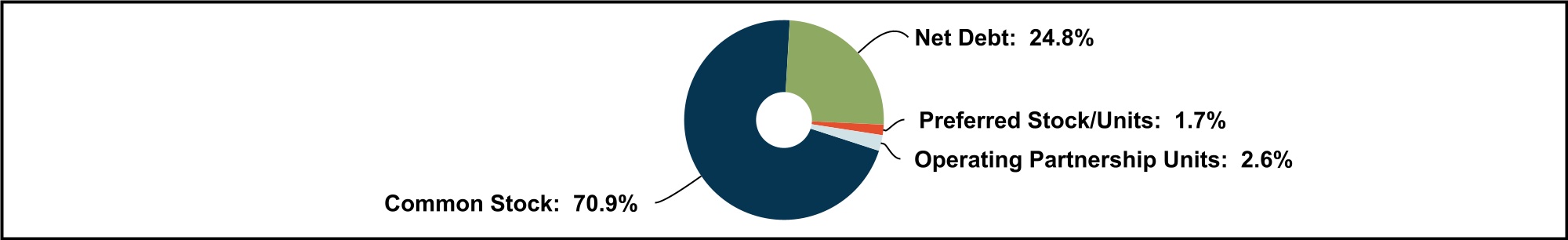

Capitalization Summary. | ||||||||

| (unaudited and in thousands, except share and per share data) | ||||||||

| Capitalization as of December 31, 2025 | ||||||||

| Description | December 31, 2025 | September 30, 2025 | June 30, 2025 | March 31, 2025 | December 31, 2024 | ||||||||||||||||||||||||

Common shares outstanding(1) | 229,957,058 | 232,297,172 | 236,151,829 | 235,610,472 | 224,868,888 | ||||||||||||||||||||||||

Operating partnership units outstanding(2) | 8,288,228 | 8,155,706 | 8,182,445 | 8,700,301 | 8,426,905 | ||||||||||||||||||||||||

| Total shares and units outstanding at period end | 238,245,286 | 240,452,878 | 244,334,274 | 244,310,773 | 233,295,793 | ||||||||||||||||||||||||

| Share price at end of quarter | $ | 38.72 | $ | 41.11 | $ | 35.57 | $ | 39.15 | $ | 38.66 | |||||||||||||||||||

| Common Stock and Operating Partnership Units - Capitalization | $ | 9,224,857 | $ | 9,885,018 | $ | 8,690,970 | $ | 9,564,767 | $ | 9,019,215 | |||||||||||||||||||

Series B and C Cumulative Redeemable Preferred Stock(3) | $ | 161,250 | $ | 161,250 | $ | 161,250 | $ | 161,250 | $ | 161,250 | |||||||||||||||||||

4.00% Series 2 Cumulative Redeemable Convertible Preferred Units(4) | — | — | — | — | 40,706 | ||||||||||||||||||||||||

3.00% Series 3 Cumulative Redeemable Convertible Preferred Units(4) | 12,000 | 12,000 | 12,000 | 12,000 | 12,000 | ||||||||||||||||||||||||

| Preferred Equity | $ | 173,250 | $ | 173,250 | $ | 173,250 | $ | 173,250 | $ | 213,956 | |||||||||||||||||||

| Total Equity Market Capitalization | $ | 9,398,107 | $ | 10,058,268 | $ | 8,864,220 | $ | 9,738,017 | $ | 9,233,171 | |||||||||||||||||||

| Total Debt | $ | 3,278,649 | $ | 3,278,896 | $ | 3,379,141 | $ | 3,379,383 | $ | 3,379,622 | |||||||||||||||||||

| Less: Cash and cash equivalents | (165,778) | (248,956) | (431,117) | (504,579) | (55,971) | ||||||||||||||||||||||||

| Net Debt | $ | 3,112,871 | $ | 3,029,940 | $ | 2,948,024 | $ | 2,874,804 | $ | 3,323,651 | |||||||||||||||||||

| Total Combined Market Capitalization (Net Debt plus Equity) | $ | 12,510,978 | $ | 13,088,208 | $ | 11,812,244 | $ | 12,612,821 | $ | 12,556,822 | |||||||||||||||||||

| Net debt to total combined market capitalization | 24.9 | % | 23.2 | % | 25.0 | % | 22.8 | % | 26.5 | % | |||||||||||||||||||

Net debt to Adjusted EBITDAre (quarterly results annualized)(5) | 4.4x | 4.1x | 4.0x | 3.9x | 4.6x | ||||||||||||||||||||||||

Net debt & preferred equity to Adjusted EBITDAre (quarterly results annualized)(5) | 4.6x | 4.4x | 4.2x | 4.1x | 4.9x | ||||||||||||||||||||||||

(1)Excludes the following number of shares of unvested restricted stock: 1,623,077 (Dec 31, 2025), 513,234 (Sep 30, 2025), 542,922 (Jun 30, 2025), 560,382 (Mar 31, 2025) and 416,123 (Dec 31, 2024). During the three months ended December 31, 2025 and September 30, 2025, the Company repurchased 2,443,438 and 3,883,845 shares common stock under its stock repurchase programs at a weighted average price of $40.93 and $38.62 per share for a total of $100.0 million and $150.1 million, respectively.

(2)Represents outstanding common units of the Company’s operating partnership (“OP”), Rexford Industrial Realty, LP, that are owned by unitholders other than Rexford Industrial Realty, Inc. Represents the noncontrolling interest in our OP. As of December 31, 2025, includes 1,485,615 vested LTIP Units & 1,156,270 vested performance units & excludes 325,395 unvested LTIP Units & 2,684,570 unvested performance units.

(3)Values based on liquidation preference of $25 per share and the following number of outstanding shares of preferred stock: 5.875% Series B (3,000,000); 5.625% Series C (3,450,000).

(4)Value based on 904,583 outstanding Series 2 preferred units at a liquidation preference of $45 per unit and 164,998 outstanding Series 3 preferred units at a liquidation preference of $72.72825 per unit. On March 6, 2025, we exercised our conversion right to convert all remaining 904,583 Series 2 preferred units into OP Units.

(5)For definition/discussion of non-GAAP financial measures and reconciliations to their nearest GAAP equivalents, see the definitions section & reconciliation section beginning on page 33 and page 12 of this report, respectively.

Fourth Quarter 2025 Supplemental Financial Reporting Package | Page 17 |  | ||||||

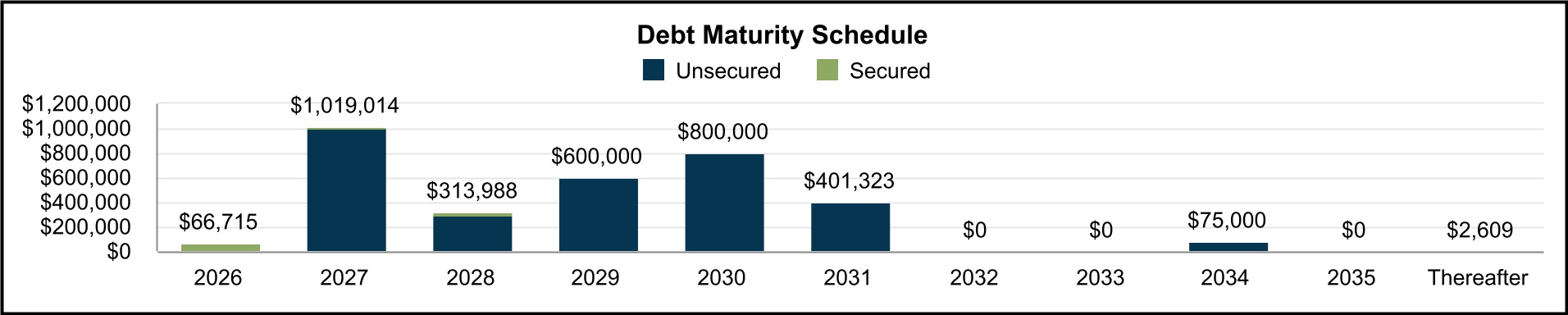

Debt Summary. | ||||||||

| (unaudited and dollars in thousands) | ||||||||

| Debt Detail: | ||||||||||||||||||||||||||

| As of December 31, 2025 | ||||||||||||||||||||||||||

| Debt Description | Maturity Date | Stated Interest Rate | Effective Interest Rate(1) | Principal Balance(2) | ||||||||||||||||||||||

| Unsecured Debt: | ||||||||||||||||||||||||||

$1.25 Billion Revolving Credit Facility(3) | 5/30/2029(4) | SOFR+0.725%(5) | 4.595% | $ | — | |||||||||||||||||||||

$575M Exchangeable 2027 Senior Notes(6) | 3/15/2027 | 4.375% | 4.375% | 575,000 | ||||||||||||||||||||||

| $300M Term Loan Facility | 5/26/2027 | SOFR+0.80%(5) | 3.617%(7) | 300,000 | ||||||||||||||||||||||

| $125M Senior Notes | 7/13/2027 | 3.930% | 3.930% | 125,000 | ||||||||||||||||||||||

| $300M Senior Notes | 6/15/2028 | 5.000% | 5.000% | 300,000 | ||||||||||||||||||||||

$575M Exchangeable 2029 Senior Notes(6) | 3/15/2029 | 4.125% | 4.125% | 575,000 | ||||||||||||||||||||||

| $25M Series 2019A Senior Notes | 7/16/2029 | 3.880% | 3.880% | 25,000 | ||||||||||||||||||||||

| $400M Senior Notes | 12/1/2030 | 2.125% | 2.125% | 400,000 | ||||||||||||||||||||||

| $400M Term Loan Facility | 5/30/2030 | SOFR+0.80%(5) | 4.214%(8) | 400,000 | ||||||||||||||||||||||

| $400M Senior Notes - Green Bond | 9/1/2031 | 2.150% | 2.150% | 400,000 | ||||||||||||||||||||||

| $75M Series 2019B Senior Notes | 7/16/2034 | 4.030% | 4.030% | 75,000 | ||||||||||||||||||||||

| Secured Debt: | ||||||||||||||||||||||||||

| $60M Term Loan Facility | 10/27/2026(9) | SOFR+1.250%(9) | 5.060%(10) | 60,000 | ||||||||||||||||||||||

| 701-751 Kingshill Place | 1/5/2026 | 3.900% | 3.900% | 6,715 | ||||||||||||||||||||||

| 13943-13955 Balboa Boulevard | 7/1/2027 | 3.930% | 3.930% | 13,814 | ||||||||||||||||||||||

| 2205 126th Street | 12/1/2027 | 3.910% | 3.910% | 5,200 | ||||||||||||||||||||||

| 2410-2420 Santa Fe Avenue | 1/1/2028 | 3.700% | 3.700% | 10,300 | ||||||||||||||||||||||

| 11832-11954 La Cienega Boulevard | 7/1/2028 | 4.260% | 4.260% | 3,688 | ||||||||||||||||||||||

| 1100-1170 Gilbert Street (Gilbert/La Palma) | 3/1/2031 | 5.125% | 5.125% | 1,323 | ||||||||||||||||||||||

| 7817 Woodley Avenue | 8/1/2039 | 4.140% | 4.140% | 2,609 | ||||||||||||||||||||||

| Total Debt | 3.732% | $ | 3,278,649 | |||||||||||||||||||||||

Debt Composition: | ||||||||||||||||||||||||||||||||

| Category | Weighted Average Term Remaining (yrs) | Stated Interest Rate | Effective Interest Rate | Balance | % of Total | |||||||||||||||||||||||||||

| Fixed | 3.3 | 3.732% (See Table Above) | 3.732% | $ | 3,278,649 | 100% | ||||||||||||||||||||||||||

| Variable | — | — | —% | $ | — | 0% | ||||||||||||||||||||||||||

| Secured | 1.5 | 4.591% | $ | 103,649 | 3% | |||||||||||||||||||||||||||

| Unsecured | 3.3 | 3.704% | $ | 3,175,000 | 97% | |||||||||||||||||||||||||||

*See footnotes on the following page*

Fourth Quarter 2025 Supplemental Financial Reporting Package | Page 18 |  | ||||||

Debt Summary (Continued). | ||||||||

| (unaudited and dollars in thousands) | ||||||||

Debt Maturity Schedule(11): | ||||||||||||||||||||||||||||||||

| Year | Secured | Unsecured | Total | % Total | Effective Interest Rate(1) | |||||||||||||||||||||||||||

| 2026 | $ | 66,715 | $ | — | $ | 66,715 | 2 | % | 4.943 | % | ||||||||||||||||||||||

| 2027 | 19,014 | 1,000,000 | 1,019,014 | 31 | % | 4.089 | % | |||||||||||||||||||||||||

| 2028 | 13,988 | 300,000 | 313,988 | 10 | % | 4.949 | % | |||||||||||||||||||||||||

| 2029 | — | 600,000 | 600,000 | 18 | % | 4.115 | % | |||||||||||||||||||||||||

| 2030 | — | 800,000 | 800,000 | 25 | % | 3.169 | % | |||||||||||||||||||||||||

| 2031 | 1,323 | 400,000 | 401,323 | 12 | % | 2.160 | % | |||||||||||||||||||||||||

| 2032 | — | — | — | — | % | — | % | |||||||||||||||||||||||||

| 2033 | — | — | — | — | % | — | % | |||||||||||||||||||||||||

| 2034 | — | 75,000 | 75,000 | 2 | % | 4.030 | % | |||||||||||||||||||||||||

| 2035 | — | — | — | — | % | — | % | |||||||||||||||||||||||||

| Thereafter | 2,609 | — | 2,609 | — | % | 4.140 | % | |||||||||||||||||||||||||

| Total | $ | 103,649 | $ | 3,175,000 | $ | 3,278,649 | 100 | % | 3.732 | % | ||||||||||||||||||||||

(1)Includes the effect of interest rate swaps effective as of Dec 31, 2025. See notes (7), (8) and (10). Excludes the effect of premiums/discounts, deferred loan costs and the credit facility fee.

(2)Excludes unamortized debt issuance costs, premiums and discounts aggregating $26.7 million as of December 31, 2025.

(3)The $1.25B revolving credit facility (“Revolver”) is subject to a facility fee which is calculated as a percentage of the total commitment amount, regardless of usage. The facility fee ranges from 0.125% to 0.300% depending on our credit ratings. There are also two sustainability-linked pricing components that can periodically change the facility fee by -/+ 0.01% (or zero) depending on our achievement of the annual sustainability performance metrics. As of Dec 31, 2025, the sustainability-linked pricing adj. for the facility fee was zero. In January 2026, the facility fee decreased by 0.01% to 0.115% after certifying that our sustainability performance targets for 2025 were met.

(4)The Revolver has two six-month extensions, subject to certain terms and conditions.

(5)The interest rates on these loans are comprised of Daily SOFR for the Revolver and $400M term loan facility (“TL”) and 1M SOFR for the $300M TL and an applicable margin ranging from 0.725% to 1.40% for the Revolver and 0.80% to 1.60% for the $300M TL and $400M TL depending on our credit ratings and leverage ratio. On Nov 21, 2025, we amended our senior unsecured credit agreement to eliminate the 0.10% SOFR adjustment for the $300M TL. There is also a sustainability-linked pricing component that can periodically change the margin by -/+ 0.04% (or zero) depending on our achievement of the annual sustainability performance metric. As of Dec 31, 2025, the sustainability-linked pricing adjustment for the margin was zero. In January 2026, the applicable margin decreased by 0.04% to 0.685% for the Revolver and to 0.76% for the $300M TL and $400M TL after certifying that our sustainability performance targets were met for 2025.

(6)Noteholders have the right to exchange their notes upon the occurrence of certain events. Exchanges will be settled in cash or in a combination of cash and shares of our common stock, at our option.

(7)We effectively fixed 1M SOFR on our $300M TL at a weighted average rate of 2.81725% from July 27, 2022 through May 26, 2027, through the use of interest rate swaps. The all-in fixed rate on the $300M TL is 3.617% after adding the applicable margin and sustainability-related rate adjustment.

(8)We effectively fixed Daily SOFR on our $400M TL at a weighted average rate of 3.41375% from July 1, 2025 through May 30, 2030, through the use of interest rate swaps. The all-in fixed rate on the $400M TL is 4.214% after adding the applicable margin and sustainability-related rate adjustment.

(9)The $60M TL has interest-only payment terms (1M SOFR + 0.10% SOFR adjustment + margin of 1.250%) and three one-year extensions remaining, subject to certain terms and conditions.

(10)We effectively fixed 1M SOFR on our $60M TL at 3.710% from April 3, 2023 through July 30, 2026, through the use of an interest rate swap. The all-in fixed rate on the $60M TL is 5.060% after adding the SOFR adjustment and applicable margin.

(11)Excludes potential exercise of extension options and excludes the effect of scheduled monthly principal payments on amortizing secured loans.

Fourth Quarter 2025 Supplemental Financial Reporting Package | Page 19 |  | ||||||

Operations. | ||||||||

| Quarterly Results | ||||||||

*Reflects the ending occupancy for the 2025 Same Property Portfolio for each period presented.

Fourth Quarter 2025 Supplemental Financial Reporting Package | Page 20 |  | ||||||

Portfolio Overview. | ||||||||

| At December 31, 2025 | (unaudited results) | |||||||

| Consolidated Portfolio: | ||||||||

| Rentable Square Feet | Ending Occupancy % | In-Place ABR(3) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Market | # of Properties | Same Property Portfolio | Non-Same Property Portfolio | Total Portfolio | Same Property Portfolio | Non-Same Property Portfolio | Total Portfolio(1) | Total Portfolio Excluding Repo/Redev(2) | Total (in 000’s) | Per Square Foot | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Central LA | 20 | 2,614,518 | 615,829 | 3,230,347 | 98.5 | % | 76.6 | % | 94.3 | % | 98.7 | % | $ | 42,289 | $13.88 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Greater San Fernando Valley | 74 | 5,483,668 | 1,647,827 | 7,131,495 | 97.1 | % | 58.6 | % | 88.2 | % | 93.1 | % | 108,248 | $17.20 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Mid-Counties | 39 | 2,984,698 | 1,871,363 | 4,856,061 | 99.3 | % | 76.0 | % | 90.3 | % | 97.2 | % | 74,955 | $17.09 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| San Gabriel Valley | 46 | 3,359,590 | 2,770,014 | 6,129,604 | 89.9 | % | 68.1 | % | 80.0 | % | 92.2 | % | 66,095 | $13.47 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| South Bay | 81 | 6,303,325 | 1,657,301 | 7,960,626 | 96.1 | % | 71.0 | % | 90.9 | % | 97.0 | % | 176,212 | $24.36 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Los Angeles County | 260 | 20,745,799 | 8,562,334 | 29,308,133 | 96.1 | % | 69.2 | % | 88.3 | % | 95.3 | % | 467,799 | $18.09 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| North Orange County | 25 | 1,094,646 | 1,580,440 | 2,675,086 | 96.4 | % | 85.0 | % | 89.6 | % | 98.4 | % | 46,850 | $19.54 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| OC Airport | 9 | 998,596 | 106,604 | 1,105,200 | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 21,854 | $19.77 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| South Orange County | 9 | 346,463 | 183,098 | 529,561 | 100.0 | % | 88.9 | % | 96.2 | % | 100.0 | % | 8,892 | $17.46 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| West Orange County | 10 | 852,079 | 436,759 | 1,288,838 | 100.0 | % | 86.3 | % | 95.4 | % | 100.0 | % | 21,289 | $17.32 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Orange County | 53 | 3,291,784 | 2,306,901 | 5,598,685 | 98.8 | % | 86.2 | % | 93.6 | % | 99.2 | % | 98,885 | $18.87 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Inland Empire East | 1 | 33,258 | — | 33,258 | 100.0 | % | — | % | 100.0 | % | 100.0 | % | 683 | $20.52 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Inland Empire West | 53 | 8,356,225 | 1,186,023 | 9,542,248 | 96.8 | % | 84.4 | % | 95.3 | % | 97.0 | % | 139,165 | $15.31 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Riverside / San Bernardino County | 54 | 8,389,483 | 1,186,023 | 9,575,506 | 96.8 | % | 84.4 | % | 95.3 | % | 97.0 | % | 139,848 | $15.33 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Central San Diego | 21 | 1,349,009 | 779,311 | 2,128,320 | 98.1 | % | 43.7 | % | 78.2 | % | 94.3 | % | 40,320 | $24.23 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| North County San Diego | 13 | 1,179,355 | 143,663 | 1,323,018 | 98.1 | % | 100.0 | % | 98.3 | % | 99.1 | % | 19,780 | $15.21 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| San Diego County | 34 | 2,528,364 | 922,974 | 3,451,338 | 98.1 | % | 52.4 | % | 85.9 | % | 96.4 | % | 60,100 | $20.27 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Ventura | 18 | 2,511,426 | 716,100 | 3,227,526 | 93.9 | % | 84.4 | % | 91.8 | % | 92.6 | % | 41,805 | $14.11 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Ventura County | 18 | 2,511,426 | 716,100 | 3,227,526 | 93.9 | % | 84.4 | % | 91.8 | % | 92.6 | % | 41,805 | $14.11 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| CONSOLIDATED TOTAL / WTD AVG | 419 | 37,466,856 | 13,694,332 | 51,161,188 | 96.5 | % | 73.0 | % | 90.2 | % | 96.0 | % | $ | 808,437 | $17.51 | (4) | |||||||||||||||||||||||||||||||||||||||||||||||||

(1)See page 37 for historical occupancy by County.

(2)Excludes space aggregating 3,056,366 square feet at our properties that were in various stages of repositioning, development or lease-up as of December 31, 2025.

(3)See page 33 for definitions and details on how these amounts are calculated.

(4)Excluding in-place ABR associated with Land/IOS properties ($46.9M ABR) and cellular tower, solar and parking lot leases ($2.9M ABR), in-place building ABR per building SF was $16.51.

Fourth Quarter 2025 Supplemental Financial Reporting Package | Page 21 |  | ||||||

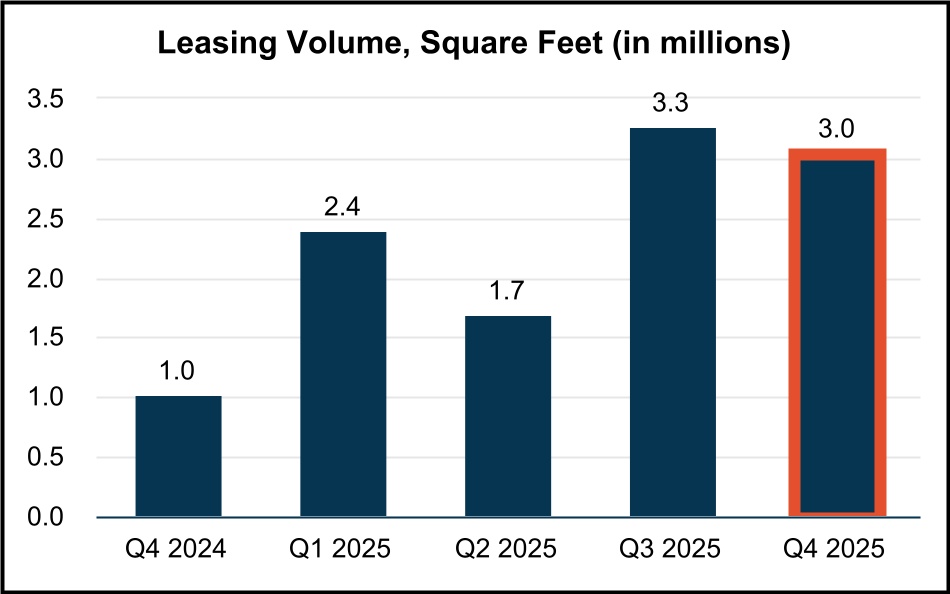

Executed Leasing Statistics and Trends. | ||||||||

| (unaudited results) | ||||||||

| Executed Leasing Activity and Weighted Average New / Renewal Leasing Spreads: | ||||||||

| Three Months Ended | ||||||||||||||||||||||||||||||||

| Dec 31, 2025 | Sep 30, 2025 | Jun 30, 2025 | Mar 31, 2025 | Dec 31, 2024 | ||||||||||||||||||||||||||||

| Leasing Spreads: | ||||||||||||||||||||||||||||||||

| Net Effective Rent Change | 22.0 | % | 26.1 | % | 20.9 | % | 23.8 | % | 55.4 | % | ||||||||||||||||||||||

| Cash Rent Change | 9.0 | % | 10.3 | % | 8.1 | % | 14.7 | % | 41.0 | % | ||||||||||||||||||||||

Leasing Activity (Building SF):(1)(2) | ||||||||||||||||||||||||||||||||

| New leases | 1,574,816 | 2,361,131 | 678,727 | 882,403 | 330,334 | |||||||||||||||||||||||||||

| Renewal leases | 1,464,751 | 904,014 | 1,020,266 | 1,511,946 | 684,961 | |||||||||||||||||||||||||||

| Total leasing activity | 3,039,567 | 3,265,145 | 1,698,993 | 2,394,349 | 1,015,295 | |||||||||||||||||||||||||||

| Total expiring leases | (3,551,170) | (1,734,790) | (1,786,814) | (3,102,514) | (2,436,160) | |||||||||||||||||||||||||||

Expiring leases - placed into repositioning/development | 957,493 | 418,878 | 304,776 | 833,218 | 996,035 | |||||||||||||||||||||||||||

Net absorption(3) | 445,890 | 1,949,233 | 216,955 | 125,053 | (424,830) | |||||||||||||||||||||||||||

Retention rate(4) | 61 | % | 72 | % | 69 | % | 68 | % | 51 | % | ||||||||||||||||||||||

Retention + Backfill rate(5) | 70 | % | 77 | % | 74 | % | 82 | % | 62 | % | ||||||||||||||||||||||

Executed Leasing Activity and Change in Annual Rental Rates and Turnover Costs for Current Quarter Leases:(6) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Net Effective Rent | Cash Rent | Turnover Costs(7) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fourth Quarter 2025: | # Leases Signed | SF of Leasing | Wtd. Avg. Lease Term (Years) | Current Lease | Prior Lease | Rent Change | Current Lease | Prior Lease | Rent Change | Wtd. Avg. Abatement (Months) | Tenant Improvements per SF | Leasing Commissions per SF | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

New | 57 | 1,574,816 | 4.9 | $14.68 | $13.71 | 7.1% | $14.77 | $14.64 | 0.9% | 3.5 | $2.94 | $3.81 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Renewal | 61 | 1,464,751 | 5.1 | $15.00 | $11.91 | 26.0% | $14.60 | $13.15 | 11.0% | 3.3 | $0.73 | $2.49 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Total / Wtd. Average | 118 | 3,039,567 | 5.0 | $14.94 | $12.25 | 22.0% | $14.63 | $13.43 | 9.0% | 3.3 | $1.14 | $2.74 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(1)Represents all executed leases, excluding leases with terms less than 12 months and month-to-month tenant leases.

(2)Leasing activity for Q4-2025 excludes the following land lease activity: (i) one renewal land lease deal with 95,209 land SF that did not have any comparable lease data.

(3)Net absorption represents total leasing activity, less expiring leases adjusted for square footage placed into repositioning/development.

(4)Retention rate is calculated as renewal lease square footage plus relocation/expansion square footage, divided by expiring lease square footage. Retention excludes square footage related to the following: (i) expiring leases associated with space that is placed into repositioning/development after the tenant vacates, (ii) early terminations with prenegotiated replacement leases and (iii) move outs where space is directly leased by subtenants.

(5)Retention + Backfill rate represents square feet retained (per Retention rate definition in footnote (4)) plus the square footage of move outs in the quarter which were re-leased prior to or during the same quarter, divided by expiring lease square footage.

(6)Net effective and cash rent statistics and turnover costs exclude 25 new leases aggregating 1,296,910 RSF for which there was no comparable lease data. Comparable leases generally exclude: (i) space that has never been occupied under our ownership, (ii) repositioned/developed space, including space in pre-development/entitlement process, (iii) space that has been vacant for greater than 1 year or (iv) lease terms less than 12 months. Net effective and cash rent statistics and turnover costs for building leases also exclude land lease deals noted in footnote (2) above.

(7)Turnover costs include estimated tenant improvement and leasing costs associated with leases executed during the current period. Excludes costs for 1st generation leases.

Fourth Quarter 2025 Supplemental Financial Reporting Package | Page 22 |  | ||||||

Leasing Statistics (Continued). | ||||||||

| (unaudited results) | ||||||||

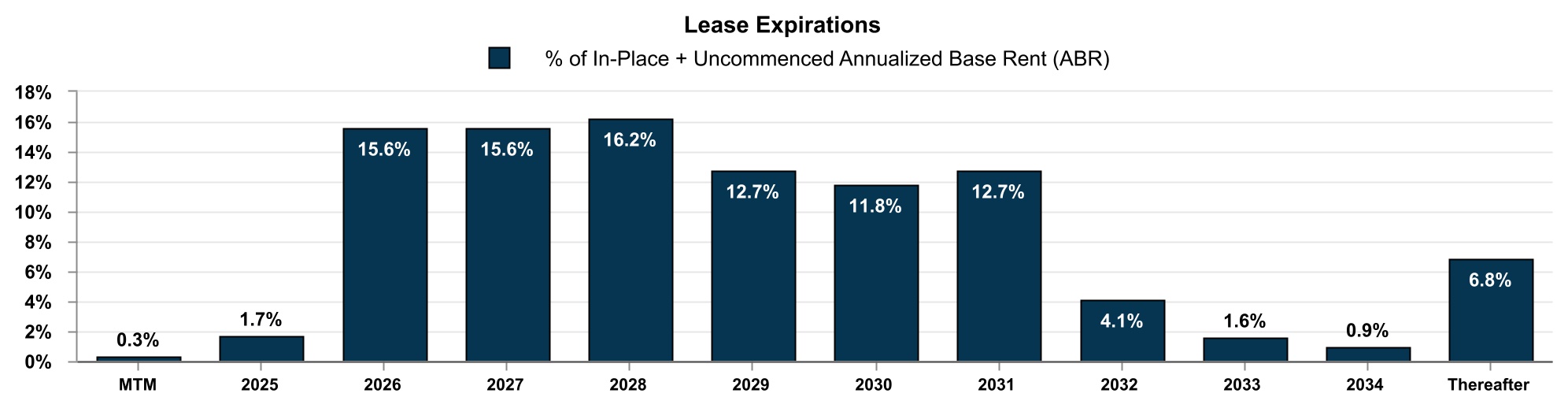

| Lease Expiration Schedule as of December 31, 2025: | ||||||||

| Year of Lease Expiration | # of Leases Expiring | Total Rentable Square Feet | In-Place + Uncommenced ABR (in thousands) | In-Place + Uncommenced ABR per SF | ||||||||||||||||||||||

| Available | — | 1,616,838 | $ | — | $— | |||||||||||||||||||||

Repositioning/Development(1) | — | 3,056,366 | — | $— | ||||||||||||||||||||||

| MTM Tenants | 9 | 138,861 | 2,439 | $17.56 | ||||||||||||||||||||||

| 2025 | 17 | 598,557 | 13,588 | $18.99 | ||||||||||||||||||||||

| 2026 | 395 | 7,860,517 | 127,869 | $16.51 | ||||||||||||||||||||||

| 2027 | 353 | 7,145,813 | 127,908 | $17.90 | ||||||||||||||||||||||

| 2028 | 281 | 6,955,762 | 132,902 | $19.11 | ||||||||||||||||||||||

| 2029 | 200 | 5,476,780 | 104,338 | $19.05 | ||||||||||||||||||||||

| 2030 | 136 | 5,867,712 | 96,315 | $16.41 | ||||||||||||||||||||||

| 2031 | 85 | 6,969,859 | 104,100 | $14.94 | ||||||||||||||||||||||

| 2032 | 28 | 1,711,407 | 33,914 | $19.82 | ||||||||||||||||||||||

| 2033 | 15 | 750,628 | 13,371 | $17.81 | ||||||||||||||||||||||

| 2034 | 7 | 355,445 | 6,980 | $19.64 | ||||||||||||||||||||||

| Thereafter | 42 | 2,656,643 | 55,897 | $21.04 | ||||||||||||||||||||||

| Total Portfolio | 1,568 | 51,161,188 | $ | 819,621 | $17.63(2) | |||||||||||||||||||||

(1)Represents vacant space at properties that were classified as repositioning, development or lease-up as of December 31, 2025.

(2)Excluding in-place + uncommenced ABR associated with Land/IOS properties ($47.25M ABR) and cellular tower, solar and parking lot leases ($2.95M ABR), in-place + uncommenced building ABR per building SF was $16.62.

Fourth Quarter 2025 Supplemental Financial Reporting Package | Page 23 |  | ||||||

Top Tenants and Lease Segmentation. | ||||||||

| (unaudited results) | ||||||||

Top 20 Tenants as of December 31, 2025 | ||||||||

| Tenant | Submarket | Leased Rentable SF | In-Place + Uncommenced ABR (in 000’s)(1) | % of In-Place + Uncommenced ABR(1) | In-Place + Uncommenced ABR per SF(1) | Lease Expiration | ||||||||||||||||||||||||||||||||

| Tireco, Inc. | Inland Empire West | 1,101,840 | $19,251 | 2.3% | $17.47 | 1/31/2027(2) | ||||||||||||||||||||||||||||||||

| L3 Technologies, Inc. | Multiple Submarkets(3) | 595,267 | $13,245 | 1.6% | $22.25 | 9/30/2031 | ||||||||||||||||||||||||||||||||

| Zenith Energy West Coast Terminals LLC | South Bay | —(4) | $11,909 | 1.5% | $3.41(4) | 9/29/2041 | ||||||||||||||||||||||||||||||||

| Cubic Corporation | Central San Diego | 315,227 | $11,443 | 1.4% | $36.30 | 3/31/2038 | ||||||||||||||||||||||||||||||||

| IBY, LLC | San Gabriel Valley | 1,178,021 | $11,322 | 1.4% | $9.61 | 4/5/2031(5) | ||||||||||||||||||||||||||||||||

| Federal Express Corporation | Multiple Submarkets(6) | 527,861 | $10,862 | 1.3% | $20.58 | 11/30/2032(6) | ||||||||||||||||||||||||||||||||

| GXO Logistics Supply Chain, Inc. | Mid-Counties | 411,034 | $9,076 | 1.1% | $22.08 | 11/30/2028 | ||||||||||||||||||||||||||||||||

| The Hertz Corporation | South Bay | 38,680(7) | $8,922 | 1.1% | $11.14(7) | 10/31/2026 | ||||||||||||||||||||||||||||||||

| Best Buy Stores, L.P. | Inland Empire West | 501,649 | $8,871 | 1.1% | $17.68 | 6/30/2029 | ||||||||||||||||||||||||||||||||

| De Fili Solutions Inc. | South Bay | 355,946 | $8,784 | 1.1% | $24.68 | 5/31/2031 | ||||||||||||||||||||||||||||||||

| Top 10 Tenants | 5,025,525 | $113,685 | 13.9% | |||||||||||||||||||||||||||||||||||

| Top 11 - 20 Tenants | 3,429,280 | $56,254 | 6.9% | |||||||||||||||||||||||||||||||||||

| Total Top 20 Tenants | 8,454,805 | $169,939 | 20.8% | |||||||||||||||||||||||||||||||||||

(1)See page 33 for further details on how these amounts are calculated.

(2)In January 2026, we executed an amendment with Tireco, Inc. to extend the lease term to April 30, 2030, with annualized base rent of approximately $17.0 million commencing February 1, 2027.