EX-99.2

Published on April 21, 2021

Exhibit 99.2

| First Quarter 2021 Supplemental Financial Reporting Package |

Page 1

|

|

||||||

Table of Contents.

|

||||||||

| Section | Page | ||||

| Corporate Data: | |||||

| Consolidated Financial Results: | |||||

| Portfolio Data: | |||||

Disclosures:

Forward-Looking Statements: This supplemental package contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. We caution investors that any forward-looking statements presented herein are based on management’s beliefs and assumptions and information currently available to management. Such statements are subject to risks, uncertainties and assumptions and may be affected by known and unknown risks, trends, uncertainties and factors that are beyond our control. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, estimated or projected. These risks and uncertainties include, without limitation: general risks affecting the real estate industry (including, without limitation, the market value of our properties, the inability to enter into or renew leases at favorable rates, dependence on tenants’ financial condition, and competition from other developers, owners and operators of real estate); risks associated with the disruption of credit markets or a global economic slowdown; risks associated with the potential loss of key personnel (most importantly, members of senior management); risks associated with our failure to maintain our status as a Real Estate Investment Trust under the Internal Revenue Code of 1986, as amended; possible adverse changes in tax and environmental laws; an epidemic or pandemic (such as the outbreak and worldwide spread of novel coronavirus (COVID-19), and the measures that international, federal, state and local governments, agencies, law enforcement and/or health authorities may implement to address it, which may (as with COVID-19) precipitate or exacerbate one or more of the above-mentioned factors and/or other risks, and significantly disrupt or prevent us from operating our business in the ordinary course for an extended period; litigation, including costs associated with prosecuting or defending pending or threatened claims and any adverse outcomes, and potential liability for uninsured losses and environmental contamination.

For a further discussion of these and other factors that could cause our future results to differ materially from any forward-looking statements, see Item 1A. Risk Factors in our 2020 Annual Report on Form 10-K, which was filed with the Securities and Exchange Commission (“SEC”) on February 19, 2021. We disclaim any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, of new information, data or methods, future events or other changes.

| First Quarter 2021 Supplemental Financial Reporting Package |

Page 2

|

|

||||||

Investor Company Summary.

|

||||||||

| Executive Management Team | ||||||||

| Howard Schwimmer | Co-Chief Executive Officer, Director | |||||||

| Michael S. Frankel | Co-Chief Executive Officer, Director | |||||||

| Laura Clark | Chief Financial Officer | |||||||

| David Lanzer | General Counsel and Corporate Secretary | |||||||

| Board of Directors | ||||||||

| Richard Ziman | Chairman | |||||||

| Howard Schwimmer | Co-Chief Executive Officer, Director | |||||||

| Michael S. Frankel | Co-Chief Executive Officer, Director | |||||||

| Robert L. Antin | Director | |||||||

| Diana J. Ingram | Director | |||||||

| Debra L. Morris | Director | |||||||

| Tyler H. Rose | Director | |||||||

| Peter Schwab | Director | |||||||

| Investor Relations Information | ||||||||

| Kosta Karmaniolas | ||||||||

| SVP, Corporate Finance & Investor Relations | ||||||||

| kkarmaniolas@rexfordindustrial.com | ||||||||

| (310) 691-5475 | ||||||||

| Equity Research Coverage | ||||||||||||||

| Bank of America Merrill Lynch | James Feldman | (646) 855-5808 | ||||||||||||

| Baird | David Rodgers | (216) 737-7341 | ||||||||||||

| Berenberg Capital Markets | Connor Siversky | (646) 949-9037 | ||||||||||||

| Capital One | Chris Lucas | (571) 633-8151 | ||||||||||||

| Citigroup Investment Research | Emmanuel Korchman | (212) 816-1382 | ||||||||||||

| Green Street | Vince Tibone | (949) 640-8780 | ||||||||||||

| J.P. Morgan | Michael W. Mueller, CFA | (212) 622-6689 | ||||||||||||

| Jefferies LLC | Jonathan Petersen | (212) 284-1705 | ||||||||||||

| Wells Fargo Securities | Blaine Heck | (443) 263-6529 | ||||||||||||

Disclaimer: This list may not be complete and is subject to change as firms add or delete coverage of our company. Please note that any opinions, estimates, forecasts or predictions regarding our historical or predicted performance made by these analysts are theirs alone and do not represent opinions, estimates, forecasts or predictions of Rexford Industrial Realty, Inc. or its management. We are providing this listing as a service to our stockholders and do not by listing these firms imply our endorsement of, or concurrence with, such information, conclusions or recommendations. Interested persons may obtain copies of analysts’ reports on their own; we do not distribute these reports.

| First Quarter 2021 Supplemental Financial Reporting Package |

Page 3

|

|

||||||

Company Overview.

|

||||||||

| First Quarter 2021 Supplemental Financial Reporting Package |

Page 4

|

|

||||||

Highlights - Consolidated Financial Results.

|

||||||||

| Quarterly Results | (in millions) | |||||||

| First Quarter 2021 Supplemental Financial Reporting Package |

Page 5

|

|

||||||

Financial and Portfolio Highlights and Common Stock Data. (1)

|

||||||||

| (in thousands except share and per share data and portfolio statistics) | ||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| March 31, 2021 | December 31, 2020 | September 30, 2020 | June 30, 2020 | March 31, 2020 | |||||||||||||||||||||||||

| Financial Results: | |||||||||||||||||||||||||||||

| Total rental income | $ | 99,644 | $ | 88,495 | $ | 83,622 | $ | 79,770 | $ | 77,490 | |||||||||||||||||||

| Net income | $ | 30,643 | $ | 18,155 | $ | 31,197 | $ | 16,271 | $ | 15,272 | |||||||||||||||||||

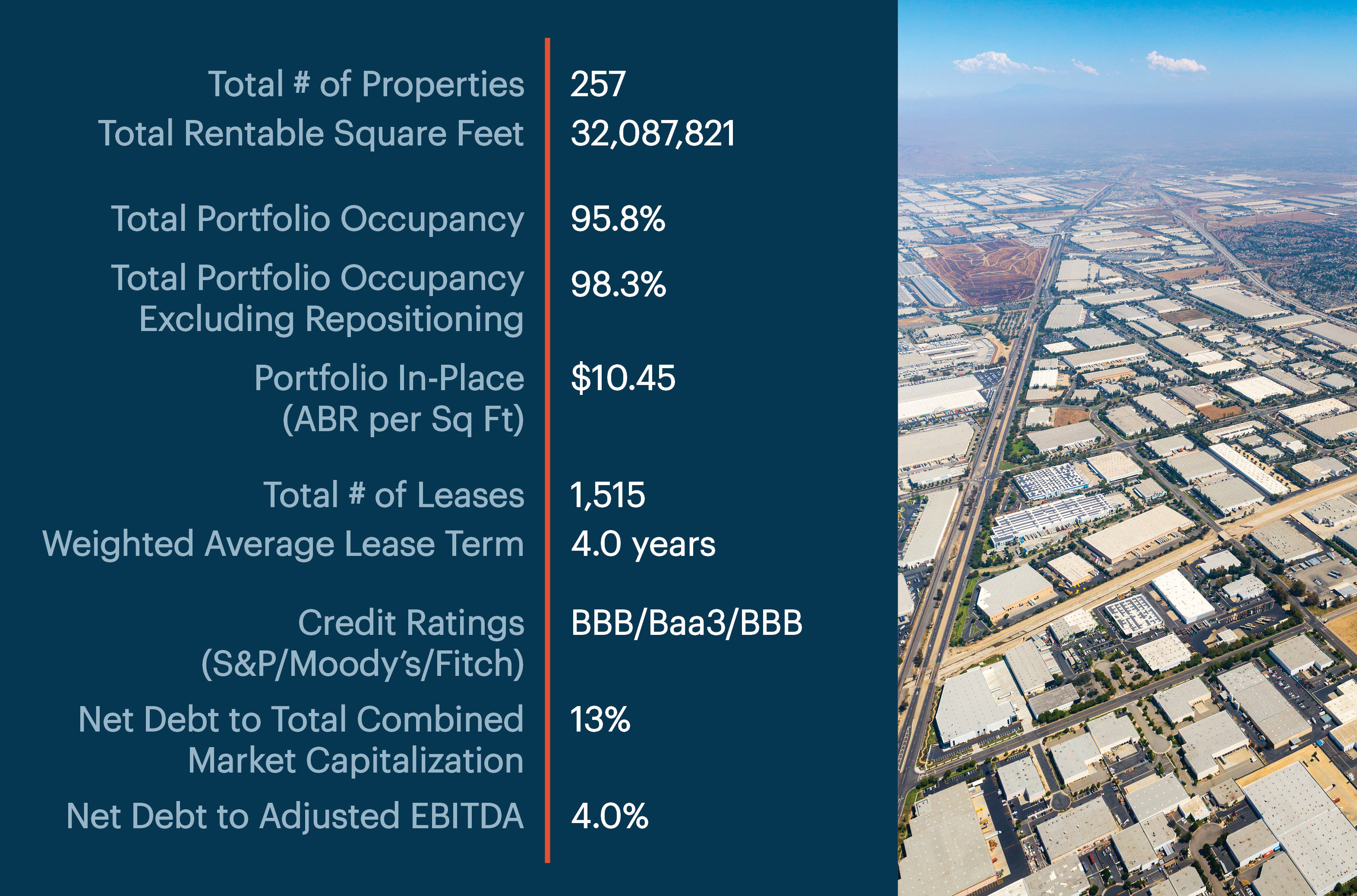

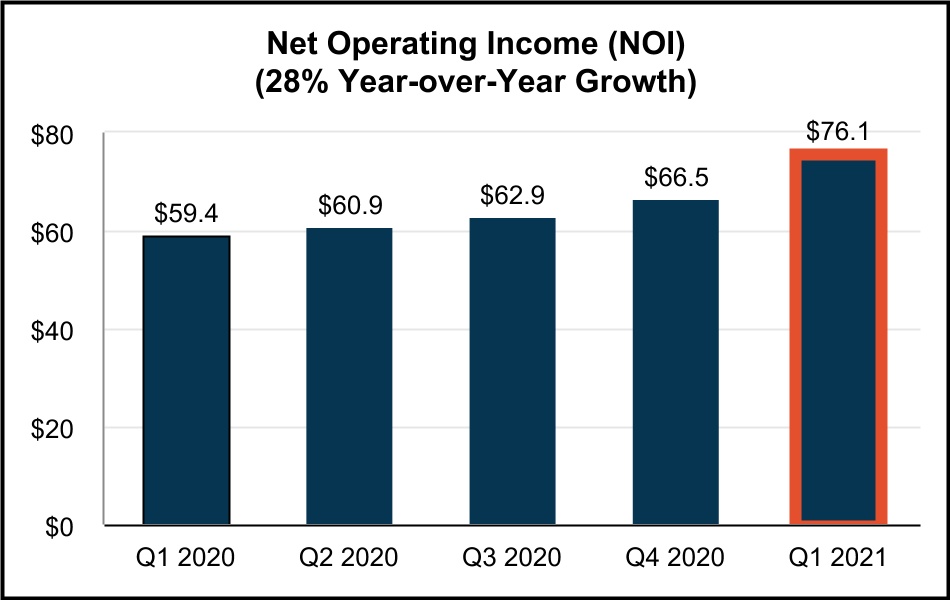

| Net Operating Income (NOI) | $ | 76,069 | $ | 66,461 | $ | 62,938 | $ | 60,886 | $ | 59,376 | |||||||||||||||||||

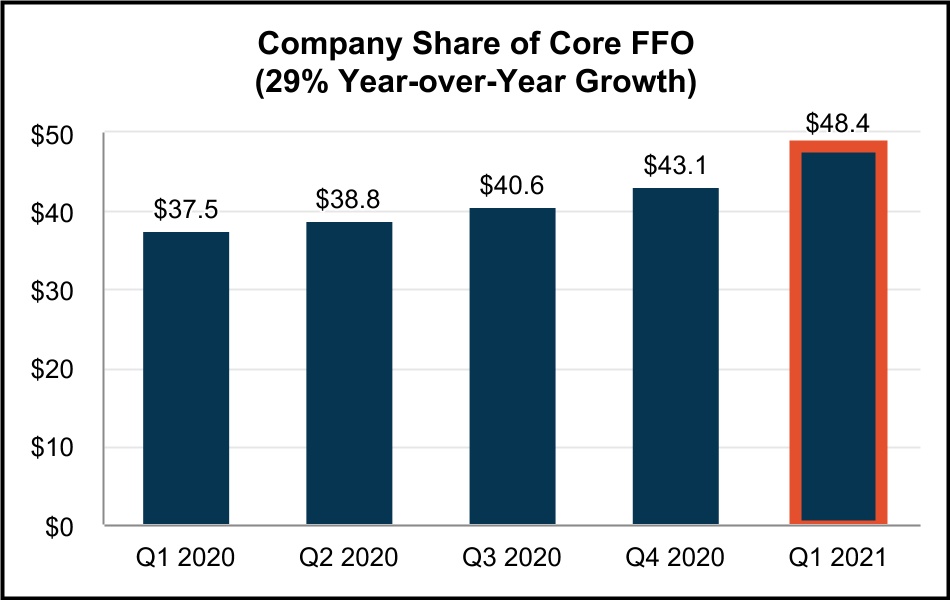

| Company share of Core FFO | $ | 48,364 | $ | 43,099 | $ | 40,557 | $ | 38,832 | $ | 37,519 | |||||||||||||||||||

| Company share of Core FFO per common share - diluted | $ | 0.37 | $ | 0.34 | $ | 0.33 | $ | 0.32 | $ | 0.33 | |||||||||||||||||||

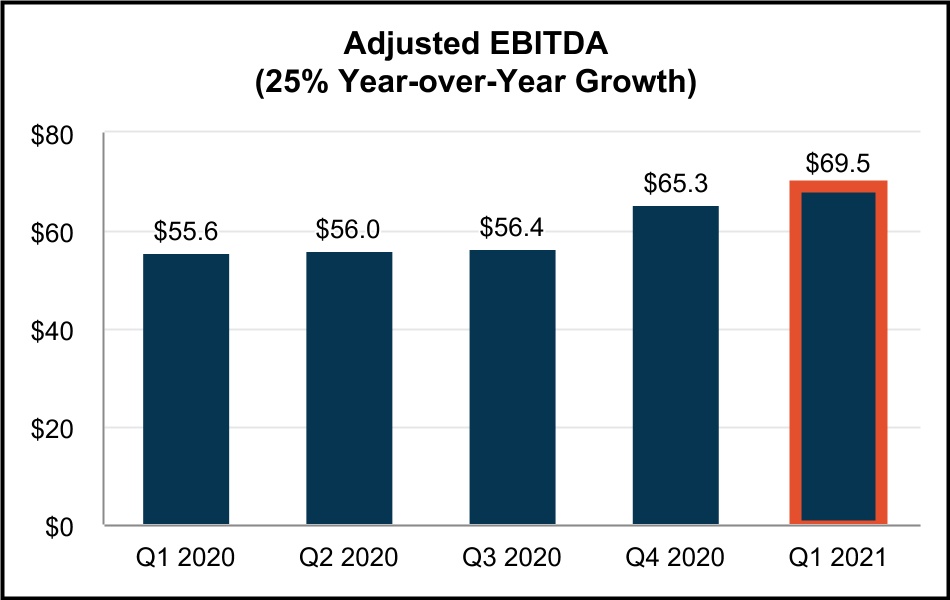

| Adjusted EBITDA | $ | 69,521 | $ | 65,328 | $ | 56,384 | $ | 55,982 | $ | 55,566 | |||||||||||||||||||

| Dividend declared per common share | $ | 0.240 | $ | 0.215 | $ | 0.215 | $ | 0.215 | $ | 0.215 | |||||||||||||||||||

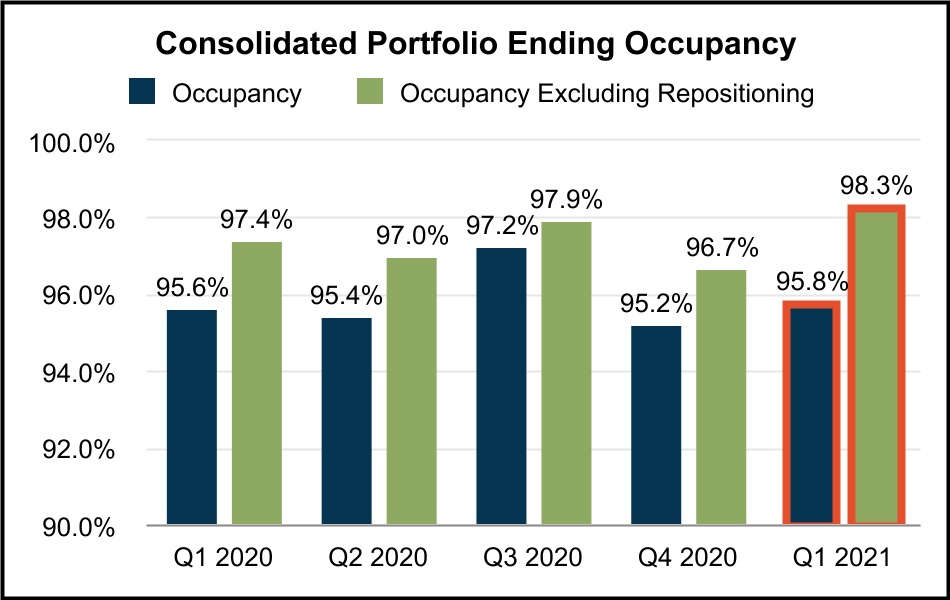

| Portfolio Statistics: | |||||||||||||||||||||||||||||

| Portfolio rentable square feet (“RSF”) - consolidated | 32,087,821 | 31,501,111 | 27,711,078 | 27,633,778 | 27,303,260 | ||||||||||||||||||||||||

| Ending occupancy - consolidated portfolio | 95.8 | % | 95.2 | % | 97.2 | % | 95.4 | % | 95.6 | % | |||||||||||||||||||

| Stabilized occupancy - consolidated portfolio | 98.3 | % | 96.7 | % | 97.9 | % | 97.0 | % | 97.4 | % | |||||||||||||||||||

| Rent Change - GAAP | 47.1 | % | 29.9 | % | 26.8 | % | 32.3 | % | 36.6 | % | |||||||||||||||||||

| Rent Change - Cash | 32.7 | % | 18.1 | % | 17.4 | % | 18.2 | % | 24.4 | % | |||||||||||||||||||

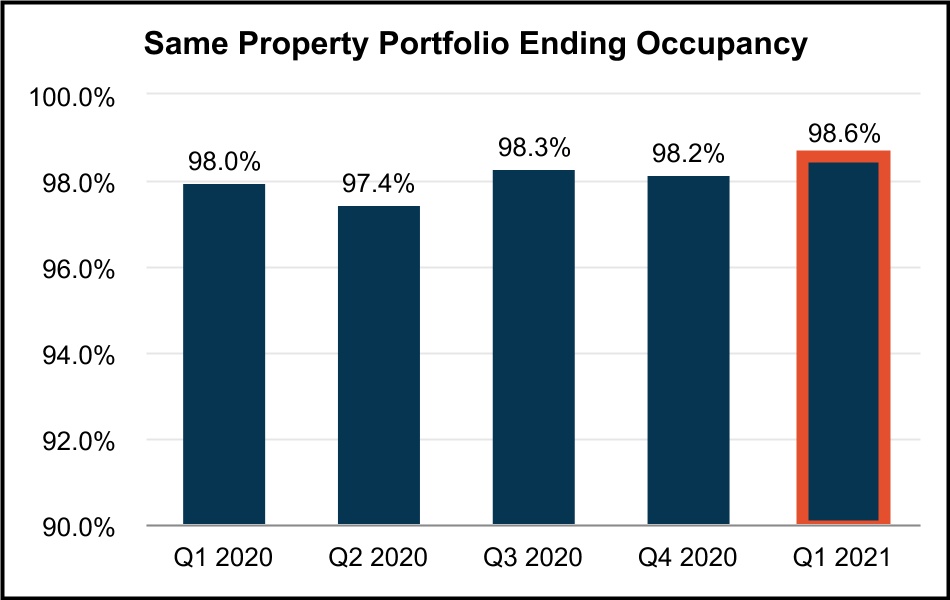

| Stabilized Same Property Performance: | |||||||||||||||||||||||||||||

| Stabilized Same Property Portfolio ending occupancy | 98.6 | % | 98.2 | % | 98.3 | % | 97.4 | % | 98.0 | % | |||||||||||||||||||

Stabilized Same Property Portfolio NOI growth(2)

|

6.8 | % | |||||||||||||||||||||||||||

Stabilized Same Property Portfolio Cash NOI growth(2)

|

8.2 | % | |||||||||||||||||||||||||||

| Capitalization: | |||||||||||||||||||||||||||||

Total shares and units issued and outstanding at period end(3)

|

140,299,354 | 137,799,832 | 127,455,361 | 127,454,636 | 120,004,376 | ||||||||||||||||||||||||

| Series A, B and C Preferred Stock and Series 1 and 2 CPOP Units | $ | 319,068 | $ | 319,068 | $ | 319,068 | $ | 319,068 | $ | 319,068 | |||||||||||||||||||

| Total equity market capitalization | $ | 7,390,155 | $ | 7,086,418 | $ | 6,151,425 | $ | 5,599,514 | $ | 5,240,447 | |||||||||||||||||||

| Total consolidated debt | $ | 1,226,415 | $ | 1,223,494 | $ | 908,046 | $ | 908,250 | $ | 905,645 | |||||||||||||||||||

| Total combined market capitalization (net debt plus equity) | $ | 8,492,637 | $ | 8,133,619 | $ | 6,815,852 | $ | 6,253,391 | $ | 6,033,660 | |||||||||||||||||||

| Ratios: | |||||||||||||||||||||||||||||

| Net debt to total combined market capitalization | 13.0 | % | 12.9 | % | 9.7 | % | 10.5 | % | 13.1 | % | |||||||||||||||||||

| Net debt to Adjusted EBITDA (quarterly results annualized) | 4.0x | 4.0x | 2.9x | 2.9x | 3.6x | ||||||||||||||||||||||||

(1)For definition/discussion of non-GAAP financial measures and reconciliations to their nearest GAAP equivalents, see the definitions section & reconciliation section beginning on page 32 and page 12 of this report, respectively.

(2)Represents the year over year percentage change in NOI and Cash NOI for the Stabilized Same Property Portfolio.

(3)Includes the following # of OP Units/vested LTIP units held by noncontrolling interests: 6,641,742 (Mar 31, 2021), 6,606,693 (Dec 31, 2020), 3,903,509 (Sep 30, 2020), 3,908,476 (Jun 30, 2020) and 3,917,284 (Mar 31, 2020). Excludes the following # of shares of unvested restricted stock: 239,748 (Mar 31, 2021), 232,899 (Dec 31, 2020), 236,739 (Sep 30, 2020), 243,039 (Jun 30, 2020) and 244,255 (Mar 31, 2020). Excludes unvested LTIP units and unvested performance units.

| First Quarter 2021 Supplemental Financial Reporting Package |

Page 6

|

|

||||||

Guidance.

|

||||||||

| As of March 31, 2021 | ||||||||

2021 OUTLOOK*

| 2021 GUIDANCE / ASSUMPTIONS | ||||||||||||||||||||

| METRIC | Q1’21 UPDATED GUIDANCE | INITIAL GUIDANCE | RESULTS AS OF MARCH 31, 2021 | |||||||||||||||||

Net Income Attributable to Common Stockholders per diluted share (1)(2)

|

$0.48 - $0.51 | $0.40 - $0.43 | $0.19 | |||||||||||||||||

Company share of Core FFO per diluted share (1)(2)

|

$1.41 - $1.44 | $1.40 - $1.43 | $0.37 | |||||||||||||||||

Stabilized Same Property Portfolio NOI Growth - GAAP (3)

|

3.75% - 4.75% | 3.0% - 4.0% | 6.8% | |||||||||||||||||

Stabilized Same Property Portfolio NOI Growth - Cash (3)

|

6.75% - 7.75% | 6.0% - 7.0% | 8.2% | |||||||||||||||||

| Average 2021 Stabilized Same Property Portfolio Occupancy (FY) | 97.25% - 97.75% | 97.0% - 97.5% | 98.4% | |||||||||||||||||

General and Administrative Expenses (4)

|

$44.5M - $45.5M | $44.5M - $45.5M | $11.5M | |||||||||||||||||

| Net Interest Expense | $36.0M - $36.5M | $36.0M - $36.5M | $9.8M | |||||||||||||||||

(1)Our 2021 Net Income and Core FFO guidance refers to the Company's in-place portfolio as of April 21, 2021, and does not include any assumptions for prospective acquisitions, dispositions or balance sheet activities that have not closed. The Company’s in-place portfolio as of April 21, 2021, reflects the acquisition of two properties that occurred subsequent to March 31, 2021.

(2)See page 35 for a reconciliation of the Company’s 2021 guidance range of net income attributable to common stockholders per diluted share, the most directly comparable forward-looking GAAP financial measure, to Company share of Core FFO per diluted share.

(3)Our 2021 Stabilized Same Property Portfolio is a subset of our consolidated portfolio and includes properties that were wholly owned by us for the period from January 1, 2020 through April 21, 2021 and excludes properties that were or will be classified as repositioning/redevelopment (current and future) or lease-up during 2020 and 2021 (unless otherwise noted). As of March 31, 2021, our 2021 Stabilized Same Property Portfolio consists of 195 properties aggregating 24,720,199 rentable square feet.

(4)Our 2021 General and Administrative expense guidance includes estimated non-cash equity compensation expense of $16.6 million.

* A number of factors could impact the Company’s ability to deliver results in line with its guidance, including, but not limited to, interest rates, the economy, the supply and demand of industrial real estate, the availability and terms of financing to potential acquirers of real estate, the impact of COVID-19 and actions taken to contain its spread on the Company, the Company’s tenants and the economy, and the timing and yields for divestment and investment. There can be no assurance that the Company can achieve such results.

| First Quarter 2021 Supplemental Financial Reporting Package |

Page 7

|

|

||||||

Guidance (Continued).

|

||||||||

| As of March 31, 2021 | ||||||||

2021 Guidance Rollforward(1)

| Range ($ per share) |

||||||||||||||||||||

| Earnings Components | Low | High | Notes | |||||||||||||||||

| 2021 Core FFO Per Diluted Share Guidance (Previous) | $1.40 | $1.43 | ||||||||||||||||||

| Same Property NOI Growth | 0.01 | 0.01 |

‘+75 basis point increase at the midpoint to 3.75% to 4.75%

|

|||||||||||||||||

| 2021 Acquisitions Closed to Date | 0.02 | 0.02 |

$191M of acquisitions closed to date (2)

|

|||||||||||||||||

| 2021 Dispositions Closed to Date | (0.01) | (0.01) | Impact of $21M of dispositions completed in the first quarter | |||||||||||||||||

| Other | (0.01) | (0.01) | Includes the incremental impact from Q1 equity issuance through ATM | |||||||||||||||||

| 2021 Core FFO Per Diluted Share Guidance (Current) | $1.41 | $1.44 | ||||||||||||||||||

| Core FFO Annual Growth Per Diluted Share | 7% | 9% | ||||||||||||||||||

(1)2021 Guidance and Guidance Rollforward represent the in-place portfolio as of April 21, 2021, and does not include any assumptions for prospective acquisitions, dispositions or balance sheet activities that have not closed.

(2) Acquisitions to date consist primarily of value add and core plus repositioning opportunities with a weighted average stabilized yield of 5.2%.

| First Quarter 2021 Supplemental Financial Reporting Package |

Page 8

|

|

||||||

Consolidated Balance Sheets.

|

||||||||

| (unaudited and in thousands) | ||||||||

| March 31, 2021 | December 31, 2020 | September 30, 2020 | June 30, 2020 | March 31, 2020 | |||||||||||||||||||||||||

| ASSETS | |||||||||||||||||||||||||||||

| Land | $ | 2,769,614 | $ | 2,636,816 | $ | 2,163,518 | $ | 2,128,243 | $ | 2,068,460 | |||||||||||||||||||

| Buildings and improvements | 2,244,948 | 2,201,187 | 1,791,668 | 1,770,930 | 1,748,675 | ||||||||||||||||||||||||

| Tenant improvements | 86,245 | 84,462 | 80,541 | 77,211 | 75,341 | ||||||||||||||||||||||||

| Furniture, fixtures, and equipment | 132 | 132 | 132 | 141 | 141 | ||||||||||||||||||||||||

| Construction in progress | 35,083 | 25,358 | 41,941 | 39,860 | 26,791 | ||||||||||||||||||||||||

| Total real estate held for investment | 5,136,022 | 4,947,955 | 4,077,800 | 4,016,385 | 3,919,408 | ||||||||||||||||||||||||

| Accumulated depreciation | (401,122) | (375,423) | (354,203) | (337,938) | (316,812) | ||||||||||||||||||||||||

| Investments in real estate, net | 4,734,900 | 4,572,532 | 3,723,597 | 3,678,447 | 3,602,596 | ||||||||||||||||||||||||

| Cash and cash equivalents | 123,933 | 176,293 | 243,619 | 254,373 | 112,432 | ||||||||||||||||||||||||

| Restricted cash | 47 | 1,230 | 42,387 | 67 | 46 | ||||||||||||||||||||||||

| Rents and other receivables, net | 7,737 | 10,208 | 5,838 | 4,790 | 5,859 | ||||||||||||||||||||||||

| Deferred rent receivable, net | 45,093 | 40,893 | 40,473 | 37,552 | 31,339 | ||||||||||||||||||||||||

| Deferred leasing costs, net | 26,039 | 23,148 | 21,842 | 20,269 | 19,482 | ||||||||||||||||||||||||

| Deferred loan costs, net | 2,060 | 2,240 | 2,419 | 2,599 | 2,770 | ||||||||||||||||||||||||

Acquired lease intangible assets, net(1)

|

87,587 | 92,172 | 67,304 | 71,513 | 76,138 | ||||||||||||||||||||||||

| Acquired indefinite-lived intangible | 5,156 | 5,156 | 5,156 | 5,156 | 5,156 | ||||||||||||||||||||||||

| Other assets | 27,272 | 14,390 | 13,982 | 16,656 | 10,717 | ||||||||||||||||||||||||

| Acquisition related deposits | 10,075 | 4,067 | 3,625 | 63,612 | 5,896 | ||||||||||||||||||||||||

Assets associated with real estate held for sale, net(2)

|

— | 8,845 | — | — | — | ||||||||||||||||||||||||

| Total Assets | $ | 5,069,899 | $ | 4,951,174 | $ | 4,170,242 | $ | 4,155,034 | $ | 3,872,431 | |||||||||||||||||||

| LIABILITIES & EQUITY | |||||||||||||||||||||||||||||

| Liabilities | |||||||||||||||||||||||||||||

| Notes payable | $ | 1,219,425 | $ | 1,216,160 | $ | 906,608 | $ | 906,687 | $ | 903,802 | |||||||||||||||||||

| Interest rate swap liability | 14,081 | 17,580 | 20,869 | 22,916 | 22,690 | ||||||||||||||||||||||||

| Accounts payable, accrued expenses and other liabilities | 41,871 | 45,384 | 45,212 | 33,731 | 39,000 | ||||||||||||||||||||||||

| Dividends payable | 33,813 | 29,747 | 27,532 | 27,532 | 25,931 | ||||||||||||||||||||||||

Acquired lease intangible liabilities, net(3)

|

66,883 | 67,256 | 61,148 | 61,108 | 63,914 | ||||||||||||||||||||||||

| Tenant security deposits | 34,367 | 31,602 | 27,683 | 26,158 | 30,342 | ||||||||||||||||||||||||

| Prepaid rents | 11,241 | 12,660 | 10,970 | 11,163 | 8,074 | ||||||||||||||||||||||||

Liabilities associated with real estate held for sale(2)

|

— | 193 | — | — | — | ||||||||||||||||||||||||

| Total Liabilities | 1,421,681 | 1,420,582 | 1,100,022 | 1,089,295 | 1,093,753 | ||||||||||||||||||||||||

| Equity | |||||||||||||||||||||||||||||

| Preferred stock | 242,327 | 242,327 | 242,327 | 242,327 | 242,327 | ||||||||||||||||||||||||

| Common stock | 1,338 | 1,313 | 1,236 | 1,236 | 1,162 | ||||||||||||||||||||||||

| Additional paid in capital | 3,300,333 | 3,182,599 | 2,821,127 | 2,820,216 | 2,524,274 | ||||||||||||||||||||||||

| Cumulative distributions in excess of earnings | (170,487) | (163,389) | (148,492) | (147,907) | (132,843) | ||||||||||||||||||||||||

| Accumulated other comprehensive income | (13,996) | (17,709) | (20,231) | (22,214) | (21,950) | ||||||||||||||||||||||||

| Total stockholders’ equity | 3,359,515 | 3,245,141 | 2,895,967 | 2,893,658 | 2,612,970 | ||||||||||||||||||||||||

| Noncontrolling interests | 288,703 | 285,451 | 174,253 | 172,081 | 165,708 | ||||||||||||||||||||||||

| Total Equity | 3,648,218 | 3,530,592 | 3,070,220 | 3,065,739 | 2,778,678 | ||||||||||||||||||||||||

| Total Liabilities and Equity | $ | 5,069,899 | $ | 4,951,174 | $ | 4,170,242 | $ | 4,155,034 | $ | 3,872,431 | |||||||||||||||||||

(1)Includes net above-market tenant lease intangibles of $7,950 (March 31, 2021), $8,308 (December 31, 2020), $5,900 (September 30, 2020), $6,230 (June 30, 2020) and $6,410 (March 31, 2020).

(2)At December 31, 2020, our property located at 14723-14825 Oxnard Street was classified as held for sale.

(3)Represents net below-market tenant lease intangibles as of the balance sheet date.

| First Quarter 2021 Supplemental Financial Reporting Package |

Page 9

|

|

||||||

Consolidated Statements of Operations.

|

||||||||

| Quarterly Results | (unaudited and in thousands, except share and per share data) | |||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| Mar 31, 2021 | Dec 31, 2020 | Sep 30, 2020 | Jun 30, 2020 | Mar 31, 2020 | |||||||||||||||||||||||||

| Revenues | |||||||||||||||||||||||||||||

Rental income(1)

|

$ | 99,644 | $ | 88,495 | $ | 83,622 | $ | 79,770 | $ | 77,490 | |||||||||||||||||||

| Management, leasing, and development services | 105 | 95 | 118 | 114 | 93 | ||||||||||||||||||||||||

| Interest income | 14 | 59 | 116 | 66 | 97 | ||||||||||||||||||||||||

| Total Revenues | 99,763 | 88,649 | 83,856 | 79,950 | 77,680 | ||||||||||||||||||||||||

| Operating Expenses | |||||||||||||||||||||||||||||

| Property expenses | 23,575 | 22,034 | 20,684 | 18,884 | 18,114 | ||||||||||||||||||||||||

| General and administrative | 11,480 | 9,042 | 9,464 | 8,972 | 9,317 | ||||||||||||||||||||||||

| Depreciation and amortization | 35,144 | 30,554 | 28,811 | 28,381 | 27,523 | ||||||||||||||||||||||||

| Total Operating Expenses | 70,199 | 61,630 | 58,959 | 56,237 | 54,954 | ||||||||||||||||||||||||

| Other Expenses | |||||||||||||||||||||||||||||

| Acquisition expenses | 29 | 35 | 70 | 14 | 5 | ||||||||||||||||||||||||

| Interest expense | 9,752 | 8,673 | 7,299 | 7,428 | 7,449 | ||||||||||||||||||||||||

| Total Expenses | 79,980 | 70,338 | 66,328 | 63,679 | 62,408 | ||||||||||||||||||||||||

| Loss on extinguishment of debt | — | (104) | — | — | — | ||||||||||||||||||||||||

| Gain (loss) on sale of real estate | 10,860 | (52) | 13,669 | — | — | ||||||||||||||||||||||||

| Net Income | 30,643 | 18,155 | 31,197 | 16,271 | 15,272 | ||||||||||||||||||||||||

| Less: net income attributable to noncontrolling interests | (1,969) | (1,160) | (1,531) | (1,084) | (717) | ||||||||||||||||||||||||

| Net income attributable to Rexford Industrial Realty, Inc. | 28,674 | 16,995 | 29,666 | 15,187 | 14,555 | ||||||||||||||||||||||||

| Less: preferred stock dividends | (3,636) | (3,636) | (3,636) | (3,637) | (3,636) | ||||||||||||||||||||||||

| Less: earnings allocated to participating securities | (141) | (120) | (129) | (129) | (131) | ||||||||||||||||||||||||

| Net income attributable to common stockholders | $ | 24,897 | $ | 13,239 | $ | 25,901 | $ | 11,421 | $ | 10,788 | |||||||||||||||||||

| Earnings per Common Share | |||||||||||||||||||||||||||||

| Net income attributable to common stockholders per share - basic | $ | 0.19 | $ | 0.11 | $ | 0.21 | $ | 0.10 | $ | 0.09 | |||||||||||||||||||

| Net income attributable to common stockholders per share - diluted | $ | 0.19 | $ | 0.10 | $ | 0.21 | $ | 0.10 | $ | 0.09 | |||||||||||||||||||

| Weighted average shares outstanding - basic | 131,612,881 | 125,995,123 | 123,548,978 | 119,810,283 | 114,054,434 | ||||||||||||||||||||||||

| Weighted average shares outstanding - diluted | 131,758,744 | 126,401,077 | 123,843,977 | 120,068,176 | 114,314,331 | ||||||||||||||||||||||||

(1)See footnote (1) on page 11 for details related to our presentation of “Rental income” in the consolidated statements of operations for all periods presented.

| First Quarter 2021 Supplemental Financial Reporting Package |

Page 10

|

|

||||||

Consolidated Statements of Operations.

|

||||||||

| Quarterly Results (continued) | (unaudited and in thousands, except share and per share data) | |||||||

| Three Months Ended March 31, | ||||||||||||||

| 2021 | 2020 | |||||||||||||

| Revenues | ||||||||||||||

Rental income(1)

|

$ | 99,644 | $ | 77,490 | ||||||||||

| Management, leasing, and development services | 105 | 93 | ||||||||||||

| Interest income | 14 | 97 | ||||||||||||

| Total Revenues | 99,763 | 77,680 | ||||||||||||

| Operating Expenses | ||||||||||||||

| Property expenses | 23,575 | 18,114 | ||||||||||||

| General and administrative | 11,480 | 9,317 | ||||||||||||

| Depreciation and amortization | 35,144 | 27,523 | ||||||||||||

| Total Operating Expenses | 70,199 | 54,954 | ||||||||||||

| Other Expenses | ||||||||||||||

| Acquisition expenses | 29 | 5 | ||||||||||||

| Interest expense | 9,752 | 7,449 | ||||||||||||

| Total Expenses | 79,980 | 62,408 | ||||||||||||

| Gain on sale of real estate | 10,860 | — | ||||||||||||

| Net Income | 30,643 | 15,272 | ||||||||||||

| Less: net income attributable to noncontrolling interests | (1,969) | (717) | ||||||||||||

| Net income attributable to Rexford Industrial Realty, Inc. | 28,674 | 14,555 | ||||||||||||

| Less: preferred stock dividends | (3,636) | (3,636) | ||||||||||||

| Less: earnings allocated to participating securities | (141) | (131) | ||||||||||||

| Net income attributable to common stockholders | $ | 24,897 | $ | 10,788 | ||||||||||

| Net income attributable to common stockholders per share – basic | $ | 0.19 | $ | 0.09 | ||||||||||

| Net income attributable to common stockholders per share – diluted | $ | 0.19 | $ | 0.09 | ||||||||||

| Weighted-average shares of common stock outstanding – basic | 131,612,881 | 114,054,434 | ||||||||||||

| Weighted-average shares of common stock outstanding – diluted | 131,758,744 | 114,314,331 | ||||||||||||

(1)On January 1, 2019, we adopted ASC 842 and, among other practical expedients, elected the “non-separation practical expedient” in ASC 842, which allows us to avoid separating lease and non-lease rental income. As a result of this election, all rental income earned pursuant to tenant leases, including tenant reimbursements, is reflected as one line, “Rental income,” in the consolidated statements of operations. Prior to the adoption of ASC 842, we presented rental revenues, tenant reimbursements and other income related to leases separately in our consolidated statements of operations. Under the section “Rental Income” on page 35 in the definitions section of this report, we include a presentation of rental revenues, tenant reimbursements and other income for all periods because we believe this information is frequently used by management, investors, securities analysts and other interested parties to evaluate our performance.

| First Quarter 2021 Supplemental Financial Reporting Package |

Page 11

|

|

||||||

Non-GAAP FFO and Core FFO Reconciliations. (1)

|

||||||||

| (unaudited and in thousands, except share and per share data) | ||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| March 31, 2021 | December 31, 2020 | September 30, 2020 | June 30, 2020 | March 31, 2020 | |||||||||||||||||||||||||

| Net Income | $ | 30,643 | $ | 18,155 | $ | 31,197 | $ | 16,271 | $ | 15,272 | |||||||||||||||||||

| Add: | |||||||||||||||||||||||||||||

| Depreciation and amortization | 35,144 | 30,554 | 28,811 | 28,381 | 27,523 | ||||||||||||||||||||||||

| Deduct: | |||||||||||||||||||||||||||||

| Gain (loss) on sale of real estate | 10,860 | (52) | 13,669 | — | — | ||||||||||||||||||||||||

NAREIT Defined Funds From Operations (FFO)

|

54,927 | 48,761 | 46,339 | 44,652 | 42,795 | ||||||||||||||||||||||||

| Less: preferred stock dividends | (3,636) | (3,636) | (3,636) | (3,637) | (3,636) | ||||||||||||||||||||||||

Less: FFO attributable to noncontrolling interests(2)

|

(3,134) | (2,182) | (2,017) | (2,005) | (1,450) | ||||||||||||||||||||||||

Less: FFO attributable to participating securities(3)

|

(209) | (188) | (197) | (192) | (195) | ||||||||||||||||||||||||

| Company share of FFO | $ | 47,948 | $ | 42,755 | $ | 40,489 | $ | 38,818 | $ | 37,514 | |||||||||||||||||||

| Company share of FFO per common share‐basic | $ | 0.36 | $ | 0.34 | $ | 0.33 | $ | 0.32 | $ | 0.33 | |||||||||||||||||||

| Company share of FFO per common share‐diluted | $ | 0.36 | $ | 0.34 | $ | 0.33 | $ | 0.32 | $ | 0.33 | |||||||||||||||||||

| FFO | $ | 54,927 | $ | 48,761 | $ | 46,339 | $ | 44,652 | $ | 42,795 | |||||||||||||||||||

| Add: | |||||||||||||||||||||||||||||

| Acquisition expenses | 29 | 35 | 70 | 14 | 5 | ||||||||||||||||||||||||

| Loss on extinguishment of debt | — | 104 | — | — | — | ||||||||||||||||||||||||

| Amortization of loss on termination of interest rate swap | 410 | 218 | — | — | — | ||||||||||||||||||||||||

| Core FFO | 55,366 | 49,118 | 46,409 | 44,666 | 42,800 | ||||||||||||||||||||||||

| Less: preferred stock dividends | (3,636) | (3,636) | (3,636) | (3,637) | (3,636) | ||||||||||||||||||||||||

Less: Core FFO attributable to noncontrolling interests(2)

|

(3,155) | (2,193) | (2,019) | (2,005) | (1,450) | ||||||||||||||||||||||||

Less: Core FFO attributable to participating securities(3)

|

(211) | (190) | (197) | (192) | (195) | ||||||||||||||||||||||||

| Company share of Core FFO | $ | 48,364 | $ | 43,099 | $ | 40,557 | $ | 38,832 | $ | 37,519 | |||||||||||||||||||

| Company share of Core FFO per common share‐basic | $ | 0.37 | $ | 0.34 | $ | 0.33 | $ | 0.32 | $ | 0.33 | |||||||||||||||||||

| Company share of Core FFO per common share‐diluted | $ | 0.37 | $ | 0.34 | $ | 0.33 | $ | 0.32 | $ | 0.33 | |||||||||||||||||||

| Weighted-average shares outstanding-basic | 131,612,881 | 125,995,123 | 123,548,978 | 119,810,283 | 114,054,434 | ||||||||||||||||||||||||

Weighted-average shares outstanding-diluted(4)

|

131,758,744 | 126,401,077 | 123,843,977 | 120,068,176 | 114,314,331 | ||||||||||||||||||||||||

(1)For a definition and discussion of non-GAAP financial measures, see the definitions section beginning on page 32 of this report.

(2)Noncontrolling interests relate to interests in the Company’s operating partnership, represented by common units and preferred units (Series 1 & Series 2 CPOP units) of partnership interests in the operating partnership that are owned by unit holders other than the Company.

(3)Participating securities include unvested shares of restricted stock, unvested LTIP units and unvested performance units.

(4)Weighted-average shares outstanding-diluted includes adjustments for unvested performance units if the effect is dilutive for the reported period.

| First Quarter 2021 Supplemental Financial Reporting Package |

Page 12

|

|

||||||

Non-GAAP FFO and Core FFO Reconciliations. (1)

|

||||||||

| (unaudited and in thousands, except share and per share data) | ||||||||

| Three Months Ended, | ||||||||||||||

| March 31, 2021 | March 31, 2020 | |||||||||||||

| Net Income | $ | 30,643 | $ | 15,272 | ||||||||||

| Add: | ||||||||||||||

| Depreciation and amortization | 35,144 | 27,523 | ||||||||||||

| Deduct: | ||||||||||||||

| Gain on sale of real estate | 10,860 | — | ||||||||||||

| Funds From Operations (FFO) | 54,927 | 42,795 | ||||||||||||

| Less: preferred stock dividends | (3,636) | (3,636) | ||||||||||||

| Less: FFO attributable to noncontrolling interests | (3,134) | (1,450) | ||||||||||||

| Less: FFO attributable to participating securities | (209) | (195) | ||||||||||||

| Company share of FFO | $ | 47,948 | $ | 37,514 | ||||||||||

| Company share of FFO per common share‐basic | $ | 0.36 | $ | 0.33 | ||||||||||

| Company share of FFO per common share‐diluted | $ | 0.36 | $ | 0.33 | ||||||||||

| FFO | $ | 54,927 | $ | 42,795 | ||||||||||

| Add: | ||||||||||||||

| Acquisition expenses | 29 | 5 | ||||||||||||

| Amortization of loss on termination of interest rate swap | 410 | — | ||||||||||||

| Core FFO | 55,366 | 42,800 | ||||||||||||

| Less: preferred stock dividends | (3,636) | (3,636) | ||||||||||||

| Less: Core FFO attributable to noncontrolling interests | (3,155) | (1,450) | ||||||||||||

| Less: Core FFO attributable to participating securities | (211) | (195) | ||||||||||||

| Company share of Core FFO | $ | 48,364 | $ | 37,519 | ||||||||||

| Company share of Core FFO per common share‐basic | $ | 0.37 | $ | 0.33 | ||||||||||

| Company share of Core FFO per common share‐diluted | $ | 0.37 | $ | 0.33 | ||||||||||

| Weighted-average shares outstanding-basic | 131,612,881 | 114,054,434 | ||||||||||||

| Weighted-average shares outstanding-diluted | 131,758,744 | 114,314,331 | ||||||||||||

| First Quarter 2021 Supplemental Financial Reporting Package |

Page 13

|

|

||||||

Non-GAAP AFFO Reconciliation. (1)

|

||||||||

| (unaudited and in thousands, except share and per share data) | ||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| March 31, 2021 | December 31, 2020 | September 30, 2020 | June 30, 2020 | March 31, 2020 | |||||||||||||||||||||||||

Funds From Operations(2)

|

$ | 54,927 | $ | 48,761 | $ | 46,339 | $ | 44,652 | $ | 42,795 | |||||||||||||||||||

| Add: | |||||||||||||||||||||||||||||

| Amortization of deferred financing costs | 447 | 408 | 373 | 381 | 343 | ||||||||||||||||||||||||

| Non-cash stock compensation | 4,261 | 2,491 | 3,101 | 3,709 | 3,570 | ||||||||||||||||||||||||

| Loss on extinguishment of debt | — | 104 | — | — | — | ||||||||||||||||||||||||

| Amortization of loss on termination of interest rate swap | 410 | 218 | — | — | — | ||||||||||||||||||||||||

| Deduct: | |||||||||||||||||||||||||||||

| Preferred stock dividends | 3,636 | 3,636 | 3,636 | 3,637 | 3,636 | ||||||||||||||||||||||||

Straight line rental revenue adjustment(3)

|

4,199 | 434 | 3,088 | 6,212 | 1,672 | ||||||||||||||||||||||||

| Amortization of net below-market lease intangibles | 2,712 | 2,711 | 2,751 | 2,669 | 2,402 | ||||||||||||||||||||||||

Capitalized payments(4)

|

2,322 | 2,149 | 2,442 | 2,355 | 2,067 | ||||||||||||||||||||||||

| Note payable premium amortization | 29 | 47 | 66 | 59 | 16 | ||||||||||||||||||||||||

Recurring capital expenditures(5)

|

2,541 | 2,671 | 1,380 | 1,323 | 1,575 | ||||||||||||||||||||||||

2nd generation tenant improvements and leasing commissions(6)

|

3,528 | 1,741 | 2,243 | 2,000 | 1,727 | ||||||||||||||||||||||||

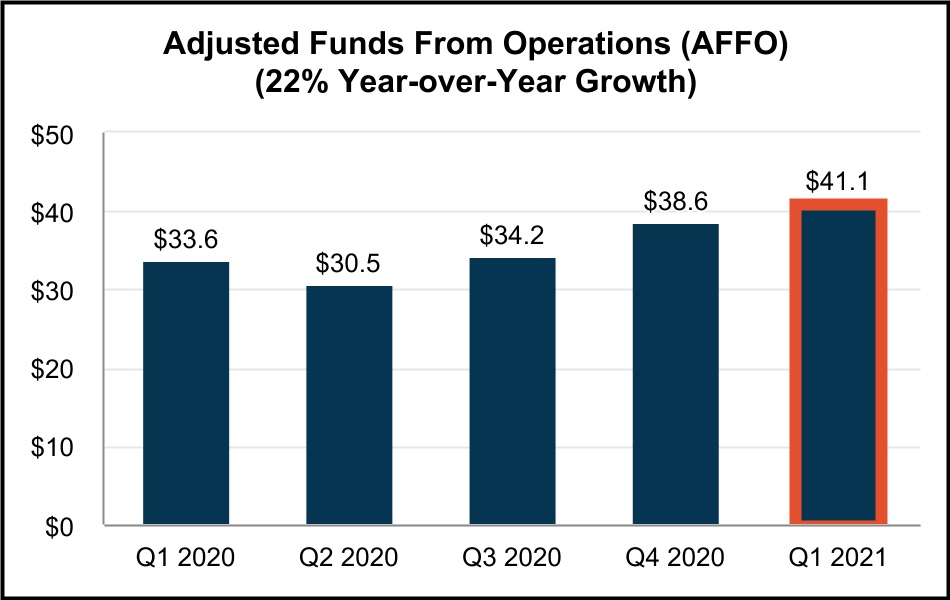

| Adjusted Funds From Operations (AFFO) | $ | 41,078 | $ | 38,593 | $ | 34,207 | $ | 30,487 | $ | 33,613 | |||||||||||||||||||

(1)For a definition and discussion of non-GAAP financial measures, see the definitions section beginning on page 32 of this report.

(2)A reconciliation of net income to Funds From Operations is set forth on page 13 of this report.

(3)The straight line rental revenue adjustment includes concessions of $2,563 (including deferral of $62 of base rent provided by COVID-19 rent relief agreements), $2,358 (including deferral of $250 of base rent provided by COVID-19 rent relief agreements), $2,273 (including deferral of $686 of base rent provided by COVID-19 rent relief agreements), $5,775 (including impact of acceleration of $825 of future concessions and deferral of $3,635 of base rent provided by COVID-19 rent relief agreements), and $1,329 for the three months ended March 31, 2021, December 31, 2020, September 30, 2020, June 30, 2020, and March 31, 2020, respectively.

(4)Includes capitalized interest, taxes, insurance and construction related compensation costs.

(5)Excludes nonrecurring capital expenditures of $16,584, $20,569, $18,835, $14,773 and $12,411 for the three months ended March 31, 2021, December 31, 2020, September 30, 2020, June 30, 2020, and March 31, 2020, respectively.

(6)Excludes 1st generation tenant improvements and leasing commissions of $1,369, $1,327, $1,744, $549 and $831 for the three months ended March 31, 2021, December 31, 2020, September 30, 2020, June 30, 2020, and March 31, 2020, respectively.

| First Quarter 2021 Supplemental Financial Reporting Package |

Page 14

|

|

||||||

Statement of Operations Reconciliations - NOI, Cash NOI, EBITDAre and Adjusted EBITDA. (1)

| ||||||||

| (unaudited and in thousands) | ||||||||

| NOI and Cash NOI | |||||||||||||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| Mar 31, 2021 | Dec 31, 2020 | Sep 30, 2020 | Jun 30, 2020 | Mar 31, 2020 | |||||||||||||||||||||||||

Rental income(2)(3)

|

$ | 99,644 | $ | 88,495 | $ | 83,622 | $ | 79,770 | $ | 77,490 | |||||||||||||||||||

| Property expenses | 23,575 | 22,034 | 20,684 | 18,884 | 18,114 | ||||||||||||||||||||||||

| Net Operating Income (NOI) | $ | 76,069 | $ | 66,461 | $ | 62,938 | $ | 60,886 | $ | 59,376 | |||||||||||||||||||

| Amortization of above/below market lease intangibles | (2,712) | (2,711) | (2,751) | (2,669) | (2,402) | ||||||||||||||||||||||||

| Straight line rental revenue adjustment | (4,199) | (434) | (3,088) | (6,212) | (1,672) | ||||||||||||||||||||||||

| Cash NOI | $ | 69,158 | $ | 63,316 | $ | 57,099 | $ | 52,005 | $ | 55,302 | |||||||||||||||||||

EBITDAre and Adjusted EBITDA

|

|||||||||||||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| Mar 31, 2021 | Dec 31, 2020 | Sep 30, 2020 | Jun 30, 2020 | Mar 31, 2020 | |||||||||||||||||||||||||

| Net income | $ | 30,643 | $ | 18,155 | $ | 31,197 | $ | 16,271 | $ | 15,272 | |||||||||||||||||||

| Interest expense | 9,752 | 8,673 | 7,299 | 7,428 | 7,449 | ||||||||||||||||||||||||

| Depreciation and amortization | 35,144 | 30,554 | 28,811 | 28,381 | 27,523 | ||||||||||||||||||||||||

| (Gain) loss on sale of real estate | (10,860) | 52 | (13,669) | — | — | ||||||||||||||||||||||||

EBITDAre

|

$ | 64,679 | $ | 57,434 | $ | 53,638 | $ | 52,080 | $ | 50,244 | |||||||||||||||||||

| Stock-based compensation amortization | 4,261 | 2,491 | 3,101 | 3,709 | 3,570 | ||||||||||||||||||||||||

| Loss on extinguishment of debt | — | 104 | — | — | — | ||||||||||||||||||||||||

| Acquisition expenses | 29 | 35 | 70 | 14 | 5 | ||||||||||||||||||||||||

Pro forma effect of acquisitions(4)

|

662 | 5,260 | 5 | 179 | 1,747 | ||||||||||||||||||||||||

Pro forma effect of dispositions(5)

|

(110) | 4 | (430) | — | — | ||||||||||||||||||||||||

| Adjusted EBITDA | $ | 69,521 | $ | 65,328 | $ | 56,384 | $ | 55,982 | $ | 55,566 | |||||||||||||||||||

(1)For a definition and discussion of non-GAAP financial measures, see the definitions section beginning on page 32 of this report.

(2)See footnote (1) on page 11 for details related to our presentation of “Rental income” in the consolidated statements of operations for all periods presented.

(3)Reflects (reduction) increase to rental income due to changes in the Company’s assessment of lease payment collectability as follows (in thousands): $(496), $(2,114), $(1,479), $(1,059) and $(395) for the three months ended March 31, 2021, December 31, 2020, September 30, 2020, June 30, 2020, and March 31, 2020, respectively.

(4)Represents the estimated impact on Q1'21 EBITDAre of Q1'21 acquisitions as if they had been acquired on January 1, 2021, the impact on Q4'20 EBITDAre of Q4'20 acquisitions as if they had been acquired on October 1, 2020, the impact on Q3'20 EBITDAre of Q3'20 acquisitions as if they had been acquired on July 1, 2020, the impact on Q2'20 EBITDAre of Q2'20 acquisitions as if they had been acquired on April 1, 2020, and the impact on Q1'20 EBITDAre of Q1'20 acquisitions as if they had been acquired on January 1, 2020. We have made a number of assumptions in such estimates and there can be no assurance that we would have generated the projected levels of EBITDAre had we owned the acquired entities as of the beginning of each period.

(5)Represents the impact on Q1'21 EBITDAre of Q1'21 dispositions as if they had been sold as of January 1, 2021, Q4'20 EBITDAre of Q4'20 dispositions as if they had been sold as of October 1, 2020, and the impact on Q3'20 EBITDAre of Q3'20 dispositions as if they had been sold as of July 1, 2020. We did not sell any properties during Q2'20 or Q1'20.

| First Quarter 2021 Supplemental Financial Reporting Package |

Page 15

|

|

||||||

Stabilized Same Property Portfolio Performance. (1)

|

||||||||

| (unaudited and dollars in thousands) | ||||||||

| Stabilized Same Property Portfolio: | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Number of properties | 195 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Square Feet | 24,720,199 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Stabilized Same Property Portfolio NOI and Cash NOI: | ||||||||||||||||||||||||||

| Three Months Ended March 31, | ||||||||||||||||||||||||||

| 2021 | 2020 | $ Change | % Change | |||||||||||||||||||||||

Rental income(2)(3)(4)

|

$ | 77,348 | $ | 72,966 | $ | 4,382 | 6.0% | |||||||||||||||||||

| Property expenses | 17,354 | 16,796 | 558 | 3.3% | ||||||||||||||||||||||

| Stabilized same property portfolio NOI | $ | 59,994 | $ | 56,170 | $ | 3,824 | 6.8% | (4) |

||||||||||||||||||

| Straight-line rental revenue | (1,756) | (1,680) | (76) | 4.5% | ||||||||||||||||||||||

| Amort. of above/below market lease intangibles | (1,502) | (2,072) | 570 | (27.5)% | ||||||||||||||||||||||

| Stabilized same property portfolio Cash NOI | $ | 56,736 | $ | 52,418 | $ | 4,318 | 8.2% | (4) |

||||||||||||||||||

| Stabilized Same Property Portfolio Occupancy: | ||||||||||||||||||||

| March 31, | ||||||||||||||||||||

| 2021 | 2020 | Change (basis points) | ||||||||||||||||||

Weighted Average Occupancy:(5)

|

||||||||||||||||||||

| Los Angeles County | 98.9% | 98.7% | 20 bps | |||||||||||||||||

| Orange County | 99.3% | 98.3% | 100 bps | |||||||||||||||||

| San Bernardino County | 99.4% | 97.6% | 180 bps | |||||||||||||||||

| Ventura County | 94.6% | 96.5% | (190) bps | |||||||||||||||||

| San Diego County | 96.7% | 96.3% | 40 bps | |||||||||||||||||

| Total Portfolio Weighted Average Occupancy | 98.4% | 98.0% | 40 bps | |||||||||||||||||

| Ending Occupancy: | 98.6% | 98.0% | 60 bps | |||||||||||||||||

(1)For a definition and discussion of non-GAAP financial measures, see the definitions section beginning on page 32 of this report.

(2)See “Stabilized Same Property Portfolio Rental Income” on page 35 of the definitions section of this report for a breakdown of rental income into rental revenues, tenant reimbursement and other income for the three months ended March 31, 2021 and 2020.

(3)Reflects (reduction) increase to rental income due to changes in the Company’s assessment of lease payment collectability as follows (in thousands): $(336) and $(411) for the three months ended March 31, 2021 and 2020, respectively.

(4)Rental income includes lease termination fees of $37 thousand and $120 thousand for the three months ended March 31, 2021 and 2020, respectively. Excluding these lease termination fees, Stabilized Same Property Portfolio NOI increased by approximately 7.0% and Stabilized Same Property Portfolio Cash NOI increased by approximately 8.4% during the three months ended March 31, 2021, compared to the three months ended March 31, 2020, respectively.

(5)Calculated by averaging the occupancy rate at the end of each month in 1Q-2021 and December 2020 (for 1Q-2021) and the end of each month in 1Q-2020 and December 2019 (for 1Q-2020).

| First Quarter 2021 Supplemental Financial Reporting Package |

Page 16

|

|

||||||

Capitalization Summary.

|

||||||||

| (unaudited and in thousands, except share and per share data) | ||||||||

| Capitalization as of March 31, 2021 | ||||||||

| Description | March 31, 2021 | December 31, 2020 | September 30, 2020 | June 30, 2020 | March 31, 2020 | |||||||||||||||||||||||||||

Common shares outstanding(1)

|

133,657,612 | 131,193,139 | 123,551,852 | 123,546,160 | 116,087,092 | |||||||||||||||||||||||||||

Operating partnership units outstanding(2)

|

6,641,742 | 6,606,693 | 3,903,509 | 3,908,476 | 3,917,284 | |||||||||||||||||||||||||||

| Total shares and units outstanding at period end | 140,299,354 | 137,799,832 | 127,455,361 | 127,454,636 | 120,004,376 | |||||||||||||||||||||||||||

| Share price at end of quarter | $ | 50.40 | $ | 49.11 | $ | 45.76 | $ | 41.43 | $ | 41.01 | ||||||||||||||||||||||

| Common Stock and Operating Partnership Units - Capitalization | $ | 7,071,087 | $ | 6,767,350 | $ | 5,832,357 | $ | 5,280,446 | $ | 4,921,379 | ||||||||||||||||||||||

Series A, B and C Cumulative Redeemable Preferred Stock(3)

|

$ | 251,250 | $ | 251,250 | $ | 251,250 | $ | 251,250 | $ | 251,250 | ||||||||||||||||||||||

4.43937% Series 1 Cumulative Redeemable Convertible Preferred Units(4)

|

27,031 | 27,031 | 27,031 | 27,031 | 27,031 | |||||||||||||||||||||||||||

4.00% Series 2 Cumulative Redeemable Convertible Preferred Units(4)

|

40,787 | 40,787 | 40,787 | 40,787 | 40,787 | |||||||||||||||||||||||||||

| Preferred Equity | $ | 319,068 | $ | 319,068 | $ | 319,068 | $ | 319,068 | $ | 319,068 | ||||||||||||||||||||||

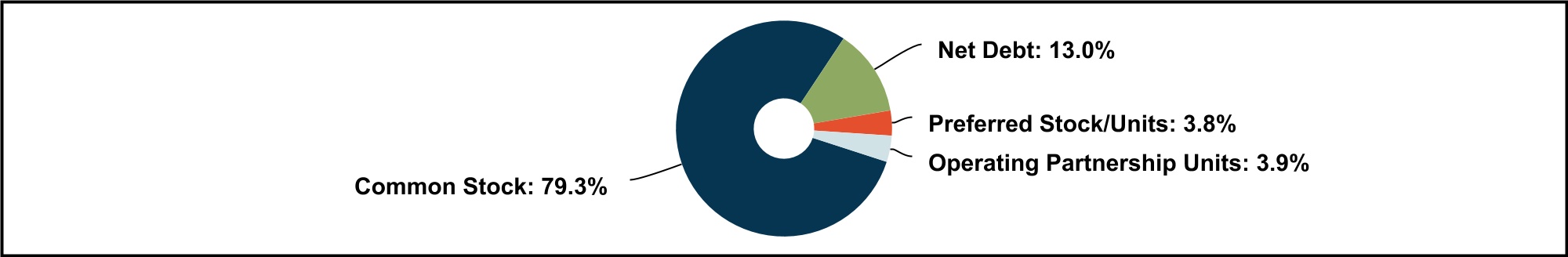

| Total Equity Market Capitalization | $ | 7,390,155 | $ | 7,086,418 | $ | 6,151,425 | $ | 5,599,514 | $ | 5,240,447 | ||||||||||||||||||||||

| Total Debt | $ | 1,226,415 | $ | 1,223,494 | $ | 908,046 | $ | 908,250 | $ | 905,645 | ||||||||||||||||||||||

| Less: Cash and cash equivalents | (123,933) | (176,293) | (243,619) | (254,373) | (112,432) | |||||||||||||||||||||||||||

| Net Debt | $ | 1,102,482 | $ | 1,047,201 | $ | 664,427 | $ | 653,877 | $ | 793,213 | ||||||||||||||||||||||

| Total Combined Market Capitalization (Net Debt plus Equity) | $ | 8,492,637 | $ | 8,133,619 | $ | 6,815,852 | $ | 6,253,391 | $ | 6,033,660 | ||||||||||||||||||||||

| Net debt to total combined market capitalization | 13.0 | % | 12.9 | % | 9.7 | % | 10.5 | % | 13.1 | % | ||||||||||||||||||||||

Net debt to Adjusted EBITDA (quarterly results annualized)(5)

|

4.0x | 4.0x | 2.9x | 2.9x | 3.6x | |||||||||||||||||||||||||||

Net debt & preferred equity to Adjusted EBITDA (quarterly results annualized)(5)

|

5.1x | 5.2x | 4.4x | 4.3x | 5.0x | |||||||||||||||||||||||||||

(1)Excludes the following number of shares of unvested restricted stock: 239,748 (Mar 31, 2021), 232,899 (Dec 31, 2020), 236,739 (Sep 30, 2020), 243,039 (Jun 30, 2020) and 244,255 (Mar 31, 2020).

(2)Represents outstanding common units of the Company’s operating partnership (“OP”), Rexford Industrial Realty, LP, that are owned by unitholders other than Rexford Industrial Realty, Inc. Represents the noncontrolling interest in our OP. As of Mar 31, 2021, includes 625,026 vested LTIP Units & 614,022 vested performance units & excludes 255,913 unvested LTIP Units & 905,732 unvested performance units.

(3)Values based on liquidation preference of $25 per share and the following number of outstanding shares of preferred stock: 5.875% Series A (3,600,000); 5.875% Series B (3,000,000); 5.625% Series C (3,450,000).

(4)Value based on 593,960 outstanding Series 1 preferred units at a liquidation preference of $45.50952 per unit and 906,374 outstanding Series 2 preferred units at a liquidation preference of $45.00 per unit.

(5)For a definition and discussion of non-GAAP financial measures, see the definitions section beginning on page 32 of this report.

| First Quarter 2021 Supplemental Financial Reporting Package |

Page 17

|

|

||||||

Debt Summary.

|

||||||||

| (unaudited and dollars in thousands) | ||||||||

| Debt Detail: | ||||||||||||||||||||||||||||||||

| As of March 31, 2021 | ||||||||||||||||||||||||||||||||

| Debt Description | Maturity Date | Stated Interest Rate |

Effective Interest Rate(1)

|

Principal Balance(2)

|

Expiration Date of Effective Swaps | |||||||||||||||||||||||||||

| Unsecured Debt: | ||||||||||||||||||||||||||||||||

$500M Revolving Credit Facility(3)

|

2/13/2024(4)

|

LIBOR +0.85%(5)

|

0.961% | $ | — | |||||||||||||||||||||||||||

| $225M Term Loan Facility | 1/14/2023 |

LIBOR +1.10%(5)

|

2.474% | 225,000 | 1/14/2022 | |||||||||||||||||||||||||||

| $150M Term Loan Facility | 5/22/2025 |

LIBOR +1.55%(5)

|

4.313% | 150,000 | 11/22/2024 | |||||||||||||||||||||||||||

| $100M Senior Notes | 8/6/2025 | 4.290% | 4.290% | 100,000 | ||||||||||||||||||||||||||||

| $125M Senior Notes | 7/13/2027 | 3.930% | 3.930% | 125,000 | ||||||||||||||||||||||||||||

| $25M Series 2019A Senior Notes | 7/16/2029 | 3.880% | 3.880% | 25,000 | ||||||||||||||||||||||||||||

| $400M Senior Notes | 12/1/2030 | 2.125% | 2.125% | 400,000 | ||||||||||||||||||||||||||||

| $75M Series 2019B Senior Notes | 7/16/2034 | 4.030% | 4.030% | 75,000 | ||||||||||||||||||||||||||||

| Secured Debt: | ||||||||||||||||||||||||||||||||

| 2601-2641 Manhattan Beach Boulevard | 4/5/2023 | 4.080% | 4.080% | 4,037 | ||||||||||||||||||||||||||||

| $60M Term Loan |

8/1/2023(6)

|

LIBOR + 1.70% | 1.811% | 58,499 | ||||||||||||||||||||||||||||

| 960-970 Knox Street | 11/1/2023 | 5.000% | 5.000% | 2,466 | ||||||||||||||||||||||||||||

| 7612-7642 Woodwind Drive | 1/5/2024 | 5.240% | 5.240% | 3,874 | ||||||||||||||||||||||||||||

| 11600 Los Nietos Road | 5/1/2024 | 4.190% | 4.190% | 2,745 | ||||||||||||||||||||||||||||

| 5160 Richton Street | 11/15/2024 | 3.790% | 3.790% | 4,359 | ||||||||||||||||||||||||||||

| 22895 Eastpark Drive | 11/15/2024 | 4.330% | 4.330% | 2,733 | ||||||||||||||||||||||||||||

| 701-751 Kingshill Place | 1/5/2026 | 3.900% | 3.900% | 7,100 | ||||||||||||||||||||||||||||

| 13943-13955 Balboa Boulevard | 7/1/2027 | 3.930% | 3.930% | 15,577 | ||||||||||||||||||||||||||||

| 2205 126th Street | 12/1/2027 | 3.910% | 3.910% | 5,200 | ||||||||||||||||||||||||||||

| 2410-2420 Santa Fe Avenue | 1/1/2028 | 3.700% | 3.700% | 10,300 | ||||||||||||||||||||||||||||

| 11832-11954 La Cienega Boulevard | 7/1/2028 | 4.260% | 4.260% | 4,054 | ||||||||||||||||||||||||||||

| 1100-1170 Gilbert Street (Gilbert/La Palma) | 3/1/2031 | 5.125% | 5.125% | 2,250 | ||||||||||||||||||||||||||||

| 7817 Woodley Avenue | 8/1/2039 | 4.140% | 4.140% | 3,221 | ||||||||||||||||||||||||||||

| 3.064% | $ | 1,226,415 | ||||||||||||||||||||||||||||||

| Debt Composition: | ||||||||||||||||||||||||||||||||

| Category |

Weighted Average Term Remaining (yrs)(7)

|

Stated Interest Rate | Effective Interest Rate | Balance | % of Total | |||||||||||||||||||||||||||

| Fixed | 6.6 | 3.13% | 3.13% | $ | 1,167,916 | 95% | ||||||||||||||||||||||||||

| Variable | 2.3 | LIBOR + 1.70% | 1.81% | $ | 58,499 | 5% | ||||||||||||||||||||||||||

| Secured | 4.3 | 3.04% | $ | 126,415 | 10% | |||||||||||||||||||||||||||

| Unsecured | 6.7 | 3.07% | $ | 1,100,000 | 90% | |||||||||||||||||||||||||||

*See footnotes on the following page*

| First Quarter 2021 Supplemental Financial Reporting Package |

Page 18

|

|

||||||

Debt Summary (Continued).

|

||||||||

| (unaudited and dollars in thousands) | ||||||||

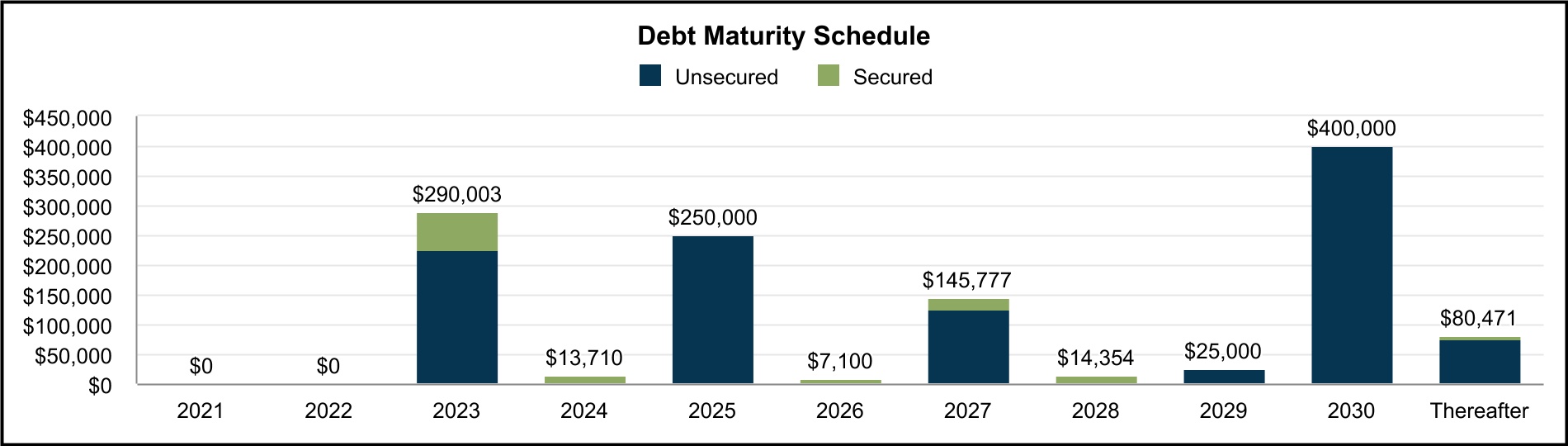

| Debt Maturity Schedule: | ||||||||||||||||||||||||||||||||

| Year |

Secured(8)

|

Unsecured | Total | % Total | Effective Interest Rate | |||||||||||||||||||||||||||

| 2021 | $ | — | $ | — | $ | — | — | % | — | % | ||||||||||||||||||||||

| 2022 | — | — | — | — | % | — | % | |||||||||||||||||||||||||

| 2023 | 65,003 | 225,000 | 290,003 | 24 | % | 2.384 | % | |||||||||||||||||||||||||

| 2024 | 13,710 | — | 13,710 | 1 | % | 4.387 | % | |||||||||||||||||||||||||

| 2025 | — | 250,000 | 250,000 | 20 | % | 4.304 | % | |||||||||||||||||||||||||

| 2026 | 7,100 | — | 7,100 | 1 | % | 3.900 | % | |||||||||||||||||||||||||

| 2027 | 20,777 | 125,000 | 145,777 | 12 | % | 3.929 | % | |||||||||||||||||||||||||

| 2028 | 14,354 | — | 14,354 | 1 | % | 3.858 | % | |||||||||||||||||||||||||

| 2029 | — | 25,000 | 25,000 | 2 | % | 3.880 | % | |||||||||||||||||||||||||

| 2030 | — | 400,000 | 400,000 | 33 | % | 2.125 | % | |||||||||||||||||||||||||

| Thereafter | 5,471 | 75,000 | 80,471 | 6 | % | 4.065 | % | |||||||||||||||||||||||||

| Total | $ | 126,415 | $ | 1,100,000 | $ | 1,226,415 | 100 | % | 3.064 | % | ||||||||||||||||||||||

(1)Includes the effect of interest rate swaps effective as of March 31, 2021, and excludes the effect of premiums/discounts, deferred loan costs and the credit facility fee.

(2)Excludes unamortized debt issuance costs, premiums and discounts aggregating $7.0 million as of March 31, 2021.

(3)The credit facility is subject to a facility fee which is calculated as a percentage of the total commitment amount, regardless of usage. The facility fee ranges from 0.125% to 0.300% depending on our investment grade rating. As March 31, 2021, the facility fee rate is 0.200%.

(4)Two additional six-month extensions are available, provided that certain conditions are satisfied.

(5)The applicable LIBOR margin ranges from 0.725% to 1.400% for the revolving credit facility, 0.90% to 1.75% for the $225M term loan facility and 1.40% to 2.35% for the $150M term loan facility depending on our investment grade rating, which is subject to change. As a result, the effective interest rate for these loans can fluctuate from period to period.

(6)One two-year extension is available, provided that certain conditions are satisfied.

(7)The weighted average remaining term to maturity of our consolidated debt is 6.4 years.

(8)Excludes the effect of scheduled monthly principal payments on amortizing loans.

| First Quarter 2021 Supplemental Financial Reporting Package |

Page 19

|

|

||||||

Operations.

|

||||||||

| Quarterly Results | ||||||||

| First Quarter 2021 Supplemental Financial Reporting Package |

Page 20

|

|

||||||

Portfolio Overview.

|

||||||||

| At March 31, 2021 | (unaudited results) | |||||||

| Consolidated Portfolio: | ||||||||

| Rentable Square Feet | Ending Occupancy % |

In-Place ABR(2)

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Market | # Properties | Stabilized Same Properties Portfolio | Non-Stabilized Same Properties Portfolio | Total Portfolio | Stabilized Same Properties Portfolio | Non-Stabilized Same Properties Portfolio | Total Portfolio |

Total Portfolio Excluding Repositioning(1)

|

Total (in 000’s) |

Per Square Foot | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Central LA | 16 | 1,892,144 | 657,530 | 2,549,674 | 99.5 | % | 100.0 | % | 99.6 | % | 99.6 | % | $ | 24,084 | $9.48 | |||||||||||||||||||||||||||||||||||||||||||||||

| Greater San Fernando Valley | 47 | 3,758,135 | 1,369,890 | 5,128,025 | 99.1 | % | 90.5 | % | 96.8 | % | 98.2 | % | 56,264 | $11.33 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Mid-Counties | 21 | 1,000,336 | 1,549,038 | 2,549,374 | 98.6 | % | 78.7 | % | 86.5 | % | 94.8 | % | 24,254 | $11.00 | ||||||||||||||||||||||||||||||||||||||||||||||||

| San Gabriel Valley | 23 | 3,314,010 | 235,127 | 3,549,137 | 99.8 | % | 70.0 | % | 97.8 | % | 99.8 | % | 30,370 | $8.75 | ||||||||||||||||||||||||||||||||||||||||||||||||

| South Bay | 41 | 3,070,976 | 1,378,199 | 4,449,175 | 98.5 | % | 86.0 | % | 94.7 | % | 98.0 | % | 48,804 | $11.59 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Los Angeles County | 148 | 13,035,601 | 5,189,784 | 18,225,385 | 99.2 | % | 86.1 | % | 95.4 | % | 98.2 | % | 183,776 | $10.57 | ||||||||||||||||||||||||||||||||||||||||||||||||

| North Orange County | 13 | 1,150,348 | 179,127 | 1,329,475 | 99.1 | % | 100.0 | % | 99.2 | % | 99.2 | % | 13,505 | $10.24 | ||||||||||||||||||||||||||||||||||||||||||||||||

| OC Airport | 7 | 463,373 | 122,060 | 585,433 | 98.9 | % | 100.0 | % | 99.1 | % | 99.1 | % | 7,010 | $12.08 | ||||||||||||||||||||||||||||||||||||||||||||||||

| South Orange County | 4 | 329,458 | 27,960 | 357,418 | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 3,681 | $10.30 | ||||||||||||||||||||||||||||||||||||||||||||||||

| West Orange County | 8 | 939,996 | 183,177 | 1,123,173 | 100.0 | % | 34.1 | % | 89.2 | % | 100.0 | % | 9,358 | $9.34 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Orange County | 32 | 2,883,175 | 512,324 | 3,395,499 | 99.5 | % | 76.4 | % | 96.0 | % | 99.5 | % | 33,554 | $10.30 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Inland Empire East | 1 | 33,258 | — | 33,258 | 100.0 | % | — | % | 100.0 | % | 100.0 | % | 222 | $6.69 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Inland Empire West | 29 | 3,658,089 | 1,425,645 | 5,083,734 | 99.7 | % | 94.2 | % | 98.1 | % | 99.8 | % | 45,027 | $9.03 | ||||||||||||||||||||||||||||||||||||||||||||||||

| San Bernardino County | 30 | 3,691,347 | 1,425,645 | 5,116,992 | 99.7 | % | 94.2 | % | 98.1 | % | 99.8 | % | 45,249 | $9.01 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Ventura | 16 | 2,403,672 | — | 2,403,672 | 94.9 | % | — | % | 94.9 | % | 94.9 | % | 23,173 | $10.16 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Ventura County | 16 | 2,403,672 | — | 2,403,672 | 94.9 | % | — | % | 94.9 | % | 94.9 | % | 23,173 | $10.16 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Central San Diego | 17 | 1,190,294 | 239,869 | 1,430,163 | 97.5 | % | 65.2 | % | 92.1 | % | 98.4 | % | 18,158 | $13.79 | ||||||||||||||||||||||||||||||||||||||||||||||||

| North County San Diego | 14 | 1,516,110 | — | 1,516,110 | 96.0 | % | — | % | 96.0 | % | 96.0 | % | 17,193 | $11.81 | ||||||||||||||||||||||||||||||||||||||||||||||||

| San Diego County | 31 | 2,706,404 | 239,869 | 2,946,273 | 96.7 | % | 65.2 | % | 94.1 | % | 97.1 | % | 35,351 | $12.75 | ||||||||||||||||||||||||||||||||||||||||||||||||

| CONSOLIDATED TOTAL / WTD AVG | 257 | 24,720,199 | 7,367,622 | 32,087,821 | 98.6 | % | 86.3 | % | 95.8 | % | 98.3 | % | $ | 321,103 | $10.45 | |||||||||||||||||||||||||||||||||||||||||||||||

(1)Excludes space aggregating 812,302 square feet at our properties that were in various stages of repositioning, redevelopment or lease-up as of March 31, 2021. See pages 27-28 for additional details on these properties.

(2)See page 32 for definition and details on how these amounts are calculated.

| First Quarter 2021 Supplemental Financial Reporting Package |

Page 21

|

|

||||||

Occupancy and Leasing Trends.

|

||||||||

| (unaudited results, data represents consolidated portfolio only) | ||||||||

| Occupancy by County: | ||||||||

| Mar 31, 2021 | Dec 31, 2020 | Sep 30, 2020 | Jun 30, 2020 | Mar 31, 2020 | ||||||||||||||||||||||||||||

Ending Occupancy:(1)

|

||||||||||||||||||||||||||||||||

| Los Angeles County | 95.4% | 97.2% | 98.2% | 97.3% | 97.2% | |||||||||||||||||||||||||||

| Orange County | 96.0% | 95.7% | 94.4% | 91.6% | 91.2% | |||||||||||||||||||||||||||

| San Bernardino County | 98.1% | 87.5% | 96.8% | 95.6% | 96.9% | |||||||||||||||||||||||||||

| Ventura County | 94.9% | 94.6% | 96.3% | 95.0% | 96.8% | |||||||||||||||||||||||||||

| San Diego County | 94.1% | 95.9% | 96.3% | 90.3% | 90.5% | |||||||||||||||||||||||||||

| Total/Weighted Average | 95.8% | 95.2% | 97.2% | 95.4% | 95.6% | |||||||||||||||||||||||||||

| Consolidated Portfolio RSF | 32,087,821 | 31,501,111 | 27,711,078 | 27,633,778 | 27,303,260 | |||||||||||||||||||||||||||

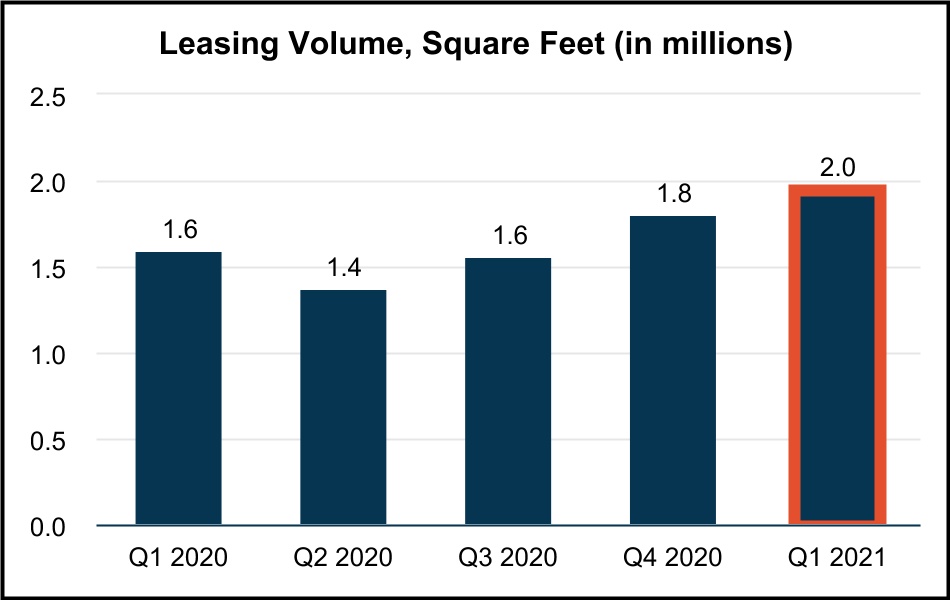

| Leasing Activity: | ||||||||||||||||||||||||||||||||

| Three Months Ended | ||||||||||||||||||||||||||||||||

| Mar 31, 2021 | Dec 31, 2020 | Sep 30, 2020 | Jun 30, 2020 | Mar 31, 2020 | ||||||||||||||||||||||||||||

Leasing Activity (SF):(2)

|

||||||||||||||||||||||||||||||||

New leases(2)

|

909,694 | 672,134 | 987,176 | 550,977 | 424,435 | |||||||||||||||||||||||||||

Renewal leases(2)

|

1,049,547 | 1,132,687 | 575,003 | 818,529 | 1,169,923 | |||||||||||||||||||||||||||

| Gross leasing | 1,959,241 | 1,804,821 | 1,562,179 | 1,369,506 | 1,594,358 | |||||||||||||||||||||||||||

| Expiring leases | 1,392,181 | 1,839,669 | 998,277 | 1,328,499 | 1,486,424 | |||||||||||||||||||||||||||

| Expiring leases - placed into repositioning | 389,486 | 13,020 | — | — | 198,762 | |||||||||||||||||||||||||||

| Net absorption | 177,574 | (47,868) | 563,902 | 41,007 | (90,828) | |||||||||||||||||||||||||||

Retention rate(3)

|

79 | % | 79 | % | 68 | % | 67 | % | 81 | % | ||||||||||||||||||||||

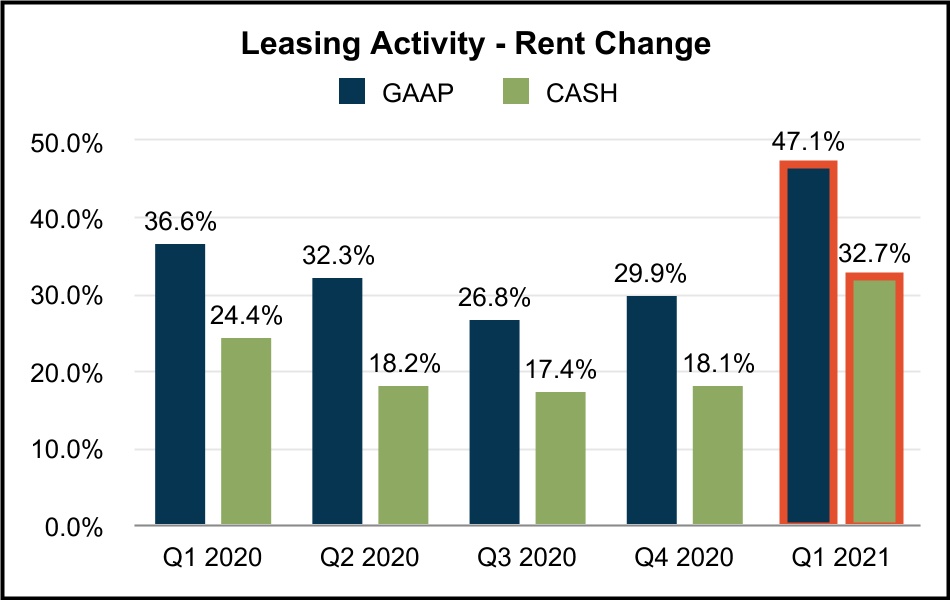

| Weighted Average New / Renewal Leasing Spreads: | ||||||||||||||||||||||||||||||||

| Three Months Ended | ||||||||||||||||||||||||||||||||

| Mar 31, 2021 | Dec 31, 2020 | Sep 30, 2020 | Jun 30, 2020 | Mar 31, 2020 | ||||||||||||||||||||||||||||

| GAAP Rent Change | 47.1% | 29.9% | 26.8% | 32.3% | 36.6% | |||||||||||||||||||||||||||

| Cash Rent Change | 32.7% | 18.1% | 17.4% | 18.2% | 24.4% | |||||||||||||||||||||||||||

(1)See page 21 for the ending occupancy by County of our total consolidated portfolio excluding repositioning space.

(2)Excludes month-to-month tenants.

(3)Retention rate is calculated as renewal lease square footage plus relocation/expansion square footage, divided by expiring lease square footage. Retention excludes square footage related to the following: (i) expiring leases associated with space that is placed into repositioning after the tenant vacates, (ii) early terminations with prenegotiated replacement leases and (iii) move outs where space is directly leased by subtenants.

| First Quarter 2021 Supplemental Financial Reporting Package |

Page 22

|

|

||||||

Leasing Statistics.

|

||||||||

| (unaudited results, data represents consolidated portfolio only) | ||||||||

| Leasing Activity: | ||||||||

| # Leases Signed | SF of Leasing | Weighted Average Lease Term (Years) | ||||||||||||||||||

| First Quarter 2021: | ||||||||||||||||||||

| New | 52 | 909,694 | 5.2 | |||||||||||||||||

| Renewal | 70 | 1,049,547 | 4.6 | |||||||||||||||||

| Total/Weighted Average | 122 | 1,959,241 | 4.9 | |||||||||||||||||

| Change in Annual Rental Rates and Turnover Costs for Current Quarter Leases: | ||||||||||||||||||||||||||||||||||||||||||||||||||

| GAAP Rent | Cash Rent | |||||||||||||||||||||||||||||||||||||||||||||||||

| First Quarter 2021: | Current Lease | Prior Lease | Rent Change - GAAP | Weighted Avg. Abatement (Months) | Starting Cash Rent - Current Lease | Expiring Cash Rent - Prior Lease | Rent Change - Cash |

Turnover Costs per SF(2)

|

||||||||||||||||||||||||||||||||||||||||||

New(1)

|

$13.71 | $9.54 | 43.8% | 1.6 | $13.02 | $10.27 | 26.7% | $5.65 | ||||||||||||||||||||||||||||||||||||||||||

| Renewal | $12.71 | $8.56 | 48.5% | 1.5 | $12.41 | $9.17 | 35.4% | $1.60 | ||||||||||||||||||||||||||||||||||||||||||

| Weighted Average | $13.00 | $8.84 | 47.1% | 1.5 | $12.58 | $9.48 | 32.7% | $2.77 | ||||||||||||||||||||||||||||||||||||||||||

| Uncommenced Leases by County: | ||||||||||||||||||||||||||||||||||||||

| Market |

Uncommenced Renewal Leases: Leased SF(3)

|

Uncommenced New Leases: Leased SF(3)

|

Percent Leased |

ABR Under Uncommenced Leases

(in thousands)(4)(5)

|

In-Place + Uncommenced ABR

(in thousands)(4)(5)

|

In-Place + Uncommenced ABR

per SF(5)

|

||||||||||||||||||||||||||||||||

| Los Angeles County | 799,294 | 62,984 | 95.3% | $ | 1,345 | $ | 184,177 | $10.61 | ||||||||||||||||||||||||||||||

| Orange County | 135,442 | — | 98.7% | 369 | 34,866 | $10.40 | ||||||||||||||||||||||||||||||||

| San Bernardino County | 78,798 | — | 98.1% | 178 | 45,427 | $9.05 | ||||||||||||||||||||||||||||||||

| San Diego County | 119,202 | 1,138 | 94.2% | 272 | 35,624 | $12.84 | ||||||||||||||||||||||||||||||||

| Ventura County | 33,748 | 47,884 | 96.9% | 509 | 23,682 | $10.17 | ||||||||||||||||||||||||||||||||

| Total/Weighted Average | 1,166,484 | 112,006 | 96.1% | $ | 2,673 | $ | 323,776 | $10.50 | ||||||||||||||||||||||||||||||

(1)GAAP and cash rent statistics and turnover costs for new leases exclude 14 leases aggregating 525,431 RSF for which there was no comparable lease data. Of these 14 excluded leases, four leases for 253,455 RSF related to current year significant repositioning/redevelopment properties. Comparable leases generally exclude: (i) space that has never been occupied under our ownership, (ii) repositioned/redeveloped space, (iii) space that has been vacant for over one year or (iv) lease terms shorter than six months.

(2)Turnover costs include estimated tenant improvement and leasing costs associated with leases executed during the current period. Excludes costs for first generation leases.

(3)Reflects the square footage of renewal and new leases, respectively, that have been signed but have not yet commenced as of March 31, 2021.

(4)Includes $1.5 million of annualized base rent under Uncommenced New Leases and $1.2 million of incremental annualized base rent under Uncommenced Renewal Leases.

(5)See page 32 for further details on how these amounts are calculated.

| First Quarter 2021 Supplemental Financial Reporting Package |

Page 23

|

|

||||||

Leasing Statistics (Continued).

|

||||||||

| (unaudited results, data represents consolidated portfolio only) | ||||||||

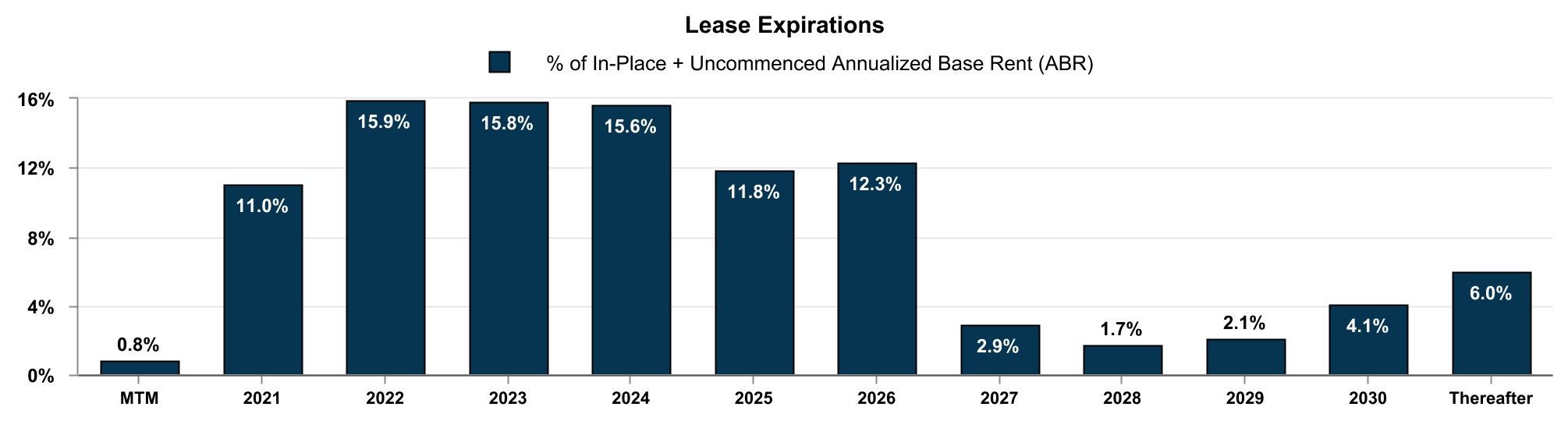

| Lease Expiration Schedule as of March 31, 2021: | ||||||||

| Year of Lease Expiration | # of Leases Expiring | Total Rentable Square Feet | In-Place + Uncommenced ABR (in thousands) |

In-Place + Uncommenced ABR per SF |

||||||||||||||||||||||

| Available | — | 577,031 | $ | — | $— | |||||||||||||||||||||

Repositioning/Redevelopment(1)

|

— | 668,334 | — | $— | ||||||||||||||||||||||

| MTM Tenants | 22 | 163,496 | 2,728 | $16.68 | ||||||||||||||||||||||

| 2021 | 274 | 3,602,125 | 35,477 | $9.85 | ||||||||||||||||||||||

| 2022 | 400 | 4,644,177 | 51,568 | $11.10 | ||||||||||||||||||||||

| 2023 | 341 | 4,481,064 | 50,987 | $11.38 | ||||||||||||||||||||||

| 2024 | 214 | 4,893,209 | 50,431 | $10.31 | ||||||||||||||||||||||

| 2025 | 118 | 3,823,586 | 38,130 | $9.97 | ||||||||||||||||||||||

| 2026 | 81 | 4,203,229 | 39,942 | $9.50 | ||||||||||||||||||||||

| 2027 | 14 | 934,640 | 9,387 | $10.04 | ||||||||||||||||||||||

| 2028 | 11 | 591,074 | 5,551 | $9.39 | ||||||||||||||||||||||

| 2029 | 9 | 550,549 | 6,894 | $12.52 | ||||||||||||||||||||||

| 2030 | 11 | 1,212,453 | 13,184 | $10.87 | ||||||||||||||||||||||

| Thereafter | 20 | 1,742,854 | 19,497 | $11.19 | ||||||||||||||||||||||

| Total Portfolio | 1,515 | 32,087,821 | $ | 323,776 | $10.50 | |||||||||||||||||||||

(1)Represents vacant space at properties that were classified as repositioning or redevelopment as of March 31, 2021. Excludes completed or pre-leased repositioning/redevelopment properties and properties in lease-up. See pages 27-28 for additional details on these properties.

| First Quarter 2021 Supplemental Financial Reporting Package |

Page 24

|

|

||||||

Top Tenants and Lease Segmentation.

|

||||||||

| (unaudited results, data represents consolidated portfolio only) | ||||||||

| Top 20 Tenants: | ||||||||

| Tenant | Submarket | Leased Rentable SF |

% of In-Place + Uncommenced ABR | In-Place + Uncommenced ABR per SF |

Lease Expiration | |||||||||||||||||||||||||||

| Federal Express Corporation |

Multiple Submarkets(1)

|

527,861 | 2.5% |

$15.87(1)

|

11/30/2032 (1)

|

|||||||||||||||||||||||||||

| Unified Natural Foods, Inc. | Central LA | 695,120 | 1.7% | $7.76 | 5/8/2038 | |||||||||||||||||||||||||||

| Michael Kors (USA), Inc. | Mid-Counties | 565,619 | 1.6% | $8.94 | 11/30/2026 | |||||||||||||||||||||||||||

| Cosmetic Laboratories of America, LLC | Greater San Fernando Valley | 319,348 | 0.8% | $8.64 | 6/30/2027 | |||||||||||||||||||||||||||

| Global Mail. Inc. | Mid-Counties | 240,959 | 0.8% | $10.68 | 6/30/2030 | |||||||||||||||||||||||||||

| Omega/Cinema Props, Inc. | Central LA | 246,588 | 0.8% | $10.02 | 12/31/2029 | |||||||||||||||||||||||||||

| 32 Cold, LLC | Central LA | 149,157 | 0.7% | $16.00 |

3/31/2026 (2)

|

|||||||||||||||||||||||||||

| Dendreon Pharmaceuticals, LLC | West Orange County | 184,000 | 0.7% | $12.36 | 2/28/2030 | |||||||||||||||||||||||||||

| Command Logistic Services | South Bay | 228,903 | 0.7% | $9.60 | 9/30/2025 | |||||||||||||||||||||||||||

| Lumber Liquidators Services, LLC | San Gabriel Valley | 504,016 | 0.6% | $4.14 | 11/30/2024 | |||||||||||||||||||||||||||

| Top 10 Tenants | 3,661,571 | 10.9% | $9.64 | |||||||||||||||||||||||||||||

| Top 11 - 20 Tenants | 2,166,974 | 5.9% | $8.80 | |||||||||||||||||||||||||||||

| Total Top 20 Tenants | 5,828,545 | 16.8% | $9.32 | |||||||||||||||||||||||||||||

(1)Includes (i) one land lease in North Orange County expiring October 31, 2026, (ii) 30,160 RSF in Ventura expiring September 30, 2027, (iii) one land lease in LA - Mid-Counties expiring June 30, 2029, (iv) 42,270 RSF in LA - South Bay expiring October 31, 2030, (v) 311,995 RSF in North County San Diego expiring February 28, 2031, and (vi) 143,436 RSF in LA - South Bay expiring November 30, 2032.

(2)Includes (i) 78,280 RSF expiring September 30, 2025, and (ii) 70,877 RSF expiring March 31, 2026.

| Lease Segmentation by Size: | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Square Feet | Number of Leases | Leased Rentable SF | Rentable Square Feet | Leased % | Leased % Excluding Repositioning |

In-Place + Uncommenced ABR

(in thousands)(1)

|

% of In-Place + Uncommenced ABR |

In-Place + Uncommenced ABR

per SF(1)

|

||||||||||||||||||||||||||||||||||||||||||

| <4,999 | 680 | 1,532,181 | 1,705,668 | 89.8% | 93.3% | $ | 25,108 | 7.8% | $16.39 | |||||||||||||||||||||||||||||||||||||||||

| 5,000 - 9,999 | 227 | 1,620,287 | 1,773,533 | 91.4% | 95.0% | 21,803 | 6.7% | $13.46 | ||||||||||||||||||||||||||||||||||||||||||

| 10,000 - 24,999 | 311 | 5,003,614 | 5,260,543 | 95.1% | 97.3% | 61,995 | 19.2% | $12.39 | ||||||||||||||||||||||||||||||||||||||||||

| 25,000 - 49,999 | 145 | 5,251,290 | 5,442,692 | 96.5% | 98.9% | 56,394 | 17.4% | $10.74 | ||||||||||||||||||||||||||||||||||||||||||

| >50,000 | 152 | 17,435,084 | 17,905,385 | 97.4% | 99.4% | 158,476 | 48.9% | $9.09 | ||||||||||||||||||||||||||||||||||||||||||

| Total / Weighted Average | 1,515 | 30,842,456 | 32,087,821 | 96.1% | 98.4% | $ | 323,776 | 100.0% | $10.50 | |||||||||||||||||||||||||||||||||||||||||

(1)See page 32 for further details on how these amounts are calculated.

| First Quarter 2021 Supplemental Financial Reporting Package |

Page 25

|

|

||||||

Capital Expenditure Summary.

|

||||||||

| (unaudited results, in thousands, except square feet and per square foot data) | ||||||||

| Three Months Ended March 31, 2021 | ||||||||

| Year to Date | ||||||||||||||||||||

| Total |

SF(1)

|

PSF | ||||||||||||||||||

| Tenant Improvements: | ||||||||||||||||||||

| New Leases‐1st Generation | $ | 353 | 262,025 | $ | 1.35 | |||||||||||||||

| New Leases‐2nd Generation | 4 | 27,125 | $ | 0.15 | ||||||||||||||||

| Renewals | 58 | 267,945 | $ | 0.22 | ||||||||||||||||

| Total Tenant Improvements | $ | 415 | ||||||||||||||||||

| Leasing Commissions & Lease Costs: | ||||||||||||||||||||

| New Leases‐1st Generation | $ | 1,016 | 420,285 | $ | 2.42 | |||||||||||||||

| New Leases‐2nd Generation | 2,017 | 574,555 | $ | 3.51 | ||||||||||||||||

| Renewals | 1,449 | 1,077,108 | $ | 1.35 | ||||||||||||||||

| Total Leasing Commissions & Lease Costs | $ | 4,482 | ||||||||||||||||||

| Total Recurring Capex | $ | 2,541 | 31,727,816 | $ | 0.08 | |||||||||||||||

| Recurring Capex % of NOI | 3.3 | % | ||||||||||||||||||

| Recurring Capex % of Rental Revenue | 3.1 | % | ||||||||||||||||||

| Nonrecurring Capex: | ||||||||||||||||||||

Repositioning and Redevelopment in Process(2)

|

$ | 13,191 | ||||||||||||||||||

Unit Renovation(3)

|

474 | |||||||||||||||||||

Other(4)

|

2,919 | |||||||||||||||||||

| Total Nonrecurring Capex | $ | 16,584 | 14,760,489 | $ | 1.12 | |||||||||||||||

Other Capitalized Costs(5)

|

$ | 2,400 | ||||||||||||||||||

(1)For tenant improvements and leasing commissions, reflects the aggregate square footage of the leases in which we incurred such costs, excluding new/renewal leases in which there were no tenant improvements and/or leasing commissions. For recurring capex, reflects the weighted average square footage of our consolidated portfolio for the period (including properties that were sold during the period). For nonrecurring capex, reflects the aggregate square footage of the properties in which we incurred such capital expenditures.

(2)Includes capital expenditures related to properties that were under repositioning or redevelopment as of March 31, 2021. See pages 27-28 for details of these properties.

(3)Includes non-tenant-specific capital expenditures with costs less than $100,000 per unit.

(4)Includes other nonrecurring capital expenditures including, but not limited to, seismic and fire sprinkler upgrades, replacements of either roof or parking lots, ADA related construction and capital expenditures for deferred maintenance existing at the time such property was acquired.

(5)Includes the following capitalized costs: (i) compensation costs of personnel directly responsible for and who spend their time on redevelopment, renovation and rehabilitation activity and (ii) interest, property taxes and insurance costs incurred during the pre-development and construction periods of repositioning or redevelopment projects.

| First Quarter 2021 Supplemental Financial Reporting Package |

Page 26

|

|

||||||

Properties and Space Under Repositioning/Redevelopment.(1)

| ||||||||

| As of March 31, 2021 | (unaudited results, in thousands, except square feet) | |||||||

| Repositioning | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Est. Constr. Period(1)

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Property (Submarket) |

Total Property RSF(2)

|

Repo/ Lease-Up RSF(2)

|

Total Property Leased % 3/31/2021 | Start | Target Complet. |

Est. Stabilization Period(1)(3)

|

Purch.

Price(1)

|

Projected Repo Costs(1)

|

Projected Total Invest.(1) |

Cumulative

Investment

to Date(1)

|

Actual Cash NOI 1Q-2021(1)

|

Est. An.

Stabilized

Cash NOI(1)

|

Est. Stabilized Yield(1)

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SIGNIFICANT CURRENT REPOSITIONING IN PROCESS: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

12821 Knott Street (West OC)(4)

|

165,171 | 165,171 | 0% | 1Q-19 | 3Q-21 | 4Q-21 | $ | 20,673 | $ | 11,687 | $ | 32,360 | $ | 24,876 | $ | 23 | $ | 1,800 | 5.6% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Rancho Pacifica - Bldgs 1 & 6 (South Bay)(5)

|

488,114 | 488,114 | 87% | 4Q-20 | 3Q-21 | 3Q-21 | $ | 89,123 | $ | 9,093 | $ | 98,216 | $ | 91,949 | $ | 638 | $ | 5,876 | 6.0% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

12133 Greenstone Ave. (Mid-Counties)(6)

|

12,586 | 12,586 | 0% | 1Q-21 | 4Q-21 | 2Q-22 | $ | 5,657 | $ | 6,973 | $ | 12,630 | $ | 5,818 | $ | — | $ | 783 | 6.2% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

16221 Arthur Street (Mid-Counties)(7)

|

61,372 | 61,372 | 100% | 1Q-21 | 2Q-21 | 2Q-21 | $ | 6,280 | $ | 1,525 | $ | 7,805 | $ | 6,953 | $ | 14 | $ | 613 | 7.9% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8745-8775 Production Ave. (Central SD) | 46,820 | 26,200 | 47% | 1Q-21 | 2Q-21 | 3Q-21 | $ | 8,050 | $ | 1,419 | $ | 9,469 | $ | 9,056 | $ | 34 | $ | 657 | 6.9% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TOTAL | 774,063 | 753,443 | $ | 129,783 | $ | 30,697 | $ | 160,480 | $ | 138,652 | $ | 709 | $ | 9,729 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| OTHER CURRENT REPOSITIONING IN PROCESS: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Other Repositioning - 17 properties with estimated costs < $1 million individually(8)

|

$ | 10,460 | $ | 3,836 | 5.5%-6.5% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| LEASE-UP: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Merge (Inland Empire West) | 333,544 | 333,544 | 75% | 2Q-19 | 4Q-20 | 3Q-21 | $ | 23,827 | $ | 33,018 | $ | 56,845 | $ | 54,855 | $ | 146 | $ | 3,341 | 5.9% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| FUTURE REPOSITIONING: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||