EXHIBIT 99.2

Published on October 31, 2017

Exhibit 99.2

Table of Contents.

|

||

Section |

Page |

Corporate Data: |

|

Investor Company Summary |

3 |

Financial and Portfolio Highlights and Common Stock Data |

4 |

Consolidated Financial Results: |

|

Consolidated Balance Sheets |

5 |

Consolidated Statements of Operations |

6-7 |

Non-GAAP FFO, Core FFO and AFFO Reconciliations |

8-9 |

Statement of Operations Reconciliations |

10 |

Same Property Portfolio Performance |

11 |

Capitalization Summary |

12 |

Debt Summary |

13 |

Portfolio Data: |

|

Portfolio Overview |

14 |

Occupancy and Leasing Trends |

15 |

Leasing Statistics |

16-17 |

Top Tenants and Lease Segmentation |

18 |

Capital Expenditure Summary |

19 |

Properties and Space Under Repositioning |

20-21 |

Current Year Acquisitions and Dispositions Summary |

22 |

Guidance |

23 |

Net Asset Value Components |

24 |

Notes and Definitions |

25-28 |

Disclosures:

Forward Looking Statements: This supplemental package contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. We caution investors that any forward-looking statements presented herein are based on management’s beliefs and assumptions and information currently available to management. Such statements are subject to risks, uncertainties and assumptions and may be affected by known and unknown risks, trends, uncertainties and factors that are beyond our control. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, estimated or projected. These risks and uncertainties include, without limitation: general risks affecting the real estate industry (including, without limitation, the market value of our properties, the inability to enter into or renew leases at favorable rates, dependence on tenants’ financial condition, and competition from other developers, owners and operators of real estate); risks associated with the disruption of credit markets or a global economic slowdown; risks associated with the potential loss of key personnel (most importantly, members of senior management); risks associated with our failure to maintain our status as a Real Estate Investment Trust under the Internal Revenue Code of 1986, as amended; possible adverse changes in tax and environmental laws; litigation, including costs associated with prosecuting or defending pending or threatened claims and any adverse outcomes, and potential liability for uninsured losses and environmental contamination.

For a further discussion of these and other factors that could cause our future results to differ materially from any forward-looking statements, see Item 1A. Risk Factors in our 2016 Annual Report on Form 10-K, which was filed with the Securities and Exchange Commission (“SEC”) on February 23, 2017. We disclaim any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, of new information, data or methods, future events or other changes.

|

Third Quarter 2017

Supplemental Financial Reporting Package

|

Page 2

|

|

|

Investor Company Summary.

|

||

Executive Management Team | ||

Howard Schwimmer |

Co-Chief Executive Officer, Director |

|

Michael S. Frankel |

Co-Chief Executive Officer, Director |

|

Adeel Khan |

Chief Financial Officer |

|

David Lanzer |

General Counsel and Corporate Secretary |

|

Board of Directors | ||

Richard Ziman |

Chairman |

|

Howard Schwimmer |

Co-Chief Executive Officer, Director |

|

Michael S. Frankel |

Co-Chief Executive Officer, Director |

|

Robert L. Antin |

Director |

|

Steven C. Good |

Director |

|

Peter Schwab |

Director |

|

Tyler H. Rose |

Director |

|

Investor Relations Information | ||

ICR |

||

Stephen Swett | ||

www.icrinc.com | ||

212-849-3882 | ||

Equity Research Coverage |

||||

Bank of America Merrill Lynch |

James Feldman |

(646) 855-5808 |

||

Capital One |

Chris Lucas |

(571) 633-8151 |

||

Citigroup Investment Research |

Emmanuel Korchman |

(212) 816-1382 |

||

D.A Davidson |

Barry Oxford |

(212) 240-9871 |

||

J.P. Morgan |

Michael W. Mueller, CFA |

(212) 622-6689 |

||

Jefferies LLC |

Jonathan Petersen |

(212) 284-1705 |

||

National Securities Corporation |

John R. Benda |

(212) 417-8127 |

||

Stifel Nicolaus & Co. |

John W. Guinee |

(443) 224-1307 |

||

Wells Fargo Securities |

Blaine Heck |

(443) 263-6529 |

||

FBR & Co. |

Craig Kucera |

(540) 277-3366 |

||

Disclaimer: This list may not be complete and is subject to change as firms add or delete coverage of our company. Please note that any opinions, estimates, forecasts or predictions regarding our historical or predicted performance made by these analysts are theirs alone and do not represent opinions, estimates, forecasts or predictions of Rexford Industrial Realty, Inc. or its management. We are providing this listing as a service to our stockholders and do not by listing these firms imply our endorsement of, or concurrence with, such information, conclusions or recommendations. Interested persons may obtain copies of analysts’ reports on their own; we do not distribute these reports.

|

Third Quarter 2017

Supplemental Financial Reporting Package

|

Page 3

|

|

|

Financial and Portfolio Highlights and Common Stock Data. (1)

|

||

(in thousands except share and per share data and portfolio statistics) |

||

Three Months Ended |

|||||||||||||||||||

September 30, 2017 |

June 30, 2017 |

March 31, 2017 |

December 31, 2016 |

September 30, 2016 |

|||||||||||||||

Financial Results: |

|||||||||||||||||||

Total rental revenues |

$ |

43,230 |

$ |

36,419 |

$ |

35,001 |

$ |

34,449 |

$ |

32,944 |

|||||||||

Net income |

$ |

2,009 |

$ |

19,855 |

$ |

5,721 |

$ |

8,546 |

$ |

3,061 |

|||||||||

Net Operating Income (NOI) |

$ |

32,001 |

$ |

26,883 |

$ |

25,779 |

$ |

25,310 |

$ |

23,966 |

|||||||||

Company share of Core FFO |

$ |

18,049 |

$ |

15,893 |

$ |

15,104 |

$ |

15,048 |

$ |

14,240 |

|||||||||

Core FFO per common share - diluted |

$ |

0.25 |

$ |

0.23 |

$ |

0.23 |

$ |

0.23 |

$ |

0.22 |

|||||||||

Company share of FFO |

$ |

18,034 |

$ |

15,873 |

$ |

14,733 |

$ |

15,071 |

$ |

13,874 |

|||||||||

FFO per common share - diluted |

$ |

0.25 |

$ |

0.23 |

$ |

0.22 |

$ |

0.23 |

$ |

0.21 |

|||||||||

Adjusted EBITDA |

$ |

28,265 |

$ |

25,360 |

$ |

22,292 |

$ |

22,388 |

$ |

20,622 |

|||||||||

Dividend declared per common share |

$ |

0.145 |

$ |

0.145 |

$ |

0.145 |

$ |

0.135 |

$ |

0.135 |

|||||||||

Portfolio Statistics: |

|||||||||||||||||||

Portfolio SF - consolidated |

18,044,612 |

16,221,646 |

15,069,122 |

15,020,336 |

14,588,101 |

||||||||||||||

Ending occupancy - consolidated portfolio |

92.9 |

% |

91.4 |

% |

88.9 |

% |

91.7 |

% |

89.7 |

% |

|||||||||

Stabilized occupancy - consolidated portfolio |

97.2 |

% |

96.5 |

% |

96.4 |

% |

96.8 |

% |

95.8 |

% |

|||||||||

Leasing spreads - GAAP |

26.3 |

% |

20.4 |

% |

23.3 |

% |

16.1 |

% |

15.6 |

% |

|||||||||

Leasing spreads - cash |

16.7 |

% |

10.6 |

% |

13.7 |

% |

5.9 |

% |

7.0 |

% |

|||||||||

Same Property Performance: |

|||||||||||||||||||

Same Property Portfolio SF |

11,211,193 |

11,211,193 |

11,211,193 |

11,211,193 |

11,211,193 |

||||||||||||||

Same Property Portfolio ending occupancy |

95.2 |

% |

93.5 |

% |

93.1 |

% |

94.9 |

% |

93.0 |

% |

|||||||||

Stabilized Same Property Portfolio ending occupancy |

96.9 |

% |

96.0 |

% |

96.0 |

% |

96.9 |

% |

96.5 |

% |

|||||||||

NOI growth(2)

|

9.8 |

% |

6.6 |

% |

8.3 |

% |

n/a |

n/a |

|||||||||||

Cash NOI growth(2)

|

11.3 |

% |

5.1 |

% |

10.1 |

% |

n/a |

n/a |

|||||||||||

Capitalization: |

|||||||||||||||||||

Common stock price at quarter end |

$ |

28.62 |

$ |

27.44 |

$ |

22.52 |

$ |

23.19 |

$ |

22.89 |

|||||||||

Common shares issued and outstanding |

77,337,373 |

70,810,523 |

66,375,624 |

66,166,548 |

65,725,504 |

||||||||||||||

Total shares and units issued and outstanding at period end (3)

|

79,284,781 |

72,785,007 |

68,365,436 |

68,175,212 |

67,704,346 |

||||||||||||||

Weighted average shares outstanding - diluted |

73,068,081 |

68,331,234 |

66,626,239 |

66,079,935 |

67,985,177 |

||||||||||||||

5.875% Series A Cumulative Redeemable Preferred Stock |

90,000 |

90,000 |

90,000 |

90,000 |

90,000 |

||||||||||||||

Total equity market capitalization |

$ |

2,359,130 |

$ |

2,087,221 |

$ |

1,629,590 |

$ |

1,670,983 |

$ |

1,639,752 |

|||||||||

Total consolidated debt |

$ |

666,979 |

$ |

564,242 |

$ |

512,504 |

$ |

502,476 |

$ |

502,776 |

|||||||||

Total combined market capitalization (net debt plus equity) |

$ |

3,013,191 |

$ |

2,638,345 |

$ |

2,130,418 |

$ |

2,157,934 |

$ |

2,087,265 |

|||||||||

Ratios: |

|||||||||||||||||||

Net debt to total combined market capitalization |

21.7 |

% |

20.9 |

% |

23.5 |

% |

22.6 |

% |

21.4 |

% |

|||||||||

Net debt to Adjusted EBITDA (quarterly results annualized) |

5.8x |

5.4x |

5.6x |

5.4x |

5.4x |

||||||||||||||

(1) |

For definition/discussion of non-GAAP financial measures and reconciliations to their nearest GAAP equivalents, see the definitions section and reconciliation section beginning on page 25 and page 8 of this report, respectively.

|

(2) |

Represents the year over year percentage change in NOI and Cash NOI for the Same Property Portfolio. For comparability, NOI growth and Cash NOI growth for Q1’17 has been restated to remove the results of 2535 Midway Drive, which was sold during Q2’17. See page 22 for a list of dispositions completed during 2017. |

(3) |

Includes the following number of OP Units held by noncontrolling interests: 1,905,740 (Sep 30, 2017), 1,932,816 (Jun 30, 2017), 1,948,144 (Mar 31, 2017), 1,966,996 (Dec 31, 2016) and 1,978,842 (Sep 30, 2016). Excludes the following number of shares of unvested restricted stock: 257,867 (Sep 30, 2017), 312,379 (Jun 30, 2017), 333,128 (Mar 31, 2017), 287,827 (Dec 31, 2016) and 322,837 (Sep 30, 2016). Current period excludes 241,691 unvested LTIP units and 514,998 unvested performance units granted during Q4-15 and Q4-16.

|

|

Third Quarter 2017

Supplemental Financial Reporting Package

|

Page 4

|

|

|

Consolidated Balance Sheets.

|

||

(unaudited and in thousands) |

||

September 30, 2017 |

June 30, 2017 |

March 31, 2017 |

December 31, 2016 |

September 30, 2016 |

|||||||||||||||

Assets |

|||||||||||||||||||

Land |

$ |

925,360 |

$ |

763,622 |

$ |

692,731 |

$ |

683,919 |

$ |

659,641 |

|||||||||

Buildings and improvements |

1,051,037 |

923,760 |

816,912 |

811,614 |

778,066 |

||||||||||||||

Tenant improvements |

47,663 |

43,717 |

39,595 |

38,644 |

36,687 |

||||||||||||||

Furniture, fixtures, and equipment |

167 |

167 |

167 |

174 |

175 |

||||||||||||||

Construction in progress |

33,158 |

25,792 |

21,792 |

17,778 |

23,300 |

||||||||||||||

Total real estate held for investment |

2,057,385 |

1,757,058 |

1,571,197 |

1,552,129 |

1,497,869 |

||||||||||||||

Accumulated depreciation |

(165,385 |

) |

(153,163 |

) |

(143,199 |

) |

(135,140 |

) |

(126,601 |

) |

|||||||||

Investments in real estate, net |

1,892,000 |

1,603,895 |

1,427,998 |

1,416,989 |

1,371,268 |

||||||||||||||

Cash and cash equivalents |

12,918 |

13,118 |

11,676 |

15,525 |

55,263 |

||||||||||||||

Restricted cash |

— |

— |

6,537 |

— |

— |

||||||||||||||

Notes receivable |

— |

— |

6,090 |

5,934 |

5,817 |

||||||||||||||

Rents and other receivables, net |

3,040 |

2,644 |

2,921 |

2,749 |

2,633 |

||||||||||||||

Deferred rent receivable |

14,929 |

13,628 |

12,793 |

11,873 |

10,913 |

||||||||||||||

Deferred leasing costs, net |

10,756 |

9,448 |

9,279 |

8,672 |

8,064 |

||||||||||||||

Deferred loan costs, net |

2,084 |

2,239 |

2,352 |

847 |

996 |

||||||||||||||

Acquired lease intangible assets, net(1)

|

49,147 |

41,087 |

33,050 |

36,365 |

38,093 |

||||||||||||||

Indefinite-lived intangible |

5,156 |

5,156 |

5,156 |

5,170 |

5,215 |

||||||||||||||

Interest rate swap asset |

4,752 |

4,399 |

5,657 |

5,594 |

— |

||||||||||||||

Other assets |

7,144 |

7,388 |

5,944 |

5,290 |

5,522 |

||||||||||||||

Acquisition related deposits |

1,075 |

2,250 |

500 |

— |

400 |

||||||||||||||

Total Assets |

$ |

2,003,001 |

$ |

1,705,252 |

$ |

1,529,953 |

$ |

1,515,008 |

$ |

1,504,184 |

|||||||||

Liabilities |

|||||||||||||||||||

Notes payable |

$ |

664,209 |

$ |

561,530 |

$ |

509,693 |

$ |

500,184 |

$ |

500,428 |

|||||||||

Interest rate swap liability |

785 |

1,094 |

1,356 |

2,045 |

5,938 |

||||||||||||||

Accounts payable and accrued expenses |

22,190 |

14,298 |

18,005 |

13,585 |

18,433 |

||||||||||||||

Dividends and distributions payable |

11,580 |

10,642 |

10,008 |

9,282 |

9,214 |

||||||||||||||

Acquired lease intangible liabilities, net(2)

|

18,147 |

10,785 |

8,653 |

9,130 |

5,722 |

||||||||||||||

Tenant security deposits |

19,149 |

16,721 |

15,311 |

15,187 |

14,946 |

||||||||||||||

Prepaid rents |

5,738 |

5,204 |

4,785 |

3,455 |

3,945 |

||||||||||||||

Total Liabilities |

741,798 |

620,274 |

567,811 |

552,868 |

558,626 |

||||||||||||||

Equity |

|||||||||||||||||||

Preferred stock, net ($90,000 liquidation preference) |

86,651 |

86,651 |

86,651 |

86,651 |

86,664 |

||||||||||||||

Common stock |

773 |

708 |

664 |

662 |

658 |

||||||||||||||

Additional paid in capital |

1,213,123 |

1,027,282 |

912,047 |

907,834 |

898,354 |

||||||||||||||

Cumulative distributions in excess of earnings |

(67,578 |

) |

(56,992 |

) |

(64,682 |

) |

(59,277 |

) |

(56,651 |

) |

|||||||||

Accumulated other comprehensive income (loss) |

3,870 |

3,216 |

4,176 |

3,445 |

(5,764 |

) |

|||||||||||||

Total stockholders’ equity |

1,236,839 |

1,060,865 |

938,856 |

939,315 |

923,261 |

||||||||||||||

Noncontrolling interests |

24,364 |

24,113 |

23,286 |

22,825 |

22,297 |

||||||||||||||

Total Equity |

1,261,203 |

1,084,978 |

962,142 |

962,140 |

945,558 |

||||||||||||||

Total Liabilities and Equity |

$ |

2,003,001 |

$ |

1,705,252 |

$ |

1,529,953 |

$ |

1,515,008 |

$ |

1,504,184 |

|||||||||

(1) |

Includes net above-market tenant lease intangibles of $5,512 (September 30, 2017), $5,640 (June 30, 2017), $5,420 (March 31, 2017), $5,779 (December 31, 2016) and $6,204 (September 30, 2016).

|

(2) |

Includes net below-market tenant lease intangibles of $17,990 (September 30, 2017), $10,102 (June 30, 2017), $8,479 (March 31, 2017), $8,949 (December 31, 2016) and $5,533 (September 30, 2016).

|

|

Third Quarter 2017

Supplemental Financial Reporting Package

|

Page 5

|

|

|

Consolidated Statements of Operations.

|

||

Quarterly Results |

(unaudited and in thousands, except share and per share data) |

|

Three Months Ended |

|||||||||||||||||||

September 30, 2017 |

June 30, 2017 |

March 31, 2017 |

December 31, 2016 |

September 30, 2016 |

|||||||||||||||

Revenues |

|||||||||||||||||||

Rental income |

$ |

36,748 |

$ |

31,132 |

$ |

29,614 |

$ |

29,691 |

$ |

28,285 |

|||||||||

Tenant reimbursements |

6,279 |

5,172 |

5,155 |

4,579 |

4,467 |

||||||||||||||

Other income |

203 |

115 |

232 |

179 |

192 |

||||||||||||||

Total Rental Revenues |

43,230 |

36,419 |

35,001 |

34,449 |

32,944 |

||||||||||||||

Management, leasing, and development services |

109 |

145 |

126 |

97 |

131 |

||||||||||||||

Interest income |

— |

218 |

227 |

231 |

228 |

||||||||||||||

Total Revenues |

43,339 |

36,782 |

35,354 |

34,777 |

33,303 |

||||||||||||||

Operating Expenses |

|||||||||||||||||||

Property expenses |

11,229 |

9,536 |

9,222 |

9,139 |

8,978 |

||||||||||||||

General and administrative |

5,843 |

5,123 |

5,086 |

4,225 |

5,067 |

||||||||||||||

Depreciation and amortization |

17,971 |

14,515 |

13,599 |

14,242 |

13,341 |

||||||||||||||

Total Operating Expenses |

35,043 |

29,174 |

27,907 |

27,606 |

27,386 |

||||||||||||||

Other Expenses |

|||||||||||||||||||

Acquisition expenses |

16 |

20 |

385 |

365 |

380 |

||||||||||||||

Interest expense |

6,271 |

4,302 |

3,998 |

4,074 |

3,804 |

||||||||||||||

Total Other Expenses |

6,287 |

4,322 |

4,383 |

4,439 |

4,184 |

||||||||||||||

Total Expenses |

41,330 |

33,496 |

32,290 |

32,045 |

31,570 |

||||||||||||||

Equity in income from unconsolidated real estate entities |

— |

— |

11 |

— |

1,328 |

||||||||||||||

Loss on extinguishment of debt |

— |

— |

(22 |

) |

— |

— |

|||||||||||||

Gains on sale of real estate |

— |

16,569 |

2,668 |

5,814 |

— |

||||||||||||||

Net Income |

2,009 |

19,855 |

5,721 |

8,546 |

3,061 |

||||||||||||||

Less: net income attributable to noncontrolling interest |

(21 |

) |

(531 |

) |

(132 |

) |

(217 |

) |

(63 |

) |

|||||||||

Net income attributable to Rexford Industrial Realty, Inc. |

1,988 |

19,324 |

5,589 |

8,329 |

2,998 |

||||||||||||||

Less: preferred stock dividends |

(1,322 |

) |

(1,322 |

) |

(1,322 |

) |

(1,322 |

) |

(661 |

) |

|||||||||

Less: earnings allocated to participating securities |

(80 |

) |

(156 |

) |

(91 |

) |

(79 |

) |

(70 |

) |

|||||||||

Net income attributable to common stockholders |

$ |

586 |

$ |

17,846 |

$ |

4,176 |

$ |

6,928 |

$ |

2,267 |

|||||||||

Earnings per Common Share |

|||||||||||||||||||

Net income attributable to common stockholders per share - basic |

$ |

0.01 |

$ |

0.26 |

$ |

0.06 |

$ |

0.11 |

$ |

0.03 |

|||||||||

Net income attributable to common stockholders per share - diluted |

$ |

0.01 |

$ |

0.26 |

$ |

0.06 |

$ |

0.10 |

$ |

0.03 |

|||||||||

Weighted average shares outstanding - basic |

72,621,219 |

67,920,773 |

66,341,138 |

65,785,226 |

65,707,476 |

||||||||||||||

Weighted average shares outstanding - diluted |

73,068,081 |

68,331,234 |

66,626,239 |

66,079,935 |

67,985,177 |

||||||||||||||

|

Third Quarter 2017

Supplemental Financial Reporting Package

|

Page 6

|

|

|

Consolidated Statements of Operations.

|

||

Quarterly Results |

(unaudited and in thousands) |

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||

2017 |

2016 |

2017 |

2016 |

||||||||||||

Rental Revenues |

|||||||||||||||

Rental income |

$ |

36,748 |

$ |

28,285 |

$ |

97,494 |

$ |

77,903 |

|||||||

Tenant reimbursements |

6,279 |

4,467 |

16,606 |

12,144 |

|||||||||||

Other income |

203 |

192 |

550 |

764 |

|||||||||||

Total Rental Revenues |

43,230 |

32,944 |

114,650 |

90,811 |

|||||||||||

Management, leasing, and development services |

109 |

131 |

380 |

376 |

|||||||||||

Interest income |

— |

228 |

445 |

228 |

|||||||||||

Total Revenues |

43,339 |

33,303 |

115,475 |

91,415 |

|||||||||||

Operating Expenses |

|||||||||||||||

Property expenses |

11,229 |

8,978 |

29,987 |

24,480 |

|||||||||||

General and administrative |

5,843 |

5,067 |

16,052 |

13,190 |

|||||||||||

Depreciation and amortization |

17,971 |

13,341 |

46,085 |

37,165 |

|||||||||||

Total Operating Expenses |

35,043 |

27,386 |

92,124 |

74,835 |

|||||||||||

Other Expenses |

|||||||||||||||

Acquisition expenses |

16 |

380 |

421 |

1,490 |

|||||||||||

Interest expense |

6,271 |

3,804 |

14,571 |

10,774 |

|||||||||||

Total Other Expenses |

6,287 |

4,184 |

14,992 |

12,264 |

|||||||||||

Total Expenses |

41,330 |

31,570 |

107,116 |

87,099 |

|||||||||||

Equity in income from unconsolidated real estate entities |

— |

1,328 |

11 |

1,451 |

|||||||||||

Loss on extinguishment of debt |

— |

— |

(22 |

) |

— |

||||||||||

Gains on sale of real estate |

— |

— |

19,237 |

11,563 |

|||||||||||

Net Income |

2,009 |

3,061 |

27,585 |

17,330 |

|||||||||||

Less: net income attributable to noncontrolling interest |

(21 |

) |

(63 |

) |

(684 |

) |

(533 |

) |

|||||||

Net income attributable to Rexford Industrial Realty, Inc. |

1,988 |

2,998 |

26,901 |

16,797 |

|||||||||||

Less: preferred stock dividends |

(1,322 |

) |

(661 |

) |

(3,966 |

) |

(661 |

) |

|||||||

Less: earnings allocated to participating securities |

(80 |

) |

(70 |

) |

(327 |

) |

(223 |

) |

|||||||

Net income attributable to common stockholders |

$ |

586 |

$ |

2,267 |

$ |

22,608 |

$ |

15,913 |

|||||||

|

Third Quarter 2017

Supplemental Financial Reporting Package

|

Page 7

|

|

|

Non-GAAP FFO and Core FFO Reconciliations. (1)

|

||

(unaudited and in thousands, except share and per share data) |

||

Three Months Ended |

|||||||||||||||||||

September 30, 2017 |

June 30, 2017 |

March 31, 2017 |

December 31, 2016 |

September 30, 2016 |

|||||||||||||||

Net Income |

$ |

2,009 |

$ |

19,855 |

$ |

5,721 |

$ |

8,546 |

$ |

3,061 |

|||||||||

Add: |

|||||||||||||||||||

Depreciation and amortization |

17,971 |

14,515 |

13,599 |

14,242 |

13,341 |

||||||||||||||

Deduct: |

|||||||||||||||||||

Gains on sale of real estate |

— |

16,569 |

2,668 |

5,814 |

— |

||||||||||||||

Gain on acquisition of unconsolidated joint venture property |

— |

— |

11 |

— |

1,332 |

||||||||||||||

Funds From Operations (FFO) |

19,980 |

17,801 |

16,641 |

16,974 |

15,070 |

||||||||||||||

Less: preferred stock dividends |

(1,322 |

) |

(1,322 |

) |

(1,322 |

) |

(1,322 |

) |

(661 |

) |

|||||||||

Less: FFO attributable to noncontrolling interests(2)

|

(491 |

) |

(468 |

) |

(449 |

) |

(457 |

) |

(424 |

) |

|||||||||

Less: FFO attributable to participating securities(3)

|

(133 |

) |

(138 |

) |

(137 |

) |

(124 |

) |

(111 |

) |

|||||||||

Company share of FFO |

$ |

18,034 |

$ |

15,873 |

$ |

14,733 |

$ |

15,071 |

$ |

13,874 |

|||||||||

FFO per common share‐basic |

$ |

0.25 |

$ |

0.23 |

$ |

0.22 |

$ |

0.23 |

$ |

0.21 |

|||||||||

FFO per common share‐diluted |

$ |

0.25 |

$ |

0.23 |

$ |

0.22 |

$ |

0.23 |

$ |

0.21 |

|||||||||

FFO |

$ |

19,980 |

$ |

17,801 |

$ |

16,641 |

$ |

16,974 |

$ |

15,070 |

|||||||||

Adjust: |

|||||||||||||||||||

Legal fee reimbursements(4)

|

— |

— |

— |

(389 |

) |

— |

|||||||||||||

Acquisition expenses |

16 |

20 |

385 |

365 |

380 |

||||||||||||||

Core FFO |

19,996 |

17,821 |

17,026 |

16,950 |

15,450 |

||||||||||||||

Less: preferred stock dividends |

(1,322 |

) |

(1,322 |

) |

(1,322 |

) |

(1,322 |

) |

(661 |

) |

|||||||||

Less: Core FFO attributable to noncontrolling interests(2)

|

(492 |

) |

(468 |

) |

(460 |

) |

(456 |

) |

(435 |

) |

|||||||||

Less: Core FFO attributable to participating securities(3)

|

(133 |

) |

(138 |

) |

(140 |

) |

(124 |

) |

(114 |

) |

|||||||||

Company share of Core FFO |

$ |

18,049 |

$ |

15,893 |

$ |

15,104 |

$ |

15,048 |

$ |

14,240 |

|||||||||

Core FFO per common share‐basic |

$ |

0.25 |

$ |

0.23 |

$ |

0.23 |

$ |

0.23 |

$ |

0.22 |

|||||||||

Core FFO per common share‐diluted |

$ |

0.25 |

$ |

0.23 |

$ |

0.23 |

$ |

0.23 |

$ |

0.22 |

|||||||||

Weighted-average shares outstanding-basic |

72,621,219 |

67,920,773 |

66,341,138 |

65,785,226 |

65,707,476 |

||||||||||||||

Weighted-average shares outstanding-diluted(5)

|

73,068,081 |

68,331,234 |

66,626,239 |

66,079,935 |

65,994,173 |

||||||||||||||

(1) |

For a definition and discussion of non-GAAP financial measures, see the definitions section beginning on page 25 of this report.

|

(2) |

Noncontrolling interests represent holders of outstanding common units of the Company’s operating partnership that are owned by unit holders other than us. |

(3) |

Participating securities include unvested shares of restricted stock, unvested LTIP units and unvested performance units. |

(4) |

Legal fee reimbursements relate to prior litigation of the Company. For more information, see Item 3. Legal Proceedings in our 2014 Annual Report on Form 10-K. |

(5) |

Weighted-average shares outstanding-diluted includes adjustments for unvested performance units and operating partnership units if their effect is dilutive for the reported period. |

|

Third Quarter 2017

Supplemental Financial Reporting Package

|

Page 8

|

|

|

Non-GAAP AFFO Reconciliation. (1)

|

||

(unaudited and in thousands, except share and per share data) |

||

Three Months Ended |

|||||||||||||||||||

September 30, 2017 |

June 30, 2017 |

March 31, 2017 |

December 31, 2016 |

September 30, 2016 |

|||||||||||||||

Funds From Operations(2)

|

$ |

19,980 |

$ |

17,801 |

$ |

16,641 |

$ |

16,974 |

$ |

15,070 |

|||||||||

Add: |

|||||||||||||||||||

Amortization of deferred financing costs |

290 |

288 |

275 |

266 |

263 |

||||||||||||||

Net fair value lease revenue (expense) |

(885 |

) |

(201 |

) |

(117 |

) |

(95 |

) |

(39 |

) |

|||||||||

Non-cash stock compensation |

1,330 |

1,394 |

1,346 |

956 |

992 |

||||||||||||||

Straight line corporate office rent expense adjustment |

(19 |

) |

(36 |

) |

(36 |

) |

(50 |

) |

(12 |

) |

|||||||||

Loss on extinguishment of debt |

— |

— |

22 |

— |

— |

||||||||||||||

Deduct: |

|||||||||||||||||||

Preferred stock dividends |

1,322 |

1,322 |

1,322 |

1,322 |

661 |

||||||||||||||

Straight line rental revenue adjustment(3)

|

1,307 |

996 |

956 |

1,095 |

1,395 |

||||||||||||||

Capitalized payments(4)

|

1,219 |

1,021 |

976 |

726 |

833 |

||||||||||||||

Note payable premium amortization |

37 |

36 |

58 |

60 |

60 |

||||||||||||||

Recurring capital expenditures(5)

|

452 |

857 |

390 |

667 |

691 |

||||||||||||||

2nd generation tenant improvements and leasing commissions(6)(7)

|

1,618 |

900 |

1,241 |

1,311 |

1,988 |

||||||||||||||

Unconsolidated joint venture AFFO adjustments |

— |

— |

— |

— |

2 |

||||||||||||||

Adjusted Funds From Operations (AFFO) |

$ |

14,741 |

$ |

14,114 |

$ |

13,188 |

$ |

12,870 |

$ |

10,644 |

|||||||||

(1) |

For a definition and discussion of non-GAAP financial measures, see the definitions section beginning on page 25 of this report.

|

(2) |

A reconciliation of net income to Funds From Operations is set forth on page 8 of this report. |

(3) |

The straight line rental revenue adjustment includes concessions of $1,019, $851, $612, $873 and $1,072 for the three months ended September 30, 2017, June 30, 2017, March 31, 2017, December 31, 2016, and September 30, 2016, respectively.

|

(4) |

Includes capitalized interest, and leasing and construction development compensation. |

(5) |

Excludes nonrecurring capital expenditures of $9,259, $9,007, $5,700, $4,494 and $7,030 for the three months ended September 30, 2017, June 30, 2017, March 31, 2017, December 31, 2016, and September 30, 2016, respectively.

|

(6) |

Excludes 1st generation tenant improvements/space preparation and leasing commissions of $860, $370, $569, $636 and $1,407 for the three months ended September 30, 2017, June 30, 2017, March 31, 2017, December 31, 2016, and September 30, 2016, respectively.

|

(7) |

Prior period amounts have been adjusted to reflect the reclass of $304 (Q1-2017) and $721 (Q2-2017) of costs from 2nd generation tenant improvements and leasing commissions to nonrecurring capital expenditures. |

|

Third Quarter 2017

Supplemental Financial Reporting Package

|

Page 9

|

|

|

Statement of Operations Reconciliations - NOI, Cash NOI, EBITDA and Adjusted EBITDA. (1)

| ||

(unaudited and in thousands) |

||

NOI and Cash NOI |

||||||||||||||||||||

Three Months Ended |

||||||||||||||||||||

September 30, 2017 |

June 30, 2017 |

March 31, 2017 |

December 31, 2016 |

September 30, 2016 |

||||||||||||||||

Rental income |

$ |

36,748 |

$ |

31,132 |

$ |

29,614 |

$ |

29,691 |

$ |

28,285 |

||||||||||

Tenant reimbursements |

6,279 |

5,172 |

5,155 |

4,579 |

4,467 |

|||||||||||||||

Other income |

203 |

115 |

232 |

179 |

192 |

|||||||||||||||

Total Rental Revenues |

43,230 |

36,419 |

35,001 |

34,449 |

32,944 |

|||||||||||||||

Property Expenses |

11,229 |

9,536 |

9,222 |

9,139 |

8,978 |

|||||||||||||||

Net Operating Income (NOI) |

$ |

32,001 |

$ |

26,883 |

$ |

25,779 |

$ |

25,310 |

$ |

23,966 |

||||||||||

Net fair value lease revenue (expense) |

(885 |

) |

(201 |

) |

(117 |

) |

(95 |

) |

(39 |

) |

||||||||||

Straight line rental revenue adjustment |

(1,307 |

) |

(996 |

) |

(956 |

) |

(1,095 |

) |

(1,395 |

) |

||||||||||

Cash NOI |

$ |

29,809 |

$ |

25,686 |

$ |

24,706 |

$ |

24,120 |

$ |

22,532 |

||||||||||

EBITDA and Adjusted EBITDA |

|||||||||||||||||||

Three Months Ended |

|||||||||||||||||||

September 30, 2017 |

June 30, 2017 |

March 31, 2017 |

December 31, 2016 |

September 30, 2016 |

|||||||||||||||

Net income |

$ |

2,009 |

$ |

19,855 |

$ |

5,721 |

$ |

8,546 |

$ |

3,061 |

|||||||||

Interest expense |

6,271 |

4,302 |

3,998 |

4,074 |

3,804 |

||||||||||||||

Depreciation and amortization |

17,971 |

14,515 |

13,599 |

14,242 |

13,341 |

||||||||||||||

EBITDA |

$ |

26,251 |

$ |

38,672 |

$ |

23,318 |

$ |

26,862 |

$ |

20,206 |

|||||||||

Stock-based compensation amortization |

1,330 |

1,394 |

1,346 |

956 |

992 |

||||||||||||||

Gains on sale of real estate |

— |

(16,569 |

) |

(2,668 |

) |

(5,814 |

) |

— |

|||||||||||

Gain on sale of real estate from unconsolidated joint ventures |

— |

— |

(11 |

) |

— |

(1,332 |

) |

||||||||||||

Loss on extinguishment of debt |

— |

— |

22 |

— |

— |

||||||||||||||

Legal fee reimbursements(2)

|

— |

— |

— |

(389 |

) |

— |

|||||||||||||

Acquisition expenses |

16 |

20 |

385 |

365 |

380 |

||||||||||||||

Pro forma effect of acquisitions(3)

|

668 |

2,000 |

(15 |

) |

521 |

376 |

|||||||||||||

Pro forma effect of dispositions(4)

|

— |

(157 |

) |

(85 |

) |

(113 |

) |

— |

|||||||||||

Adjusted EBITDA |

$ |

28,265 |

$ |

25,360 |

$ |

22,292 |

$ |

22,388 |

$ |

20,622 |

|||||||||

(1) |

For a definition and discussion of non-GAAP financial measures, see the definitions section beginning on page 25 of this report.

|

(2) |

Legal fee reimbursements relate to prior litigation of the Company. For more information, see Item 3. Legal Proceedings in our 2014 Annual Report on Form 10-K. |

(3) |

Represents the estimated impact on Q3’17 EBITDA of Q3’17 acquisitions as if they had been acquired July 1, 2017, the impact on Q2’17 EBITDA of Q2’17 acquisitions as if they had been acquired April 1, 2017, the impact on Q1’17 EBITDA of Q1’17 acquisitions as if they had been acquired January 1, 2017, the impact on Q4’16 EBITDA of Q4’16 acquisitions as if they had been acquired October 1, 2016 and the impact on Q3’16 EBITDA of Q3’16 acquisitions as if they had been acquired July 1, 2016. We have made a number of assumptions in such estimates and there can be no assurance that we would have generated the projected levels of EBITDA had we owned the acquired entities as of the beginning of each period. |

(4) |

Represents the impact on Q2’17 EBITDA of Q2’17 dispositions as if they had been sold as of April 1, 2017, the impact on Q1’17 EBITDA of Q1’17 dispositions as if they had been sold as of January 1, 2017, and the impact on Q4’16 EBITDA of Q4’16 dispositions as if they had been sold as of October 1, 2016. See page 22 for a detail of current year disposition properties. |

|

Third Quarter 2017

Supplemental Financial Reporting Package

|

Page 10

|

|

|

Same Property Portfolio Performance. (1)

|

||

(unaudited and dollars in thousands) |

||

Same Property Portfolio NOI and Cash NOI: |

||||||||||||||||||||||||||||

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||||||||||||||

2017 |

2016 |

$ Change |

% Change |

2017 |

2016 |

$ Change |

% Change |

|||||||||||||||||||||

Rental income |

$ |

25,155 |

$ |

23,359 |

$ |

1,796 |

7.7% |

$ |

73,682 |

$ |

68,541 |

$ |

5,141 |

7.5% |

||||||||||||||

Tenant reimbursements |

3,834 |

3,508 |

326 |

9.3% |

11,536 |

10,394 |

1,142 |

11.0% |

||||||||||||||||||||

Other income |

134 |

171 |

(37 |

) |

(21.6)% |

436 |

592 |

(156 |

) |

(26.4)% |

||||||||||||||||||

Total rental revenues |

29,123 |

27,038 |

2,085 |

7.7% |

85,654 |

79,527 |

6,127 |

7.7% |

||||||||||||||||||||

Property expenses |

7,655 |

7,493 |

162 |

2.2% |

22,791 |

21,449 |

1,342 |

6.3% |

||||||||||||||||||||

Same property portfolio NOI |

$ |

21,468 |

$ |

19,545 |

$ |

1,923 |

9.8% |

(2) |

$ |

62,863 |

$ |

58,078 |

$ |

4,785 |

8.2% |

(2) |

||||||||||||

Straight-line rents |

(730 |

) |

(887 |

) |

157 |

(17.7)% |

(2,150 |

) |

(2,177 |

) |

27 |

(1.2)% |

||||||||||||||||

Amort. above/below market leases |

73 |

41 |

32 |

78.0% |

246 |

124 |

122 |

98.4% |

||||||||||||||||||||

Same property portfolio Cash NOI |

$ |

20,811 |

$ |

18,699 |

$ |

2,112 |

11.3% |

$ |

60,959 |

$ |

56,025 |

$ |

4,934 |

8.8% |

||||||||||||||

Same Property Portfolio Summary: | |||||||||||

Same Property Portfolio |

|||||||||||

Number of properties |

114 |

||||||||||

Square Feet |

11,211,193 |

||||||||||

Same Property Portfolio Occupancy: | |||||||||||

September 30, 2017 |

September 30, 2016 |

Change (basis points) |

|||||||||

Same Property Portfolio |

Stabilized Same Property Portfolio(3)

|

Same Property Portfolio |

Stabilized Same Property Portfolio(4)

|

Same Property Portfolio |

Stabilized Same Property Portfolio |

||||||

Occupancy: |

|||||||||||

Los Angeles County |

95.4% |

98.3% |

92.7% |

97.5% |

270 bps |

80 bps |

|||||

Orange County |

95.1% |

96.2% |

86.7% |

95.2% |

840 bps |

100 bps |

|||||

San Bernardino County |

98.3% |

98.3% |

95.2% |

95.2% |

310 bps |

310 bps |

|||||

San Diego County |

94.5% |

94.5% |

96.9% |

96.9% |

(240) bps |

(240) bps |

|||||

Ventura County |

92.3% |

92.3% |

94.3% |

94.3% |

(200) bps |

(200) bps |

|||||

Total/Weighted Average |

95.2% |

96.9% |

93.0% |

96.5% |

220 bps |

40 bps |

|||||

(1) |

For a definition and discussion of non-GAAP financial measures, see the definitions section beginning on page 25 of this report.

|

(2) |

Excluding the three and nine months operating results of properties under repositioning in 2016 and 2017, Same Property Portfolio NOI increased by approximately 6.1% and 5.2% during the three and nine months ended September 30, 2017, compared to the three and nine months ended September 30, 2016, respectively.

|

(3) |

Reflects the occupancy of our Same Property Portfolio as of September 30, 2017, adjusted for space aggregating 190,158 rentable square feet at three of our properties that were classified as repositioning or lease-up as of September 30, 2017. For additional details, refer to pages 20-21 of this report.

|

(4) |

Reflects the occupancy of our Same Property Portfolio as of September 30, 2016, adjusted for space aggregating 412,888 rentable square feet at six of our properties that were classified as repositioning or lease-up as of September 30, 2016. |

|

Third Quarter 2017

Supplemental Financial Reporting Package

|

Page 11

|

|

|

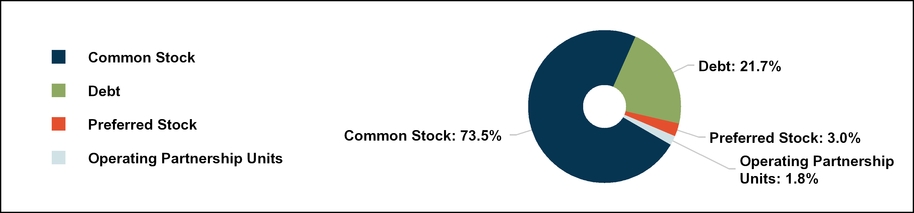

Capitalization Summary.

|

||

(unaudited and in thousands, except share and per share data) |

||

Capitalization as of September 30, 2017 |

||

Description |

September 30, 2017 |

June 30, 2017 |

March 31, 2017 |

December 31, 2016 |

September 30, 2016 |

|||||||||||||||

Common shares outstanding(1)

|

77,337,373 |

70,810,523 |

66,375,624 |

66,166,548 |

65,725,504 |

|||||||||||||||

Operating partnership units outstanding(2)

|

1,947,408 |

1,974,484 |

1,989,812 |

2,008,664 |

1,978,842 |

|||||||||||||||

Total shares and units outstanding at period end |

79,284,781 |

72,785,007 |

68,365,436 |

68,175,212 |

67,704,346 |

|||||||||||||||

Share price at end of quarter |

$ |

28.62 |

$ |

27.44 |

$ |

22.52 |

$ |

23.19 |

$ |

22.89 |

||||||||||

Common Stock and Operating Partnership Units - Capitalization |

$ |

2,269,130 |

$ |

1,997,221 |

$ |

1,539,590 |

$ |

1,580,983 |

$ |

1,549,752 |

||||||||||

5.875% Series A Cumulative Redeemable Preferred Stock(3) |

90,000 |

90,000 |

90,000 |

90,000 |

90,000 |

|||||||||||||||

Total Equity Market Capitalization |

$ |

2,359,130 |

$ |

2,087,221 |

$ |

1,629,590 |

$ |

1,670,983 |

$ |

1,639,752 |

||||||||||

Total Debt |

$ |

666,979 |

$ |

564,242 |

$ |

512,504 |

$ |

502,476 |

$ |

502,776 |

||||||||||

Less: Cash and cash equivalents |

(12,918 |

) |

(13,118 |

) |

(11,676 |

) |

(15,525 |

) |

(55,263 |

) |

||||||||||

Net Debt |

$ |

654,061 |

$ |

551,124 |

$ |

500,828 |

$ |

486,951 |

$ |

447,513 |

||||||||||

Total Combined Market Capitalization (Net Debt plus Equity) |

$ |

3,013,191 |

$ |

2,638,345 |

$ |

2,130,418 |

$ |

2,157,934 |

$ |

2,087,265 |

||||||||||

Net debt to total combined market capitalization |

21.7 |

% |

20.9 |

% |

23.5 |

% |

22.6 |

% |

21.4 |

% |

||||||||||

Net debt to Adjusted EBITDA (quarterly results annualized)(4)

|

5.8x |

5.4x |

5.6x |

5.4x |

5.4x |

|||||||||||||||

(1) |

Excludes the following number of shares of unvested restricted stock: 257,867 (Sep 30, 2017), 312,379 (Jun 30, 2017), 333,128 (Mar 31, 2017), 287,827 (Dec 31, 2016) and 322,837 (Sep 30, 2016).

|

(2) |

Represents outstanding common units of the Company’s operating partnership, Rexford Industrial Realty, LP, that are owned by unit holders other than Rexford Industrial Realty, Inc. Represents the noncontrolling interest in our operating partnership. Includes 41,668 vested LTIP Units and excludes 241,691 unvested LTIP Units and 514,998 unvested performance units.

|

(3) |

Value based on 3,600,000 outstanding shares of preferred stock at a liquidation preference of $25.00 per share. |

(4) |

For a definition and discussion of non-GAAP financial measures, see the definitions section beginning on page 25 of this report.

|

|

Third Quarter 2017

Supplemental Financial Reporting Package

|

Page 12

|

|

|

Debt Summary.

|

||

(unaudited and dollars in thousands) |

||

Debt Detail: |

||

As of September 30, 2017 |

||

Debt Description |

Maturity Date |

Stated Interest Rate |

Effective Interest Rate(1) |

Principal Balance |

Maturity Date of Effective Swaps |

|||||

Secured Debt: |

||||||||||

$60M Term Loan |

8/1/2019(2)

|

LIBOR + 1.90% |

3.817% |

$59,087 |

2/15/2019 |

|||||

Gilbert/La Palma |

3/1/2031 |

5.125% |

5.125% |

2,803 |

-- |

|||||

12907 Imperial Highway |

4/1/2018 |

5.95% |

5.950% |

5,089 |

-- |

|||||

Unsecured Debt: |

||||||||||

$100M Term Loan Facility |

2/14/2022 |

LIBOR +1.20%(4)

|

3.098% |

100,000 |

12/14/2018 |

|||||

$350M Revolving Credit Facility(5)

|

2/12/2021(3)

|

LIBOR +1.10%(4)

|

2.332% |

50,000 |

-- |

|||||

$225M Term Loan Facility(6)

|

1/14/2023 |

LIBOR +1.50%(4)

|

2.732% |

225,000 |

-- |

|||||

$100M Senior Notes |

8/6/2025 |

4.29% |

4.290% |

100,000 |

-- |

|||||

$125M Senior Notes |

7/13/2027 |

3.93% |

3.930% |

125,000 |

-- |

|||||

Total Consolidated: |

3.346% |

$666,979 |

||||||||

(1) |

Includes the effect of interest rate swaps effective as of September 30, 2017, and excludes the effect of discounts/premiums, deferred loan costs and the facility fee.

|

(2) |

One additional one-year extension is available, provided that certain conditions are satisfied. |

(3) |

Two additional six-month extensions are available, provided that certain conditions are satisfied. |

(4) |

The applicable LIBOR margin will range from 1.10% to 1.50% for the revolving credit facility, 1.20% to 1.70% for the $100M term loan facility and 1.50% to 2.25% for the $225M term loan facility depending on the ratio of our outstanding consolidated indebtedness to the value of our consolidated gross asset value, which is measured on a quarterly basis. As a result, the effective interest rate will fluctuate from period to period. |

(5) |

The credit facility is subject to a facility fee which is calculated as a percentage of the total commitment amount, regardless of usage. The facility fee ranges from 0.15% to 0.30% depending on the ratio of our outstanding consolidated indebtedness to the value of our consolidated gross asset value, which is measured on a quarterly basis. |

(6) |

We have two interest rate swaps that will effectively fix this $225M term loan as follows: (i) $125M at 1.349% + an applicable LIBOR margin from 2/14/18 to 1/14/22 and (ii) $100M at 1.406% + an applicable LIBOR margin from 8/14/18 to 1/14/22. |

Debt Composition: |

||||||||||

Category |

Avg. Term Remaining (yrs)(1)

|

Stated

Interest Rate

|

Effective Interest Rate |

Balance |

% of Total |

|||||

Fixed(2)

|

6.6 |

3.83% |

3.83% |

$391,979 |

59% |

|||||

Variable(2)

|

4.9 |

LIBOR + 1.43% |

2.66% |

$275,000 |

41% |

|||||

Secured |

2.2 |

4.03% |

$66,979 |

10% |

||||||

Unsecured |

6.3 |

3.27% |

$600,000 |

90% |

||||||

(1) |

The weighted average remaining term to maturity of our consolidated debt is 5.9 years.

|

(2) |

If all of our interest rate swaps were effective as of September 30, 2017, our consolidated debt would be 93% fixed and 7% variable. See footnote (6) above.

|

Debt Maturity Schedule: |

||||||||||||||||||

Year |

Secured(1)

|

Unsecured |

Total |

% Total |

Effective Interest Rate |

|||||||||||||

2017 |

$ |

— |

$ |

— |

$ |

— |

— |

% |

— |

% |

||||||||

2018 |

5,089 |

— |

5,089 |

1 |

% |

5.950 |

% |

|||||||||||

2019 |

59,087 |

— |

59,087 |

9 |

% |

3.817 |

% |

|||||||||||

2020 |

— |

— |

— |

— |

% |

— |

% |

|||||||||||

2021 |

— |

50,000 |

50,000 |

7 |

% |

2.332 |

% |

|||||||||||

Thereafter |

2,803 |

550,000 |

552,803 |

83 |

% |

3.363 |

% |

|||||||||||

Total |

$ |

66,979 |

$ |

600,000 |

$ |

666,979 |

100 |

% |

3.346 |

% |

||||||||

(1) |

Excludes the effect of scheduled monthly principal payments on amortizing loans. |

|

Third Quarter 2017

Supplemental Financial Reporting Package

|

Page 13

|

|

|

Portfolio Overview.

|

||

at 9/30/17 |

(unaudited results) |

|

Consolidated Portfolio: |

||

Rentable Square Feet |

Occupancy % |

Annualized Base Rent |

|||||||||||||||||||||||||||

Market |

# Properties |

Same Properties Portfolio |

Non-Same Properties Portfolio |

Total Portfolio |

Same Properties Portfolio |

Non-Same Properties Portfolio |

Total Portfolio |

Total Portfolio Excluding Repositioning(1)

|

Total

(in 000’s)(2)

|

per SF |

|||||||||||||||||||

Central LA |

5 |

387,310 |

25,040 |

412,350 |

100.0 |

% |

100.0 |

% |

100.0 |

% |

100.0 |

% |

$ |

4,380 |

$10.62 |

||||||||||||||

Greater San Fernando Valley |

26 |

2,600,837 |

309,036 |

2,909,873 |

92.1 |

% |

64.0 |

% |

89.1 |

% |

97.9 |

% |

25,643 |

$9.89 |

|||||||||||||||

Mid-Counties |

10 |

672,090 |

198,062 |

870,152 |

97.9 |

% |

100.0 |

% |

98.4 |

% |

98.4 |

% |

7,976 |

$9.32 |

|||||||||||||||

San Gabriel Valley |

16 |

1,329,061 |

639,631 |

1,968,692 |

99.4 |

% |

77.0 |

% |

92.1 |

% |

99.6 |

% |

14,271 |

$7.87 |

|||||||||||||||

South Bay |

17 |

961,214 |

1,562,578 |

2,523,792 |

95.3 |

% |

94.4 |

% |

94.7 |

% |

98.7 |

% |

19,966 |

$8.35 |

|||||||||||||||

Los Angeles County |

74 |

5,950,512 |

2,734,347 |

8,684,859 |

95.4 |

% |

87.3 |

% |

92.9 |

% |

98.7 |

% |

72,236 |

$8.96 |

|||||||||||||||

North Orange County |

6 |

528,256 |

345,756 |

874,012 |

94.9 |

% |

89.8 |

% |

92.9 |

% |

92.9 |

% |

6,954 |

$8.57 |

|||||||||||||||

OC Airport |

7 |

512,407 |

116,575 |

628,982 |

92.1 |

% |

100.0 |

% |

93.5 |

% |

96.0 |

% |

5,925 |

$10.07 |

|||||||||||||||

South Orange County |

3 |

46,178 |

283,280 |

329,458 |

100.0 |

% |

100.0 |

% |

100.0 |

% |

100.0 |

% |

2,976 |

$9.03 |

|||||||||||||||

West Orange County |

4 |

285,777 |

243,274 |

529,051 |

100.0 |

% |

55.6 |

% |

79.6 |

% |

100.0 |

% |

3,359 |

$7.98 |

|||||||||||||||

Orange County |

20 |

1,372,618 |

988,885 |

2,361,503 |

95.1 |

% |

85.5 |

% |

91.1 |

% |

96.1 |

% |

19,214 |

$8.93 |

|||||||||||||||

Inland Empire East |

2 |

85,282 |

— |

85,282 |

93.3 |

% |

— |

% |

93.3 |

% |

93.3 |

% |

558 |

$7.01 |

|||||||||||||||

Inland Empire West |

16 |

1,108,197 |

2,200,618 |

3,308,815 |

98.7 |

% |

99.3 |

% |

99.1 |

% |

99.1 |

% |

22,890 |

$6.98 |

|||||||||||||||

San Bernardino County |

18 |

1,193,479 |

2,200,618 |

3,394,097 |

98.3 |

% |

99.3 |

% |

99.0 |

% |

99.0 |

% |

23,448 |

$6.98 |

|||||||||||||||

Ventura |

13 |

1,144,575 |

599,910 |

1,744,485 |

92.3 |

% |

71.4 |

% |

85.1 |

% |

93.4 |

% |

12,644 |

$8.52 |

|||||||||||||||

Ventura County |

13 |

1,144,575 |

599,910 |

1,744,485 |

92.3 |

% |

71.4 |

% |

85.1 |

% |

93.4 |

% |

12,644 |

$8.52 |

|||||||||||||||

Central San Diego |

13 |

889,050 |

254,919 |

1,143,969 |

95.1 |

% |

94.4 |

% |

95.0 |

% |

95.0 |

% |

12,567 |

$11.57 |

|||||||||||||||

North County San Diego |

7 |

584,258 |

54,740 |

638,998 |

93.5 |

% |

— |

% |

85.5 |

% |

85.5 |

% |

5,603 |

$10.25 |

|||||||||||||||

South County San Diego |

1 |

76,701 |

— |

76,701 |

95.1 |

% |

— |

% |

95.1 |

% |

95.1 |

% |

686 |

$9.41 |

|||||||||||||||

San Diego County |

21 |

1,550,009 |

309,659 |

1,859,668 |

94.5 |

% |

77.7 |

% |

91.7 |

% |

91.7 |

% |

18,856 |

$11.05 |

|||||||||||||||

CONSOLIDATED TOTAL / WTD AVG |

146 |

11,211,193 |

6,833,419 |

18,044,612 |

95.2 |

% |

89.1 |

% |

92.9 |

% |

97.2 |

% |

$ |

146,398 |

$8.73 |

||||||||||||||

(1) |

Excludes space aggregating 790,138 square feet at eight of our properties that were in various stages of repositioning or lease-up as of September 30, 2017. See pages 20-21 for additional details on these properties.

|

(2) |

Calculated for each property as monthly contracted base rent per the terms of the lease(s) at such property, as of September 30, 2017, multiplied by 12 and then aggregated by market. Excludes billboard and antenna revenue and rent abatements.

|

|

Third Quarter 2017

Supplemental Financial Reporting Package

|

Page 14

|

|

|

Occupancy and Leasing Trends.

|

||

(unaudited results, data represents consolidated portfolio only) |

||

Occupancy by County: |

||

Sep 30, 2017 |

Jun 30, 2017 |

Mar 31, 2017 |

Dec 31, 2016 |

Sep 30, 2016 |

||||||

Occupancy:(1)

|

||||||||||

Los Angeles County |

92.9% |

90.5% |

89.8% |

92.1% |

91.2% |

|||||

Orange County |

91.1% |

92.0% |

92.7% |

96.1% |

92.3% |

|||||

San Bernardino County |

99.0% |

95.2% |

92.0% |

96.4% |

96.1% |

|||||

Ventura County |

85.1% |

83.1% |

88.1% |

92.3% |

86.2% |

|||||

San Diego County |

91.7% |

95.7% |

79.8% |

81.0% |

79.5% |

|||||

Total/Weighted Average |

92.9% |

91.4% |

88.9% |

91.7% |

89.7% |

|||||

Consolidated Portfolio SF |

18,044,612 |

16,221,646 |

15,069,122 |

15,020,336 |

14,588,101 |

|||||

Leasing Activity: |

||||||||||

Three Months Ended |

||||||||||

Sep 30, 2017 |

Jun 30, 2017 |

Mar 31, 2017 |

Dec 31, 2016 |

Sep 30, 2016 |

||||||

Leasing Activity (SF):(2)

|

||||||||||

New leases(3)

|

678,882 |

310,950 |

423,766 |

401,081 |

519,212 |

|||||

Renewal leases(3)

|

614,175 |

469,766 |

439,602 |

363,601 |

318,179 |

|||||

Gross leasing |

1,293,057 |

780,716 |

863,368 |

764,682 |

837,391 |

|||||

Expiring leases |

942,721 |

663,128 |

914,098 |

477,966 |

619,461 |

|||||

Expiring leases - placed into repositioning |

28,830 |

107,965 |

334,689 |

— |

— |

|||||

Net absorption |

321,506 |

9,623 |

(385,419) |

286,716 |

217,930 |

|||||

Retention rate(4)

|

66% |

71% |

57% |

76% |

51% |

|||||

Weighted Average New / Renewal Leasing Spreads: |

||||||||||

Three Months Ended |

||||||||||

Sep 30, 2017 |

Jun 30, 2017 |

Mar 31, 2017 |

Dec 31, 2016 |

Sep 30, 2016 |

||||||

GAAP Rent Change |

26.3% |

20.4% |

23.3% |

16.1% |

15.6% |

|||||

Cash Rent Change |

16.7% |

10.6% |

13.7% |

5.9% |

7.0% |

|||||

(1) |

See page 14 for the occupancy by county of our total consolidated portfolio excluding repositioning space. |

(2) |

Excludes month-to-month tenants. |

(3) |

Renewal leasing activity for Q3’17 and Q1’17 excludes relocations/expansions within Rexford’s portfolio totaling 9,493 and 77,738 rentable square feet, respectively, which are included as part of new leasing activity.

|

(4) |

Retention rate is calculated as renewal lease square footage plus relocation/expansion square footage noted in (3) above, divided by expiring lease square footage (excluding expiring lease square footage placed into repositioning). |

|

Third Quarter 2017

Supplemental Financial Reporting Package

|

Page 15

|

|

|

Leasing Statistics.

|

||

(unaudited results, data represents consolidated portfolio only) |

||

Leasing Activity: |

||

# Leases Signed |

SF of Leasing |

Weighted Average Lease Term (Years) |

||||

Third Quarter 2017: |

||||||

New |

61 |

678,882 |

4.4 |

|||

Renewal |

66 |

614,175 |

3.6 |

|||

Total/Weighted Average |

127 |

1,293,057 |

4.0 |

|||

Change in Annual Rental Rates for Current Quarter Leases: |

||||||||||||||

GAAP Rent |

Cash Rent |

|||||||||||||

Third Quarter 2017: |

Current Lease |

Prior Lease |

Rent Change - GAAP |

Weighted Average Abatement (Months) |

Starting Cash Rent - Current Lease |

Expiring Cash Rent - Prior Lease |

Rent Change - Cash |

|||||||

New(1)

|

$10.81 |

$8.09 |

33.6% |

0.8 |

$10.55 |

$8.69 |

21.4% |

|||||||

Renewal(2)

|

$8.60 |

$7.09 |

21.2% |

1.8 |

$8.58 |

$7.57 |

13.4% |

|||||||

Total/Weighted Average |

$9.44 |

$7.47 |

26.3% |

1.4 |

$9.33 |

$7.99 |

16.7% |

|||||||

Uncommenced Leases by County: |

||||||||||

Market |

Leased SF |

Uncommenced Leases

Annualized Base Rent

(in thousands)

|

Total Pro Forma

Annualized Base Rent

(in thousands)

|

Leased Percentage |

Pro Forma

Annualized Base

Rent per SF

|

|||||

Los Angeles County |

38,708 |

$416 |

$72,653 |

93.3% |

$8.97 |

|||||

Orange County |

34,826 |

410 |

19,624 |

92.5% |

$8.98 |

|||||

San Bernardino County |

2,770 |

33 |

23,481 |

99.0% |

$6.99 |

|||||

San Diego County |

95,737 |

1,067 |

19,922 |

96.9% |

$11.06 |

|||||

Ventura County |

43,927 |

343 |

12,987 |

87.6% |

$8.50 |

|||||

Total/Weighted Average |

215,968 |

$2,269 |

$148,667 |

94.1% |

$8.76 |

|||||

(1) |

GAAP and cash rent statistics for new leases exclude 21 leases aggregating 314,601 rentable square feet for which there was no comparable lease data. Of these 21 excluded leases, four leases aggregating 172,675 rentable square feet relate to repositioning projects. Comparable leases generally exclude: (i) space that has never been occupied under our ownership, (ii) repositioned/redeveloped space, (iii) space that has been vacant for over one year, (iv) space with different lease structures (for example a change from a gross lease to a modified gross lease or an increase or decrease in the leased square footage) or (v) lease terms shorter than six months.

|

(2) |

GAAP and cash rent statistics for renewal leases excludes one lease with 21,975 rentable square feet for which there was no comparable lease data, due to either (i) space with different lease structures or (ii) lease terms shorter than six months.

|

|

Third Quarter 2017

Supplemental Financial Reporting Package

|

Page 16

|

|

|

Leasing Statistics (Continued).

|

||

(unaudited results, data represents consolidated portfolio only) |

||

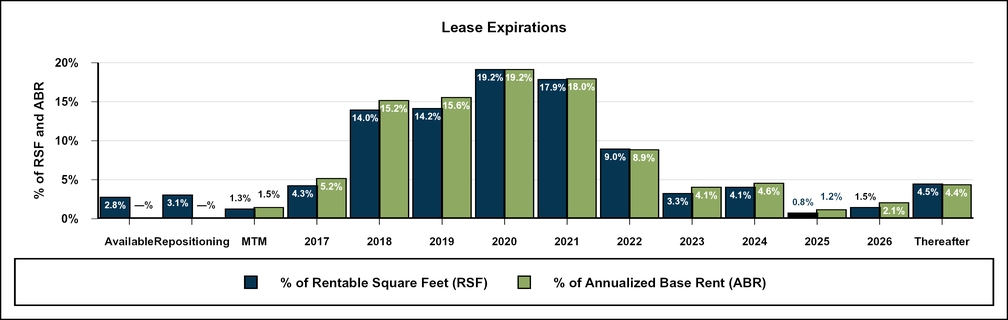

Lease Expiration Schedule for Leases in Place as of September 30, 2017: |

||

Year of Lease Expiration |

# of Leases Expiring |

Total Rentable SF |

Annualized Base Rent

(in thousands)

|

Annualized Base

Rent per SF

|

||||||

Available |

— |

504,853 |

$ |

— |

$— |

|||||

Current Repositioning(1)

|

— |

559,308 |

— |

$— |

||||||

MTM Tenants |

100 |

223,304 |

2,225 |

$9.96 |

||||||

2017 |

99 |

780,868 |

7,713 |

$9.88 |

||||||

2018 |

352 |

2,519,326 |

22,522 |

$8.94 |

||||||

2019 |

301 |

2,565,082 |

23,170 |

$9.03 |

||||||

2020 |

252 |

3,471,261 |

28,599 |

$8.24 |

||||||

2021 |

123 |

3,233,164 |

26,758 |

$8.28 |

||||||

2022 |

85 |

1,626,380 |

13,286 |

$8.17 |

||||||

2023 |

20 |

595,581 |

6,159 |

$10.34 |

||||||

2024 |

13 |

731,124 |

6,892 |

$9.43 |

||||||

2025 |

4 |

148,215 |

1,712 |

$11.55 |

||||||

2026 |

6 |

273,904 |

3,150 |

$11.50 |

||||||

Thereafter |

11 |

812,242 |

6,481 |

$7.98 |

||||||

Total Portfolio |

1,366 |

18,044,612 |

$ |

148,667 |

$8.76 |

|||||

(1) |

Represents space at six of our properties that were classified as current repositioning as of September 30, 2017. Excludes completed repositioning properties, properties in lease-up and pre-leased space at current repositioning properties. See pages 20-21 for additional details on these properties.

|

|

Third Quarter 2017

Supplemental Financial Reporting Package

|

Page 17

|

|

|

Top Tenants and Lease Segmentation.

|

||

(unaudited results, data represents consolidated portfolio only) |

||

Top 10 Tenants: |

||

Tenant |

Submarket |

Leased SF |

% of Total Annualized

Base Rent

|

Annualized Base

Rent per SF

|

Lease Expiration |

|||||

32 Cold, LLC |

Central LA |

149,157 |

1.4% |

$14.44 |

3/31/2026(1)

|

|||||

Command Logistics Services, Inc. |

South Bay |

340,672 |

1.4% |

$6.00 |

9/30/2020(2)

|

|||||

Triscenic Production Services, Inc. |

Greater San Fernando Valley |

255,303 |

1.3% |

$7.51 |

3/31/2022(3)

|

|||||

Cosmetic Laboratories of America, LLC |

Greater San Fernando Valley |

319,348 |

1.3% |

$5.95 |

6/30/2020 |

|||||

Universal Technical Institute of Southern California, LLC |

South Bay |

142,593 |

1.3% |

$13.29 |

8/31/2030 |

|||||

Dendreon Corporation |

West Orange County |

170,865 |

1.0% |

$8.87 |

12/31/2019 |

|||||

Undisclosed luxury high-end car company |

Greater San Fernando Valley |

167,425 |

1.0% |

$8.44 |

8/31/2022(4)

|

|||||

Triumph Processing, Inc. |

South Bay |

164,662 |

0.9% |

$8.47 |

5/31/2030 |

|||||

Elliott Auto Supply Co., Inc. |

North Orange County |

228,379 |

0.9% |

$5.98 |

12/31/2021(5)

|

|||||

Heritage Bag Company |

Inland Empire West |

284,676 |

0.8% |

$4.34 |

11/27/2030 |

|||||

Top 10 Total / Weighted Average |

2,223,080 |

11.3% |

$7.57 |

|||||||

(1) |

Includes (i) 78,280 rentable square feet expiring September 30, 2025, and (ii) 70,877 rentable square feet expiring March 31, 2026.

|

(2) |

Includes (i) 111,769 rentable square feet expiring June 30, 2018, and (ii) 228,903 rentable square feet expiring September 30, 2020.

|

(3) |

Includes (i) 38,766 rentable square feet expiring November 30, 2019, (ii) 147,318 rentable square feet expiring September 30, 2021, and (iii) 69,219 rentable square feet expiring March 31, 2022.

|

(4) |

Includes (i) 16,868 rentable square feet expiring 4/30/2018, (ii) 21,697 rentable square feet expiring 11/30/2019, (iii) 20,310 rentable square feet expiring 5/31/2020, and (iv) 108,550 rentable square feet expiring 8/31/2022.

|

(5) |

Includes (i) 28,217 rentable square feet expiring October 31, 2021, and (ii) 200,162 rentable square feet expiring December 31, 2021.

|

Lease Segmentation by Size: |

||||||||||||||||||

Square Feet |

Number of Leases |

Leased Rentable SF |

Rentable SF |

Leased % |

Leased % Excluding Repositioning |

Annualized Base Rent

(in thousands)

|

% of Total Annualized

Base Rent

|

Annualized Base Rent

per SF

|

||||||||||

<4,999 |

811 |

1,709,117 |

1,824,120 |

93.7% |

93.8% |

$ |

19,985 |

13.4% |

$11.69 |

|||||||||

5,000 - 9,999 |

188 |

1,310,159 |

1,431,834 |

91.5% |

97.0% |

13,817 |

9.3% |

$10.55 |

||||||||||

10,000 - 24,999 |

223 |

3,572,302 |

3,988,579 |

89.6% |

96.1% |

33,560 |

22.6% |

$9.39 |

||||||||||

25,000 - 49,999 |

70 |

2,492,505 |

2,533,581 |

98.4% |

98.4% |

22,532 |

15.2% |

$9.04 |

||||||||||

>50,000 |

74 |

7,896,368 |

8,266,498 |

95.5% |

100.0% |

58,773 |

39.5% |

$7.44 |

||||||||||

Total / Weighted Average |

1,366 |

16,980,451 |

18,044,612 |

94.1% |

98.0% |

$ |

148,667 |

100.0% |

$8.76 |

|||||||||

|

Third Quarter 2017

Supplemental Financial Reporting Package

|

Page 18

|

|

|

Capital Expenditure Summary.

|

||

(unaudited results, in thousands, except square feet and per square foot data) | ||

Nine months ended September 30, 2017 |

||

Year to Date |

||||||||||||||||||||||

Q3-2017 |

Q2-2017 |

Q1-2017 |

Total |

SF(1)

|

PSF |

|||||||||||||||||

Tenant Improvements and Space Preparation(2):

|

||||||||||||||||||||||

New Leases‐1st Generation |

$ |

306 |

$ |

267 |

$ |

445 |

$ |

1,018 |

448,243 |

$ |

2.27 |

|||||||||||

New Leases‐2nd Generation |

$ |

299 |

$ |

109 |

$ |

225 |

$ |

633 |

500,514 |

$ |

1.26 |

|||||||||||

Renewals |

$ |

109 |

$ |

214 |

$ |

19 |

$ |

342 |

316,312 |

$ |

1.08 |

|||||||||||

Leasing Commissions & Lease Costs: |

||||||||||||||||||||||

New Leases‐1st Generation |

$ |

554 |

$ |

103 |

$ |

116 |

$ |

773 |

278,885 |

$ |

2.77 |

|||||||||||

New Leases‐2nd Generation |

$ |

980 |

$ |

448 |

$ |

835 |

$ |

2,263 |

1,043,627 |

$ |

2.17 |

|||||||||||

Renewals |

$ |

230 |

$ |

129 |

$ |

162 |

$ |

521 |

520,533 |

$ |

1.00 |

|||||||||||

Total Recurring Capex: |

||||||||||||||||||||||

Recurring Capex |

$ |

452 |

$ |

857 |

$ |

390 |

$ |

1,699 |

16,104,713 |

$ |

0.11 |

|||||||||||

Recurring Capex % of NOI |

1.4 |

% |

3.2 |

% |

1.5 |

% |

2.0 |

% |

||||||||||||||

Recurring Capex % of Operating Revenue |

1.0 |

% |

2.4 |

% |

1.1 |

% |

1.5 |

% |

||||||||||||||

Nonrecurring Capex(2)

|