EX-10.15

Published on July 9, 2013

Exhibit 10.15

FIDELITY NATIONAL TITLE CO.

9758569-DJ

Recording Requested by

and when recorded return to

WELLS FARGO BANK, National Association Commercial Mortgage Origination MAC# A0194-093 45 Fremont Street, 9th Floor,

San Francisco, California 94105

Attention CMO Loan Administration

Loan No. 31-0901787

MERS MIN No 800010100000005354

Recorded in Official Records, County of San Bernardino

12/10/2004 8:00 AM

LM

LARRY WALKER

Auditor/Controller Recorder

688 Fidelity/Riverside

Titles: 4 Pages: 33

Fees 128.00

Taxes 0.00

Other 0.00

PAID $128.00

DEED OF TRUST

and

ABSOLUTE ASSIGNMENT OF RENTS AND LEASES and SECURITY AGREEMENT (AND FIXTURE FILING)

The parties to this DEED OF TRUST AND ABSOLUTE ASSIGNMENT OF RENTS AND LEASES AND SECURITY AGREEMENT (AND FIXTURE FILING) (Deed of Trust), dated as of November 29, 2004 are JERSEY BUSINESS PARK, a California general partnership (Trustor), with a mailing address at 10700 Jersey Boulevard, Suite 610, Rancho Cucmonga, CA 91730, AMERICAN SECURITIES COMPANY (Trustee), with a mailing address at 1320 Willow Pass Road, Suite 205, Concord, CA 94520, and MORTGAGE ELECTRONIC REGISTRATION SYSTEMS, INC, a Delaware corporation (MERS or Beneficiary), with a mailing address at MERS Commercial, P O. Box 2300, Flint, Michigan 48501-2300

RECITALS

A JERSEY BUSINESS PARK, a California general partnership (Borrower) proposes to borrow from Wells Fargo Bank, National Association (Lender) and Lender proposes to lend to Borrower the principal sum of SIX MILLION AND NO/100THS DOLLARS ($6,000,000) (Loan). The Loan is evidenced by a promissory note (Note) executed by Borrower, dated the date of this Deed of Trust, payable to the order of Lender in the principal amount of the Loan The Maturity Date of the Loan is January 1, 2015

B The loan documents include this Deed of Trust, the Note and the other documents described in the Note as Loan

Documents (Loan Documents)

SI CA RG (rev 02/2004)

1

ARTICLE 1. DEED OF TRUST

1 1 GRANT For the purposes of and upon the terms and conditions of this Deed of Trust, Trustor irrevocably grants, conveys and assigns to Trustee, in trust, for the benefit of Beneficiary, with power of sale and right of entry and possession, all estate, right, title and interest which Trustor now has or may hereafter acquire in, to, under or derived from any or all of the following.

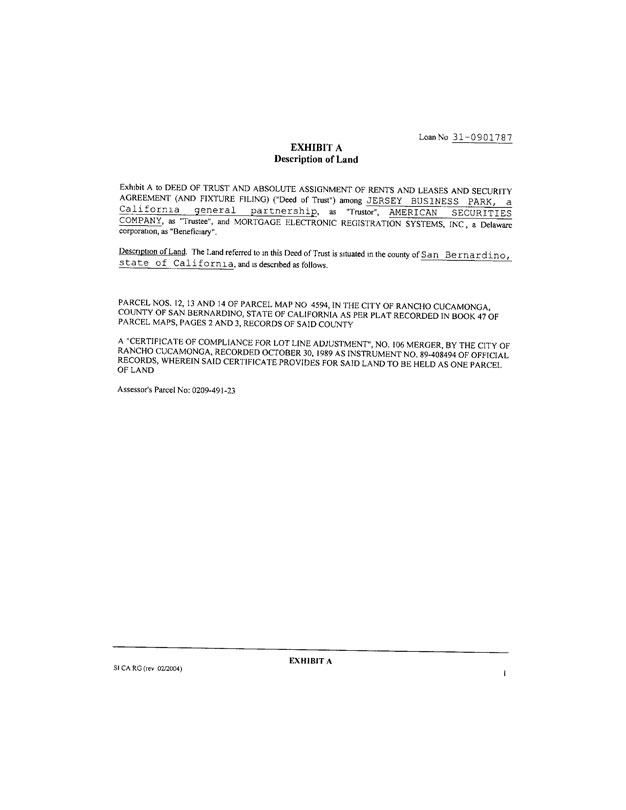

a. That real property (Land) located in Rancho Cucamonga, County of San Bernardino, California and more particularly described on Exhibit A attached hereto,

b All appurtenances, easements, rights of way, water and water rights, pumps, pipes, flumes and ditches and ditch rights, water stock, ditch and/or reservoir stock or interests, royalties, development rights and credits, air rights, minerals, oil rights, and gas rights, now or later used or useful in connection with, appurtenant to or related to the Land;

c. All buildings, structures, facilities, other improvements and fixtures now or hereafter located on the Land,

d. All apparatus, equipment, machinery and appliances and all accessions thereto and renewals and replacements thereof and substitutions therefor used in the operation or occupancy of the Land, it being intended by the parties that all such items shall be conclusively considered to be a part of the Land, whether or not attached or affixed to the Land,

e All land lying in the right-of-way of any street, road, avenue, alley or right-of-way opened, proposed or vacated, and all sidewalks, strips and gores of land adjacent to or used in connection with the Land,

f All additions and accretions to the property described above,

g All licenses, authorizations, certificates, variances, consents, approvals and other permits now or hereafter pertaining to the Land and all estate, right, title and interest of Trustor in, to, under or derived from all tradenames or business names relating to the Land or the present or future development, construction, operation or use of the Land, and

h All proceeds of any of the foregoing

All of the property described above is hereinafter collectively defined as the Property The listing of specific rights or property shall not be interpreted as a limitation of general terms

ARTICLE 2. OBLIGATIONS SECURED

2 1 OBLIGATIONS SECURED. Trustor makes the foregoing grant and assignment for the purpose of securing the following obligations (Secured Obligations)

a Full and punctual payment to Lender of all sums at any time owing under the Note,

b Payment and performance of all covenants and obligations of Trustor under this Deed of Trust including, without limitation, indemnification obligations and advances made to protect the Property,

c Payment and performance of all additional covenants and obligations of Borrower and Trustor under the Loan Documents;

SI CA RG (rev 02/2004)

2

d. Payment and performance of all covenants and obligations, if any, which any rider attached as an exhibit to this Deed of Trust recites are secured hereby;

e Payment and performance of all future advances and other obligations that the then record owner of all or part of the Property may agree to pay and/or perform (whether as principal, surety or guarantor) for the benefit of Beneficiary, when the obligation is evidenced by a writing which recites that it is secured by this Deed of Trust,

f All interest and charges on all obligations secured hereby including, without limitation, prepayment charges, late charges and loan fees,

g. All modifications, extensions and renewals of any of the obligations secured hereby, however evidenced, including, without limitation (i) modifications of the required principal payment dates or interest payment dates or both, as the case may be, deferring or accelerating payment dates wholly or partly, and (ii) modifications, extensions or renewals at a different rate of interest whether or not any such modification, extension or renewal is evidenced by a new or additional promissory note or notes, and

h. Payment and performance of any other obligations which are defined as Secured Obligations in the Note

2 2 OBLIGATIONS The term obligations is used herein in its broadest and most comprehensive sense and shall be deemed to include, without limitation, all interest and charges, prepayment charges, late charges and loan tees at any time accruing or assessed on any of the Secured Obligations.

2 3 INCORPORATION All terms and conditions of the documents which evidence any of the Secured Obligations are incorporated herein by this reference All persons who may have or acquire an interest in the Property shall be deemed to have notice of the terms of the Secured Obligations and to have notice that the rate of interest on one or more Secured Obligation may vary from time to time.

ARTICLE 3. ABSOLUTE ASSIGNMENT OF RENTS AND LEASES

3.1 ASSIGNMENT. Trustor irrevocably assigns to Beneficiary all of Trustors right, title and interest in, to and under. (a) all present and future leases of the Property or any portion thereof, all licenses and agreements relating to the management, leasing or operation of the Property or any portion thereof, and all other agreements of any kind relating to the use or occupancy of the Property or any portion thereof, whether such leases, licenses and agreements are now existing or entered into after the date hereof (Leases), and (b) the rents, issues, deposits and profits of the Property, including, without limitation, all amounts payable and all rights and benefits accruing to Trustor under the Leases (Payments) The term Leases shall also include all guarantees of and security for the tenants performance thereunder, and all amendments, extensions, renewals or modifications thereto which are permitted hereunder This is a present and absolute assignment, no an assignment for security purposes only, and Beneficiarys right to the Leases and Payments is not contingent upon, and may be exercised without possession of, the Property

3 2 GRANT OF LICENSE Beneficiary confers upon Trustor a revocable license (License) to collect and retain the Payments as they become due and payable, until the occurrence of a Default (as hereinafter defined) Upon a Default, the License shall be automatically revoked and Beneficiary may collect and apply the Payments pursuant to the terms hereof without notice and without taking possession of the Property All Payments thereafter collected by Trustor shall be held by Trustor as trustee under a constructive trust for the benefit of Beneficiary Trustor hereby irrevocably authorizes and directs the tenants under the Leases to rely upon and comply with any notice or demand by Beneficiary for the payment to Beneficiary of any rental or other sums which may at any time become due under the Leases, or for the performance of any of the tenants undertakings under the Leases, and the tenants shall have no right or duty to inquire as to whether any Default has actually

SI CA RG (rev 02/2004)

3

occurred or is then existing Trustor hereby relieves the tenants from any liability to Trustor by reason of relying upon and complying with any such notice or demand by Beneficiary. Beneficiary may apply, in its sole discretion, any Payments so collected by Beneficiary against any Secured Obligation or any other obligation of Borrower, Trustor or any other person or entity, under any document or instrument related to or executed in connection with the Loan Documents, whether existing on the date hereof or hereafter arising Collection of any Payments by Beneficiary shall not cure or waive any Default or notice of Default or invalidate any acts done pursuant to such notice If and when no Default exists, Beneficiary shall re-confer the License upon Trustor until the occurrence of another Default

3.3 EFFECT OF ASSIGNMENT The foregoing irrevocable assignment shall not cause Beneficiary to be; (a) a mortgagee in possession, (b) responsible or liable for the control, care, management or repair of the Property or for performing any of the terms, agreements, undertakings, obligations, representations, warranties, covenants and conditions of the Leases; (c) responsible or liable for any waste committed on the Property by the tenants under any of the Leases or by any other parties, for any dangerous or defective condition of the Property; or for any negligence in the management, upkeep, repair or control of the Property resulting in loss or injury or death to any tenant, licensee, employee, invitee or other person; or (d) responsible for or impose upon Beneficiary any duty to produce rents or profits. Beneficiary shall not directly or indirectly be liable to Trustor or any other person as a consequence of: (e) the exercise or failure to exercise any of the rights, remedies or powers granted to Beneficiary hereunder, or (f) the failure or refusal of Beneficiary to perform or discharge any obligation, duty or liability of Trustor arising under the Leases

3 4 COVENANTS-LONG TERM LEASES

a All Leases Trustor shall, at Trustors sole cost and expense

(i) perform all obligations of the landlord under the Leases and use reasonable efforts to enforce performance by the tenants of all obligations of the tenants under the Leases,

(ii) use reasonable efforts to keep the Property leased at all times to tenants which Trustor reasonably and in good faith believes are creditworthy at rents not less than the fair market rental value (including, but not limited to, free or discounted rents to the extent the market so requires),

(iii) promptly upon Beneficiarys request, deliver to Beneficiary a copy of each requested Lease and all amendments thereto and waivers thereof, and

(iv) promptly upon Beneficiarys request, execute and record any additional assignments of landlords interest under any Lease to Beneficiary and specific subordinations of any Lease to this Deed of Trust, in form and substance satisfactory to Beneficiary.

Unless consented to in writing by Beneficiary or otherwise permitted under any other provision of the Loan Documents, Trustor shall not

(v) grant any tenant under any Lease any option, right of first refusal or other right to purchase all or any portion of the Property under any circumstances,

(vi) grant any tenant under any Lease any right to prepay rent more than 1 month in advance;

(vii) except upon Beneficiarys request, execute any assignment of landlords interest in any Lease, or

(viii) collect rent or other sums due under any Lease in advance, other than to collect rent 1 month in advance of the time when it becomes due

Any such attempted action in violation of the provisions of this Section shall be null and void

SI CA RG (rev 02/2004)

4

Trustor shall deposit with Beneficiary any sums received by Trustor in consideration of any termination, modification or amendment of any Lease or any release or discharge of any tenant under any Lease from any obligation thereunder and any such sums received by Trustor shall be held in trust by Trustor for such purpose. Notwithstanding the foregoing, so long as no Default exists, the portion of any such sum received by Trustor with respect to any Lease which is less than $50,000 shall be payable to Trustor All such sums received by Beneficiary with respect to any Lease shall be deemed Impounds (as defined in Section 6.12b) and shall be deposited by Beneficiary into a pledged account in accordance with Section 6.12b. If no Default exists, Beneficiary shall release such Impounds to Trustor from time to time as necessary to pay or reimburse Trustor for such tenant improvements, brokerage commissions and other leasing costs as may be required to re-tenant the affected space, provided, however, Beneficiary shall have received and approved each of the following for each tenant for which such costs were incurred; (1) Trustors written request for such release, including the name of the tenant, the location and net rentable area of the space and a description and cost breakdown of the tenant improvements or other leasing costs covered by the request; (2) Trustors certification that any tenant improvements have been completed lien-free and in a workmanlike manner; (3) a fully executed Lease, or extension or renewal of the current Lease; (4) an estoppel certificate executed by the tenant including its acknowledgement that all tenant improvements have been satisfactorily completed; and (5) such other information with respect to such costs as Beneficiary may require Following the re-tenanting of all affected space (including, without limitation, the completion of all tenant improvements), and provided no Default exists, Beneficiary shall release any remaining such Impounds relating to the affected space to Trustor. Trustor shall construct all tenant improvements in a workmanlike manner and in accordance with all applicable laws, ordinances, rules and regulations

b Major Leases. Trustor shall, at Trustors sole cost and expense, give Beneficiary prompt written notice of any material default by landlord or tenant under any Major Lease (as defined below). Unless consented to in writing by Beneficiary or otherwise permitted under any other provision of the Loan Documents, Trustor shall not

(i) enter into any Major Lease which (aa) is not on fair market terms (which terms may include free or discounted rent to the extent the market so requires), (bb) does not contain a provision requiring the tenant to execute and deliver to the landlord an estoppel certificate in form and substance satisfactory to the landlord promptly upon the landlords request, or (cc) allows the tenant to assign or sublet the premises without the landlords consent,

(ii) reduce any rent or other sums due from the tenant under any Major Lease;

(iii) terminate or materially modify or amend any Major Lease, or

(iv) release or discharge the tenant or any guarantor under any Major Lease from any material obligation thereunder

Any such attempted action in violation of the provisions of this Section shall be null and void.

Major Lease, as used herein, shall mean any Lease, which is, at any time. (1) a Lease of more than 20% the total rentable area of the Property, as reasonably determined by Beneficiary; or (2) a Lease which generates a gross base monthly rent exceeding 20% of the total gross base monthly rent generated by all Leases (excluding all Leases under which the tenant is then in default), as reasonably determined by Beneficiary. Trustors obligations with respect to Major Leases shall be governed by the provisions of Section 3 4a as well as by the provisions of this Section

SI CA RG (rev 02/2004)

5

c Failure to Deny Request. Beneficiarys failure to deny any written request by Trustor for Beneficiarys consent under the provisions of Sections 3 4a or 3 4b within 10 Business Days after Beneficiarys receipt of such request (and all documents and information reasonably related thereto) shall be deemed to constitute Beneficiarys consent to such request.

3 5 ESTOPPEL CERTIFICATES. Within 30 days after request by Beneficiary, Trustor shall deliver to Beneficiary and to any party designated by Beneficiary, estoppel certificates relating to the Leases executed by Trustor and by each of the tenants, in form and substance acceptable to Beneficiary, provided, however, if any tenant shall fail or refuse to so execute and deliver any such estoppel certificate upon request, Trustor shall use reasonable efforts to cause such tenant to execute and deliver such estoppel certificate but such tenants continued failure or refusal to do so, despite Trustors reasonable efforts, shall not constitute a default by Trustor under this Section

3 6 RIGHT OF SUBORDINATION. Beneficiary may at any time and from time to time by specific written

instrument intended for the purpose unilaterally subordinate the lien of this Deed of Trust to any Lease, without joinder or consent of, or notice to, Trustor, any tenant or any other person Notice is hereby given to each tenant under a Lease of such right to subordinate No subordination referred to in this Section shall constitute a subordination to any lien or other encumbrance, whenever arising, or improve the right of any junior lienholder. Nothing herein shall be construed as subordinating this Deed of Trust to any Lease

ARTICLE 4. SECURITY AGREEMENT AND FIXTURE FILING

4 1 SECURITY INTEREST Trustor grants and assigns to Beneficiary a security interest to secure payment

and performance of all of the Secured Obligations, in all of the following described personal property in which Trustor now or at any time hereafter has any interest (Collateral)

All goods, building and other materials, supplies, work in process, equipment, machinery, fixtures, furniture, furnishings, signs and other personal property, wherever situated, which are or are to be incorporated into, used in connection with or appropriated for use on the Property; all rents, issues, deposits and profits of the Property (to the extent, if any, they are not subject to the Absolute Assignment of Rents and Leases), all inventory, accounts, cash receipts, deposit accounts, impounds, accounts receivable, contract rights, general intangibles, software, chattel paper, instruments, documents, promissory notes, drafts, letters of credit, letter of credit rights, supporting obligations, insurance policies, insurance and condemnation awards and proceeds, any other rights to the payment of money, trade names, trademarks and service marks arising from or related to the Property or any business now or hereafter conducted thereon by Trustor, all permits, consents, approvals, licenses, authorizations and other rights granted by, given by or obtained from, any governmental entity with respect to the Property, all deposits or other security now or hereafter made with or given to utility companies by Trustor with respect to the Property, all advance payments of insurance premiums made by Trustor with respect to the Property; all plans, drawings and specifications relating to the Property, all loan funds held by Beneficiary, whether or not disbursed; all funds deposited with Beneficiary pursuant to any Loan Document, all reserves, deferred payments, deposits, accounts, refunds, cost savings and payments of any kind related to the Property or any portion thereof, including, without limitation, all Impounds as defined herein, together with all replacements and proceeds of, and additions and accessions to, any of the foregoing, and all books, records and files relating to any of the foregoing

As to all of the above-described personal property which is or which hereafter becomes a fixture under applicable law, this Deed of Trust constitutes a fixture filing under the California Uniform Commercial Code, as amended or recodified from time to time (UCC)

SI CA RG (rev 02/2004)

6

4.2 COVENANTS Trustor agrees (a) to execute and deliver such documents as Beneficiary deems necessary

to create, perfect and continue the security interests contemplated hereby; (b) not to change its name, and, as applicable, its chief executive offices, its principal residence or the jurisdiction in which it is organized without giving Beneficiary at least 30 days prior written notice thereof; and (c) to cooperate with Beneficiary in perfecting all security interests granted herein and in obtaining such agreements from third parties as Beneficiary deems necessary, proper or convenient in connection with the preservation, perfection or enforcement of any of Beneficiarys rights hereunder

4 3 RIGHTS OF BENEFICIARY In addition to Beneficiarys rights as a Secured Party under the UCC, Beneficiary may, but shall not be obligated to, at any time without notice and at the expense of Trustor.

(a) give notice to any person of Beneficiarys rights hereunder and enforce such rights at law or in equity,

(b) insure, protect, defend and preserve the Collateral or any rights or interests of Beneficiary therein, and

(c) inspect the Collateral. Notwithstanding the above, in no event shall Beneficiary be deemed to have accepted any property other than cash in satisfaction of any obligation of Trustor to Beneficiary unless Beneficiary shall make an express written election of said remedy under the UCC or other applicable law.

4 4 RIGHTS OF BENEFICIARY UPON DEFAULT. Upon the occurrence of a Default, then in addition to all of Beneficiarys rights as a Secured Party under the UCC or otherwise at law:

a Disposition of Collateral Beneficiary may: (i) upon written notice, require Trustor to assemble any or all of the Collateral and make it available to Beneficiary at a place designated by Beneficiary,

(ii) without prior notice, enter upon the Property or other place where the Collateral may be located and take possession of, collect, sell, lease, license and otherwise dispose of the Collateral, and store the same at locations acceptable to Beneficiary at Trustors expense, or (iii) sell, assign and deliver the Collateral at any place or in any lawful manner and bid and become purchaser at any such sales, and

b Other Rights Beneficiary may, for the account of Trustor and at Trustors expense: (i) operate, use, consume, sell, lease, license or otherwise dispose of the Collateral as Beneficiary deems appropriate for the purpose of performing any or all of the Secured Obligations; (ii) enter into any agreement, compromise or settlement including insurance claims, which Beneficiary may deem desirable or proper with respect to any of the Collateral, and (iii) endorse and deliver evidences of title for, and receive, enforce and collect by legal action or otherwise, all indebtedness and obligations now or hereafter owing to Trustor in connection with or on account of any or all of the Collateral

Trustor acknowledges and agrees that a disposition of the Collateral in accordance with Beneficiarys rights and remedies as heretofore provided is a disposition thereof in a commercially reasonable manner and that 5 days prior notice of such disposition is commercially reasonable notice Beneficiary shall have no obligation to process or prepare the Collateral for sale or other disposition In disposing of the Collateral, Beneficiary may disclaim all warranties of title, possession, quiet enjoyment and the like. Any proceeds of any sale or other disposition of the Collateral may be applied by Beneficiary first to the reasonable expenses incurred by Beneficiary in connection therewith, including, without limitations, reasonable attorneys fees and disbursements, and then to the payment of the Secured Obligations, in such order of application as Beneficiary may from time to time elect

4 5 POWER OF ATTORNEY. Trustor hereby irrevocably appoints Beneficiary as Trustors attorney-in-fact (such agency being coupled with an interest), and as such attorney-in-fact, Beneficiary may, without the obligation to do so, in Beneficiarys name or in the name of Trustor, prepare, execute, file and record financing statements, continuation statements, applications for registration and like papers necessary to create, perfect or preserve any of Beneficiarys security interests and rights in or to the Collateral, and upon a

Default, take any other action required of Trustor, provided, however, that Beneficiary as such attorney-in-fact shall be accountable only for such funds as are actually received by Beneficiary

SI CA RG (rev 02/2004) 7

ARTICLE 5. REPRESENTATIONS AND WARRANTIES

5 1 REPRESENTATIONS AND WARRANTIES Trustor represents and warrants to Beneficiary that, to Trustors current actual knowledge after reasonable investigation and inquiry, the following statements are true and correct as of the Effective Date

a Legal Status Trustor and Borrower are duly organized and existing and in good standing under the laws of the state(s) in which Trustor and Borrower are organized Trustor and Borrower are qualified or licensed to do business in all jurisdictions in which such qualification or licensing is required

b Permits Trustor and Borrower possess all permits, franchises and licenses and all rights to all trademarks, trade names, patents and fictitious names, if any, necessary to enable Trustor and Borrower to conduct the business(es) in which Trustor and Borrower are now engaged in compliance with applicable law

c Authorization and Validity The execution and delivery of the Loan Documents have been duly authorized and the Loan Documents constitute valid and binding obligations of Trustor, Borrower or the party which executed the same, enforceable in accordance with their respective terms, except as such enforcement may be limited by bankruptcy, insolvency, moratorium or other laws affecting the enforcement of creditors rights, or by the application of rules of equity

d Violations The execution, delivery and performance by Trustor and Borrower of each of the Loan Documents do not violate any provision of any law or regulation, or result in any breach or default under any contract, obligation, indenture or other instrument to which Trustor or Borrower is a party or by which Trustor or Borrower is bound

e. Litigation. There are no pending or threatened actions, claims, investigations, suits or proceedings before any governmental authority, court or administrative agency which may adversely affect the financial condition or operations of Trustor or Borrower other than those previously disclosed in writing by Trustor or Borrower to Beneficiary

f Financial Statements The financial statements of Trustor and Borrower, of each general partner (if Trustor or Borrower is a partnership), of each member (if Trustor or Borrower is a limited liability company) and of each guarantor, if any, previously delivered by Trustor or Borrower to Beneficiary (i) are materially complete and correct; (ii) present fairly the financial condition of such party; and (iii) have been prepared in accordance with the same accounting standard used by Trustor or Borrower to prepare the financial statements delivered to and approved by Beneficiary in connection with the making of the Loan, or other accounting standards approved by Beneficiary Since the date of such financial statements, there has been no material adverse change in such financial condition, nor have any assets or properties reflected on such financial statements been sold, transferred, assigned, mortgaged, pledged or encumbered except as previously disclosed in writing by Trustor or Borrower to Beneficiary and approved in writing by Beneficiary

g Reports All reports, documents, instruments and information delivered to Beneficiary in connection with the Loan. (i) are correct and sufficiently complete to give Beneficiary accurate knowledge of their subject matter, and (ii) do not contain any misrepresentation of a material fact or omission of a material fact which omission makes the provided information misleading.

h Income Taxes There are no pending assessments or adjustments of Trustors or Borrowers income tax payable with respect to any year

SI CA RG (rev 02/2004) 8

i. Subordination There is no agreement or instrument to which Borrower is a party or by which Borrower is bound that would require the subordination in right of payment of any of Borrowers obligations under the Note to an obligation owed to another party.

j Title Trustor lawfully holds and possesses fee simple title to the Property, without limitation on the right to encumber same This Deed of Trust is a first lien on the Property prior and superior to all other liens and encumbrances on the Property except. (i) liens for real estate taxes and assessments not yet due and payable, (ii) senior exceptions previously approved by Beneficiary and shown in the title insurance policy insuring the lien of this Deed of Trust, and (iii) other matters, if any, previously disclosed to Beneficiary by Trustor in a writing specifically referring to this representation and warranty.

k. Mechanics Liens. There are no mechanics or similar liens or claims which have been filed for work, labor or material (and no rights are outstanding that under law could give rise to any such liens) affecting the Property which are or may be prior to or equal to the lien of this Deed of Trust.

l Encroachments. Except as shown in the survey, if any, previously delivered to Beneficiary, none of the buildings or other improvements which were included for the purpose of determining the appraised value of the Property lies outside of the boundaries or building restriction lines of the Property and no buildings or other improvements located on adjoining properties encroach upon the Property

m Leases All existing Leases are in full force and effect and are enforceable in accordance with their respective terms No material breach or default by any party, or event which would constitute a material breach or default by any party after notice or the passage of time, or both, exists under any existing Lease None of the landlords interests under any of the Leases, including, but not limited to, rents, additional rents, charges, issues or profits, has been transferred or assigned. No rent or other payment under any existing Lease has been paid by any tenant for more than 1 month in advance

n. Collateral. Trustor has good title to the existing Collateral, free and clear of all liens and encumbrances except those, if any, previously disclosed to Beneficiary by Trustor in writing specifically referring to this representation and warranty Trustors chief executive office (or principal residence, if applicable) is located at the address shown on page one of this Deed of Trust JERSEY BUSINESS PARK is an organization organized solely under the laws of the State of California All organizational documents of JERSEY BUSINESS PARK delivered to Beneficiary are complete and accurate in every respect Trustors legal name is exactly as shown on page one of this Deed of Trust.

o Condition of Property Except as shown in the property condition survey or other engineering reports, if any, previously delivered to or obtained by Beneficiary, the Property is in good condition and repair and is tree from any damage that would materially and adversely affect the value of the Property as security for the Loan or the intended use of the Property.

p Hazardous Materials Except as shown in the environmental assessment report(s), if any, previously delivered to or obtained by Beneficiary, the Property is not and has not been a site for the use, generation, manufacture, storage, treatment, release, threatened release, discharge, disposal, transportation or presence of Hazardous Materials (as hereinafter defined) except as otherwise previously disclosed in writing by Trustor to Beneficiary

q Hazardous Materials Laws The Property complies with all Hazardous Materials Laws (as hereinafter defined).

r Hazardous Materials Claims. There are no pending or threatened Hazardous Materials Claims (as hereinafter defined)

SI CA RG (rev 02/2004)

9

s. Wetlands. No part of the Property consists of or is classified as wetlands, tidelands or swamp and overflow lands

t Compliance With Laws. All federal, state and local laws, rules and regulations applicable to the Property, including, without limitation, all zoning and building requirements and all requirements of the Americans With Disabilities Act of 1990, as amended from time to time (42 U. S C. Section 12101 et seq ) have been satisfied or complied with Trustor is in possession of all certificates of occupancy and all other licenses, permits and other authorizations required by applicable law for the existing use of the Property. All such certificates of occupancy and other licenses, permits and authorizations are valid and in full force and effect.

u Property Taxes and Other Liabilities All taxes, governmental assessments, insurance premiums, water, sewer and municipal charges, and ground rents, if any, which previously became due and owing in respect of the Property have been paid

v. Condemnation There is no proceeding pending or threatened for the total or partial condemnation of the Property

w Homestead There is no homestead or other exemption available to Trustor which would materially interfere with the right to sell the Property at a trustees sale or the right to foreclose this Deed of Trust

x Solvency. None of the transactions contemplated by the Loan will be or have been made with an actual intent to hinder, delay or defraud any present or future creditors of Trustor, and Trustor, on the Effective Date, will have received fair and reasonably equivalent value in good faith for the grant of the liens or security interests effected by the Loan Documents. On the Effective Date, Trustor will be solvent and will not be rendered insolvent by the transactions contemplated by the Loan Documents Trustor is able to pay its debts as they become due.

y Separate Tax Parcel(s). The Property is assessed for real estate tax purposes as one or more wholly independent tax parcels, separate from any other real property, and no other real property is assessed and taxed together with the Property or any portion thereof.

z. Utilities; Water; Sewer. The Property is served by all utilities required for the current or contemplated use thereof All utility service is provided by public utilities and the Property has accepted or is equipped to accept such utility service The Property is served by public water and sewer systems

aa ERISA Matters. Trustor is not an employee benefit plan as defined in Section 3.(3) of the Employee Retirement Income Security Act of 1974, as amended (ERISA), which is subject to Title I of ERISA, nor a plan as defined in Section 4975(e)(1) of the Internal Revenue Code of 1986, as amended (each of the foregoing hereinafter referred to individually and collectively as a Plan). Trustors assets do not constitute plan assets of any plan within the meaning of Department of Labor Regulation Section 2510 3-101 Trustor will not transfer or convey the Property to a Plan or to a person or entity whose assets constitute such plan assets, and Trustor will not be reconstituted as a Plan or as an entity whose assets constitute plan assets. No Lease is with a Plan or an entity whose assets constitute such plan assets , and Trustor will not enter into any Lease with a Plan or an entity whose assets constitute such plan assets With respect to the Loan, Trustor is acting on Trustors own behalf and not on account of or for the benefit of any Plan

5.2 REPRESENTATIONS, WARRANTIES AND COVENANTS REGARDING STATUS (LEVEL I SPE).

Trustor hereby represents, warrants and covenants to Beneficiary as follows.

SI CA RG (rev 02/2004) 10

(a) such entity was organized solely for the purpose of owning the Property,

(b) such entity has not and will not engage in any business unrelated to the ownership of the Property,

(c) such entity has not and will not have any assets other than the Property (and personal property incidental to the ownership and operation of the Property),

(d) such entity has not and will not engage in, seek or consent to any dissolution, winding up, liquidation, consolidation, merger, asset sale, or amendment of its articles of incorporation, articles of organization, certificate of formation, operating agreement or partnership agreement, as applicable,

(e) such entity, without the unanimous consent of all of its directors, general partners or members, as applicable, shall not file or consent to the filing of any bankruptcy or insolvency petition or otherwise institute insolvency proceedings,

(f) such entity has no indebtedness (and will have no indebtedness) other than (i) the Loan, and (ii) unsecured trade debt not to exceed 2% of the loan amount in the aggregate, which is not evidenced by a note and is incurred in the ordinary course of its business in connection with owning, operating and maintaining the Property and is paid within 30 days from the date incurred,

(g) such entity has not and will not fail to correct any known misunderstanding regarding the separate identity of such entity,

(h) such entity has maintained and will maintain its accounts, books and records separate from any other person or entity,

(i) such entity has maintained and will maintain its books, records, resolutions and agreements as official records;

(j) such entity (i) has not and will not commingle its funds or assets with those of any other entity, and (ii) has held and will hold its assets in its own name;

(k) such entity has conducted and will conduct its business in its own name,

(l) such entity has maintained and will maintain its accounting records and other entity documents separate from any other person or entity,

(m) such entity has prepared and will prepare separate tax returns and financial statements, or if part of a consolidated group, is shown as a separate member of such group,

(n) such entity has paid and will pay its own liabilities and expenses out of its own funds and assets,

(o) such entity has held and will hold regular meetings, as appropriate, to conduct its business and has observed and will observe all corporate, partnership or limited liability company formalities and record keeping, as applicable,

(p) such entity has not and will not assume or guarantee or become obligated for the debts of any other entity or hold out its credit as being available to satisfy the obligations of any other entity,

(q) such entity has not and will not acquire obligations or securities of its shareholders, partners or members, as applicable,

SI CA RG (rev 02/2004)

11

(r) such entity has allocated and will allocate fairly and reasonably the costs associated with common employees and any overhead for shared office space and such entity has used and will use separate stationery, invoices and checks,

(s) such entity has not and will not pledge its assets for the benefit of any other person or entity,

(t) such entity has held and identified itself and will hold itself out and identify itself as a separate and distinct entity under its own name and not as a division or part of any other person or entity,

(u) such entity has not made and will not make loans to any person or entity,

(v) such entity has not and will not identify its shareholders, partners or members, as applicable, or any affiliates of any of the foregoing, as a division or part of it;

(w) such entity has not entered into and will not enter into or be a party to, any transaction with its shareholders, partners or members, as applicable, or any affiliates of any of the foregoing, except in the ordinary course of its business pursuant to written agreements and on terms which are intrinsically fair and are no less favorable to it than would be obtained in a comparable arms-length transaction with an unrelated third party,

(x) if any such entity is a corporation, the directors of such entity shall consider the interests of the creditors of such entity in connection with all corporate action,

(y) such entity has paid and will pay the salaries of its own employees and has maintained and will maintain a sufficient number of employees in light of its contemplated business operations;

(z) such entity has maintained and will maintain adequate capital in light of its contemplated business operations; and

(aa) if any such entity is a partnership with more than one general partner, its partnership agreement requires the remaining partners to continue the partnership as long as one solvent general partner exists.

ARTICLE 6. RIGHTS AND DUTIES OF THE PARTIES

6 1 MAINTENANCE AND PRESERVATION OF THE PROPERTY. Trustor shall (a) keep the Property in good condition and repair; (b) complete or restore promptly and in workmanlike manner the Property or any part thereof which may be damaged or destroyed, (c) comply and cause the Property to comply with (i) all laws, ordinances, regulations and standards, (ii) all covenants, conditions, restrictions and equitable servitudes, whether public or private, of every kind and character and (iii) all requirements of insurance companies and any bureau or agency which establishes standards of insurability, which laws, covenants or requirements affect the Property and pertain to acts committed or conditions existing thereon, including, without limitation, any work of alteration, improvement or demolition as such laws, covenants or requirements mandate; (d) operate and manage the Property at all times in a professional manner and do all other acts which from the character or use of the Property may be reasonably necessary to maintain and preserve its value, (e) promptly after execution, deliver to Beneficiary a copy of any management agreement concerning the Property and all amendments thereto and waivers thereof, and (f) execute and acknowledge all further documents, instruments and other papers as Beneficiary or Trustee deems necessary or appropriate to preserve, continue, perfect and enjoy the benefits of this Deed of Trust and perform Trustors obligations, including, without limitation, statements of the amount secured hereby then owing and statements of no offset Trustor shall not. (g) remove or demolish all or any material part of the Property; (h) alter either (i) the

SI CA RG (rev 02/2004) 12

exterior of the Property in a manner which materially and adversely affects the value of the Property or (ii) the roof or other structural elements of the Property in a manner which requires a building permit except for tenant improvements required under the Leases, (i) initiate or acquiesce in any change in any zoning or other land classification which affects the Property; (j) materially alter the type of occupancy or use of all or any part of the Property; or (k) commit or permit waste of the Property

6 2 HAZARDOUS MATERIALS Without limiting any other provision of this Deed of Trust, Trustor agrees as follows.

a Prohibited Activities Trustor shall not cause or permit the Property to be used as a site for the use, generation, manufacture, storage, treatment, release, discharge, disposal, transportation or presence of any of the following (collectively, Hazardous Materials), oil or other petroleum products, flammable explosives, asbestos, urea formaldehyde insulation; radioactive materials, hazardous wastes, fungus, mold, mildew, spores or other biological or microbial agents the presence of which may affect human health, impair occupancy or materially affect the value or utility of the Property, toxic or contaminated substances or similar materials, including, without limitation, any substances which are hazardous substances, hazardous wastes, hazardous materials or toxic substances under the Hazardous Materials Laws (defined below) and/or other applicable environmental laws, ordinances or regulations

The foregoing to the contrary notwithstanding, (i) Trustor may store, maintain and use on the Property janitorial and maintenance supplies, paint and other Hazardous Materials of a type and in a quantity readily available for purchase by the general public and normally stored, maintained and used by owners and managers of properties of a type similar to the Property, and (ii) tenants of the Property may store, maintain and use on the Property (and, if any tenant is a retail business, hold in inventory and sell in the ordinary course of such tenants business) Hazardous Materials of a type and quantity readily available for purchase by the general public and normally stored, maintained and used (and, if tenant is a retail business, sold) by tenants in similar lines of business on properties similar to the Property

b Hazardous Materials Laws Trustor shall comply and cause the Property to comply with all federal, state and local laws, ordinances and regulations relating to Hazardous Materials (Hazardous Materials Laws), including, without limitation. the Clean Air Act, as amended, 42 U S.C Section 7401 et seq, the Federal Water Pollution Control Act, as amended, 33 U S C. Section 1251 et seq ; the Resource Conservation and Recovery Act of 1976, as amended, 42 U S.C Section 6901 et seq, the Comprehensive Environmental Response, Compensation and Liability Act of 1980, as amended (including the Superfund Amendments and Reauthorization Act of 1986, CERCLA), 42 U S C Section 9601 et seq., the Toxic Substances Control Act, as amended, 15 U S C Section 2601 et seq , the Occupational Safety and Health Act, as amended, 29 U S C Section 651, the Emergency Planning and Community Right-to-Know Act of 1986, 42 U S C Section 11001 et seq, the Mine Safety and Health Act of 1977, as amended, 30 U S C. Section 801 et seq., the Safe Drinking Water Act, 42 U S C. Section 300f et seq , and all comparable state and local laws, laws of other jurisdictions or orders and regulations.

c Notices Trustor shall immediately notify Beneficiary in writing of (i) the discovery of any Hazardous Materials on, under or about the Property (other than Hazardous Materials permitted under Section 6 2(a)), (ii) any knowledge by Trustor that the Property does not comply with any Hazardous Materials Laws, (iii) any claims or actions (Hazardous Materials Claims) pending or threatened against Trustor or the Property by any governmental entity or agency or any other person or entity relating to Hazardous Materials or pursuant to the Hazardous Materials Laws, and (iv) the discovery of any occurrence or condition on any real property adjoining or in the vicinity of the Property that could cause the Property or any part thereof to become contaminated with Hazardous Materials

SI CA RG (rev 02/2004) 13

d Remedial Action. In response to the presence of any Hazardous Materials on, under or about the Property, Trustor shall immediately take, at Trustors sole expense, all remedial action required by any Hazardous Materials Laws or any judgment, consent decree, settlement or compromise in respect to any Hazardous Materials Claims

e Inspection By Beneficiary Upon reasonable prior notice to Trustor, Beneficiary, its employees and agents, may from time to time (whether before or after the commencement of a nonjudicial or judicial foreclosure proceeding), enter and inspect the Property for the purpose of determining the existence, location, nature and magnitude of any past or present release or threatened release of any Hazardous Materials into, onto, beneath or from the Property

f. Legal Effect of Section Trustor and Beneficiary agree that (i) this Hazardous Materials Section is intended as Beneficiarys written request for information (and Trustors response) concerning the environmental condition of the real property security as required by California Code of Civil Procedure Section 726 5, and (ii) each representation and warranty and covenant in this Section (together with any indemnity applicable to a breach of any such representation and warranty) with respect to the environmental condition of the Property is intended by Beneficiary and Trustor to be an environmental provision for purposes of California Code of Civil Procedure Section 736

6 3 COMPLIANCE WITH LAWS Trustor shall comply with all federal, state and local laws, rules and regulations applicable to the Property, including, without limitation, all zoning and building requirements and all requirements of the Americans With Disabilities Act of 1990 (42 U S.C Section 12101 et seq ), as amended from time to time Trustor shall possess and maintain or cause Borrower to possess and maintain in full force and effect at all times (a) certificates of occupancy and other licenses, permits and authorizations required by applicable law for the existing use of the Property and (b) all permits, franchises and licenses and all rights to all trademarks, trade names, patents and fictitious names, if any, required by applicable law for Trustor and Borrower to conduct the business(es) in which Trustor and Borrower are now engaged

6 4 LITIGATION Trustor shall promptly notify Beneficiary in writing of any litigation pending or threatened against Trustor or Borrower claiming damages in excess of $50,000 and of all pending or threatened litigation against Trustor or Borrower if the aggregate damage claims against Trustor or Borrower exceed $100,000

6 5 MERGER, CONSOLIDATION, TRANSFER OF ASSETS Trustor shall not (a) merge or consolidate with any other entity or permit Borrower to merge or consolidate with any other entity, (b) make any substantial change in the nature of Trustors business or structure or permit Borrower to make any substantial change in the nature of Borrowers business or structure, (c) acquire all or substantially all of the assets of any other entity or permit Borrower to acquire all or substantially all of the assets of any other entity; or (d) sell, lease, assign transfer or otherwise dispose of a material part of Trustors assets except in the ordinary course of Trustors business or permit Borrower to sell, lease, assign, transfer or otherwise dispose of a material part of Borrowers assets except in the ordinary course of Borrowers business.

6 6 ACCOUNTING RECORDS Trustor shall maintain and cause Borrower to maintain adequate books and records in accordance with the same accounting standard used by Trustor or Borrower to prepare the financial statements delivered to and approved by Beneficiary in connection with the making of the Loan or other accounting standards approved by Beneficiary Trustor shall permit and shall cause Borrower to permit any representative of Beneficiary, at any reasonable time and from time to time, to inspect, audit and examine such books and records and make copies of same

6 7 COSTS, EXPENSES AND ATTORNEYS FEES. Trustor shall pay to Beneficiary the full amount of all costs and expenses, including, without limitation, reasonable attorneys fees and expenses of Beneficiarys in-house or outside counsel, incurred by Beneficiary in connection with. (a) appraisals and inspections of the Property or Collateral required by Beneficiary as a result of (i) a Transfer or proposed Transfer (as defined

SI CA RG (rev 02/2004) 14

below), or (ii) a Default; (b) appraisals and inspections of the Property or Collateral required by applicable law, including, without limitation, federal or state regulatory reporting requirements; and (c) any acts performed by Beneficiary at Trustors request or wholly or partially for the benefit of Trustor (including, without limitation, the preparation or review of amendments, assumptions, waivers, releases, reconveyances, estoppel certificates or statements of amounts owing under any Secured Obligation) In connection with appraisals and inspections, Trustor specifically (but not by way of limitation) acknowledges that (aa) a formal written appraisal of the Property by a state certified or licensed appraiser may be required by federal regulatory reporting requirements on an annual or more frequent basis, and (bb) Beneficiary may require inspection of the Property by an independent supervising architect, a cost engineering specialist, or both Trustor shall pay all indebtedness arising under this Section immediately upon demand by Beneficiary together with interest thereon following notice of such indebtedness at the rate of interest then applicable to the principal balance of the Note as specified therein

6 8 LIENS, ENCUMBRANCES AND CHARGES Trustor shall immediately discharge by bonding or otherwise any lien, charge or other encumbrance which attaches to the Property in violation of Section 6 15 Subject to Trustors right to contest such matters under this Deed of Trust or as expressly permitted in the Loan Documents, Trustor shall pay when due all obligations secured by or reducible to liens and encumbrances which shall now or hereafter encumber or appear to encumber all or any part of the Property or any interest therein, whether senior or subordinate hereto, including, without limitation, all claims for work or labor performed, or materials or supplies furnished, in connection with any work of demolition, alteration, repair, improvement or construction of or upon the Property, except such as Trustor may in good faith contest or as to which a bona fide dispute may arise (provided provision is made to the satisfaction of Beneficiary for eventual payment thereof in the event that Trustor is obligated to make such payment and that any recorded claim of lien, charge or other encumbrance against the Property is immediately discharged by bonding or otherwise)

6.9 TAXES AND OTHER LIABILITIES Trustor shall pay and discharge when due any and all indebtedness, obligations, assessments and taxes, both real and personal and including federal and state income taxes and state and local property taxes and assessments. Trustor shall promptly provide to Beneficiary copies of all tax and assessment notices pertaining to the Property Trustor hereby authorizes Beneficiary to obtain, at Trustors expense, a tax service contract which shall provide tax information on the Property to Beneficiary for the term of the Loan and any extensions or renewals of the Loan

6.10 INSURANCE COVERAGE. Trustor shall obtain and maintain all insurance coverage required pursuant to that certain Agreement Regarding Required Insurance dated as of the date hereof by and between Trustor and Beneficiary.

6.11 CONDEMNATION AND INSURANCE PROCEEDS

a Assignment of Claims Trustor absolutely and irrevocably assigns to Beneficiary all of the following rights, claims and amounts (collectively, Claims), all of which shall be paid to Beneficiary. (i) all awards of damages and all other compensation payable directly or indirectly by reason of a condemnation or proposed condemnation for public or private use affecting all or any part of, or any interest in, the Property, (ii) all other claims and awards for damages to or decrease in value of all or any part of, or any interest in, the Property; (iii) all proceeds of any insurance policies payable by reason of loss sustained to all or any part of the Property, and (iv) all interest which may accrue on any of the foregoing Trustor shall give Beneficiary prompt written notice of the occurrence of any casualty affecting, or the institution of any proceedings for eminent domain or for the condemnation of, the Property or any portion thereof So long as no Default has occurred and is continuing at the time, (i) Trustor shall have the right to adjust, compromise and settle any Claim or group of related Claims of $100,000 or less without the participation or consent of Beneficiary and (ii) Beneficiary shall have the right to participate in and consent to any adjustment, compromise or settlement of any Claim or group of related Claims exceeding $100,000 if a Default has occurred and is continuing at the time, Trustor hereby irrevocably empowers Beneficiary, in the name of Trustor, as Trustors true

SI CA RG (rev 02/2004) 15

and lawful attorney in fact, to commence, appear in, defend, prosecute, adjust, compromise and settle all Claims, provided, however, Beneficiary shall not be responsible for any failure to undertake any or all of such actions regardless of the cause of the failure All awards, proceeds and other sums described herein shall, in all cases, be payable to Beneficiary

b. Application of Proceeds; No Default So long as no Default has occurred and is continuing at the time of Beneficiarys receipt of the proceeds of the Claims (Proceeds) and no Default occurs thereafter, the following provisions shall apply.

(i) Condemnation If the Proceeds are the result of Claims described in clauses 6.11 a (i) or (ii) above, or interest accrued thereon, Beneficiary shall apply the Proceeds in the following order of priority. First, to Beneficiarys expenses in settling, prosecuting or defending the Claims; Second, to the repair or restoration of the portion of the Property, if any, not condemned or proposed for condemnation and not otherwise the subject of a claim or award, and Third, to the Secured Obligations in any order without suspending, extending or reducing any obligation of Trustor to make installment payments

(ii) Insurance If the Proceeds are the result of Claims described in clause 6.11 a (iii) above or interest accrued thereon, Beneficiary shall apply the Proceeds in the following order of priority First, to Beneficiarys expenses in settling, prosecuting or defending the Claims, Second, to the repair or restoration of the Property; and Third, (aa) if the repair or restoration of the Property has been completed and all costs incurred in connection with the repair or restoration have been paid in full, to Trustor or (bb) in all other circumstances, to the Secured Obligations in any order without suspending, extending or reducing any obligation of Trustor to make installment payments

(iii) Restoration Notwithstanding the foregoing Sections 6 11 b (i) and (ii), Beneficiary shall have no obligation to make any Proceeds available for the repair or restoration of all or any portion of the Property unless and until all the following conditions have been satisfied: (aa) delivery to Beneficiary of the Proceeds plus any additional amount which is needed to pay all costs of the repair or restoration (including, without limitation, taxes, financing charges, insurance and rent during the repair period), (bb) establishment of an arrangement for lien releases and disbursement of funds acceptable to Beneficiary, (cc) delivery to Beneficiary in form and content acceptable to Beneficiary of all of the following (1) plans and specifications for the work, (2) a contract for the work, signed by a contractor acceptable to Beneficiary, (3) a cost breakdown for the work, (4) if required by Beneficiary, a payment and performance bond for the work, (5) evidence of the continuation of all Leases unless consented to in writing by Beneficiary, (6) evidence that, upon completion of the work, the size, capacity, value, and income coverage ratios for the Property will be at least as great as those which existed immediately before the damage or condemnation occurred, (7) evidence that the work can reasonably be completed on or before that date which is 6 months prior to the Maturity Date, and (8) evidence of the satisfaction of any additional conditions that Beneficiary may reasonably establish to protect Beneficiarys security Trustor acknowledges that the specific conditions described above are reasonable

c. Application of Proceeds; Default If a Default has occurred and is continuing at the time of Beneficiarys receipt of the Proceeds or if a Default occurs at any time thereafter, Beneficiary may, at Beneficiarys absolute discretion and regardless of any impairment of security or lack of impairment of security, but subject to applicable law governing use of the Proceeds, if any, apply all or any of the Proceeds to Beneficiarys expenses in settling, prosecuting or defending the Claims and then apply the balance to the Secured Obligations in any order without suspending, extending or reducing any obligation of Trustor to make installment payments, and may release all or any part of the Proceeds to Trustor upon any conditions Beneficiary chooses.

SI CA RG (rev 02/2004)

16

6 12 IMPOUNDS

a Post-Default Impounds If required by Beneficiary at any time after a Default occurs (and regardless of whether such Default is thereafter cured), Trustor shall deposit with Beneficiary such amounts (Post-Default Impounds) on such dates (determined by Beneficiary as provided below) as will be sufficient to pay any or all Costs (as defined below) specified by Beneficiary Beneficiary in its sole discretion shall estimate the amount of such Costs that will be payable or required during any period selected by Beneficiary not exceeding 1 year and shall determine the fractional portion thereof that Trustor shall deposit with Beneficiary on each date specified by Beneficiary during such period If the Post-Default Impounds paid by Trustor are not sufficient to pay the related Costs, Trustor shall deposit with Beneficiary upon demand an amount equal to the deficiency All Post-Default Impounds shall be payable by Trustor in addition to (but without duplication of) any other Impounds (as defined below)

b All Impounds Post-Default Impounds and any other impounds that may be payable by Borrower under the Note are collectively called Impounds. All Impounds shall be deposited into one or more segregated or commingled accounts maintained by Beneficiary or its servicing agent Except as otherwise provided in the Note, such account(s) shall not bear interest Beneficiary shall not be a trustee, special depository or other fiduciary for Trustor with respect to such account, and the existence of such account shall not limit Beneficiarys rights under this Deed of Trust, any other agreement or any provision of law If no Default exists, Beneficiary shall apply all Impounds to the payment of the related Costs, or in Beneficiarys sole discretion may release any or all Impounds to Trustor for application to and payment of such Costs If a Default exists, Beneficiary may apply any or all Impounds to any Secured Obligation and/or to cure such Default, whereupon Trustor shall restore all Impounds so applied and cure all Defaults not cured by such application The obligations of Trustor hereunder shall not be diminished by deposits of Impounds made by Trustor, except to the extent that such obligations have actually been met by application of such Impounds Upon any assignment of this Deed of Trust, Beneficiary may assign all Impounds in its possession to Beneficiarys assignee, whereupon Beneficiary and Trustee shall be released from all liability with respect to such Impounds Within 60 days following full repayment of the Secured Obligations (other than as a consequence of foreclosure or conveyance in lieu of foreclosure) or at such earlier time as Beneficiary may elect, Beneficiary shall pay to Trustor all Impounds in its possession, and no other party shall have any right or claim thereto Costs means (i) all taxes and other liabilities payable by Trustor under Section 6 9, (ii) all insurance premiums payable by Trustor under Section 6.10, (iii) all other costs and expenses for which Impounds are required under the Note, and/or (iv) all other amounts that will be required to preserve the value of the Property Trustor shall deliver to Beneficiary, promptly upon receipt, all bills for Costs for which Beneficiary has required Post-Default Impounds

6 13 DEFENSE AND NOTICE OF LOSSES, CLAIMS AND ACTIONS Trustor shall protect, preserve and

defend the Property and title to and right of possession of the Property, the security of this Deed of Trust and the rights and powers of Beneficiary and Trustee hereunder at Trustors sole expense against all adverse claims, whether the claim (a) is against a possessory or non-possessory interest, (b) arose prior or subsequent to the Effective Date; or (c) is senior or junior to Trustors or Beneficiarys rights Trustor shall give Beneficiary and Trustee prompt notice in writing of the assertion of any claim, of the filing of any action or proceeding of the occurrence of any damage to the Property and of any condemnation offer or action

6 14 RIGHT OF INSPECTION Beneficiary and its independent contractors, agents and employees may enter the Property from time to time at any reasonable time for the purpose of inspecting the Property and ascertaining Trustors compliance with the terms of this Deed of Trust Beneficiary shall use reasonable efforts to assure that Beneficiarys entry upon and inspection of the Property shall not materially and unreasonably interfere with the business or operations of Trustor or Trustors tenants on the Property

6 15 DUE ON SALE/ENCUMBRANCE.

SI CA RG (rev 02/2004)

17

a. Definitions. The following terms shall have the meanings indicated.

Restricted Party shall mean each of (i) Borrower, (ii) Trustor, (iii) any entity obligated under any guaranty or indemnity made in favor of Beneficiary in connection with the Loan and (iv) any shareholder, partner, member or non-member manager, or any direct or indirect legal or beneficial owner of Borrower, Trustor or any entity obligated under a guaranty or indemnity made in favor of Beneficiary in connection with the Loan

Transfer shall mean any sale, installment sale, exchange, mortgage, pledge, hypothecation, assignment, encumbrance or other transfer, conveyance or disposition, whether voluntarily, involuntarily or by operation of law or otherwise.

b Property Transfers

(i) Prohibited Property Transfers Trustor shall not cause or permit any Transfer of all or any part of or any direct or indirect legal or beneficial interest in the Property or the Collateral (collectively, a Prohibited Property Transfer), including, without limitation, (A) a Lease or all or a material part of the Property for any purpose other than actual occupancy by a space tenant, and (B) the Transfer of all or any part of Trustors right, title and interest in and to any Leases or Payments,

(ii) Permitted Property Transfers Notwithstanding the foregoing, none of the following Transfers shall be deemed to be a Prohibited Property Transfer; (A) a Transfer which is expressly permitted under the Note; (B) a Lease which is permitted under Article 3; and (C) the sale of inventory in the ordinary course of business

c. Equity Transfers

(i) Prohibited Equity Transfers. Trustor shall not cause or permit any Transfer of any direct or indirect legal or beneficial interest in a Restricted Party (collectively, a Prohibited Equity Transfer), including without limitation, (A) if a Restricted Party is a corporation, any merger, consolidation or other Transfer of such corporations stock or the creation or issuance of new stock in one or a series of transactions; (B) if a Restricted Party is a limited partnership, limited liability partnership, general partnership or joint venture, any merger or consolidation or the change, removal, resignation or addition of a general partner or the Transfer of the partnership interest of any general or limited partner or any profits or proceeds relating to such partnership interests or the creation or issuance of new limited partnership interests; (C) if a Restricted Party is a limited liability company, any merger or consolidation or the change, removal, resignation or addition of a managing member or non-member manager (or if no managing member, any member) or any profits or proceeds relating to such membership interest, or the Transfer of a non-managing membership interest or the creation or issuance of new non-managing membership interests, or (D) if a Restricted Party is a trust, any merger consolidation or other Transfer of any legal or beneficial interest in such Restricted Party or the creation or issuance of new legal or beneficial interests.

(ii) Permitted Equity Transfers Notwithstanding the foregoing, none of the following Transfers shall be deemed to be a Prohibited Equity Transfer. (A) a Transfer by a natural person who is a member, partner or shareholder of a Restricted Party to a revocable inter vivos trust having such natural person as both trustor and trustee of such trust and one or more immediate family members of such natural person as the sole beneficiaries of such trust (Revocable Family Trust), (B) a Transfer by devise or descent or by operation of law upon the death of a member, partner or shareholder of a Restricted Party where such Transfer does not result in a Default

SI CA RG (rev 02/2004)

18

under Section 7.1 a(vi) below; (C) a Transfer, in one or a series of transactions, of not more than 49% of the stock, limited partnership interests or non-managing membership interests (as the case may be) in a Restricted Party where such Transfer does not result in a change in management control in the Restricted Party

(iii) SPE Status. Nothing contained in this Section 6 15c shall be construed to permit any Transfer which would result in a breach of any representation, warranty or covenant of Trustor under Section 5.2 above. Notwithstanding anything to the contrary contained in this Section 6 15c, if a nonconsolidation opinion was required as a condition to closing of the Loan, (A) Trustor shall deliver to Beneficiary at least 60 days prior written notice of any Transfer under Section 6 15c(ii)(A) or (C) above, (B) if required by Beneficiary, it shall be a condition precedent to any Transfer under Section 6 15c(ii)(A) or (C) above that Trustor deliver to Beneficiary a current nonconsolidation opinion in form and content and rendered by counsel satisfactory to Beneficiary in its sole and absolute discretion and (C) such a current nonconsolidation opinion shall be delivered to Beneficiary, not more than 60 days following any Transfer under Section 6 15c(ii)(B) above

d. Certificates of Ownership Trustor shall deliver to Beneficiary, at any time and from time to time, not more than 5 days after Beneficiarys written request therefor, a certificate, in form acceptable to Beneficiary, signed and dated by Borrower and Trustor, listing the names of all persons and entities holding direct or indirect legal or beneficial interests in the Property or any Restricted Party and the type and amount of each such interest

6 16 ACCEPTANCE OF TRUST; POWERS AND DUTIES OF TRUSTEE Trustee accepts this trust when this Deed of Trust is recorded From time to time upon written request of Beneficiary and presentation of this Deed of Trust, or a certified copy thereof, for endorsement, and without affecting the personal liability of any person for payment of any indebtedness or performance of any Secured Obligation, Trustee may, without liability therefor and without notice (a) reconvey all or any part of the Property, (b) consent to the making of any map or plat of the Property, (c) join in granting any easement on the Property, (d) join in any declaration of covenants and restrictions, or (e) join in any extension agreement or any agreement subordinating the lien or charge of this Deed of Trust Nothing contained in the immediately preceding sentence shall be construed to limit, impair or otherwise affect the rights of Trustor in any respect. Except as may otherwise be required by applicable law, Trustee or Beneficiary may from time to time apply to any court of competent jurisdiction for aid and direction in the execution of the trusts hereunder and the enforcement of the rights and remedies available hereunder, and Trustee or Beneficiary may obtain orders or decrees directing or confirming or approving acts in the execution of said trusts and the enforcement of said remedies Trustee has no obligation to notify any party of any pending sale or any action or proceeding (including, without limitation, actions in which Trustor, Beneficiary or Trustee shall be a party) unless held or commenced and maintained by Trustee under this Deed of Trust Trustee shall not be obligated to perform any act required of it hereunder unless the performance of the act is requested in writing and Trustee is reasonably indemnified and held harmless against loss, cost, liability and expense.

6 17 COMPENSATION OF TRUSTEE Trustor shall pay to Trustee reasonable compensation and reimbursement for services and expenses in the administration of this trust, including, without limitation, reasonable attorneys fees. Trustor shall pay all indebtedness arising under this Section immediately upon demand by Trustee or Beneficiary together with interest thereon from the date the indebtedness arises at the rate of interest then applicable to the principal balance of the Note as specified therein.

6 18 EXCULPATION Beneficiary shall not directly or indirectly be liable to Trustor or any other person as a consequence of (a) the exercise of the rights, remedies or powers granted to Beneficiary in this Deed of Trust, (b) the failure or refusal of Beneficiary to perform or discharge any obligation or liability of Trustor under any agreement related to the Property or under this Deed of Trust, or (c) any loss sustained by Trustor or any third party resulting from Beneficiarys failure to lease the Property after a Default (hereafter defined) or from any

SI CA RG (rev 02/2004)

19

other act or omission of Beneficiary in managing the Property after a Default unless the loss is caused by the willful misconduct and bad faith of Beneficiary and no such liability shall be asserted or enforced against Beneficiary, all such liability being expressly waived and released by Trustor

6 19 INDEMNITY. Without in any way limiting any other indemnity contained in this Deed of Trust, Trustor agrees to defend, indemnify and hold harmless Trustee and the Beneficiary Group from and against any claim, loss, damage, cost, expense or liability directly or indirectly arising out of: (a) the making of the Loan, except for violations of banking laws or regulations by the Beneficiary Group, (b) this Deed of Trust; (c) the execution of this trust or the performance of any act required or permitted hereunder or by law; (d) any failure of Trustor to perform Trustors obligations under this Deed of Trust or the other Loan Documents, (e) any alleged obligation or undertaking on the Beneficiary Groups part to perform or discharge any of the representations, warranties, conditions, covenants or other obligations contained in any other document related to the Property;

(f) any act or omission by Trustor or any contractor, agent, employee or representative of Trustor with respect to the Property, or (g) any claim, loss, damage, cost, expense or liability directly or indirectly arising out of (1) the use, generation, manufacture, storage, treatment, release, threatened release, discharge, disposal, transportation or presence of any Hazardous Materials which are found in, on, under or about the Property (including, without limitation, underground contamination), or (ii) the breach of any covenant, representation or warranty of Trustor under Sections 5 1 p, 5 1.q, 5 1.r, or 6.2 above The foregoing to the contrary notwithstanding, this indemnity shall not include any claim, loss, damage, cost, expense or liability directly or indirectly arising out of the gross negligence or willful misconduct of any member of the Beneficiary Group or Trustee, or any claim, loss, damage, cost, expense or liability incurred by the Beneficiary Group or Trustee arising from any act or incident on the Property occurring after the full reconveyance and release of the lien of this Deed of Trust on the Property, or with respect to the matters set forth in clause (g) above, any claim, loss, damage, cost, expense or liability incurred by the Beneficiary Group resulting from the introduction and initial release of Hazardous Materials on the Property occurring after the transfer of title to the Property at a foreclosure sale under this Deed of Trust, either pursuant to judicial decree or the power of sale, or by deed in lieu of such foreclosure This indemnity shall include, without limitation. (aa) all consequential damages (including, without limitation, any third party tort claims or governmental claims, fines or penalties against Trustee or the Beneficiary Group), (bb) all court costs and reasonable attorneys fees (including, without limitation, expert witness fees) paid or incurred by Trustee or the Beneficiary Group, and (cc) the costs, whether foreseeable or unforeseeable, of any investigation, repair, cleanup or detoxification of the Property which is required by any governmental entity or is otherwise necessary to render the Property in compliance with all laws and regulations pertaining to Hazardous Materials. Beneficiary Group, as used herein, shall mean (1) Beneficiary and Lender (including, without limitation, any participant in the Loan), (2) any entity controlling, controlled by or under common control with Beneficiary and Lender, (3) the directors, officers, employees and agents of Beneficiary and Lender and such other entities, and (4) the successors, heirs and assigns of the entities and persons described in foregoing clauses (1) through (3). Trustor shall pay immediately upon Trustees or Beneficiarys demand any amounts owing under this indemnity together with interest from the date the indebtedness arises until paid at the rate of interest applicable to the principal balance of the Note as specified therein Trustor agrees to use legal counsel reasonably acceptable to Trustee and the Beneficiary Group in any action or proceeding arising under this indemnity THE PROVISIONS OF THIS SECTION SHALL SURVIVE THE TERMINATION AND RECONVEYANCE OF THIS DEED OF TRUST, BUT TRUSTORS LIABILITY UNDER THIS INDEMNITY SHALL BE SUBJECT TO THE PROVISIONS OF THE SECTION IN THE NOTE ENTITLED BORROWERS LIABILITY.