424B5: Prospectus filed pursuant to Rule 424(b)(5)

Published on August 12, 2014

Table of Contents

Filed Pursuant to Rule 424(b)(5)

Registration No. 333-197850

This preliminary prospectus supplement relates to an effective registration statement under the Securities Act of 1933, as amended, but is not complete and may be changed. This preliminary prospectus supplement and the accompanying prospectus are not an offer to sell these securities and are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject To Completion,

Dated August 12, 2014

Prospectus Supplement

(To Prospectus dated August 12, 2014)

15,000,000 Shares

Common Stock

We are offering 15,000,000 shares of our common stock, $0.01 par value per share.

We are organized and conduct our operations to qualify as a real estate investment trust, or REIT, for federal income tax purposes. To assist us in complying with certain federal income tax requirements applicable to REITs, our charter contains certain restrictions relating to the ownership and transfer of our capital stock, including an ownership limit of 9.8% of the outstanding shares of our common stock.

Our common stock is listed on the New York Stock Exchange, or NYSE, under the symbol REXR, and the last reported sale price of our common stock on the NYSE on August 11, 2014 was $13.95 per share.

See Risk Factors beginning on page S-7 of this prospectus supplement and the risks set forth under the caption Item 1A. Risk Factors included in our most recent Annual Report on Form 10-K, which is incorporated by reference herein, for certain risks relevant to an investment in our common stock.

| Per Share |

Total |

|||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discount(1) |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ | ||||||

| (1) | We refer you to Underwriting beginning on page S-28 of this prospectus supplement for additional information regarding underwriting compensation. |

The underwriters may also exercise their option to purchase up to an additional 2,250,000 shares from us, at the public offering price, less the underwriting discount, for 30 days after the date of this prospectus supplement.

Our Chairman, Richard Ziman, and our Co-Chief Executive Officers, Howard Schwimmer and Michael Frankel, are being allocated the opportunity to purchase shares of our common stock in this offering at the public offering price, for a purchase price of up to $300,000, $200,000 and $250,000, respectively. As of June 30, 2014, Messrs. Ziman, Schwimmer and Frankel beneficially owned 109,290 shares, 53,263 shares and 21,303 shares of our outstanding common stock, respectively. Based on an assumed public offering price of $13.95 per share, which was the closing sales price of our common stock on the New York Stock Exchange on August 11, 2014, Messrs. Ziman, Schwimmer and Frankel are being allocated the opportunity to purchase 21,505 shares, 14,337 shares and 17,921 shares, respectively, of our common stock in this offering and have indicated an interest in purchasing all of such shares. The underwriters will receive the same discount from any shares of our common stock purchased by Messrs. Ziman, Schwimmer and Frankel as they will from any other shares of our common stock sold to the public in this offering.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement and the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The shares will be ready for delivery on or about August , 2014.

Joint Book-Running Managers

| BofA Merrill Lynch | J.P. Morgan |

Wells Fargo Securities | Citigroup | Jefferies | ||||

The date of this prospectus supplement is August , 2014

Table of Contents

TABLE OF CONTENTS

Prospectus Supplement

| S-iii | ||||

| S-iv | ||||

| S-1 | ||||

| S-7 | ||||

| S-11 | ||||

| S-16 | ||||

| S-26 | ||||

| S-27 | ||||

| S-28 | ||||

| S-34 | ||||

| S-34 | ||||

| S-35 | ||||

| S-36 | ||||

Prospectus

| 1 | ||||

| 2 | ||||

| 3 | ||||

| 4 | ||||

| 5 | ||||

| 6 | ||||

| 8 | ||||

| 9 | ||||

| 10 | ||||

| 12 | ||||

| 15 | ||||

| 18 | ||||

| 20 | ||||

| 21 | ||||

| 22 | ||||

| Description of the Partnership Agreement of Rexford Industrial Realty, L.P |

26 | |||

| Material Provisions of Maryland Law and of Our Charter and Bylaws |

33 | |||

| 39 | ||||

| 62 | ||||

| 64 | ||||

| 64 | ||||

S-i

Table of Contents

You should rely only on the information contained in or incorporated by reference into this prospectus supplement, the accompanying prospectus or any applicable free writing prospectus. We have not, and the underwriters have not, authorized any other person to provide you with different or additional information. If anyone provides you with different or additional information, you should not rely on it. This prospectus supplement and the accompanying prospectus do not constitute an offer to sell, or a solicitation of an offer to purchase, any securities in any jurisdiction where it is unlawful to make such offer or solicitation. You should assume that the information appearing in this prospectus supplement, the accompanying prospectus, any applicable free writing prospectus and the documents incorporated by reference herein or therein is accurate only as of their respective dates or on the date or dates which are specified in these documents. Our business, financial condition, liquidity, results of operations and prospects may have changed since those dates.

S-ii

Table of Contents

ABOUT THIS PROSPECTUS SUPPLEMENT AND THE PROSPECTUS

This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering and also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference. The second part, the accompanying prospectus, gives more general information, some of which may not apply to this offering.

To the extent the information contained in this prospectus supplement differs or varies from the information contained in the accompanying prospectus or documents incorporated by reference, the information in this prospectus supplement will supersede such information. In addition, any statement in a filing we make with the Securities and Exchange Commission that adds to, updates or changes information contained in an earlier filing we made with the Securities and Exchange Commission shall be deemed to modify and supersede such information in the earlier filing.

This prospectus supplement does not contain all of the information that is important to you. You should read the accompanying prospectus as well as the documents incorporated by reference in this prospectus supplement and the accompanying prospectus. See Incorporation by Reference and Where You Can Find More Information in this prospectus supplement and the accompanying prospectus. Unless otherwise indicated or unless the context requires otherwise, references in this prospectus supplement to we, our, us and our company refer to Rexford Industrial Realty, Inc., a Maryland corporation, Rexford Industrial Realty, L.P., and any of our other subsidiaries. Rexford Industrial Realty, L.P. is a Maryland limited partnership of which we are the sole general partner and to which we refer in this prospectus supplement as our operating partnership.

S-iii

Table of Contents

This prospectus supplement and the accompanying prospectus and the documents that we incorporate by reference in each contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (set forth in Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities and Exchange Act of 1934, as amended, or the Exchange Act). Also, documents we subsequently file with the Securities and Exchange Commission and incorporate by reference will contain forward-looking statements. In particular, statements relating to our liquidity and capital resources, portfolio performance and results of operations contain forward-looking statements. Furthermore, all of the statements regarding future financial or operating performance (including anticipated funds from operations, or FFO), or anticipated market conditions and demographics are forward-looking statements. We are including this cautionary statement to make applicable and take advantage of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 for any such forward-looking statements. We caution investors that any forward-looking statements presented in this prospectus supplement and the accompanying prospectus and the documents that we incorporate by reference in each are based on managements beliefs and assumptions made by, and information currently available to, management. When used, the words anticipate, believe, expect, intend, may, might, plan, estimate, project, should, will, result and similar expressions that do not relate solely to historical matters are intended to identify forward-looking statements. You can also identify forward-looking statements by discussions of strategy, plans or intentions.

Forward-looking statements are subject to risks, uncertainties and assumptions and may be affected by known and unknown risks, trends, uncertainties and factors that are beyond our control. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, estimated or projected. We do not guarantee that the transactions and events described will happen as described (or that they will happen at all).

Some of the risks and uncertainties that may cause our actual results, performance, liquidity or achievements to differ materially from those expressed or implied by forward-looking statements include, among others, the following:

| | the competitive environment in which we operate; |

| | real estate risks, including fluctuations in real estate values and the general economic climate in local markets and competition for tenants in such markets; |

| | decreased rental rates or increasing vacancy rates; |

| | potential defaults on or non-renewal of leases by tenants; |

| | potential bankruptcy or insolvency of tenants; |

| | acquisition risks, including failure of such acquisitions to perform in accordance with projections; |

| | the timing of acquisitions and dispositions; |

| | potential natural disasters such as earthquakes, wildfires or floods; |

| | national, international, regional and local economic conditions; |

| | the general level of interest rates; |

| | potential changes in the law or governmental regulations that affect us and interpretations of those laws and regulations, including changes in real estate, zoning, environmental or REIT tax laws, and potential increases in real property tax rates; |

| | financing risks, including the risks that our cash flows from operations may be insufficient to meet required payments of principal and interest and we may be unable to refinance our existing debt upon maturity or obtain new financing on attractive terms or at all; |

S-iv

Table of Contents

| | lack of or insufficient amounts of insurance; |

| | our ability to qualify and maintain our qualification as a REIT; |

| | litigation, including costs associated with prosecuting or defending pending or threatened claims and any adverse outcomes; and |

| | possible environmental liabilities, including costs, fines or penalties that may be incurred due to necessary remediation of contamination of properties presently owned or previously owned by us. |

While forward-looking statements reflect our good faith beliefs, they are not guarantees of future performance. We disclaim any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. For a further discussion of these and other factors that could impact our future results, performance, liquidity or transactions, see the section entitled Risk Factors, including the risks incorporated therein from our most recent Annual Report on Form 10-K, as updated by our subsequent filings with the Securities and Exchange Commission and incorporated by reference herein.

S-v

Table of Contents

This summary highlights information contained elsewhere or incorporated by reference in this prospectus supplement and the accompanying prospectus. This summary is not complete and does not contain all of the information that you should consider before investing in our common stock. We urge you to read this entire prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein carefully, including the financial statements and notes to those financial statements incorporated by reference herein and therein. Please read Risk Factors for more information about important risks that you should consider before investing in our common stock.

Rexford Industrial Realty, Inc.

We are a self-administered and self-managed real estate invest trust, or REIT, focused on owning and operating industrial properties in Southern California infill markets. Our goal is to generate attractive risk-adjusted returns for our stockholders by providing superior access to industrial property investments in Southern California infill markets.

We completed our initial public offering (IPO) in July 2013. As of June 30, 2014, our consolidated portfolio consists of 82 properties with approximately 7.9 million rentable square feet. We also own a 15% interest in a joint venture (the JV) that indirectly owns three properties with approximately 1.2 million square feet, which we manage. In addition, we currently manage an additional 20 properties with approximately 1.2 million rentable square feet.

We will elect to be taxed as a REIT for federal income tax purposes on our federal income tax return commencing with our taxable year ended December 31, 2013. We believe that we have been organized and have operated, and we intend to continue operating, in a manner that will allow us to qualify as a REIT for federal income tax purposes commencing with such taxable year. We conduct substantially all of our business through our operating partnership, of which we are the sole general partner.

Recent Developments

Acquisitions and Acquisition Pipeline. Since completing our IPO, we have acquired 31 properties totaling 3.1 million rentable square feet for an aggregate purchase price of approximately $309 million, which has expanded the total rentable square footage of our portfolio by approximately 50%, including 2.2 million square feet acquired in 2014. We believe that we enjoy superior access to off-market and lightly marketed acquisition opportunities, many of which may be difficult for competing investors to access. Off-market and lightly marketed transactions are characterized by a lack of a formal marketing process and a lack of widely disseminated marketing materials. Approximately 62% of our acquisitions since our IPO and approximately 58% of our acquisitions pre-IPO have been what we consider to be off-market or lightly marketed. As we are principally focused on the Southern California infill markets, our executive management and acquisition teams have developed and maintain a deep, broad network of relationships among key market participants, including property brokers, lenders, owners and tenants. We employ an extensive broker marketing, incentives and loyalty program. We also utilize data-driven and event-driven analytics and primary research to identify and pursue events and circumstances, including financial distress, related to owners, lenders, and tenants that we believe tend to generate early access to emerging investment opportunities. We believe that our relationship network, creative sourcing approach and research-driven originations methods contribute to a superior level of attractive investment opportunities.

We believe that the combination of our proprietary origination methods and the experience and relationships of our management team provide us access to and allow us to capitalize on attractive transaction opportunities.

S-1

Table of Contents

The following table provides a summary of our acquisition activity since our IPO:

Acquisitions (unaudited results, data presented on a wholly-owned basis)

| Acquisition Date |

Property | Address | Submarket | Rentable Square Feet |

Purchase Price ($ in millions) |

Occupancy % at Acquisition |

Occupancy % at June 30, 2014 |

Annualized Base Rent at June 30, 2014(1) |

Total Annualized Base Rent per Square Foot at June 30, 2014 |

Single or Multi- Tenant |

||||||||||||||||||||||||

| July 2013 |

Orion | 8101-8117 Orion Ave. |

LA - San Fern. Valley |

48,394 | $ | 5.6 | 90 | % | 100 | % | $ | 593,188 | $ | 12.26 | Multi | |||||||||||||||||||

| August 2013 |

Tarzana |

18310-18330 Oxnard St. |

LA - San Fern. Valley |

75,288 | $ | 8.4 | 81 | % | 96 | % | $ | 782,502 | $ | 10.78 | Multi | |||||||||||||||||||

| November 2013 |

Yorba Linda Business Park |

22343-22349 La Palma Ave. |

OC - North | 115,760 | $ | 12.7 | 79 | % | 77 | % | $ | 1,036,373 | $ | 11.60 | Multi | |||||||||||||||||||

| November 2013 |

The Park | 1100-1170 Gilbert St., 2353-2373 La Palma Ave. |

OC - North | 120,313 | $ | 10.6 | 85 | % | 98 | % | $ | 1,158,344 | $ | 9.79 | Multi | |||||||||||||||||||

| December 2013 |

Bonita Thompson |

280 Bonita Ave., 2743 Thompson Creek Rd. |

LA - San Gabriel |

365,859 | $ | 27.2 | 100 | % | 100 | % | $ | 1,580,511 | $ | 4.32 | Single | |||||||||||||||||||

| December 2013 |

Madera (2) | 2900-2950 N. Madera Road |

LA - San Fern. Valley |

199,370 | $ | 15.8 | 68 | % | 100 | % | $ | 800,062 | $ | 5.88 | Single | |||||||||||||||||||

| December 2013 |

Vanowen | 10635 W. Vanowen St. |

LA - San Fern. Valley |

31,037 | $ | 3.4 | 100 | % | 100 | % | $ | 254,621 | $ | 8.20 | Multi | |||||||||||||||||||

| January 2014 |

Rosecrans | 7110 Rosecrans Avenue |

LA - South Bay |

72,000 | $ | 5.0 | 50 | % | 50 | % | $ | 254,880 | $ | 7.08 | Multi | |||||||||||||||||||

| January 2014 |

14723-14825 Oxnard |

14723-14825 Oxnard Street |

LA - San Fern. Valley |

78,000 | $ | 8.9 | 98 | % | 98 | % | $ | 887,352 | $ | 11.58 | Multi | |||||||||||||||||||

| February 2014 |

Ontario Airport |

Ana Street | Inland Empire |

113,612 | $ | 8.6 | 95 | % | 92 | % | $ | 594,876 | $ | 5.66 | Multi | |||||||||||||||||||

| February 2014 |

228th Street | 1500-1510 West 228th Street |

LA - South Bay |

88,330 | $ | 6.6 | 100 | % | 95 | % | $ | 423,120 | $ | 5.02 | Multi | |||||||||||||||||||

| March 2014 |

24105 Frampton |

24105 & 24201 Frampton Avenue |

LA - South Bay |

47,903 | $ | 3.9 | 100 | % | 100 | % | $ | 278,964 | $ | 5.82 | Single | |||||||||||||||||||

| April 2014 |

Saturn Way | 1700 Saturn Way |

OC-West | 170,865 | $ | 21.1 | 100 | % | 100 | % | $ | 1,307,682 | $ | 7.65 | Single | |||||||||||||||||||

| May 2014 |

San Fernando | 2980 & 2990 N. San Fernando Blvd. |

OC-South | 130,800 | $ | 15.4 | 100 | % | 100 | % | $ | 1,325,664 | $ | 10.14 | Multi | |||||||||||||||||||

| May 2014 |

Crescent Bay | 20531 Crescent Bay Drive |

LA- San Fern. Valley |

46,178 | $ | 6.5 | 100 | % | 100 | % | $ | 371,271 | $ | 8.04 | Single | |||||||||||||||||||

| June 2014 |

Birch | 2610 & 2701 S. Birch Street |

OC- Airport | 98,105 | $ | 11.0 | 100 | % | 100 | % | $ | 0 | (3) | $ | 0.00 | (3) | Single | |||||||||||||||||

| June 2014 |

Dupont | 4051 Santa Ana St. & 701 Dupont Ave. |

Inland Empire West |

111,890 | $ | 10.2 | 100 | % | 100 | % | $ | 638,255 | $ | 5.70 | Multi | |||||||||||||||||||

S-2

Table of Contents

| Acquisition Date |

Property | Address | Submarket | Rentable Square Feet |

Purchase Price ($ in millions) |

Occupancy % at Acquisition |

Occupancy % at June 30, 2014 |

Annualized Base Rent at June 30, 2014(1) |

Total Annualized Base Rent per Square Foot at June 30, 2014 |

Single or Multi- Tenant |

||||||||||||||||||||||||

| June 2014 |

9755 Distribution Ave |

9755 Distribution Ave |

San Diego- Central |

47,666 | $ | 5.4 | 100 | % | 100 | % | $ | 341,100 | $ | 7.16 | Multi | |||||||||||||||||||

| June 2014 |

9855 Distribution Ave |

9855 Distribution Ave |

San Diego- Central |

60,819 | $ | 8.5 | 100 | % | 100 | % | $ | 537,756 | $ | 8.84 | Multi | |||||||||||||||||||

| June 2014 |

9340 Cabot Drive |

9340 Cabot Drive |

San Diego- Central |

86,564 | $ | 11.0 | 84 | % | 84 | % | $ | 576,897 | $ | 7.95 | Multi | |||||||||||||||||||

| June 2014 |

9404 Cabot Drive |

9404 Cabot Drive |

San Diego- Central |

46,846 | $ | 6.4 | 100 | % | 100 | % | $ | 478,296 | $ | 10.21 | Single | |||||||||||||||||||

| June 2014 |

9455 Cabot Drive |

9455 Cabot Drive |

San Diego- Central |

96,840 | $ | 12.1 | 84 | % | 84 | % | $ | 651,240 | $ | 8.04 | Multi | |||||||||||||||||||

| June 2014 |

14955- 14971 E Salt Lake Ave |

14955-14971 E Salt Lake Ave |

LA- San Gabriel Valley |

126,036 | $ | 10.9 | 100 | % | 100 | % | $ | 853,647 | $ | 6.77 | Multi | |||||||||||||||||||

| June 2014 |

5235 Hunter Ave |

5235 Hunter Ave |

OC- North | 119,692 | $ | 11.3 | 100 | % | 100 | % | $ | 842,439 | $ | 7.04 | Single | |||||||||||||||||||

| June 2014 |

3880 W Valley Blvd |

3880 W Valley Blvd |

LA- San Gabriel Valley |

108,703 | $ | 9.6 | 100 | % | 100 | % | $ | 705,888 | $ | 6.49 | Single | |||||||||||||||||||

| June 2014 |

1601 & 1621 Alton Pkwy |

1601 & 1621 Alton Pkwy |

OC- Airport |

124,000 | $ | 13.3 | 40 | % | 40 | % | $ | 467,896 | $ | 9.48 | Multi | |||||||||||||||||||

| July 2014 |

3116 Avenue 32 |

3116 W. Avenue 32 |

LA- San Fern. Valley |

100,500 | $ | 11.0 | 100 | % | 100 | %(4) | $ | 688,720 | (4) | $ | 6.85 | (4) | Multi | |||||||||||||||||

| July 2014 |

Chatsworth Industrial Park |

21040 Nordoff Street; 9035 Independence Avenue; 21019-21045 Osborne Street |

LA- San Fern. Valley |

153,212 | $ | 16.8 | 100 | % | 100 | %(4) | $ | 1,083,465 | (4) | $ | 7.07 | (4) | Multi | |||||||||||||||||

| July 2014 |

24935 & 24955 Avenue Kearny |

24935 & 24955 Avenue Kearny |

LA- San Fern. Valley |

138,980 | $ | 11.5 | 100 | % | 100 | %(4) | $ | 917,891 | (4) | $ | 6.60 | (4) | Multi | |||||||||||||||||

| (1) | Calculated as monthly contracted base rent per the terms of the lease(s) at such property, as of June 30, 2014, multiplied by 12. Excludes billboard and antenna revenue and rent abatements. Annualized base rent includes rent from triple net leases, modified gross leases and gross leases. |

| (2) | Madera acquisition includes a 136,065 square foot industrial building and a 63,035 square foot office building. The office building was subsequently sold in March 2014. |

| (3) | Reflecting a short-term sale leaseback to the prior owner at no rent. |

| (4) | Reflecting values at the time of acquisition. |

We intend to continue to grow our portfolio through disciplined acquisitions in prime Southern California infill markets. Since our IPO, we have acquired approximately 3.1 million square feet of property that we believe provide opportunities for repositioning or redevelopment that will increase the occupancy and the cash flow from the property, which we sometimes refer to as a value-add play. We believe that our relationship-, data- and event-driven research allows us to identify and exploit asset mispricing and market inefficiencies. Through these proprietary origination methods, we are actively monitoring, as of the date of this prospectus supplement, approximately 40 million square feet of properties in our markets that we believe represent attractive potential investment opportunities, including properties containing approximately 7.1 million square feet on which we have submitted non-binding offers that remain outstanding.

S-3

Table of Contents

We believe there are a large number of leveraged industrial properties within our target markets with unfavorable debt terms characterized by high loan to value rates, relatively high cost of debt service or high pre-payment costs, which can create illiquidity for owners facing loan maturities over the next several years. We seek to source transactions from owners with maturing loans, some facing pressing liquidity needs or financial distress, including loans that lack economical refinancing options. We also seek to transact with lenders, which, following the recent recession, may face a need to divest or resolve underperforming loans in order to meet increased capital and regulatory requirements.

We also believe there is a large number of owners increasingly experiencing a generational shift in ownership of infill industrial property in our target markets. With over one billion square feet of industrial property built prior to 1980 within infill Southern California, we are also focused on opportunities to identify and transact with such owners in an effort to address their generational needs with flexible purchase solutions that may include UPREIT-type transactions or straight purchases for cash.

Dispositions. Since our IPO, we have also disposed of two properties totaling approximately 188,000 square feet for approximately $14.5 million. The following table provides a summary of our disposition activity since our IPO:

Dispositions (unaudited results, data presented on a wholly-owned basis)

| Date |

Property | Address |

Submarket |

Rentable SF |

Purchase Price ($ in millions) |

Reason for Selling |

||||||||||

| January 2014 |

Kaiser | 1335 Park Center Drive | San Diego - North | 124,997 | $ | 10.1 | Sale to user | |||||||||

| March 2014 |

Madera Office | 2900 N. Madera Road | LA - San Fern. Valley | 63,305 | $ | 4.4 | Non core business | |||||||||

Leasing Activity. From July 1, 2013 to June 30, 2014, we have entered into 180 new leases covering approximately 800,000 square feet and renewed 236 leases covering approximately 1,100,000 square feet.(3) The following table provides a summary of our GAAP and cash releasing spreads since our IPO.

| Leasing Spreads |

Three Months Ended June 30, 2014 |

Three Months Ended March 31, 2014 |

Three Months Ended December 31, 2013 |

Three Months Ended September 30, 2013(3) |

||||

| Cash(1) |

5.2% | 3.6% | 3.5% | (1.1)% | ||||

| GAAP(2) |

17.1% | 11.5% | 12.9% | 6.7% |

| (1) | Compares the first month cash rent excluding any abatement on new leases to the last month rent for the most recent expiring lease. Data included for comparable leases only. Comparable leases generally exclude properties under repositioning, short-term leases, and space that has been vacant for over one year. |

| (2) | Compares GAAP rent, which straightlines rental rate increases and abatement, on new leases to GAAP rent for the most recent expiring leases. Data included for comparable leases only. Comparable leases generally exclude properties under reposition, short-term leases, and space that has been vacant for over one year. |

| (3) | Includes operations of our predecessor business from July 1, 2013 to July 23, 2013. |

Corporate Information

Our principal executive offices are located at 11620 Wilshire Boulevard, Suite 1000, Los Angeles, California 90025. Our telephone number is 310-966-1680. Our Web site address is www.rexfordindustrial.com. The information on, or otherwise accessible through, our Web site does not constitute a part of this prospectus supplement or the accompanying prospectus.

S-4

Table of Contents

The Offering

The offering terms are summarized below solely for your convenience. For a more complete description of the terms of our common stock, see Description of Common Stock in the accompanying prospectus.

| Issuer | Rexford Industrial Realty, Inc., a Maryland corporation. | |

| Securities offered |

15,000,000 shares of common stock, $0.01 par value per share. The underwriters may also exercise their option to purchase up to an additional 2,250,000 shares from us, at the public offering price, less the underwriting discount, for 30 days after the date of this prospectus supplement. | |

| New York Stock Exchange symbol |

REXR | |

| Shares of common stock outstanding immediately prior to this offering |

25,649,026 shares. | |

| Shares of common stock outstanding upon completion of this offering |

40,649,026 shares(1) (42,899,026 shares if the underwriters exercise their option to purchase additional shares in full). | |

| Shares of common stock and common units outstanding upon completion of this offering |

43,658,285 shares and common units of partnership interest in our operating partnership, or common units(1)(2) (45,908,285 shares and common units if the underwriters exercise their option to purchase additional shares in full). (2) | |

| Use of proceeds |

We estimate that the net proceeds from this offering will be approximately $ million, after deducting the underwriting discount and estimated offering expenses payable by us, or approximately $ million if the underwriters option to purchase additional shares is exercised in full. We will contribute the net proceeds of this offering to our operating partnership in exchange for common units. Our operating partnership intends to use the net proceeds from this offering to repay $137.9 million of borrowings outstanding under our unsecured revolving credit facility, fund potential acquisition opportunities and/or for general corporate purposes. See Use of Proceeds. | |

| Restrictions on ownership |

Our charter contains restrictions on the ownership and transfer of our stock that are intended to assist us in complying with the requirements for qualification as a REIT. Among other things, our charter provides that, subject to certain exceptions, no person or entity may actually or beneficially own, or be deemed to own by virtue of the applicable constructive ownership provisions of the Internal Revenue Code of 1986, as amended, or the Code, more than 9.8% (in value or in number of shares, whichever is more restrictive) of the outstanding shares of our common stock. See Restrictions on Ownership and Transfer in the accompanying prospectus. | |

| Risk factors |

Investing in our common stock involves a high degree of risk and the purchasers of our common stock may lose their entire investment. Before deciding to invest in our common stock, please carefully read the section entitled Risk Factors, including the risks incorporated therein | |

S-5

Table of Contents

| from our most recent Annual Report on Form 10-K for the year ended December 31, 2013 and our other periodic reports filed with the Securities and Exchange Commission and incorporated by reference herein. |

| (1) | Excludes (i) 2,250,000 shares of our common stock issuable upon the exercise of the underwriters option to purchase additional shares in full and (ii) a maximum of 2,036,153 shares of our common stock available for issuance in the future under our equity incentive plan. |

| (2) | Includes 3,009,259 common units held by limited partners of our operating partnership, which units may, subject to certain limitations, be redeemed for cash or, at our option, exchanged for shares of our common stock on a one-for-one basis. |

Our Chairman, Richard Ziman, and our Co-Chief Executive Officers, Howard Schwimmer and Michael Frankel, are being allocated the opportunity to purchase shares of our common stock in this offering at the public offering price, for a purchase price of up to $300,000, $200,000 and $250,000, respectively. As of June 30, 2014, Messrs. Ziman, Schwimmer and Frankel beneficially owned 109,290 shares, 53,263 shares and 21,303 shares of our outstanding common stock, respectively. Based on an assumed public offering price of $13.95 per share, which was the closing sales price of our common stock on the New York Stock Exchange on August 11, 2014, Messrs. Ziman, Schwimmer and Frankel are being allocated the opportunity to purchase 21,505 shares, 14,337 shares and 17,921 shares, respectively, of our common stock in this offering and have indicated an interest in purchasing all of such shares. The underwriters will receive the same discount from any shares of our common stock purchased by Messrs. Ziman, Schwimmer and Frankel as they will from any other shares of our common stock sold to the public in this offering.

S-6

Table of Contents

Investing in our common stock involves a high degree of risk. In addition to the other information in this prospectus supplement, you should carefully consider the following risks, the risks described in our Annual Report on Form 10-K for the year ended December 31, 2013, as well as the other information and data set forth in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein before making an investment decision with respect to our common stock. The occurrence of any of the following risks could materially and adversely affect our business, prospects, financial condition, results of operations and our ability to make cash distributions to our stockholders, which could cause you to lose all or a part of your investment in our common stock. Some statements in this prospectus supplement, including statements in the following risk factors, constitute forward-looking statements. See Forward-Looking Statements.

Risks Related to Our Properties and Our Business

As of the date of this prospectus supplement, we had approximately $407.6 million of consolidated indebtedness outstanding, which may expose us to interest rate fluctuations, and our debt service obligations with respect to such indebtedness will reduce cash available for distribution, including cash available to pay dividends on our common stock, and expose us to the risk of default under our debt obligations.

Our total consolidated indebtedness, as of the date of this prospectus supplement, was approximately $407.6 million, including approximately $137.9 million outstanding under our revolving credit facility, $100 million in principal amount of mortgage debt under our term loan, and approximately $169.7 million in principal amount of mortgage debt. Additionally, we have approximately $6.2 million of secured indebtedness allocable to our 15% joint venture interest in the three properties owned indirectly by the JV. A substantial portion of this indebtedness is guaranteed by our operating partnership. In addition, as of the date of this prospectus supplement, approximately $389.1 million of our outstanding long-term debt is exposed to fluctuations in short term interest rates. We may incur significant additional debt to finance future acquisition and development activities.

Payments of principal and interest on borrowings may leave us with insufficient cash resources to operate our properties or to pay the current level of dividends on our common stock or necessary to maintain our REIT qualification. Our level of debt and the limitations imposed on us by our debt agreements could have significant adverse consequences, including the following:

| | our cash flow may be insufficient to meet our required principal and interest payments; |

| | we may be unable to borrow additional funds as needed or on favorable terms, which could, among other things, adversely affect our ability to meet operational needs; |

| | we may be unable to refinance our indebtedness at maturity or the refinancing terms may be less favorable than the terms of our original indebtedness; |

| | because a significant portion of our debt bears interest at variable rates, increases in interest rates could increase our interest expense; |

| | we may be forced to dispose of one or more of our properties, possibly on unfavorable terms or in violation of certain covenants to which we may be subject; |

| | we may violate restrictive covenants in our loan documents, which would entitle the lenders to accelerate our debt obligations; and |

| | our default under any loan with cross default provisions could result in a default on other indebtedness. |

If any one of these events were to occur, our financial condition, results of operations, cash flows and our ability to make distributions on, and the per share trading price of, our common stock could be adversely affected. Furthermore, foreclosures could create taxable income without accompanying cash proceeds, which could hinder our ability to meet the REIT distribution requirements imposed by the Code.

S-7

Table of Contents

Risks Related to this Offering

The market price and trading volume of our common stock may be volatile following this offering.

The per share trading price of our common stock may be volatile. In addition, the trading volume of our common stock may fluctuate and cause significant price variations to occur. If the per share trading price of our common stock declines significantly, you may be unable to resell your shares at or above the purchase price. We cannot assure you that the per share trading price of our common stock will not fluctuate or decline significantly in the future.

Some of the factors that could negatively affect our share price or result in fluctuations in the price or trading volume of our common stock include:

| | actual or anticipated variations in our quarterly operating results or dividends; |

| | changes in our funds from operations or earnings estimates; |

| | publication of research reports about us or the real estate industry; |

| | increases in market interest rates that lead purchasers of our shares to demand a higher yield; |

| | changes in market valuations of similar companies; |

| | adverse market reaction to any additional debt we incur in the future; |

| | additions or departures of key management personnel; |

| | actions by institutional stockholders; |

| | speculation in the press or investment community; |

| | the realization of any of the other risk factors presented in this prospectus; |

| | the extent of investor interest in our securities; |

| | the general reputation of REITs and the attractiveness of our equity securities in comparison to other equity securities, including securities issued by other real estate-based companies; |

| | our underlying asset value; |

| | investor confidence in the stock and bond markets, generally; |

| | changes in tax laws; |

| | future equity issuances; |

| | failure to meet earnings estimates; |

| | failure to qualify and maintain our qualification as a REIT; |

| | changes in our credit ratings; |

| | litigation or threatened litigation, which may divert management time and attention, require us to pay damages and expenses or restrict the operation of our business; |

| | general market and economic conditions; |

| | our issuance of debt or preferred equity securities; and |

| | our financial condition, results of operations and prospects. |

In the past, securities class action litigation has often been instituted against companies following periods of volatility in the price of their common stock. This type of litigation could result in substantial costs and divert our managements attention and resources, which could have an adverse effect on our financial condition, results of operations, cash flows and our ability to pay distributions on, and the per share trading price of, our common stock.

S-8

Table of Contents

Affiliates of the underwriters may receive benefits in connection with this offering.

Affiliates of Merrill Lynch, Pierce, Fenner & Smith Incorporated, J.P. Morgan Securities LLC, Wells Fargo Securities, LLC, Citigroup Global Markets Inc. (underwriters in this offering) and certain of the other underwriters in this offering are lenders under our unsecured revolving credit facility. As described above, our operating partnership intends to use a portion of the net proceeds from this offering to repay the borrowings outstanding under our unsecured revolving credit facility. As a result, these affiliates will receive their proportionate share of any amount of our unsecured revolving credit facility that is repaid with the proceeds of this offering.

Market interest rates may have an effect on the per share trading price of our common stock.

One of the factors that influences the price of our common stock is the dividend yield on our common stock (as a percentage of the price of our common stock) relative to market interest rates. An increase in market interest rates, which are currently at low levels relative to historical rates, may lead prospective purchasers of our common stock to expect a higher dividend yield and higher interest rates would likely increase our borrowing costs and potentially decrease funds available for distribution. Thus, higher market interest rates could cause the market price of our common stock to decrease.

The number of shares of our common stock available for future issuance or sale could adversely affect the per share trading price of our common stock.

We cannot predict whether future issuances or sales of shares of our common stock or the availability of shares for resale in the open market will decrease the per share trading price per share of our common stock. The issuance of substantial numbers of shares of our common stock in the public market, or upon exchange of common units, or the perception that such issuances might occur, could adversely affect the per share trading price of our common stock. The per share trading price of our common stock may decline significantly upon the sale or registration of additional shares of our common stock pursuant to registration rights granted in connection with our IPO.

The exercise of the underwriters option to purchase additional shares, the exchange of common units for common stock or the vesting of any restricted stock granted to directors, executive officers and other employees under our equity incentive plan, the issuance of our common stock or common units in connection with future property, portfolio or business acquisitions and other issuances of our common stock could have an adverse effect on the per share trading price of our common stock, and the existence of common units or shares of our common stock available for issuance as equity compensation may adversely affect the terms upon which we may be able to obtain additional capital through the sale of equity securities. In addition, future issuances of shares of our common stock may be dilutive to existing stockholders.

You may experience significant dilution as a result of this offering, which may adversely affect the per share trading price of our common stock.

This offering may have a dilutive effect on our earnings per share and funds from operations per share after giving effect to the issuance of our common stock in this offering and the receipt of the expected net proceeds. The actual amount of dilution from this offering, or from any future offering of common stock, will be based on numerous factors, particularly the use of proceeds and the return generated by such investment, and cannot be determined at this time. The per share trading price of our common stock could decline as a result of sales of a large number of shares of our common stock in the market pursuant to this offering, or otherwise, or as a result of the perception or expectation that such sales could occur.

Future offerings of debt securities, which would be senior to our common stock upon liquidation, and/or preferred equity securities which may be senior to our common stock for purposes of dividend distributions or upon liquidation, may adversely affect the per share trading price of our common stock.

In the future, we may attempt to increase our capital resources by making additional offerings of debt or equity securities (or causing our operating partnership to issue debt securities), including medium-term notes,

S-9

Table of Contents

senior or subordinated notes and classes or series of preferred stock. Upon liquidation, holders of our debt securities and shares of preferred stock or preferred units of partnership interest in our operating partnership and lenders with respect to other borrowings will be entitled to receive our available assets prior to distribution to the holders of our common stock. Additionally, any convertible or exchangeable securities that we issue in the future may have rights, preferences and privileges more favorable than those of our common stock and may result in dilution to holders of our common stock. Holders of our common stock are not entitled to preemptive rights or other protections against dilution. Any shares of our preferred stock or preferred units that we issue in the future could have a preference on liquidating distributions or a preference on dividend payments that could limit our ability pay dividends to the holders of our common stock. Because our decision to issue securities in any future offering will depend on market conditions and other factors beyond our control, we cannot predict or estimate the amount, timing or nature of our future offerings. Thus, our stockholders bear the risk of our future offerings reducing the per share trading price of our common stock and diluting their interest in us.

S-10

Table of Contents

Unless otherwise indicated, all information contained in this Market Overview section is derived from market materials prepared by DAUM Commercial Real Estate Services (DAUM) as of December 31, 2013, citing CoStar Property Database, CBRE and other sources.

Southern California Infill Industrial Market

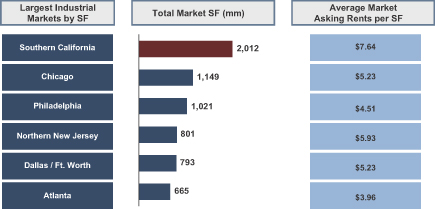

The Southern California industrial real estate market is the largest in the United States, with approximately 2.0 billion square feet of space, approximately 1.7 times larger than the next largest industrial real estate market (Chicago, Illinois) when measured by square footage, as illustrated below:

Source: DAUM market materials, citing CoStar Property Database and CoStar Industrial Report 1Q2014

Note: Southern California market comprised of Los Angeles, Orange, Ventura, San Bernardino, Riverside and San Diego Counties.

Southern California is generally segmented into infill and non-infill industrial markets. Infill markets are considered high-barrier to-entry markets and have characteristics that tend to limit new construction.

S-11

Table of Contents

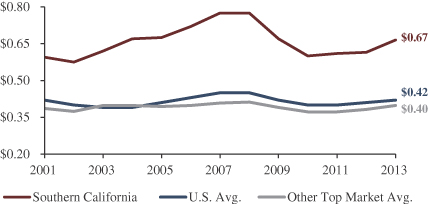

Our investment strategy focuses on the 1.73 billion square foot infill market comprised of Los Angeles County, Orange County, West Inland Empire, San Diego County and Ventura County. These markets benefit from some of the highest rents in the country. While the United States average asking rent per square foot is $4.80, the average annualized base rent of our properties located in Los Angeles County, Orange County, San Bernardino County, San Diego County and Ventura County as of June 30, 2014 was $8.45, $7.90, $7.95, $9.05 and $7.81, respectively. Over $7.2 billion of industrial property was sold in Southern California during the 12 month period ended May 2014. We believe the market trends and conditions discussed below have created favorable investment opportunities that we are competitively positioned to capitalize upon.

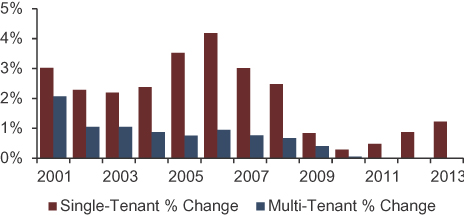

Limited, Diminishing Supply with Substantial Barriers to Entry

Southern California is generally considered to be nearly fully developed and is characterized by a scarcity of vacant or developable land. Further, lease rates typically do not justify development of new industrial properties for lease in infill markets, which presents an economic barrier for those seeking to develop new industrial properties. The entitlement process is also restrictive and requires particular expertise to navigate. Consequently, there has been a dearth of new multi-tenant industrial properties built for lease since 1999, with infill development generally limited to relatively few owner-user and build-to-suit developments. Multi-tenant development represented only 1.2% of total new industrial property construction in Southern California markets during 2013. Further, as a majority of infill product is multi-tenant, a majority of new construction occurred in the Inland Empire, much of which is non-infill and generally outside of our primary target markets.

% Change in Southern California Existing Industrial Stock

Source: DAUM market materials, citing CoStar Property Database as of December 2013

S-12

Table of Contents

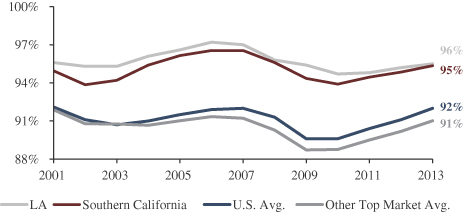

High Current Occupancy and High Rental Rates

The Southern California infill industrial market has consistently out-performed other national markets on the basis of occupancy and asking rents. As of December 31, 2013, occupancy was 95.5% and 95.2% for Los Angeles and Orange Counties, respectively, versus the national average of 92.0%. Since 2001, average Los Angeles and Orange County asking rents were 68.5% higher than the average of the next nine largest markets in the nation over the same thirteen-year period. As shown in the charts below, the occupancy rates for Los Angeles and Southern California have consistently been above the other large markets in the United States since the fourth quarter of 2001 and the occupancy rates never dipped below 90%, even during the most recent recession.

Market Leading Occupancy

Source: DAUM market report, citing CoStar Property Database and data provided by CBRE as of December 2013

Market Leading Rental Rates

Source: DAUM market report, citing CoStar Property Database and data provided by CBRE as of December 2013

S-13

Table of Contents

Low Vacancy Rates in Target Markets

Due to the supply constrained nature of the Southern California infill industrial market, industrial vacancies in our markets remain very low at 2.8%(1), compared to 11.1% nationally. The vacancy rate by submaket is as follows:

| Submarket |

Market Size |

Triple Net Asking Rent |

Vacancy Rate |

|||||

| Ventura County |

62 million SF | $0.63 / SF | 5.4 | % | ||||

| San Fernando Valley |

172 million SF | $0.69 / SF | 1.3 | % | ||||

| Central Los Angeles |

124 million SF | $0.70 / SF | 2.5 | % | ||||

| Vernon/ Commerce |

160 million SF | $0.53 / SF | 2.4 | % | ||||

| San Gabriel Valley |

146 million SF | $0.56 / SF | 1.3 | % | ||||

| South Bay |

218 million SF | $0.59 / SF | 2.1 | % | ||||

| Mid-Counties |

108 million SF | $0.57 / SF | 3.2 | % | ||||

| North Orange County |

110 million SF | $0.58 / SF | 1.8 | % | ||||

| West Orange County |

41 million SF | $0.64 / SF | 2.0 | % | ||||

| Orange County Airport |

69 million SF | $0.70 / SF | 3.0 | % | ||||

| San Diego County - Warehouse |

47 million SF | $0.63 / SF | 6.6 | % | ||||

| San Diego County - Light Industrial |

69 million SF | $0.75 / SF | 5.4 | % | ||||

| (1) | Represents the weighted average vacancy based on our square footage in each of the submarkets in the table above |

Diverse Tenant Demand Base

Southern California is home to the nations largest and most diverse manufacturing, distribution and consumer staples sector, as well as the largest number of high-tech jobs. We draw our tenants from over 17 industry sectors. The trend of off-shoring domestic manufacturing to Asia further fuels Southern California industrial tenant demand, as Asian goods pass through the Los Angeles-area ports and require regional warehousing and distribution to access the broader U.S. market. As of December 31, 2013, approximately 18.5% of our tenants imported product from outside the U.S. Additionally, the emergence of e-commerce and the growth of Internet retailers and wholesalers are expanding the universe of tenants seeking industrial space in our target markets. Forrester Research Inc. projects that online shoppers in the United States will spend $327 billion in 2016, up 45% from the $226 billion spent in 2012, increasing to an estimated 9.0% of total retail sales by 2016.

Large and Growing Regional Population

Southern California represents the largest regional population in the United States, with over 21 million residents, comprising over 57% of California residents. The population has increased by approximately 2 million since 2000 and is projected to increase to over 25 million residents by 2030. Californias 2.6% GDP growth in 2013 exceeded the national average and is expected to exceed the national average again in 2014. Our infill tenant base tends to disproportionately serve the direct consumption needs of this growing regional Southern California population.

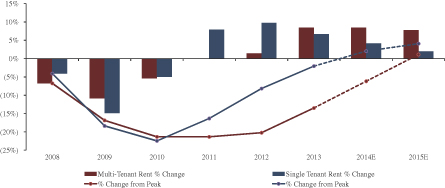

Smaller Spaces and Multi-Tenant Properties Tend to Outperform Larger, Single-Tenant Properties

Our target infill markets feature a majority of properties valued below $25 million or sized below 300,000 square feet. We believe smaller spaces, generally under 40,000 square feet, are positioned for rental rate recovery as economic conditions improve for smaller- and mid-sized tenants in the face of ongoing scarcity of supply of these spaces. Rental rates for larger, single-tenant spaces have recovered nearly to their pre-recession levels. Conversely, rental rates for small- and mid-sized tenants on average remain fifteen percent below their pre-recession levels and have lagged in recovery compared to larger spaces in our target markets. Consequently, we

S-14

Table of Contents

believe the potential for rental rates to increase in the smaller- and medium-sized spaces and buildings may be substantially greater in the near- to medium-term than for larger spaces fueled, in part, by improving liquidity and access to working capital for small and medium sized businesses as the economy continues to recover more broadly.

As shown in the chart below, rental rates in the Southern California industrial infill market are projected to increase over the next three years. Moreover, multi-tenant space under 40,000 square feet, which has been slower to recover from the recent recession, is projected to outperform single-tenant space containing 100,000 or more square feet according to DAUM, utilizing data provided by CBRE.

Southern California Industrial Asking Rent Growth

Source: DAUM market materials, citing CoStar Property

Database and data provided by CBRE as of December 2013

S-15

Table of Contents

Overview

Rexford Industrial Realty, Inc. is a Maryland corporation formed to operate as a self-administered and self-managed REIT focused on owning and operating industrial properties in Southern California infill markets. We were formed to succeed our predecessor business, which was controlled and operated by our principals, Richard Ziman, Howard Schwimmer and Michael Frankel, who collectively have decades of experience acquiring, owning and operating industrial properties in Southern California infill markets. We completed our IPO in July 2013. As of June 30, 2014, our portfolio consists of 82 properties with approximately 7.9 million rentable square feet in infill locations. We also own a 15% interest in a joint venture (the JV) that indirectly owns 3 properties with approximately 1.2 million rentable square feet. In addition, we currently manage an additional 20 properties with approximately 1.2 million rentable square feet.

Our goal is to generate attractive risk-adjusted returns for our stockholders by providing superior access to industrial property investments in Southern California infill markets. Our target markets provide us with opportunities to acquire both stabilized properties generating favorable cash flow, as well as properties where we can enhance returns through value-add renovations and redevelopment. We believe that Southern California infill markets are among the most attractive industrial real estate markets for investment in the United States. Significant fragmentation, scarcity of available space and high barriers limiting new construction all contribute to create superior long-term supply/demand fundamentals. We built our company from the ground up as an institutional quality, vertically integrated platform with extensive value-add investment and management capabilities to focus on this specific market opportunity.

We own both multi-tenant and single-tenant properties comprising approximately 73% and 27% of our portfolio, respectively. Our properties are highly adaptable and appeal to a wide range of potential tenants and uses, which, in our experience, reduces re-tenanting costs, time and risk, thereby enhancing our return on investment. Our tenants generally are small and medium sized businesses that are structurally tied to the Southern California economy and therefore find that locating within our target markets is critical to the ongoing operations of their business. Our portfolio is highly diversified by tenant and industry. Of our 1,001 tenants, no single tenant accounted for more than 2.2% of our total annualized rent as of June 30, 2014. Our average tenant size is approximately 7,146 square feet, with approximately 98% of tenants occupying less than 50,000 square feet each.

We benefit from our management teams extensive market knowledge, long-standing business and personal relationships and research- and relationship-driven origination methods developed over more than 30 years to generate attractive investment opportunities. In our view, the fragmented and complex nature of our target markets generally makes it difficult for less experienced or less focused investors to access comparable opportunities on a consistent basis.

We plan to grow our business through disciplined acquisitions of additional industrial properties in Southern California infill markets, and believe that there are substantial and attractive acquisition opportunities available to us in our target markets. According to DAUM, citing to a CoStar Industrial Report, the Southern California infill industrial property market consists of approximately 2 billion square feet of industrial properties. Our portfolio represents substantially less than 1% of this target market.

We and our predecessor have acquired 5.1 million square feet of industrial real estate since 2011 through a broad range of transaction catalysts, which we estimate as follows (based on the number of transactions closed since the start of 2011): generational ownership shift (32%); fund divestment (21%); realization of capital (5%); sale-leaseback (5%); near term debt maturity (5%); and sale-leaseback/corporate surplus (5%). Of the properties acquired since our IPO, we believe approximately 62% of these transactions were sourced through a combination of off-market and lightly marketed transactions. We believe the current market environment represents an attractive time in the real estate cycle to invest in our target properties as the many small and medium sized

S-16

Table of Contents

businesses that our properties seek to serve are just beginning to participate in the economic recovery. Despite being consistently one of the highest occupied markets in the United States approaching 95% occupancy rates as of the second quarter of 2014 according to DAUM, citing CBRE, particularly for multi-tenant properties, rental rates in our target markets have only recently begun to recover from their recessionary lows.

We will elect to be taxed as a REIT for federal income tax purposes on our federal income tax return, commencing with the year ended December 31, 2013, and generally are not subject to U.S. federal taxes on our income to the extent we annually distribute at least 90% of our REIT taxable income, determined without regard to the deduction for dividends paid, to our stockholders and otherwise maintain our qualification as a REIT. We are structured as an UPREIT and own substantially all of our assets and conduct substantially all of our business through our operating partnership. We serve as the sole general partner and, as of June 30, 2014, own an approximately 89.4% interest in our operating partnership.

Experienced Management and Vertically Integrated Team

Our predecessor business was founded in 2001 by our Chairman Richard Ziman, and our Co-Chief Executive Officer, Howard Schwimmer, to take advantage of what they believed to be a particularly attractive opportunity to invest in industrial properties in Southern California infill markets. Messrs. Ziman and Schwimmer were joined by Michael Frankel, our Co-Chief Executive Officer, in 2004. These three members of our senior executive management team have worked together for over a decade, and each has substantial experience investing in and managing Southern California industrial properties.

Rexfords vertically integrated company and team provides an entrepreneurial set of processes and personnel experienced in virtually every facet of industrial property investment and management, from originations, finance and underwriting, to asset, construction and property management.

Competitive Strengths

In addition to our infill Southern California target market and asset focus, we believe that our investment strategy and operating model distinguish us from other owners, operators and acquirers of industrial real estate in several important ways, including the following:

Attractive Existing Portfolio with Diversified Tenant Mix: We have built a difficult-to-replicate portfolio of interests in 87 properties totaling approximately 8.4 million rentable square feet. We own 100% of the interests in 84 of these properties and own a 15% interest in the remaining three properties. We believe our portfolio is attractively positioned to participate in a recovery in rental rates in our markets. As of June 30, 2014, we had 1,001 individual tenants, with no single tenant accounting for more than 2.2% of our total annualized rent. Our portfolio is also geographically diversified within the Southern California market across the following submarkets: Los Angeles (53%); Orange (17%); San Diego (14%); San Bernardino (10%); Ventura (5%).

Superior Access to Deal Flow: We believe that we enjoy superior access to distressed, off-market and lightly marketed acquisition opportunities, many of which are difficult for competing investors to access. We believe approximately 62% of the acquisitions completed by us since our IPO were off-market or lightly-marketed transactions. Off-market and lightly marketed transactions are characterized by a lack of a formal marketing process and a lack of widely disseminated marketing materials. As we are principally focused on the Southern California market, our executive management and acquisition teams have developed and maintain a deep, broad network of relationships among key market participants, including property brokers, lenders, owners and tenants. We employ an extensive broker marketing, incentives and loyalty program. We also utilize data-driven and event-driven analytics and primary research to identify and pursue events and circumstances, including financial distress, related to owners, lenders, and tenants that tend to generate early access to emerging investment opportunities. We believe that our relationship network, creative sourcing approach and research-driven originations methods contribute to a superior level of attractive investment opportunities.

S-17

Table of Contents

Experienced Management Team: Members of our senior management team contribute over 64 years of prior public company experience, and collectively have been involved with over $25 billion of real estate acquisitions over multiple cycles. Members of our senior management team bring 130 years of experience focused on creating value by investing in infill Southern California industrial property.

Ability to Execute Opportunistic Transactions: The combination of our proprietary origination methods and the experience and relationships of our management team provide us access to and allow us to capitalize on unique transaction opportunities, for example:

| | Tarzana: Tarzana is a 75,288 square foot two building, multi-tenant complex, with units ranging from 1,150 square feet to 4,595 square feet located in Los Angeles, California with 100% occupancy. We acquired this property in August 2013 for a purchase price of $8.4 million. This off-market transaction was driven by a generational ownership shift and value-add opportunity to drive rent growth through building and site modernization and professional management. We increased occupancy from 81% to 100% within 10 months following acquisition, with new leases and renewals up 8% above current in-place rents at the time of the acquisition. |

| | The Park: The Park is a 120,313 square foot six building multi-tenant industrial complex located in Anaheim, California with 98% occupancy. We acquired this property in November 2013 in an off-market transaction where the seller was liquidating a long-term ownership partnership. We acquired this property for a purchase price of $10.6 million. We have increased occupancy from 85% to 98% eighteen months ahead of our plan, with new leases driving monthly rent up 6% in eight months. |

| | Birch: Birch is 98,105 square feet comprised of two industrial buildings and excess land located in Santa Ana, California. We acquired this property in June 2014 for a purchase price of $11 million in an off-market transaction. We signed a six month lease-back agreement with the seller. We have the opportunity to modernize and reposition this asset and are currently negotiating two letters of intent to lease both sites for long-term leases at terms that would out-perform our initial underwriting. |

| | Avenue Kearny: Avenue Kearny is comprised of two fully occupied single-tenant industrial buildings totaling 138,980 square feet located in Santa Clarita, California. We acquired the property in July 2014 for a purchase price of $11.5 million in an off-market transaction. We have value-add plans for the property, including adding dock high loading, ESFR sprinklers, seismic retrofitting and cosmetic upgrades, and believe the short term leases on the properties will allow near term rents to increase closer to market levels. The buildings are on two parcels allowing for possible user sales at premium values. |

| | Westcore: Westcore consists of nine industrial projects in attractive locations, diversified over three strong infill Southern California markets, including Los Angeles, Orange and San Diego counties aggregating 817,166 square feet. We acquired this portfolio in June 2014 for a purchase price of $88.5 million as part of a corporate re-capitalization and leveraged our seller-broker relationship to exclude undesired ground lease assets from the portfolio. The portfolio is 87.3% occupied. The 24 total units are leased to 17 tenants with staggered lease expirations. We have engaged in value-add improvements, which include demising to smaller spaces and adding dock-high loading which we believe will support higher rents and cash flow. |

| | 240th Street: 240th Street is a 100,851 square foot single-tenant industrial warehouse and distribution building in the Southbay area of Los Angeles, California. We acquired this property in May 2013 for a purchase price of $5.0 million in an off-market transaction. We maintained a partial sale-leaseback through March 2014 and have commenced a development plan to create a like new institutional quality building which will include 14 new docks, new offices, a new entry façade and landscape upgrades. Construction is underway with a September 2014 target date for completion. |

Vertically Integrated Platform: We are a full-service real estate operating company, with in-house capabilities in all aspects of our business. Our platform includes experienced in-house teams focused on

S-18

Table of Contents

acquisitions, analytics and underwriting, asset management and repositioning, property management, leasing, construction management and sales, as well as finance, accounting, legal and human relations departments.

Growth-Oriented Capital Structure: As of June 30, 2014, our total debt (pro rata) to total market capitalization was approximately 48.1%. We have a $200.0 million senior unsecured revolving credit facility. As of the date of this prospectus supplement, we had $137.9 million outstanding on this facility, leaving $62.1 million available, plus additional capacity through other potential third-party debt providers outside of our revolving credit facility. The facility has an accordion feature that may be utilized upon our exercise and consent of the lenders.

Value-Add Repositioning and Redevelopment Expertise: Our in-house redevelopment and construction management team collectively has over 75 years of industrial property development and redevelopment experience. Our in-house team employs an entrepreneurial approach to redevelopment and repositioning activities that are designed to increase the functionality and cash flow of our properties. These activities include converting large underutilized spaces into a series of smaller and more functional spaces, adding additional square footage and modernizing properties by, among other things, modernizing fire, life-safety and building operating systems, resolving functional obsolescence, adding or enhancing loading areas and truck access and making certain other accretive improvements.

Our Business and Growth Strategies

Our primary objective is to generate attractive risk-adjusted returns for our stockholders through dividends and capital appreciation. We believe that pursuing the following strategies will enable us to achieve this objective:

External Growth through Acquisitions

We continue to grow our portfolio through disciplined acquisitions in prime Southern California infill markets. We believe that our relationship-, data- and event-driven research allows us to identify and exploit asset mispricing and market inefficiencies. Through these proprietary origination methods, we are actively monitoring, as of August 8, 2014, approximately 40 million square feet of properties in our markets that we believe represent attractive potential investment opportunities, including properties containing approximately 7.1 million square feet on which we have submitted non-binding offers that remain outstanding. We believe there are a large number of leveraged industrial properties within our target markets with unfavorable debt terms characterized by high loan to value ratios, relatively high cost of debt service or high pre-payment costs, which can create illiquidity for owners or facing loan maturities over the next several years. We seek to source transactions from owners with maturing loans, some facing liquidity needs or financial distress, including loans that lack economical refinancing options. We also seek to transact with lenders, which, following the recent recession, may face a need to divest or resolve underperforming loans in order to meet increased capital and regulatory requirements.

We also believe there is a large number of owners increasingly experiencing a generational shift in ownership of infill industrial property in our target markets. With over one billion square feet of industrial property built prior to 1980 within infill Southern California, we are also focused on opportunities to identify and transact with such owners in an effort to address their generational needs with flexible purchase solutions that may include UPREIT-type transactions or straight purchases for cash.

Internal Growth through Intensive, Value-Added Asset Management

We employ an intensive asset management strategy that is designed to increase cash flow and occupancy from our properties. Our strategy includes repositioning industrial property by renovating, modernizing or increasing functionality to increase cash flow and value. For example, we sometimes convert formerly single-tenant properties to multi-tenant occupancy to capitalize upon the higher per square foot rents generated by smaller spaces in our target markets. We believe that by undertaking such conversions or other functional enhancements, we can position our properties to attract a larger universe of potential tenants, increase occupancy,

S-19

Table of Contents

tenant quality and rental rates. We also believe that multi-tenant properties help to limit our exposure to tenant default risk and diversify our sources of cash flow.

Our proactive approach to leasing and asset management is driven by our in-house team of leasing, portfolio and property managers, which maintains direct, day-to-day relationships and dialogue with our tenants. In addition, we motivate listing brokers through leasing incentives combined with highly entrepreneurial leasing plans that we develop for each of our properties. We believe our proactive approach to leasing and asset management enhances recurring cash flow and reduces periods of vacancy. We have successfully increased cash flow through the leasing up of value-add acquisitions.

| Property(1) |

Square Feet | Date Acquired |

Occupancy % at Acquisition |

Occupancy % at 6/30/14 |

Occupancy Change |

|||||||||||||||

| Grand Commerce Center |

101,210 | Sep-10 | 80 | % | 99 | % | +19 ppt | |||||||||||||

| Arroyo |

76,993 | Dec-10 | | (2) | 100 | % | +100 ppt | |||||||||||||

| Odessa |

29,544 | Aug-11 | | (2) | 100 | % | +100 ppt | |||||||||||||

| Golden Valley |

58,084 | Nov-11 | 70 | % | 98 | % | +28 ppt | |||||||||||||

| Jersey |

107,568 | Nov-11 | 80 | % | 82 | % | +2 ppt | |||||||||||||

| Arrow Business Center |

69,592 | Dec-11 | 91 | % | 97 | % | +6 ppt | |||||||||||||

| Normandie Business Center |

49,519 | Dec-11 | 73 | % | 100 | % | +27 ppt | |||||||||||||

| Paramount Business Center |

30,224 | Dec-11 | 88 | % | 100 | % | +12 ppt | |||||||||||||

| Shoemaker Industrial Park |

85,950 | Dec-11 | 68 | % | 95 | % | +27 ppt | |||||||||||||

| 3001 Mission Oaks Blvd. |

309,500 | Jun-12 | 97 | % | 100 | % | +3 ppt | |||||||||||||

| Orion |

48,394 | Jul-13 | 90 | % | 100 | % | +10 ppt | |||||||||||||

| Tarzana |

75,288 | Aug-13 | 81 | % | 96 | % | +15 ppt | |||||||||||||

| The Park |

120,313 | Nov-13 | 87 | % | 98 | % | +11 ppt | |||||||||||||

| (1) | Acquisitions that we consider value-add where we have demonstrated increases in occupancy since the acquisition. |

| (2) | Reflecting vacancy at acquisition. |

We believe that our current portfolio vacancy of 8.9% represents a significant internal growth opportunity to lease-up repositioned space and re-tenant for higher rents based on the average vacancy of 2.8% in our markets. As of June 30, 2014, our consolidated portfolio was 91.1% leased. We believe key factors will continue to contribute to increasing our cash flow from leasing in the near term, including:

| | a number of our properties are in their final lease-up stage after being repositioned through our value-add activities, |

| | we expect the firming up of supply and demand in certain markets, such as San Diego, that has generally lagged the infill markets of Los Angeles County and Orange County through the 2010 to 2012 recovery, and are now experiencing net positive absorption, and |

| | expected market rental rate increases in the multi-tenant industrial market, as smaller and medium sized business tenants begin to gain access to increased liquidity and available credit as the economy recovers. |

Post-IPO Execution

Since our IPO, we have focused on leveraging our competitive strengths and executing on our business and growth strategies to drive the growth of our business. In addition to substantially increasing the size of our portfolio and increasing rents and occupancy in our portfolio, these efforts have resulted in substantial improvements in our financial performance since the IPO, as evidenced by the notable growth in our FFO, Cash NOI and EBITDA:

S-20

Table of Contents

FFO(1)

| (in thousands, | ||||||||||||||||||||

| except share and (unaudited results) |

||||||||||||||||||||

| Rexford Industrial Realty, Inc.(2) |

Rexford Industrial Realty, Inc. Predecessor |

|||||||||||||||||||

| Three Months Ended |

July 24, 2013 to Sep. 30, 2013 |

July 1, 2013 to July 23, 2013 |

||||||||||||||||||

|

June 30, 2014 |

March 31, 2014 |

December 31, 2013 |

||||||||||||||||||

| Funds From Operations (FFO) |

||||||||||||||||||||

| Net income (loss) attributable to common stockholders/predecessor |

$ | 73 | $ | 1,277 | (881 | ) | $ | 256 | $ | (5,868 | ) | |||||||||

| Add: |

||||||||||||||||||||

| Depreciation and amortization, including amounts in discontinued operations |

6,003 | 6,137 | 5,716 | 3,062 | 901 | |||||||||||||||

| Depreciation and amortization from unconsolidated joint ventures |

103 | 85 | 153 | 96 | 107 | |||||||||||||||

| Loss from early extinguishment of debt |

| | | | 3,935 | |||||||||||||||

| Net income (loss) attributable to noncontrolling interests |

8 | 152 | (125 | ) | 39 | | ||||||||||||||

| Deduct: |

||||||||||||||||||||