DEF 14A: Definitive proxy statements

Published on April 15, 2014

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| x | Definitive Proxy Statement | |

| ¨ | Definitive Additional Materials | |

| ¨ | Soliciting Material Pursuant to §240.14a-12 | |

Rexford Industrial Realty, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

|

|||

| (2) | Aggregate number of securities to which transaction applies:

|

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|||

| (4) | Proposed maximum aggregate value of transaction:

|

|||

| (5) | Total fee paid:

|

|||

| ¨ | Fee paid previously with preliminary materials: | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | |||

| (1) | Amount previously paid:

|

|||

| (2) | Form, Schedule or Registration Statement No.:

|

|||

| (3) | Filing Party:

|

|||

| (4) | Date Filed:

|

|||

Table of Contents

April 15, 2014

Dear Fellow Stockholder:

On behalf of the Board of Directors of Rexford Industrial Realty, Inc., a Maryland corporation, I cordially invite you to attend our Annual Meeting of Stockholders on Friday, May 30, 2014, at the Omni Los Angeles Hotel, 251 South Olive Street, Los Angeles, California 90012 at 8:00 a.m. (Pacific Time).

The notice of meeting and Proxy Statement that follow describe the business we will consider at the meeting. We sincerely hope you will be able to attend the meeting. However, whether or not you are personally present, your vote is very important. We are pleased to offer multiple options for voting your shares. You may authorize a proxy to vote by telephone, via the Internet, by mail or in person as described in the Proxy Statement.

Thank you for your continued support of Rexford Industrial Realty, Inc.

Sincerely yours,

Richard Ziman

Chairman of the Board of Directors

Table of Contents

Rexford Industrial Realty, Inc.

11620 Wilshire Boulevard, Suite 1000

Los Angeles, California 90025

(310) 966-1680

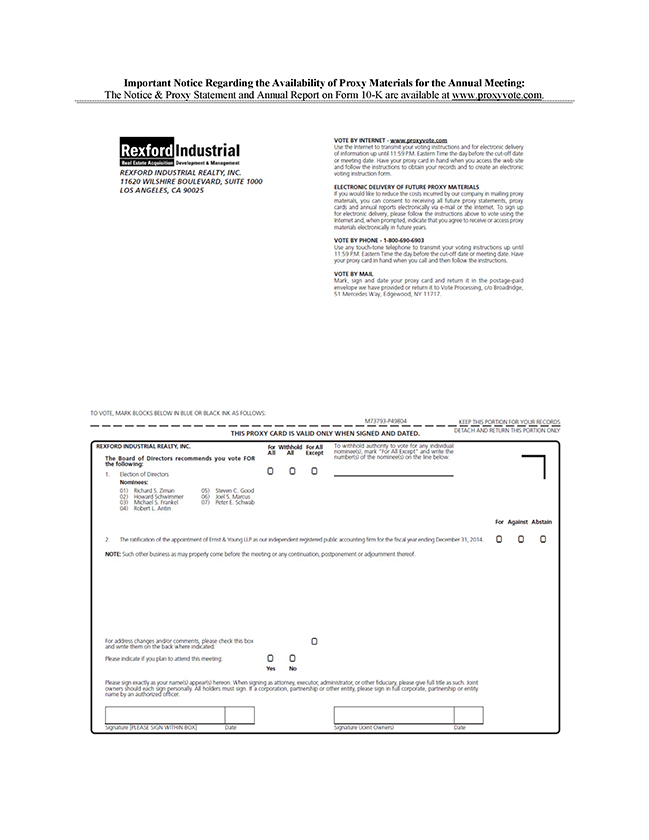

NOTICE OF 2014 ANNUAL MEETING OF STOCKHOLDERS

Please join us for the 2014 Annual Meeting of Stockholders of Rexford Industrial Realty, Inc., a Maryland corporation. The meeting will be held at 8:00 a.m. (Pacific Time), on Friday, May 30, 2014, at the Omni Los Angeles Hotel, 251 South Olive Street, Los Angeles, California 90012.

At the 2014 Annual Meeting of Stockholders, our stockholders will consider and vote on the following matters:

| (1) | The election of seven directors, each to serve until the next annual meeting of our stockholders and until his successor is duly elected and qualifies; |

| (2) | The ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2014; and |

| (3) | Any other business properly introduced at the Annual Meeting or any continuation, postponement or adjournment of the Annual Meeting. |

You must own shares of Rexford Industrial Realty, Inc. common stock of record at the close of business on April 1, 2014, the record date for the 2014 Annual Meeting of Stockholders, or hold a valid proxy from a record holder as of the record date, to attend and vote at the Annual Meeting and at any continuation, postponement or adjournment of the Annual Meeting. If you plan to attend, please bring proper photo identification and, if your shares are held in street name (i.e., through a broker, bank or other nominee), a copy of a brokerage statement reflecting your stock ownership as of the close of business on April 1, 2014. Regardless of whether you will attend, please authorize your proxy electronically through the Internet or by telephone or by completing and mailing your proxy card so that your votes can be cast at the Annual Meeting in accordance with your instructions. For specific instructions on authorizing a proxy, please refer to the instructions on the proxy card, or if your shares are held in street name, the instructions provided by your broker, bank or other nominee. Authorizing a proxy in any of these ways will not prevent you from voting in person at the 2014 Annual Meeting of Stockholders if you are a stockholder of record as of the record date for the Annual Meeting or if you hold a proxy from a record holder.

By Order of the Board of Directors,

Jonathan Abrams

General Counsel and Secretary

Los Angeles, California

April 15, 2015

1

Table of Contents

Rexford Industrial Realty, Inc.

11620 Wilshire Boulevard, Suite 1000

Los Angeles, California 90025

(310) 966-1680

PROXY STATEMENT

| 3 | ||||

| 3 | ||||

| 7 | ||||

| 7 | ||||

| 10 | ||||

| 11 | ||||

| 11 | ||||

| 11 | ||||

| 13 | ||||

| 14 | ||||

| 14 | ||||

| 14 | ||||

| 14 | ||||

| 14 | ||||

| 15 | ||||

| 15 | ||||

| 16 | ||||

| 17 | ||||

| 17 | ||||

| 17 | ||||

| 18 | ||||

| PROPOSAL NO. 2 (RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM) |

18 | |||

| 19 | ||||

| 19 | ||||

| 20 | ||||

| 24 | ||||

| 26 | ||||

| 27 | ||||

| 27 | ||||

| 28 | ||||

| RELATED-PARTY AND OTHER TRANSACTIONS INVOLVING OUR OFFICERS AND DIRECTORS |

29 | |||

| 33 | ||||

| 33 | ||||

| 33 | ||||

| 34 | ||||

| 35 | ||||

2

Table of Contents

This Proxy Statement and accompanying proxy card are available beginning April 15, 2014 in connection with the solicitation of proxies by the Board of Directors of Rexford Industrial Realty, Inc., for use at the 2014 Annual Meeting of Stockholders, which we may refer to alternatively as the Annual Meeting. We may refer to ourselves in this Proxy Statement alternatively as the Company, we, us or our and we may refer to our Board of Directors as the Board. A copy of our Annual Report to Stockholders for the 2013 fiscal year, including financial statements, is being made available simultaneously with this Proxy Statement to each stockholder.

Important Notice Regarding Availability of Proxy Materials For the Stockholder Meeting to be Held on May 30, 2014: The Notice of Annual Meeting of Stockholders, the Proxy Statement and our 2013 Annual Report are available at www.proxyvote.com. Website addresses referred to in this Proxy Statement are not intended to function as hyperlinks, and the information contained on any such website is not a part of this Proxy Statement.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

Why am I receiving these materials? Our Board of Directors is making these materials available to you over the Internet or by delivering paper copies to you by mail in connection with Rexford Industrial Realty, Inc.s Annual Meeting of Stockholders. As a stockholder, you are invited to attend the Annual Meeting and are entitled and requested to vote on the items of business described in this Proxy Statement. This Proxy Statement includes information that we are required to provide under Securities and Exchange Commission (SEC) rules and is designed to assist you in voting your shares.

How do I vote? If you plan to attend the Annual Meeting and wish to vote in person, we will give you a ballot at the Annual Meeting. However, if your common stock is held in the name of your broker, bank or other nominee, and you want to vote in person, you will need to obtain a legal proxy from the institution that holds your common stock.

If your common stock is held in your name, there are three ways for you to authorize a proxy:

| (1) | If you received a paper copy of the proxy materials by mail, sign and mail the proxy card in the enclosed return envelope; |

| (2) | Call 1-800-579-1639; or |

| (3) | Log on to the Internet at www.proxyvote.com and follow the instructions at that site. The website address for authorizing a proxy by Internet is also provided on your Notice, as well as your unique 12 digit control number needed to access the Companys Annual Meeting information located at www.proxyvote.com. |

Telephone and Internet proxy authorizations will close at 11:59 p.m. (Eastern Time) on May 29, 2014. If you authorize a proxy, unless you indicate otherwise, the persons named as your proxies will cast your votes FOR all of the nominees for election as directors named in this Proxy Statement and FOR the ratification of Ernst & Young LLP as our independent registered public accounting firm. The persons named as proxies will vote in their discretion on any other business properly introduced at the Annual Meeting or any continuation, postponement or adjournment of the Annual Meeting.

If your common stock is held in the name of your broker, bank or other nominee, you should receive separate instructions from the holder of your common stock describing how to provide voting instructions.

Even if you plan to attend the Annual Meeting, we recommend that you authorize a proxy in advance as described above so that your vote will be counted if you later decide not to attend the Annual Meeting.

3

Table of Contents

Where and when is the Annual Meeting? The Annual Meeting will be held at 8:00 a.m. (Pacific Time) on Friday, May 30, 2014 at the Omni Los Angeles Hotel, 251 South Olive Street, Los Angeles, California 90012.

What is the purpose of the Annual Meeting of Stockholders? At the Annual Meeting, stockholders will vote upon matters described in the Notice of Annual Meeting and this Proxy Statement, including the election of directors and the ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm.

Who can attend the Annual Meeting? All of our stockholders as of the close of business on April 1, 2014, the record date for the Annual Meeting, or individuals holding their duly appointed proxies, may attend the Annual Meeting. You should be prepared to present proper photo identification for admittance. Authorizing a proxy in response to this solicitation will not affect a stockholders right to attend the Annual Meeting and to vote in person. Please note that if you hold your common stock in street name (that is, through a broker, bank or other nominee), you will need to bring a copy of a brokerage statement reflecting your stock ownership as of April 1, 2014 to gain admittance to the Annual Meeting.

What am I voting on? At the Annual Meeting, you may consider and vote on:

| (1) | the election of seven directors; |

| (2) | the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2014; and |

| (3) | any other business properly introduced at the Annual Meeting. |

What are the Boards recommendations? The Board recommends a vote:

| | FOR the election of each nominee named in this Proxy Statement (see Proposal No. 1); and |

| | FOR ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2014 (see Proposal No. 2). |

Unless you give other instructions on your proxy card, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the Board and in their discretion on any other business properly introduced at the Annual Meeting.

Who may vote? You may vote if you owned shares of our common stock at the close of business on April 1, 2014, which is the record date for the Annual Meeting. You are entitled to cast one vote in the election of directors for as many individuals as there are directors to be elected at the Annual Meeting and to cast one vote on each other matter properly presented at the Annual Meeting for each share of common stock you owned as of the record date. As of April 1, 2014, we had 25,551,204 shares of common stock outstanding.

Who counts the votes? A representative of Broadridge Financial Solutions, Inc. will tabulate the votes and will act as the inspector of the election.

What is a quorum for the Annual Meeting? The presence in person or by proxy of stockholders entitled to cast a majority of all the votes entitled to be cast at the Annual Meeting on any matter will constitute a quorum at the Annual Meeting. No business may be conducted at the Annual Meeting if a quorum is not present.

If a quorum is not present at the Annual Meeting, the Chairman of the meeting may adjourn the Annual Meeting to another date, time or place, not later than 120 days after the original record date of April 1, 2014, without notice other than announcement at the meeting. We may also postpone the Annual Meeting to a date that is not later than 120 days after the original record date or cancel the Annual Meeting by making a public announcement of the postponement or cancellation before the time scheduled for the Annual Meeting.

4

Table of Contents

What vote is required to approve an item of business at the Annual Meeting? To be elected as a director (Proposal No. 1), a nominee must receive a plurality of all the votes cast in the election of directors.

To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm (Proposal No. 2), the affirmative vote of a majority of the votes cast on the proposal is required.

If you are a stockholder of record as of the record date for the Annual Meeting and you authorize a proxy (whether by Internet, telephone or mail) without specifying a choice on any given matter to be considered at this Annual Meeting, the proxy holders will vote your shares according to the Boards recommendation on that matter. If you are a stockholder of record as of the record date for the Annual Meeting and you fail to authorize a proxy or vote in person, assuming that a quorum is present at the Annual Meeting, it will have no effect on the result of the vote on any of the matters to be considered at the Annual Meeting.

If you hold your shares through a broker, bank or other nominee, under the rules of the New York Stock Exchange (NYSE), your broker or other nominee may not vote with respect to certain proposals unless you have provided voting instructions with respect to that proposal. A broker non-vote results when a broker, bank or other nominee properly executes and returns a proxy but indicates that the nominee is not voting with respect to a particular matter because the nominee has not received voting instructions from the beneficial owner. A broker non-vote is not considered a vote cast on a proposal; however, stockholders delivering a properly-executed broker non-vote will be counted as present for purposes of determining whether a quorum is present.

If you hold your shares in a brokerage account, then, under NYSE rules and Maryland law:

| | With respect to Proposal No. 1 (Election of Directors), your broker, bank or other nominee is not entitled to vote your shares on this matter if no instructions are received from you. Broker non-votes will have no effect on the election of directors. |

| | With respect to Proposal No. 2 (Ratification of Independent Registered Public Accounting Firm), your broker is entitled to vote your shares on this matter if no instructions are received from you. |

Because an abstention is not a vote cast, if you instruct your proxy or broker to abstain on any matter, it will have no effect on the vote on any of the matters to be considered at the Annual Meeting. However, you will still be counted as present for purposes of determining whether a quorum is present.

Can I revoke my proxy? Yes, if your common stock is held in your name, you can revoke your proxy by:

| | Filing written notice of revocation with our Secretary before our Annual Meeting at the address shown on the front of this Proxy Statement or at our Annual Meeting; |

| | signing a proxy bearing a later date; or |

| | voting in person at the Annual Meeting. |

Attendance at the Annual Meeting will not, by itself, revoke a properly-executed proxy. If your common stock is held in the name of your broker, bank or other nominee, please follow the voting instructions provided by the holder of your common stock regarding how to revoke your proxy.

What happens if additional matters are presented at the Annual Meeting? Other than the two proposals described in this Proxy Statement, we are not aware of any business that may properly be brought before the Annual Meeting. If any other matters are properly introduced for a vote at the Annual Meeting and if you properly authorize a proxy, the persons named as proxy holders will vote in their discretion on any such additional matters. As of the date of this Proxy Statement, our Board is not aware of any other individual who may properly be nominated for election as a director at the Annual Meeting or of any nominee who is unable or unwilling to serve as director. If any nominee named in this Proxy Statement is unwilling or unable to serve as a director, our Board may nominate another individual for election as a director at the Annual Meeting, and the persons named as proxy holders will vote for the election of any substitute nominee.

5

Table of Contents

Who pays for this proxy solicitation? We will bear the expense of preparing, printing and mailing this Proxy Statement and the proxies we solicit. Proxies may be solicited by mail, telephone, personal contact and electronic means and may also be solicited by directors and officers in person, by the Internet, by telephone or by facsimile transmission, without additional remuneration.

We will also request brokerage firms, banks, nominees, custodians and fiduciaries to forward proxy materials to the beneficial owners of shares of our common stock as of the record date and will reimburse them for the cost of forwarding the proxy materials in accordance with customary practice. Your cooperation in promptly voting your shares and submitting your proxy by the Internet or telephone, or by completing and returning the enclosed proxy card (if you received your proxy materials in the mail), will help to avoid additional expense.

Where can I find corporate governance materials? Our Corporate Governance Guidelines and Code of Business Conduct and Ethics and the charters for the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee are available on the Company InformationGovernance Documents page of the Investor Relations section on our website at www.rexfordindustrial.com.

NO PERSON IS AUTHORIZED ON OUR BEHALF TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATIONS WITH RESPECT TO THE PROPOSALS TO BE VOTED ON AT THE ANNUAL MEETING, OTHER THAN THE INFORMATION AND REPRESENTATIONS CONTAINED IN THIS PROXY STATEMENT, AND, IF GIVEN OR MADE, SUCH INFORMATION AND/OR REPRESENTATIONS MUST NOT BE RELIED UPON AS HAVING BEEN AUTHORIZED. THE DELIVERY OF THIS PROXY STATEMENT SHALL UNDER NO CIRCUMSTANCES CREATE ANY IMPLICATION THAT THERE HAS BEEN NO CHANGE IN OUR AFFAIRS SINCE THE DATE OF THIS PROXY STATEMENT.

The date of this Proxy Statement is April 15, 2014.

6

Table of Contents

NOMINEES FOR ELECTION TO THE BOARD

At the Annual Meeting, our stockholders will elect seven directors to serve until our next annual meeting of stockholders and until their respective successors are elected and qualify. The Board seeks directors who represent a mix of backgrounds and experiences that will enhance the quality of the Boards deliberations and decisions. In nominating candidates, the Board considers a diversified membership in the broadest sense, including persons diverse in experience, gender and ethnicity. The Board does not discriminate on the basis of race, color, national origin, gender, religion, disability or sexual preference. Our director nominees were nominated by the Board based on the recommendation of the Nominating and Corporate Governance Committee, or Governance Committee. They were selected on the basis of outstanding achievement in their professional careers, broad experience, personal and professional integrity, their ability to make independent analytical inquiries, financial literacy, mature judgment, high performance standards, familiarity with our business and industry, and an ability to work collegially. We also believe that all of our director nominees have a reputation for integrity, honesty and adherence to high ethical standards. All nominees are presently directors of Rexford Industrial Realty, Inc. and each of the nominees has consented, if elected as a director, to serve until his term expires.

Your proxy holder will cast your votes for each of the Boards nominees, unless you instruct otherwise. If a nominee is unable to serve as a director, your proxy holder will vote for any substitute nominee proposed by the Board.

The Board of Directors unanimously recommends that the stockholders vote FOR the seven nominees listed below.

| Name |

Age | Position |

||

| Richard Ziman |

71 | Chairman of the Board of Directors | ||

| Howard Schwimmer |

53 | Co-Chief Executive Officer and Director | ||

| Michael S. Frankel |

51 | Co-Chief Executive Officer and Director | ||

| Robert L. Antin |

64 | Director | ||

| Steven C. Good |

71 | Director | ||

| Joel S. Marcus |

66 | Director | ||

| Peter E. Schwab |

70 | Director |

| | Independent within the meaning of the NYSE listing standards. |

Richard Ziman

Mr. Ziman has served as the Chairman of our Board since January 18, 2013 as part of the formation transactions (formation transactions) in connection with our initial public offering (IPO), which was completed on July 24, 2013. Mr. Ziman served as the Co-Founder and Chairman of our predecessor business from its inception in December 2001. Mr. Zimans industrial real estate experience comprises over forty years of industrial real estate investment experience overseeing his personal, family and foundation-related investments in Southern California as well as having co-founded and served as chairman of the management companies that we acquired as part of our formation transactions. Mr. Zimans overall commercial real estate experience also includes his role as the founding Chairman and CEO of Arden Realty, Inc. (Arden), a real estate investment firm focused on the commercial office real estate markets in infill Southern California. Mr. Ziman served as Ardens Chairman of the Board and CEO from its inception in 1990 until its sale in mid-2006 to GE Real Estate in a $4.8 billion transaction involving Ardens portfolio of approximately 18.5 million square feet in more than 200 office buildings. Arden was publicly traded on the NYSE under the symbol ARI. In 2006, Mr. Ziman also co-founded

7

Table of Contents

AVP Advisors, LLC and AVP Capital, LLC, the exclusive advisor to American Value Partners, a real estate fund of funds deploying capital on behalf of pension funds throughout the United States. In 1979, Mr. Ziman formed Pacific Financial Group, a diversified real estate investment and development firm, of which he was Managing General Partner. Mr. Ziman also serves on the boards of directors of The Rosalinde and Arthur Gilbert Foundation and The Gilbert Collection Trust. In 2001, Mr. Ziman established and endowed the Richard S. Ziman Center for Real Estate at the Anderson Graduate School of Management at the University of California at Los Angeles. Over the years, Mr. Ziman has held many significant leadership positions in the cultural, educational and social service life of Southern California. Mr. Ziman received his Bachelors degree and his Juris Doctor degree from the University of Southern California and practiced law as a partner of the law firm Loeb & Loeb from 1971 to 1980, specializing in transactional and financial aspects of real estate. Our Board of Directors determined that Mr. Ziman should serve as a director based on his extensive executive management experience in the industrial real estate industry and in public companies and extensive knowledge of our company and our operations.

Howard Schwimmer

Mr. Schwimmer has served as our Co-Chief Executive Officer and as a Board member since January 18, 2013 as part of our formation transactions. Mr. Schwimmer also served as Co-Founder and Senior Managing Partner of our predecessor business and President of one of the management companies that we acquired as part of our formation transactions. From May 1983 until November 2001, Mr. Schwimmer, a licensed California real estate broker, served at various times as manager, executive vice president and broker of record for DAUM Commercial Real Estate, one of Californias oldest industrial brokerage companies. Mr. Schwimmers professional career has been dedicated entirely and exclusively to Southern California infill industrial real estate, including its acquisition, value-add improvement, management, sales, leasing and disposition. Mr. Schwimmer has extensive experience forming real estate investment companies, managing real estate brokerage offices, serving as a real estate brokerage company board member and acquiring, repositioning, developing, leasing, selling and adding value to over thirty million square feet of industrial properties in Southern California. Mr. Schwimmer received his Bachelors degree from the University of Southern California in 1983 where he majored in business with an emphasis in real estate finance and development. Mr. Schwimmer serves on the USC Lusk Center Real Estate Leadership Council, is Board Chair of USC Hillel, and is the Allocation Committee Chair of the Los Angeles Jewish Federation, Real Estate Principals Organization. Our Board of Directors determined that Mr. Schwimmer should serve as a director based on his executive management experience in the real estate industry and extensive knowledge of our company and our operations.

Michael S. Frankel

Mr. Frankel has served as our Co-Chief Executive Officer and as a Board member since January 18, 2013 as part of our formation transactions. Mr. Frankel served as the Chief Financial Officer of one of the management companies that we acquired as part of our formation transactions and as Managing Partner of Rexford Industrial LLC and Rexford Sponsor LLC. Mr. Frankels career includes ten years co-managing our predecessor business, which exclusively focused on investing in infill Southern California industrial real estate. Mr. Frankel has focused on real estate investment, private equity investments and senior management operating roles throughout his career. Mr. Frankel was previously responsible for investments at the private equity firm C3, a subsidiary of the Comcast Corporation (NASD: CMCSA). Mr. Frankel also served with LEK Consulting, providing strategic advisory services to several of the worlds leading investment institutions. Mr. Frankel began his career as Vice President at Melchers & Co., a European-based firm, where he was responsible for Melchers U.S.-Asia operations, principally based in Beijing. Mr. Frankel brings significant private equity, finance and management experience to our company. Mr. Frankel has substantial experience working in China, Southeast Asia and France, and speaks Mandarin and French. Mr. Frankel is a licensed real estate broker in the state of California and a member of the Urban Land Institute. Mr. Frankel earned his Bachelor of Arts degree in political economy from the University of California at Berkeley and his Masters of Business Administration from the Harvard Business School. Our Board of Directors determined that Mr. Frankel should serve as a director based on his extensive executive management and operational experience and an extensive knowledge of our company and our operations.

8

Table of Contents

Robert L. Antin

Mr. Antin has served as a Board member since the completion of our IPO on July 24, 2013 and is the Chairman of our Nominating and Corporate Governance Committee. Mr. Antin was a founder of VCA Antech, Inc. (VCA), a publicly traded national animal healthcare company (NASDAQ: WOOF) that provides veterinary services, diagnostic testing and various medical technology products and related services to the veterinary market. Mr. Antin has served as a Director, Chief Executive Officer and President at VCA since its inception in 1986. From September 1983 to 1985, Mr. Antin was President, Chief Executive Officer, a Director and co-founder of AlternaCare Corp., a publicly held company that owned, operated and developed freestanding out-patient surgical centers. From July 1978 until September 1983, Mr. Antin was an officer of American Medical International, Inc., an owner and operator of health care facilities. Mr. Antin received his Bachelors degree from the State University of New York at Cortland and his MBA with a certification in hospital and health administration from Cornell University. Our Board of Directors determined that Mr. Antin should serve as a director based on his extensive experience as an executive at a public company which enables him to make significant contributions to the deliberations of the Board, especially in relation to operations, financings and strategic planning.

Steven C. Good

Mr. Good has served as a Board member since the completion of our IPO on July 24, 2013 and is the Chairman of our Audit Committee and a member of our Compensation Committee and our Nominating and Corporate Governance Committee. Since February 2010, Mr. Good has served as a consultant for the accounting firm of Cohn Reznick LLP and provides business consulting and advisory services for a sizeable and varied client base which includes manufacturing, garment, medical services, and real estate development industries. Mr. Good founded the accounting firm of Good, Swartz, Brown & Berns (predecessor of Cohn Reznick LLP) in 1976, and served as an active Senior Partner until February 2010. From 1997 until 2005, Mr. Good served as a Director of Arden Realty Group, Inc., a publicly-held Real Estate Investment Trust listed on the New York Stock Exchange. Mr. Good currently serves as a Director of OSI Systems, Inc. (NASDAQ: OSIS). Mr. Good also currently serves as a Director of Kayne Anderson MLP Investment Company (NYSE: KYN) and Kayne Anderson Energy Total Return Fund, Inc. (NYSE: KYE). Mr. Good holds a Bachelor of Science degree in Accounting from the University of California, Los Angeles and attended its Graduate School of Business. Our Board of Directors determined that Mr. Good should serve as a director based on his extensive audit, finance and accounting expertise as well as extensive experience as a Director of several public companies.

Joel S. Marcus

Mr. Marcus has served as a Board member since the completion of our IPO on July 24, 2013 and is the Chairman of our Compensation Committee and a member of our Audit Committee. Since May 2007, Mr. Marcus has served as Chairman of the Board of Directors of Alexandria Real Estate Equities, Inc. (Alexandria, NYSE: ARE), a publicly traded REIT focused on life science real estate. Mr. Marcus has also served as Chief Executive Officer since March 1997, President since February 2009, and a Director since Alexandrias inception in 1994. Mr. Marcus co-founded Alexandria in 1994, Alexandria Venture Investments in 1996, and the annual Alexandria Summit in 2011. From 1986 to 1994, Mr. Marcus was a partner at the law firm of Brobeck, Phleger & Harrison LLP, specializing in corporate finance and capital markets, venture capital, and mergers and acquisitions. From 1984 to 1994, he also served as General Counsel and Secretary of Kirin-Amgen, Inc., a joint venture that financed the development of, and owned patents to, genetically engineered biopharmaceutical products. Mr. Marcus was formerly a practicing certified public accountant and tax manager with Arthur Young & Co. specializing in the financing and taxation of REITs. He received his undergraduate and Juris Doctor degrees from the University of California, Los Angeles. Mr. Marcus serves on the boards of the Accelerator Corporation, of which he was one of the original architects and co-founders, Foundation for the National Institutes of Health, Intra-Cellular Therapies, Inc., Multiple Myeloma Research Foundation, and the Partnership for New York City. Mr. Marcus received the Ernst & Young 1999 Entrepreneur of the Year Award

9

Table of Contents

(Los AngelesReal Estate). Mr. Marcus served on the Board of Trustees of PennyMac Mortgage Investment Trust, a publicly traded mortgage REIT, from August 2009 to August 2012. Our Board of Directors determined that Mr. Marcus should serve as a director based on his over 38 years of experience in the real estate and life sciences industries, including his 17 years of operating experience as a Chief Executive Officer and 19 years of experience as a Director of a publicly traded REIT.

Peter E. Schwab

Mr. Schwab has served as a Board member since February 26, 2014 and is a member of our Audit Committee, our Compensation Committee and our Nominating and Corporate Governance Committee. Mr. Schwab is a 39-year veteran of the lending industry. He retired in 2011 as Chairman and CEO of Wells Fargo Capital Finance, a leading provider of traditional asset-based lending and other specialized senior secured financing vehicles to companies nationwide. Mr. Schwab was a member of Wells Fargo Banks Management Committee. He served in various senior roles with Wells Fargo Capital Finance and predecessor entities (including Foothill Capital Corporation) during his 28-year tenure with the organization. Mr. Schwab currently serves on the Board of Directors of TCP Capital Corp. (NASDAQ:TCPC), a public registered investment company, as well as the boards of several private companies and educational, health, arts, and industry not-for-profit organizations. He earned his bachelors degree in education from California State University, Northridge and his masters degree in education administration from California State University, Los Angeles. Our Board of Directors determined that Mr. Schwab should serve as a director based on his extensive finance experience and expertise (in particular with respect to asset-based lending), leadership roles within major lending institutions, and service on other public and private boards.

BOARD STRUCTURE, LEADERSHIP AND RISK MANAGEMENT

We have structured our corporate governance in a manner we believe closely aligns our interests with those of our stockholders. Notable features of our corporate governance structure include the following:

| | our Board is not classified, with each of our directors subject to re-election annually; |

| | of the seven persons who serve on our Board, our Board has determined that four, or 57%, of our directors satisfy the listing standards for independence of the NYSE and Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the Exchange Act); |

| | at least one of our directors qualifies as an audit committee financial expert as defined by the SEC; |

| | we have opted out of the business combination and control share acquisition statutes in the Maryland General Corporation Law (the MGCL); and |

| | we do not have a stockholder rights plan. |

Our directors stay informed about our business by attending meetings of our Board of Directors and its committees and through supplemental reports and communications. Our independent directors meet regularly in executive sessions without the presence of our corporate officers or non-independent directors.

Our Board is currently chaired by Mr. Ziman, our Chairman. Our Board believes that Mr. Zimans service as our Chairman is in the best interests of our Company and our stockholders because Mr. Ziman possesses detailed and in-depth knowledge of the issues, opportunities and challenges we face, and because he is the person best positioned to develop agendas that ensure that our Boards time and attention is focused on the most critical matters. Our Board believes that his role as Chairman enables decisive leadership, ensures clear accountability and enhances our ability to communicate our message and strategy clearly and consistently to stockholders, employees and tenants.

10

Table of Contents

EXECUTIVE SESSIONS OF NON-MANAGEMENT DIRECTORS

Our non-management, independent directors typically meet without management present each time the full Board or a Board committee convenes for a regularly scheduled meeting. If the Board convenes for a special meeting, the non-management, independent directors will meet in executive session if circumstances warrant. We currently do not have a lead independent director.

The Board welcomes communications from stockholders. For information on how to communicate with our independent directors, please refer to the information set forth under the heading Communications with the Board.

The Board held four regularly scheduled and special meetings in 2013 following our IPO to review significant developments, engage in strategic planning, and act on matters requiring Board approval. Each incumbent director attended an aggregate of at least 75 percent of the Board meetings, and the meetings of committees on which he served, during the period that he served in 2013.

Our Board has established three standing committees: an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. The principal functions of each committee are briefly described below. We comply with the listing requirements and other rules and regulations of the NYSE, as amended or modified from time to time, with respect to each of these committees, and each of these committees is comprised exclusively of independent directors. Additionally, our Board may from time to time establish other committees to facilitate the management of our company.

Audit Committee

Our Audit Committee consists of three of our independent directors. We have determined that the Chairman of our Audit Committee qualifies as an audit committee financial expert as that term is defined by applicable SEC regulations and NYSE corporate governance listing standards. Our Board has determined that each of our Audit Committee members is financially literate as that term is defined by NYSE corporate governance listing standards. We have adopted an Audit Committee charter, which details the principal functions of the Audit Committee, including oversight related to:

| | our accounting and financial reporting processes; |

| | the integrity of our consolidated financial statements and financial reporting process; |

| | our disclosure controls and procedures and internal control over financial reporting; |

| | our compliance with financial, legal and regulatory requirements; |

| | the evaluation of the qualifications, independence and performance of our independent registered public accounting firm; |

| | the performance of our internal audit function; and |

| | our overall risk profile. |

The Audit Committee is also responsible for engaging an independent registered public accounting firm, reviewing with the independent registered public accounting firm the plans and results of the audit engagement,

11

Table of Contents

approving professional services provided by the independent registered public accounting firm, including all audit and non-audit services, reviewing the independence of the independent registered public accounting firm, considering the range of audit and non-audit fees and reviewing the adequacy of our internal accounting controls. The Audit Committee is also responsible for the Audit Committee report included in this Proxy Statement. Mr. Good is Chairman, as well as our Audit Committee Financial Expert, and Messrs. Marcus and Schwab are members of the Audit Committee. During 2013, the Audit Committee met a total of two times.

Compensation Committee

Our Compensation Committee consists of three of our independent directors. We adopted a Compensation Committee charter, which details the principal functions of the Compensation Committee, including:

| | reviewing and approving, at least annually, the performance goals and objectives relevant to our Co-Chief Executive Officers compensation, evaluating our Co-Chief Executive Officers performance in light of such goals and objectives and determining and approving the remuneration of our Co-Chief Executive Officers based on such evaluation; |

| | reviewing and approving the compensation of all of our other officers; |

| | reviewing our executive compensation policies and plans; |

| | implementing and administering our incentive compensation equity-based remuneration plans; |

| | assisting management in complying with our Proxy Statement and annual report disclosure requirements; |

| | producing a report on executive compensation to be included in our annual Proxy Statement (if required); and |

| | reviewing, evaluating and recommending changes, if appropriate, to the remuneration for directors. |

The Compensation Committee may delegate its responsibilities to a subcommittee of the Compensation Committee, provided that such responsibilities do not pertain to matters involving executive compensation or certain matters determined to involve compensation intended to comply with Section 162(m) of the Internal Revenue Code of 1986, as amended. Mr. Marcus is Chairman and Messrs. Good and Schwab are members of the Compensation Committee. During 2013, the Compensation Committee did not meet formally.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee, or Governance Committee, consists of three of our independent directors. We adopted a Nominating and Corporate Governance Committee charter, which details the principal functions of the Governance Committee, including:

| | identifying and recommending to the full Board qualified candidates for election as directors to fill vacancies on the Board or at any annual meeting of stockholders; |

| | developing and recommending to the Board corporate governance guidelines and implementing and monitoring such guidelines; |

| | reviewing and making recommendations on matters involving the general operation of the Board, including Board size and composition, and committee composition and structure; |

| | recommending to the Board nominees for each committee of the Board of Directors; |

| | annually facilitating the assessment of the Boards performance as a whole and of the individual directors, as required by applicable law, regulations and NYSE corporate governance listing standards; and |

| | overseeing the Boards evaluation of the performance of management. |

Mr. Antin is Chairman and Messrs. Good and Schwab are members of the Governance Committee. During 2013, our Governance Committee did not meet formally.

12

Table of Contents

The information contained in this Report of the Audit Committee shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the Securities Act) or the Exchange Act, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing (except to the extent that we specifically incorporate this information by reference) and shall not otherwise be deemed soliciting material or filed with the SEC or subject to Regulation 14A or 14C, or to the liabilities of Section 18 of the Exchange Act (except to the extent that we specifically incorporate this information by reference).

Although the Audit Committee of the Board of Directors (the Audit Committee) oversees the financial reporting process of Rexford Industrial Realty, Inc., a Maryland corporation (the Company), on behalf of the Board of Directors (the Board ) of the Company, consistent with the Audit Committees written charter, management has the primary responsibility for preparation of the Companys consolidated financial statements in accordance with generally accepted accounting principles and the reporting process, including disclosure controls and procedures and the system of internal control over financial reporting. The Companys independent registered public accounting firm is responsible for auditing the annual financial statements prepared by management.

The Audit Committee has reviewed and discussed with management and the Companys independent registered public accounting firm, Ernst & Young LLP, our December 31, 2013 audited financial statements. Prior to the commencement of the audit, the Audit Committee discussed with the Companys management and independent registered public accounting firm the overall scope and plans for the audit. Subsequent to the audit and each of the quarterly reviews, the Audit Committee discussed with the independent registered public accounting firm, with and without management present, the results of their examinations or reviews, including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of specific judgments and the clarity of disclosures in the consolidated financial statements.

In addition, the Audit Committee discussed with the independent registered public accounting firm the matters required to be discussed by Statements on Auditing Standards No. 61, Communication with Audit Committees, as amended. The Audit Committee has also received the written disclosures and the letter from the independent registered public accounting firm required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountants communications with the Audit Committee concerning independence. The Audit Committee discussed with the independent registered public accounting firm its independence from the Company and considered the compatibility of non-audit services with its independence.

Based upon the reviews and discussions referred to in the foregoing paragraphs, the Audit Committee recommended to the Board that the audited financial statements be included in our Annual Report on Form 10-K for the year ended December 31, 2013 filed with the Securities and Exchange Commission.

The foregoing report has been furnished by the Audit Committee as of April 15, 2014.

Steven C. Good, Chairman

Joel S. Marcus

Peter E. Schwab

13

Table of Contents

Our Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee charters, along with our Code of Business Conduct and Ethics and Corporate Governance Guidelines, are available on the Company InformationGovernance Documents page of the Investor Relations section on our website at www.rexfordindustrial.com. In addition, these documents also are available in print to any stockholder who requests a copy from our Investor Relations Department at Rexford Industrial Realty, Inc., 11620 Wilshire Boulevard, Suite 1000, Los Angeles, California 90025, or by email at investorrelations@rexfordindustrial.com.

CODE OF BUSINESS CONDUCT AND ETHICS

Our Board formally approved a Code of Business Conduct and Ethics that applies to our officers, directors and employees. Among other matters, our Code of Business Conduct and Ethics is designed to deter wrongdoing and to promote:

| | honest and ethical conduct, including the ethical handling of actual or potential conflicts of interest between personal and professional relationships; |

| | full, fair, accurate, timely and understandable disclosure in our SEC reports and other public communications; |

| | compliance with applicable governmental laws, rules and regulations; |

| | prompt internal reporting of violations of the code to appropriate persons identified in the code; and |

| | accountability for adherence to the code. |

Any waiver of the Code of Business Conduct and Ethics for our directors, executive officers and other principal financial officers must be approved by the Board or the appropriate committee thereof, and any such waiver shall be promptly disclosed as required by law or NYSE regulations.

ROLE OF THE BOARD IN RISK OVERSIGHT

One of the key functions of our Board is informed oversight of our risk management process. Our Board administers this oversight function directly, with support from its three standing committees, the Audit Committee, the Governance Committee and the Compensation Committee, each of which addresses risks specific to their respective areas of oversight. In particular, our Audit Committee has the responsibility to consider and discuss our major financial risk exposures and the steps our management has taken to monitor and control these exposures. The Audit Committee also monitors compliance with legal and regulatory requirements, in addition to oversight of the performance of our internal audit function.

Our Governance Committee monitors the effectiveness of our Corporate Governance Guidelines.

Our Compensation Committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

Since the date of our IPO, there have been no insider participations or compensation committee interlocks of the Compensation Committee. At all times since the completion of our IPO, the Compensation Committee has been comprised solely of independent, non-employee directors.

14

Table of Contents

Stockholders and other interested parties may write to the entire Board or any of its members at Rexford Industrial Realty, Inc., c/o Jonathan Abrams, General Counsel and Secretary, 11620 Wilshire Boulevard, Suite 1000, Los Angeles, California 90025. Stockholders and other interested parties also may e-mail the Chairman, the entire Board or any of its members c/o Jonathan Abrams, General Counsel and Secretary, at jabrams@rexfordindustrial.com. The Board may not be able to respond to all stockholder inquiries directly. Therefore, the Board has developed a process to assist it with managing inquiries.

The General Counsel will perform a legal review in the normal discharge of his duties to ensure that communications forwarded to the Chairman, the Board or any of its members preserve the integrity of the process. While the Board oversees management, it does not participate in day-to-day management functions or business operations, and is not normally in the best position to respond to inquiries with respect to those matters. For example, items that are unrelated to the duties and responsibilities of the Board such as spam, junk mail and mass mailings, ordinary course disputes over fees or services, personal employee complaints, business inquiries, new product or service suggestions, resumes and other forms of job inquiries, surveys, business solicitations or advertisements will not be forwarded to the Chairman or any other director. In addition, material that is unduly hostile, threatening, illegal or similarly unsuitable will not be forwarded to the Chairman or any other director and will not be retained. Such material may be forwarded to local or federal law enforcement authorities.

Any communication that is relevant to the conduct of our business and is not forwarded will be retained for one year and made available to the Chairman and any other independent director on request. The independent directors grant the General Counsel discretion to decide what correspondence will be shared with our management and any personal employee communications may be shared with our human resources department if deemed appropriate. If a response on behalf of the Board is appropriate, we gather any information and documentation necessary for answering the inquiry and provide the information and documentation, as well as a proposed response, to the appropriate director(s). We also may attempt to communicate with the stockholder for any necessary clarification. Our General Counsel (or his designee) reviews and approves responses on behalf of the Board in consultation with the applicable director(s), as appropriate.

Certain circumstances may require that the Board depart from the procedures described above, such as the receipt of threatening letters or e-mails or voluminous inquiries with respect to the same subject matter. Nevertheless, the Board considers stockholder questions and comments important, and endeavors to respond promptly and appropriately.

NOMINATION PROCESS FOR DIRECTOR CANDIDATES

The Governance Committee is, among other things, responsible for identifying and evaluating potential candidates and recommending candidates to the Board for nomination. The Governance Committee is governed by a written charter, a copy of which is available on the Company InformationGovernance Documents page of the Investor Relations section on our website at www.rexfordindustrial.com.

The Governance Committee regularly reviews the composition of the Board and whether the addition of directors with particular experiences, skills, or characteristics would make the Board more effective. When a need arises to fill a vacancy, or it is determined that a director possessing particular experiences, skills, or characteristics would make the Board more effective, the Governance Committee initiates a search. As a part of the search process, the Governance Committee may consult with other directors and members of senior management, and may hire a search firm to assist in identifying and evaluating potential candidates.

When considering a candidate, the Governance Committee reviews the candidates experiences, skills, and characteristics. The Governance Committee also considers whether a potential candidate would otherwise qualify for membership on the Board, and whether the potential candidate would likely satisfy the independence requirements of the NYSE as described below.

15

Table of Contents

Candidates are selected on the basis of outstanding achievement in their professional careers, broad experience, personal and professional integrity, their ability to make independent analytical inquiries, financial literacy, mature judgment, high performance standards, familiarity with our business and industry, and an ability to work collegially. Other factors include having members with various and relevant career experience and technical skills, and having a Board that is, as a whole, diverse. Where appropriate, we will conduct a criminal and background check on the candidate. In addition, at least one member of the Board should have the qualifications and skills necessary to be considered an Audit Committee Financial Expert under Section 407 of the Sarbanes-Oxley Act of 2002 (Sarbanes-Oxley Act), as defined by the rules of the SEC and within one year of the NYSE listing date, at least a majority of the Board must be independent as determined by the Board under the guidelines of the NYSE listing standards.

All potential candidates are interviewed by the Chairman of the Board and Governance Committee Chairman, and, to the extent practicable, the other members of the Governance Committee, and may be interviewed by other directors and members of senior management as desired and as schedules permit. In addition, the General Counsel conducts a review of the director questionnaire submitted by the candidate and, as appropriate, a background and reference check is conducted. The Governance Committee then meets to consider and approve the final candidates, and either makes its recommendation to the Board to fill a vacancy, or add an additional member, or recommends a slate of candidates to the Board for nomination for election to the Board. The selection process for candidates is intended to be flexible, and the Governance Committee, in the exercise of its discretion, may deviate from the selection process when particular circumstances warrant a different approach.

Stockholders may recommend candidates to our Board. The stockholder must submit a detailed resume of the candidate and an explanation of the reasons why the stockholder believes the candidate is qualified for service on our Board of Directors and how the candidate satisfies the Boards criteria. The stockholder must also provide such other information about the candidate as is set forth in our bylaws and as would be required by the SEC rules to be included in a Proxy Statement. In addition, the stockholder must include the consent of the candidate and describe any arrangements or undertakings between the stockholder and the candidate regarding the nomination. The stockholder must submit proof of the stockholders holding of Rexford Industrial Realty, Inc.s common stock. All communications are to be directed to the Chairman of the Governance Committee, c/o Rexford Industrial Realty, Inc., 11620 Wilshire Boulevard, Suite 1000, Los Angeles, California 90025, Attention: General Counsel. For any annual meeting, recommendations received after 120 days prior to the anniversary of the date of the Proxy Statement for the prior years annual meeting will likely not be considered timely for consideration by the Governance Committee for that annual meeting.

AUDIT COMMITTEE FINANCIAL EXPERIENCE

Our Board has determined that Mr. Good qualifies as an audit committee financial expert, as this term has been defined by the SEC in Item 407(d)(5)(ii) of Regulation S-K. Messrs. Good, Marcus and Schwab were each determined by our Board to be financially literate in accordance with SEC rules based on their prior experience. Mr. Marcus has extensive experience in real estate investment and management and was formerly a practicing certified public accountant and tax manager with Arthur Young & Co. specializing in the financing and taxation of REITs. Mr. Schwab supervised individuals responsible for financial preparation and reporting during the course of his career and reviewed public company financial processes and disclosure as both an officer and director of public companies.

Our Board determined that Mr. Good acquired the required attributes for such designations as a result of the following relevant experience, which forms of experience are not listed in any order of importance and were not assigned any relative weights or values by our Board in making such determination:

| | Since February 2010, Mr. Good has served as a consultant for the accounting firm of Cohn Reznick LLP. |

| | Mr. Good founded the accounting firm of Good, Swartz, Brown & Berns (predecessor of Cohn Reznick LLP) in 1976, and served as an active Senior Partner until February 2010. |

16

Table of Contents

| | From 1997 until 2005, Mr. Good served as a Director of Arden Realty Group, Inc., a publicly-held REIT listed on the NYSE. |

| | Mr. Good currently serves as a Director of OSI Systems, Inc. (NASDAQ: OSIS). |

| | Mr. Good also currently serves as a Director of Kayne Anderson MLP Investment Company (NYSE: KYN) and Kayne Anderson Energy Total Return Fund, Inc. (NYSE: KYE). |

| | Mr. Good holds a Bachelor of Science degree in Accounting from the University of California, Los Angeles and attended its Graduate School of Business. |

AUDIT COMMITTEE PRE-APPROVAL POLICY

The Audit Committees policy is to pre-approve all significant audit and permissible non-audit services provided by our independent auditors. These services may include audit services, audit-related services, tax services and other services. Pre-approval is generally provided for up to one year and any pre-approval is detailed as to the particular service or category of services and is generally subject to a specific budget. Our independent auditors and management are required to periodically report to the Audit Committee regarding the extent of services provided by the independent auditors in accordance with this pre-approval, and the fees for the services performed to date. The Audit Committee may also pre-approve particular services on a case-by-case basis.

PRINCIPAL ACCOUNTANT FEES AND SERVICES

Ernst & Young LLPs fees for the fiscal years ended December 31, 2013 and 2012 (to the extent applicable, as calculated for our predecessor) were as follows:

| Fiscal Year Ended December 31 | ||||||||

| 2013 | 2012 | |||||||

| Audit Fees |

$ | 1,421,000 | $ | 277,000 | ||||

| Audit-Related Fees |

2,000 | 2,000 | ||||||

| Tax Fees |

551,000 | 56,000 | ||||||

| All Other Fees |

| | ||||||

|

|

|

|

|

|||||

| Total Fees |

$ | 1,974,000 | $ | 335,000 | ||||

|

|

|

|

|

|||||

A description of the types of services provided in each category is as follows:

Audit FeesIncludes fees for professional services provided in connection with our annual audit, review of our quarterly financial statements, and services in connection with our IPO, SEC registration statements and securities offerings.

Audit-Related FeesIncludes access to accounting research database.

Tax FeesIncludes tax return preparation and other tax planning services incurred in conjunction with our IPO and the roll-up of the predecessor entities in the period the services occurred.

All of the services performed by Ernst & Young LLP subsequent to the Companys IPO were either expressly pre-approved by the Audit Committee or were pre-approved in accordance with the Audit Committee Pre-Approval Policy, and the Audit Committee was provided with regular updates as to the nature of such services and fees paid for such services.

BOARD ATTENDANCE AT ANNUAL MEETING OF STOCKHOLDERS

While the Board understands that there may be situations that prevent a director from attending an annual meeting of stockholders, the Board encourages all directors to attend our annual meetings of stockholders. The 2014 Annual Meeting of Stockholders is our first annual stockholders meeting since our IPO in July 2013.

17

Table of Contents

RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee appointed Ernst & Young LLP as our independent registered public accounting firm to audit our consolidated financial statements for the fiscal year ending December 31, 2014. Pursuant to this appointment, Ernst & Young LLP will serve as our independent registered public accounting firm and report on our consolidated financial statements for the fiscal year ending December 31, 2014.

We expect that representatives of Ernst & Young LLP will attend the Annual Meeting and will have the opportunity to make a statement if they so desire and to respond to appropriate questions.

Although stockholder ratification is not required, the appointment of Ernst & Young LLP is being submitted for ratification at the Annual Meeting with a view towards soliciting stockholders opinions, which the Audit Committee will take into consideration in future deliberations. If Ernst & Young LLPs selection is not ratified at the Annual Meeting, the Audit Committee will consider the engagement of another independent registered accounting firm. The Audit Committee may terminate Ernst & Young LLPs engagement as our independent registered public accounting firm without the approval of our stockholders whenever the Audit Committee deems termination appropriate.

Recommendation of the Board of Directors:

Our Board of Directors recommends a vote FOR the ratification of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2014.

18

Table of Contents

We are not aware of any other matters that may properly be presented at the Annual Meeting. If any other matters are properly raised at the Annual Meeting or at any continuation, postponement or adjournment thereof the proxy holders will vote on such matters in their discretion.

Rexford Industrial Realty, Inc.s executive officers are as follows:

| Name |

Age | Position |

||

| Howard Schwimmer |

53 | Co-Chief Executive Officer and Director | ||

| Michael S. Frankel |

51 | Co-Chief Executive Officer and Director | ||

| Adeel Khan |

40 | Chief Financial Officer | ||

| Jonathan L. Abrams |

38 | General Counsel and Secretary |

The following section sets forth certain background information regarding those persons currently serving as executive officers of Rexford Industrial Realty, Inc., excluding Howard Schwimmer and Michael S. Frankel, who are described on page 8 under the heading Proposal No. 1Nominees for Election to the Board:

Adeel Khan

Mr. Khan has served as our Chief Financial Officer since our IPO. Mr. Khan served as Corporate Controller for our predecessor business from March 2012 until our IPO. From February 2002 until February 2012, Mr. Khan served as Vice President and Controller at MPG Office Trust, Inc., formerly known as Maguire Properties (NYSE: MPG), the largest owner of class-A office buildings in downtown Los Angeles, with an office and hotel portfolio in Southern California and Denver, Colorado (MPG). Prior to MPG, Mr. Khan served as Senior Financial Analyst at The Walt Disney Company (NYSE: DIS). Mr. Khan also served as a Senior Auditor & Consultant at Arthur Andersen LLP, where Mr. Khan assumed responsibility for the audit of public real estate, financial services and media/technology companies. Mr. Khan is a Certified Public Accountant and obtained his Bachelor of Arts in Business Administration at the California State University, Fullerton. Mr. Khan brings to the Company 18 years of accounting, finance and operations experience.

Jonathan L. Abrams

Mr. Abrams has served as our General Counsel and Secretary since November 25, 2013. Mr. Abrams formerly served as Executive Vice President and General Counsel at MPG from 2007 to 2012. Prior to that, he served as Senior Vice President of Business and Legal Affairs at Lionsgate Entertainment (NYSE: LGF), where he advised on regulatory, acquisitions and financing related affairs. Mr. Abrams began his career as an attorney with the law firm Latham & Watkins LLP. Mr. Abrams holds a Bachelor of Arts degree in Political Science, cum laude, from the University of California, Berkeley and a Juris Doctor, cum laude, from Harvard Law School. Mr. Abrams brings to the Company 13 years of legal and corporate governance experience.

19

Table of Contents

This section discusses the material components of the executive compensation program for our executive officers who are named in the Summary Compensation Table below. Our named executive officers during 2013 were:

| | Howard Schwimmer, Co-Chief Executive Officer; |

| | Michael S. Frankel, Co-Chief Executive Officer; and |

| | Adeel Khan, Chief Financial Officer. |

We are an emerging growth company as defined under the Jumpstart Our Business Startups (JOBS) Act. As such, we are permitted to meet the disclosure requirements of Item 402 of Regulation S-K by providing the reduced disclosures required of a smaller reporting company.

Summary Compensation Table

The following table sets forth information concerning the compensation of our named executive officers for the year ended December 31, 2013.

| Name and Principal Position |

Year | Salary ($)(1) | Bonus ($)(2) | Stock Awards ($)(3) |

Total ($) | |||||||||||||||

| Howard Schwimmer |

2013 | 205,615 | | 4,000,010 | (4) | 4,205,625 | (4) | |||||||||||||

| Co-Chief Executive Officer |

||||||||||||||||||||

| Michael S. Frankel |

2013 | 205,615 | | 4,000,010 | (4) | 4,205,625 | (4) | |||||||||||||

| Co-Chief Executive Officer |

||||||||||||||||||||

| Adeel Khan |

2013 | 114,231 | 50,000 | 275,002 | 439,233 | |||||||||||||||

| Chief Financial Officer |

||||||||||||||||||||

| (1) | Amounts shown in the Salary column reflect the base salary paid to each named executive officer for the period beginning on July 24, 2013 (the closing of our IPO) and ending December 31, 2013. |

| (2) | Each of our named executive officers is eligible to receive a discretionary bonus with respect to 2013 performance. The amount of any 2013 bonuses has not been determined. It is anticipated that any bonuses with respect to 2013 performance will be determined in the second quarter of 2014. With respect to Mr. Khan, this amount includes a one-time $50,000 cash bonus awarded in connection with the completion of our IPO in 2013. |

| (3) | Amounts reflect the full grant-date fair value of restricted stock awards granted in 2013 computed in accordance with ASC Topic 718, rather than the amounts paid to or realized by the named individual. We provide information regarding the assumptions used to calculate the value of all restricted stock awards made to executive officers in Note 13 to our consolidated and combined financial statements contained in our Annual Report on Form 10-K filed March 20, 2014. There can be no assurance that awards will vest (in which case no value will be realized by the individual). |

| (4) | In connection with our IPO, we granted to each of Messrs. Schwimmer and Frankel 285,714 shares of restricted common stock. The amount shown includes a value of $3,939,530 for Mr. Schwimmer and $3,939,530 for Mr. Frankel, each of which is associated with shares of restricted common stock that were cancelled in connection with the Accommodation entered into in October 2013 such that, as of December 31, 2013, each of Messrs. Schwimmer and Frankel held 4,320 shares of restricted common stock. For additional information, refer to the heading Narrative Disclosure to Summary Compensation TableEquity Compensation and Related-Party and Other Transactions Involving Our Officers and DirectorsAccommodation below. |

20

Table of Contents

Narrative Disclosure to Summary Compensation Table

Compensation Consultant

In connection with our IPO in 2013, the Company engaged FTI Consulting, Inc., or FTI, a real estate advisory practice, to provide market-based compensation data and to advise on industry trends and best practices. Other than providing the advice as described above, FTI did not provide any material services to the Company in 2013. Further, pursuant to SEC rules, the Company conducted a conflicts of interest assessment and determined that there is no conflict of interest resulting from retaining FTI.

Executive Compensation Arrangements

In July 2013, we entered into employment agreements with Messrs. Schwimmer and Frankel, which became effective upon the completion of our IPO. The following is a summary of the material terms of the agreements. We have not entered into an employment agreement with Mr. Khan.

Under the agreements, Messrs. Schwimmer and Frankel each serve as a Co-Chief Executive Officer of our Company and report directly to our Board. The initial term of the employment agreements will end on the fourth anniversary of the completion of our IPO, or July 24, 2017. On that date, and on each subsequent one year anniversary of such date, the term of the employment agreements will automatically be extended for one year, unless earlier terminated. Pursuant to the employment agreements, during the terms of Messrs. Schwimmers and Frankels employment, we will nominate each for election as a director.

Under the employment agreements, Messrs. Schwimmer and Frankel each receive initial annual base salaries of $495,000, which are subject to increase at the discretion of our compensation committee. In addition, each of Messrs. Schwimmer and Frankel will be eligible to receive an annual discretionary cash performance bonus targeted at 100% of the executives then-current annual base salary. The actual amount of any such bonuses will be determined by reference to the attainment of applicable company and/or individual performance objectives, as determined by our compensation committee.

In connection with entering into the employment agreements and as described below, Messrs. Schwimmer and Frankel were each granted an award of 285,715 shares of restricted common stock of our common stock (of which 281,395 shares subject to each award were cancelled as of December 31, 2013 in connection with the Accommodation). These restricted stock awards vest in four equal, annual installments on each of the first four anniversaries of the date of grant, subject to each executives continued service through the applicable vesting date. In addition, beginning in calendar year 2014 and for each calendar year thereafter, Messrs. Schwimmer and Frankel are each eligible to receive an annual equity award, as determined by our compensation committee in its sole discretion. Messrs. Schwimmer and Frankel are also eligible to participate in customary health, welfare and fringe benefit plans, and, subject to certain restrictions, healthcare benefits will be provided to them and their eligible dependents at our sole expense. Each of Messrs. Schwimmer and Frankel will accrue four weeks of paid vacation per year.

Base Salaries

Each named executive officers compensation was initially established based on negotiations in connection with our IPO in 2013. We believe that these base salaries are commensurate with our named executive officers positions and are expected to provide a steady source of income sufficient to permit these officers to focus their time and attention on their work duties and responsibilities. The 2013 annual base salaries of our named executive officers, which were effective as of the completion of our IPO, are set forth in the table below, but may be adjusted by our compensation committee in the future.

| Executive |

2013 Annual Base Salary | |||

| Howard Schwimmer |

$ | 495,000 | ||

| Michael S. Frankel |

$ | 495,000 | ||

| Adeel Khan |

$ | 275,000 | ||

21

Table of Contents

No changes to base salary levels have been made for 2014.

2013 Annual Bonuses and IPO Bonuses

2013 Annual Bonuses. Our named executive officers are eligible to earn annual discretionary cash performance bonuses based on the attainment of applicable performance objectives. Eligibility to receive these cash bonuses is expected to incentivize our named executive officers to strive to attain company and/or individual performance goals that further our interests and the interests of our stockholders. The applicable terms and conditions of the cash bonuses are determined by our compensation committee.

In 2013, Messrs. Schwimmer, Frankel and Khan were eligible to receive a discretionary annual bonus targeted at 100%, 100% and 60%, respectively, of the executives annual base salary. Our compensation committee has not yet made determinations with respect to the bonus payments with respect to 2013, but anticipates that such determinations will be made in the second quarter of 2014.

IPO Bonus. In addition, in connection with the completion of our IPO we awarded Mr. Khan a one-time cash bonus equal to $50,000.

Equity Compensation

In July 2013, our Board adopted our 2013 Incentive Award Plan, referred to below as the Plan, in order to facilitate the grant of cash and equity incentives to directors, employees (including our named executive officers) and consultants of our Company and certain of our affiliates and to enable our Company and certain of our affiliates to obtain and retain services of these individuals, which is essential to our long-term success.

Pursuant to the Plan, we granted restricted stock awards to each of our named executive officers in connection with our IPO in 2013. The number of shares of restricted stock granted to our named executive officers in 2013 is set forth in the table below:

| Executive |

Number of Restricted Shares |

|||

| Howard Schwimmer |

285,715 | (1) | ||

| Michael S. Frankel |

285,715 | (1) | ||

| Adeel Khan |

19,643 | |||

| (1) | Amount includes 281,395 shares of restricted stock for each of Messrs. Schwimmer and Frankel, which were cancelled in connection with the Accommodation entered into in October 2013. As of December 31, 2013, each of Messrs. Schwimmer and Frankel held 4,320 shares of restricted common stock. For additional information, refer to Related-Party and Other Transactions Involving Our Officers and DirectorsAccommodation below. |

Each of these restricted stock awards will vest as to 25% of the number of shares subject to the award on each of the first, second, third and fourth anniversaries of the date of grant, based on the executives continued service with us through the applicable vesting date. In addition, the restricted stock awards granted to Messrs. Schwimmer and Frankel are subject to accelerated vesting provisions set forth in the executives employment agreement, as described in further detail below under the heading Severance and Change in Control Benefits.

As part of the Accommodation, in 2013 Messrs. Schwimmer and Frankel entered into restricted stock cancellation agreements, whereby they each agreed to cancel a portion of the restricted stock awards described above, based on the participation in the Accommodation by certain pre-IPO investors. As of December 31, 2013, Messrs. Schwimmer and Frankel each agreed to cancel 281,395 shares of the restricted stock awards they were granted in connection with the IPO. For additional information, refer to Related-Party and Other Transactions Involving Our Officers and DirectorsAccommodation below.

22

Table of Contents